If you’re looking to boost your money skills, I recommend exploring the 15 top personal finance books that are bestsellers and truly change how you manage money. These titles cover everything from budgeting and investing to mindset shifts and systemic understanding, all designed to help you build confidence and long-term wealth. Each one offers practical advice and inspiring stories. Stick around, and you’ll find out how these books can transform your financial journey.

Key Takeaways

- Highlights top-selling personal finance books known for transforming money management habits.

- Focuses on accessible, practical guidance suitable for beginners and young adults.

- Emphasizes mindset shifts, long-term stability, and actionable strategies for wealth building.

- Features books with real-world stories, checklists, worksheets, and motivational content.

- Provides insights into credible authors and titles widely recognized for their impact and popularity.

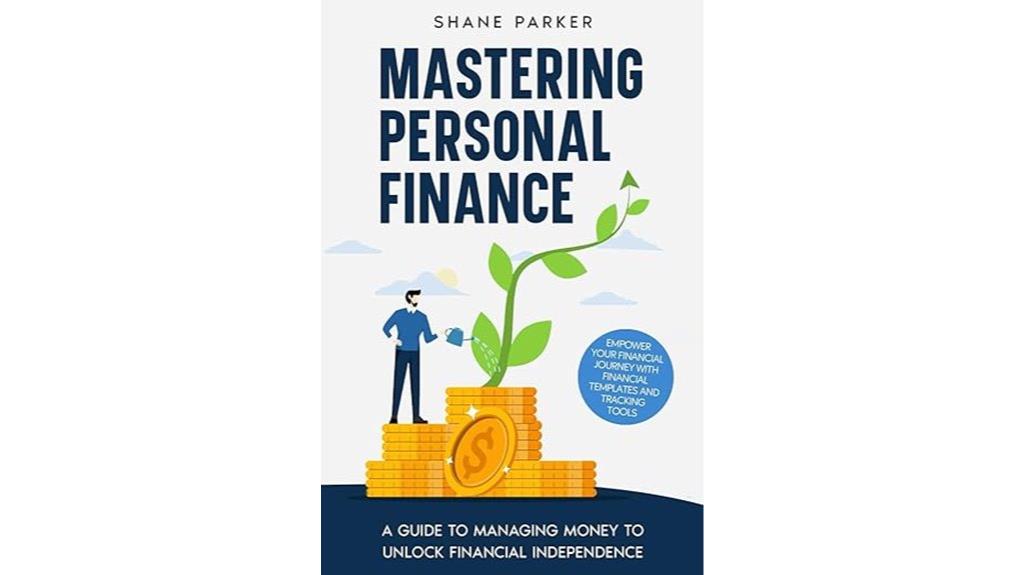

Mastering Personal Finance: A guide to managing money to unlock financial independence

As an affiliate, we earn on qualifying purchases.

Mastering Personal Finance: A Guide to Managing Money

If you’re looking for a practical starting point in personal finance, “Mastering Personal Finance: A Guide to Managing Money” is an excellent choice, especially if you’re new to managing your money or want to build a strong foundation. It emphasizes that financial literacy is a essential skill everyone should develop, encouraging continuous learning through education and technology. The book promotes a growth mindset, highlighting that financial circumstances change and adaptability is key. With straightforward strategies like the CEO framework—Cut costs, Earn more, and Optimize—it’s easy to start making smarter financial decisions. This book helps you build confidence and develop habits for long-term financial health.

Best For: Beginners seeking a straightforward, practical guide to developing essential personal finance skills and building confidence in money management.

Pros:

- Simplifies complex financial concepts into easy-to-understand actionable steps.

- Emphasizes continuous learning and adaptability for evolving financial situations.

- Provides practical strategies like the CEO framework to improve budgeting, saving, and earning.

Cons:

- Lacks in-depth analysis of specific financial tools or investment platforms.

- May not cover advanced topics for experienced investors or financial professionals.

- Focuses primarily on foundational concepts, limiting guidance on complex financial planning.

Amazon Product B0F1G1LWQY

As an affiliate, we earn on qualifying purchases.

The Simplest Guide to Financial Literacy for Young Adults

The Simplest Guide to Financial Literacy for Young Adults stands out as the perfect resource for anyone overwhelmed by personal finance concepts or just starting their money management journey. It simplifies complex ideas into clear, actionable steps, focusing on budgeting, saving, investing, and credit management. Designed for beginners, it highlights how early financial choices impact long-term wealth and offers practical tools like the Money Map Toolbox. The book emphasizes building confidence, avoiding debt, and making smarter decisions without jargon. It’s an approachable guide that transforms how young adults see money, empowering them to take control and build a solid financial future.

Best For: young adults, teens, and beginners seeking straightforward, practical guidance to improve their financial literacy and build a strong financial foundation.

Pros:

- Simplifies complex financial concepts into clear, actionable steps suitable for beginners

- Offers practical tools like the Money Map Toolbox to assist with financial planning

- Focuses on building confidence and positive money mindset without using jargon

Cons:

- May lack in-depth coverage of advanced investment strategies for experienced investors

- Some readers might desire more detailed explanations on certain topics like taxes or estate planning

- The focus on basic concepts might be less appealing to those with existing financial knowledge or higher income levels

Think and Grow Rich: The Landmark Bestseller Now Revised and Updated for the 21st Century (Think and Grow Rich Series)

Book - think and grow rich: the landmark bestseller now revised and updated for the 21st century (think...

As an affiliate, we earn on qualifying purchases.

Think and Grow Rich Book

“Think and Grow Rich” stands out as a must-read for anyone serious about transforming their mindset and achieving success across all areas of life. This landmark bestseller, updated for today’s readers, explores what truly makes a winner. It’s packed with stories of icons like Carnegie, Edison, and modern millionaires, illustrating how focus, desire, and faith open success. The book isn’t just about wealth; it’s about cultivating a success mindset—resilience, creativity, and persistence. Practical and inspiring, it empowers you to take control of your destiny by harnessing the power of your thoughts and beliefs. A transformative tool for personal growth and achievement.

Best For: individuals seeking personal development, success mindset transformation, and practical strategies to achieve wealth, health, and emotional well-being.

Pros:

- Widely regarded as a foundational success and motivation resource with proven life-changing results.

- Practical, inspiring, and easy-to-apply principles rooted in real-life success stories.

- Updated for the 21st century with contemporary examples and clearer language for modern readers.

Cons:

- Audio narration quality has been criticized as poor, which may affect listening experience.

- The physical format is small and thick, potentially challenging for those with visual impairments or preference for larger print.

- Some readers may find the language and terminology outdated or too simplified, requiring extra effort to fully grasp the concepts.

Personal Finance QuickStart Guide: The Simplified Beginner’s Guide to Eliminating Financial Stress, Building Wealth, and Achieving Financial Freedom

As an affiliate, we earn on qualifying purchases.

Personal Finance QuickStart Guide

The Personal Finance QuickStart Guide is perfect for anyone looking to take control of their finances, whether they’re just starting out or seeking a deeper understanding of money management. I appreciate how Morgen Rochard breaks down complex concepts into simple, actionable steps, making it accessible for beginners and seasoned savers alike. This book covers everything from repairing credit and managing debt to setting goals and preparing for retirement. With practical tools, real-life stories, and clear guidance, it helps you change your mindset about money and build lasting financial habits. It’s like having a personal financial coach in your hands, ready to support your journey.

Best For: individuals of all ages seeking practical, comprehensive guidance to improve their financial literacy, manage debt, and build wealth, from beginners to those planning for retirement.

Pros:

- Clear, straightforward language that makes complex financial concepts accessible

- Extensive practical tools and resources, including workbooks and spreadsheets for real-world application

- Covers a wide range of topics from credit repair to investing, providing a holistic approach to personal finance

Cons:

- Some readers might find the detailed explanations more lengthy than expected for a “quick” guide

- Certain personal stories may feel drawn out or less engaging to some audiences

- The title may be misleading, as the book offers in-depth content that resembles a textbook or coaching session

Rich AF: The Winning Money Mindset That Will Change Your Life

If you’re just starting your financial journey or feeling hesitant about managing money, “Rich AF” by Vivian Tu is the perfect book to boost your confidence and reshape your mindset. This NYT bestseller offers practical, straightforward advice rooted in Wall Street experience, making complex topics like investing and taxes easy to understand. Vivian’s relatable, fun tone helps dispel money fears and encourages you to develop a wealth-building mindset regardless of your starting point. With actionable steps and modern strategies, “Rich AF” empowers you to take control of your finances, build confidence, and start growing your wealth today.

Best For: beginners, young adults, or anyone feeling hesitant about managing their finances and seeking straightforward, relatable advice to build confidence and grow wealth.

Pros:

- Clear, practical guidance that simplifies complex financial concepts

- Engaging, relatable tone that makes learning about money enjoyable

- Actionable steps designed to motivate immediate financial improvements

Cons:

- Primarily focused on beginner-level advice, may offer less new insight for experienced investors

- Some readers might find the content too simplified or basic after advanced financial knowledge

- Lacks in-depth technical details for those seeking advanced strategies

Get Good with Money: Ten Simple Steps to Becoming Financially Whole

For anyone seeking straightforward, practical advice on achieving financial security, “Get Good with Money” by Tiffany Aliche stands out as an essential guide. She offers a clear 10-step plan to help you become financially whole, focusing on sustainable habits rather than quick fixes. Tiffany shares relatable stories and actionable strategies for managing expenses, saving, investing, and protecting your future. Her approach is accessible, especially for beginners and those feeling overwhelmed. This book empowers you to take control of your money, build confidence, and create a stable, rich life. It’s a practical resource that transforms complex concepts into achievable steps.

Best For: beginners and individuals seeking practical, accessible guidance to improve their financial literacy and build sustainable wealth.

Pros:

- Clear, actionable steps that simplify complex financial concepts

- Relatable stories and a motivating tone that encourages confidence

- Includes checklists, worksheets, and additional resources for practical application

Cons:

- Some readers find certain parts slightly repetitive

- Not a detailed deep dive into advanced investing or complex financial planning

- May require supplemental resources for comprehensive wealth-building strategies

Your Money, Your Future: Building Financial Confidence for Young Women

Are you a young woman enthusiastic to build confidence in managing your finances? Developing a strong financial foundation starts with cultivating a positive money mindset. Understand the importance of financial well-being, set clear goals, and build habits that promote stability. Creating realistic budgets, saving consistently, and making informed investments are key steps to grow your wealth and avoid debt. Advancing in your career and planning for major expenses like retirement are essential for long-term security. Remember, balancing financial growth with personal fulfillment and giving back creates a resilient, confident approach to your future. Building this mindset today sets you up for lasting financial success.

Best For: young women seeking to build financial confidence, develop healthy money habits, and plan for a secure future.

Pros:

- Provides practical guidance on budgeting, saving, and investing tailored for beginners

- Em emphasizes the importance of mindset and long-term planning for financial stability

- Encourages a balanced approach by integrating personal fulfillment and giving back

Cons:

- May require some initial effort to establish consistent habits and financial goals

- The advice is broad and might need customization for individual financial situations

- Lacks specific tools or resources for hands-on financial management or investment strategies

Financially Lit Personal Finance Guide for Teens and Young Adults

When searching for a personal finance book tailored to teens and young adults, Bryan Nicholson’s *Financially Lit Personal Finance for Teens and Young Adults* stands out as an essential resource. It offers practical, easy-to-understand advice on budgeting, saving, investing, and managing debt, filling gaps left by traditional education. The book emphasizes early financial literacy to build independence and confidence, with real-life examples and step-by-step strategies. Its engaging tone makes complex topics approachable, encouraging young readers to develop healthy money habits now that will benefit them long-term. I highly recommend it for anyone enthusiastic to start their financial journey on the right foot.

Best For: teens and young adults seeking a clear, practical introduction to personal finance to build confidence and healthy money habits early on.

Pros:

- Simplifies complex financial topics with real-life examples and step-by-step guidance

- Engaging tone makes learning about money enjoyable and accessible for beginners

- Focuses on practical strategies like budgeting, saving, and responsible credit use

Cons:

- May lack depth for readers already familiar with basic financial concepts

- Some topics, such as advanced investing, are covered only at a basic level

- Not a comprehensive guide for long-term financial planning beyond foundational skills

Increase Your Financial IQ: Be Smarter with Your Money

If you’re looking to become smarter with your money, “Increase Your Financial IQ” by Robert Kiyosaki offers practical lessons based on real-world success stories. This book focuses on developing your financial skills through case studies, showing how money moves in different business sectors. It emphasizes mindset shifts, encouraging you to change your paradigms and think differently about wealth. Kiyosaki teaches step-by-step strategies for budgeting, investing, and understanding market dynamics. By boosting your financial intelligence, you’ll make better decisions, grow your resources, and protect your wealth. It’s a practical guide that combines experience with actionable insights, helping you *discover* your financial potential.

Best For: individuals seeking practical, real-world guidance to improve their financial skills, mindset, and decision-making capabilities.

Pros:

- Offers actionable strategies and case studies rooted in real-world success stories.

- Emphasizes mindset shifts and paradigm changes crucial for financial growth.

- Provides step-by-step guidance on budgeting, investing, and understanding market dynamics.

Cons:

- Contains some promotional content for related products like the Cashflow game and Richard.com.

- May have repetitive ideas that overlap with previous works such as “Rich Dad Poor Dad.”

- Examples and references may be outdated, particularly for readers seeking the latest market insights.

Retire Young and Wealthy Book (Spanish Edition)

The “Retire Young and Wealthy” Book (Spanish Edition) stands out as an essential read for anyone enthusiastic to transform their mindset around money and accelerate their path to early retirement. Robert Kiyosaki shares personal stories of overcoming bankruptcy and building wealth through entrepreneurship and smart investing. The book emphasizes developing key skills like business acumen, money management, and investment expertise. It encourages readers to shift their mental attitude, create strategic plans, and take action. Practical and motivating, it shows that early retirement is achievable within a decade if you focus on disciplined financial habits and a proactive approach to wealth-building.

Best For: individuals eager to change their mindset about money, develop financial skills, and pursue early retirement through disciplined entrepreneurship and investing.

Pros:

- Offers practical guidance and personal stories to motivate financial transformation

- Emphasizes key skills like business acumen, money management, and investing

- Inspires a proactive attitude towards wealth-building and early retirement

Cons:

- Contains some repetitive concepts and minor editing errors

- May require readers to actively apply principles over time for noticeable results

- Assumes a certain level of motivation and discipline, which might be challenging for some readers

The Conspiracy of the Rich / Rich Dad’s Conspiracy of The Rich

Anyone enthusiastic to uncover the hidden mechanisms behind wealth accumulation and challenge mainstream economic narratives will find “Rich Dad’s Conspiracy of The Rich” an eye-opening read. It emphasizes the importance of understanding money flow, financial systems, and creating assets for true financial freedom. The book critiques traditional education, arguing that financial literacy is undervalued and essential for economic resilience. Kiyosaki exposes how the wealthy manipulate systems and highlights the risks within global financial models. It offers practical strategies for asset building and steering through economic uncertainties. This book challenges readers to rethink their approach to money, empowering them to take control of their financial future.

Best For: individuals seeking to understand the hidden mechanics of wealth creation, challenge mainstream economic narratives, and improve their financial literacy for greater economic resilience.

Pros:

- Provides insightful analysis on how the wealthy manipulate financial systems for profit.

- Offers practical strategies for asset building and navigating economic uncertainties.

- Emphasizes the importance of financial literacy over traditional education, encouraging proactive financial planning.

Cons:

- Some readers may find the conspiracy theories and critiques overly speculative or controversial.

- The focus on systemic manipulation might be perceived as overly cynical or dismissive of traditional institutions.

- Practical application may require further research or guidance beyond the book’s content to fully implement strategies.

How to Own the World: A Plain English Guide to Thinking Globally and Investing Wisely

How to Own the World stands out as a must-read for those keen to grasp global investing without getting lost in jargon. I found Andrew Craig’s straightforward approach invigorating and accessible, especially for beginners. The book simplifies complex topics like asset allocation, risk management, and economic trends, making them easy to understand. It encourages thinking beyond local markets, emphasizing diversification across international assets like stocks, bonds, gold, and oil. I appreciated its focus on building wealth through long-term strategies and understanding inflation. Overall, it’s a practical guide that empowers readers to take control of their financial future with confidence.

Best For: beginners and intermediate investors seeking a clear, global perspective on personal finance and long-term wealth building.

Pros:

- Simplifies complex financial concepts with practical examples and straightforward language

- Emphasizes global diversification and long-term investment strategies

- Inspires a proactive mindset towards controlling and growing personal wealth

Cons:

- Some strategies, like market timing using technical tools, may be viewed as less reliable or overly optimistic

- Occasional repetition and dogmatic tone can detract from the clarity of the message

- Focus on UK-specific instruments like ISAs may limit applicability for international audiences

Capital Offence: Why Some Benefit At Your Expense

Many people overlook how economic policies can unfairly benefit a few at the expense of the many, which is crucial to understand when exploring personal finance. Policies driven by flawed beliefs, like debt-fueled spending and central bank support, have widened wealth gaps instead of creating prosperity. Some individuals extract more from the economy than they contribute, leaving others to bear the costs. Younger generations often suffer because older ones benefit unfairly from these systems. Recognizing this unfairness is essential. By understanding how these “benefits” are distributed, we can make smarter financial choices and advocate for reforms that promote fairness and sustainability for everyone.

Best For: Individuals seeking a clearer understanding of economic policies and their impact on fairness and wealth distribution to make informed financial decisions and advocate for reform.

Pros:

- Simplifies complex economic concepts using everyday language and analogies.

- Highlights the importance of fairness and sustainability in economic policies.

- Empowers readers to recognize unfair advantages and advocate for reforms.

Cons:

- May oversimplify complex economic issues for the sake of accessibility.

- Does not provide specific actionable steps for policy change.

- Focuses primarily on critique, possibly lacking balanced perspectives on economic policies.

Creating Your Income Snowball: The Passive Investing Cheat Code for Mastering Wealth

Creating your income snowball is a game-changer for aspiring investors who want to build lasting wealth through passive income. This proven, patented strategy can generate hundreds or thousands of dollars monthly within just 45 days. It involves building a portfolio of cash-flow rental properties, leveraging investments, and avoiding common pitfalls. Backed by 20+ years of experience and success stories, it emphasizes rapid wealth accumulation and financial freedom. The approach includes practical steps, real-world examples, and personalized coaching options. By mastering this cheat code, you can accelerate your journey to passive income, reduce risks, and shift your mindset toward lasting financial independence.

Best For: Individuals seeking a structured, proven strategy to quickly generate passive income through real estate investing and long-term wealth building.

Pros:

- Offers a patented, tested system with real-world success stories and testimonials.

- Provides practical, step-by-step guidance suitable for beginners with educational resources.

- Emphasizes rapid wealth accumulation, financial freedom, and personalized coaching options.

Cons:

- Not a quick-rich scheme; requires time, effort, and strategic planning for results.

- Lacks specific, actionable investment recommendations, focusing more on principles and mindset.

- Success depends heavily on honest self-assessment, discipline, and ongoing commitment.

Its Not Common Cent$: Personal Finance Crash Course for Young Adults

If you’re a college student or a young adult just starting to take charge of your finances, “It’s Not Common Cent$” is an ideal crash course to jumpstart your money management skills. Aaminah Amin offers a practical, friendly 30-day plan that breaks down complex concepts like budgeting, saving, debt, and investing into simple, actionable steps. Her humorous tone makes learning engaging and less intimidating, perfect for beginners. Designed for ages 20-24, the book emphasizes early financial literacy, helping you develop habits that lead to long-term security and independence. It’s a straightforward way to gain confidence and start building wealth today.

Best For: young adults and college students aged 20-24 seeking a straightforward, engaging introduction to personal finance and money management.

Pros:

- Clear, simple explanations that make complex financial topics accessible for beginners

- Humorous and friendly tone that keeps readers engaged and less intimidated

- Practical 30-day action plan with downloadable resources to build lasting habits

Cons:

- May lack depth for those with prior financial knowledge or looking for advanced strategies

- Focused mainly on US and UK contexts, limiting applicability for international readers

- Some readers might find the light-hearted tone less serious for more complex financial issues

Factors to Consider When Choosing a Personal Finance Book (Bestseller)

When selecting a personal finance book, I look at the author’s credibility and expertise to guarantee trustworthy advice. I also consider how clearly the concepts are explained and whether the tips are practical for real-life application. Finally, I focus on how relevant the content is to my goals and how easy the book is to read.

Author Credibility and Expertise

Choosing a personal finance book backed by credible authors can make a significant difference in the quality of advice you receive. When an author has a strong background in finance, investing, or economics, it shows they understand the practical side of managing money. Credentials like CFA, CFP, or an MBA further boost their trustworthiness, indicating they’ve undergone rigorous training. Authors with extensive experience—whether through successful investing, financial planning, or teaching—bring proven insights that are more reliable. Additionally, a solid track record of published works and positive reviews within the personal finance community signals their credibility. Transparency about their background and motivations also helps you assess potential biases, ensuring the advice you follow is rooted in genuine expertise.

Clarity of Concepts

A key factor in selecting a top personal finance book is how clearly it presents its concepts. I look for books that break down complex ideas into simple, understandable language, making them accessible regardless of my financial knowledge. Well-structured explanations, with definitions, examples, and visuals, reinforce my understanding and help me remember key principles. I appreciate relatable analogies and real-life scenarios that connect theory to practical situations, making concepts easier to grasp. Avoiding jargon and technical terms without explanation prevents me from feeling overwhelmed or confused. Additionally, clear books often include summaries, checklists, or quick-reference sections that distill important ideas for easy recall and application. Clarity ensures I can confidently implement what I learn.

Practical Application Tips

After guaranteeing a personal finance book clearly explains its concepts, it’s important to focus on how practical and actionable its advice truly is. Look for books that include concrete steps, worksheets, or checklists to help you implement strategies immediately. Prioritize resources emphasizing habit formation, like automating savings or effective budgeting techniques, proven to work in real life. Choose titles that break down complex topics into simple, step-by-step instructions, making application straightforward. Real-world examples or case studies are valuable—they show how to adapt advice to different financial situations. Also, guarantee the book offers specific tips on managing expenses, investing, and paying off debt. These practical elements help turn knowledge into tangible financial improvements, making your learning truly effective.

Readability and Style

When selecting a personal finance book, the readability and style are crucial factors that can determine how effectively you’ll grasp and apply the ideas. A clear, engaging writing style makes complex concepts accessible, even if you’re new to finance. An approachable tone, often using relatable anecdotes and humor, keeps you motivated and reduces intimidation. Well-organized content with concise language and logical flow helps you understand and remember key ideas. Visual aids like charts, summaries, and bullet points enhance readability, especially for beginners. Most importantly, avoiding jargon and technical language ensures the material feels inviting and user-friendly. When a book’s style resonates with you, you’re more likely to stay engaged and actually implement what you learn.

Relevance to Goals

Have you ever chosen a personal finance book that didn’t quite match your goals? I’ve been there, and it’s frustrating. To avoid that, I always check if the book’s content aligns with my financial objectives—whether I want to build wealth, pay off debt, or save for retirement. I look for practical, actionable strategies suited to my income, age, and situation. If I’m focused on early retirement, I pick a book that covers that topic specifically. I also consider my learning style—do I prefer straightforward advice or real-life examples? Importantly, I choose books that reflect current, evidence-based trends, ensuring the advice is relevant and reliable. When a book matches my goals, I find it easier to stay motivated and implement the strategies effectively.

Frequently Asked Questions

Which Personal Finance Books Are Most Effective for Beginners?

When you’re just starting out, I believe the key is finding books that simplify finance concepts. I recommend “The Total Money Makeover” by Dave Ramsey for practical steps and “Your Money or Your Life” by Vicki Robin for mindset shifts. These books are straightforward and encourage healthy habits. They helped me build confidence in managing money, and I think they’d be great for anyone beginning their financial journey.

How Do the Authors’ Backgrounds Influence Their Financial Advice?

When I think about how authors’ backgrounds influence their advice, I realize their experiences shape their perspectives. For example, a financial planner offers practical, investment-focused tips, while someone who overcame debt might emphasize budgeting and discipline. I find that understanding their background helps me see why they recommend certain strategies. It makes their advice more relatable and trustworthy, giving me confidence to apply it to my own financial journey.

Are There Any Recommended Books Specifically for High-Income Earners?

Did you know that over 20% of high-income earners feel overwhelmed by managing their wealth? I recommend books like “The Millionaire Next Door” and “The Millionaire Real Estate Investor” because they offer tailored advice for high earners. These books focus on smart investing, tax strategies, and wealth preservation, helping you maximize your income and build lasting financial security. If you’re earning a lot, these are must-reads.

How Frequently Should I Update My Personal Finance Reading List?

When it comes to updating my personal finance reading list, I do it about once a year. I look for new books that offer fresh insights or strategies, especially as my financial situation changes. Staying current helps me adapt to market shifts or new financial tools. I recommend you review your list periodically—maybe annually or biannually—to guarantee it remains relevant and continues to inspire smarter money decisions.

Can These Bestsellers Help With Specific Financial Goals Like Debt Repayment?

You’re wondering if these bestsellers can help with specific goals like debt repayment. I believe they can, especially if you pick books focused on debt management strategies. These books often provide practical advice and motivation to tackle your debts head-on. I’ve found that applying what I learn from them makes a real difference. So yes, choosing the right book tailored to your goals can truly guide you toward financial freedom.

Conclusion

Diving into these books is like opening a treasure chest of financial wisdom, each page a shining gem guiding you toward wealth. As you turn each chapter, imagine planting seeds that will grow into a sturdy tree of financial security. Remember, mastering money isn’t a sprint—it’s a journey. So, grab your map, stay curious, and watch your financial landscape flourish like a well-tended garden. Your bright future is just a page away!