If you want to stay ahead in 2025, I recommend subscribing to top print financial magazines that combine industry updates, personal finance advice, and market analysis. Publications like FORTUNE provide insights on corporate success, while niche books like *Building A Financial Services Clientele* and *Color My Credit* offer practical guidance. Combining these with broader resources guarantees you’re always informed. Keep exploring, and you’ll discover which subscriptions best suit your growth plans this year.

Key Takeaways

- Prioritize magazines offering in-depth industry analysis, economic trends, and leadership insights to stay informed about evolving financial landscapes.

- Select publications that combine timely news with long-term strategic advice for proactive financial planning.

- Consider print editions with high-quality, well-researched articles from reputable sources like Fortune or The Economist.

- Look for magazines that include case studies, expert interviews, and actionable tips to enhance decision-making skills.

- Choose subscriptions that balance current market updates with foundational financial literacy to adapt effectively in 2025.

Building A Financial Services Clientele, 12th Edition

If you’re a financial professional looking to strengthen your client relationships and stay accountable, “Building A Financial Services Clientele, 12th Edition” is an excellent resource. I’ve used it extensively as a Northwestern Mutual representative, relying on its strategies for tracking calls and meetings with the Granum system. The book’s focus on relationship-building and accountability has truly transformed my approach. It’s adaptable across industries, including sales management, and offers invaluable insights for developing a client-focused business. I highly recommend it to anyone aiming to improve client engagement, enhance accountability, and grow a sustainable, relationship-based practice.

Best For: financial professionals, sales managers, and anyone seeking to build strong client relationships and improve accountability in their business practices.

Pros:

- Provides effective strategies for tracking and managing client interactions

- Enhances accountability and relationship-building skills

- Adaptable for use across various industries beyond financial services

Cons:

- May require customization to fit specific industry needs

- Focuses heavily on relationship management, which might not suit all business models

- Some users may find the system’s implementation time-consuming at first

Financial Development Book

The Financial Development Book is an ideal resource for anyone feeling overwhelmed by debt or struggling to manage their finances, especially those seeking a straightforward, actionable plan to improve their financial situation. It offers clear explanations and practical steps to help you navigate debt, budgeting, and financial planning. Whether you’re a beginner or looking to deepen your financial knowledge, this book provides a structured path toward financial freedom. With its accessible approach and motivational guidance, it empowers you to take control of your finances and move from financial struggle to stability and independence. It’s a valuable tool for anyone committed to financial growth.

Best For: individuals overwhelmed by debt or seeking a clear, actionable plan to improve their financial situation and achieve financial independence.

Pros:

- Provides practical, step-by-step guidance suitable for beginners.

- Combines motivational support with accessible financial strategies.

- Available on popular e-reading platforms, making it easy to access.

Cons:

- May not delve deeply into complex financial topics for advanced learners.

- Focuses primarily on basic financial management, possibly limiting scope for experienced individuals.

- As a digital resource, it requires access to an e-reading device or platform.

The Road to the Bountiful Life Achieving Success in Financial Services

Financial magazine subscriptions are ideal for professionals in the financial services industry who want to stay ahead of market trends, sharpen their strategies, and learn from industry leaders. I’ve personally found that studying Harry Hoopis’s principles—centered on mindset, attitude, and perseverance—can transform your career. Hoopis’s success, built on mentorship and relentless drive, shows that achieving a bountiful life requires continuous learning and resilience. His lessons extend beyond finance, applying universally to any business or personal growth. By embracing these timeless teachings, I’ve seen how adopting the right mindset and habits can lead to lasting success in financial services and beyond.

Best For: Financial professionals and business leaders seeking to enhance their mindset, strategies, and resilience for sustained success and growth.

Pros:

- Offers universal lessons on attitude, perseverance, and mentorship applicable across industries

- Draws on the proven success of Harry Hoopis, providing real-world insights and inspiration

- Serves as a valuable resource for ongoing personal development and leadership growth

Cons:

- May require a mindset shift for those resistant to change or new philosophies

- Focuses heavily on principles that need consistent application for effectiveness, which can be challenging to sustain

- Some readers might find the depth of personal anecdotes less directly applicable to their specific industry or role

Color My Credit: Mastering Your Credit Report – And Score – One Crayon at a Time

Are you looking for a practical and straightforward way to boost your credit score? “Color My Credit” stands out as an ideal resource for anyone enthusiastic to understand their credit report and improve their financial standing without costly services. Many readers have seen their scores jump 100 points or more, often by taking simple steps like making phone calls or reviewing their reports. Alisa’s easy-to-understand guidance empowers you to manage your credit independently. The book’s practical strategies help you build better credit, qualify for loans, and achieve your financial goals—all while making the process accessible and even fun.

Best For: individuals seeking a simple, effective, and affordable way to understand and improve their credit scores independently.

Pros:

- Practical and easy-to-follow strategies that deliver real results, often increasing scores by 100 points or more.

- Empowers readers to manage their credit without costly services, promoting self-education and independence.

- Suitable for a wide audience, including first-time buyers, parents, and professionals, making credit improvement accessible for all ages.

Cons:

- The book may require consistent effort and patience, as improvements can take several months.

- Some readers might prefer more in-depth or advanced credit management techniques.

- Limited information on complex credit issues or credit repair for severely damaged credit reports.

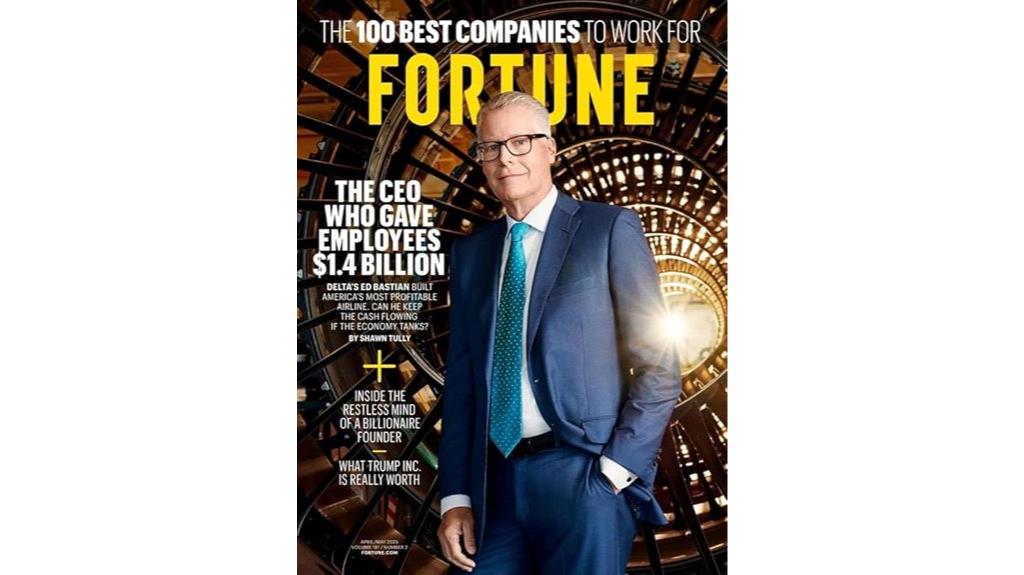

FORTUNE Magazine

Looking for a business magazine that dives deep into corporate success stories and leadership insights? FORTUNE Magazine is an excellent choice. It offers thorough coverage of economic and corporate news, including the renowned Fortune 500 and Global 500 lists, as well as features on top companies, leaders, and influential women. Known for striking photography and compelling storytelling, it provides detailed analysis that helps me understand what drives business success worldwide. While some articles are lengthy, the depth of insight makes it worth the read. If you want to stay informed about major trends, scandals, and leadership strategies, FORTUNE is a reliable resource for professionals and entrepreneurs alike.

Best For: professionals, entrepreneurs, and business enthusiasts seeking in-depth analysis and leadership insights on corporate success and economic trends.

Pros:

- Comprehensive coverage of major business topics including Fortune 500 and leadership features

- High-quality photography and engaging storytelling that enhance the reading experience

- In-depth articles providing detailed analysis valuable for professional growth and strategic insights

Cons:

- Lengthy articles may be less appealing for those preferring quick, concise information

- Some content can be repetitive, focusing heavily on scandals and corporate failures

- Digital editions occasionally experience delays or missing issues, affecting accessibility

How to Say Credit: Unlocking and Understanding Credit

If you’re new to credit and want a clear, easy-to-understand guide, “How to Say Credit: Unlocking and Understanding Credit” is perfect for you. Santiago Gil’s book simplifies complex credit concepts like scores, reports, and responsible card use, making them accessible for beginners. It’s a quick, engaging read that offers practical tips to build and maintain good credit while avoiding common mistakes. Many readers find it motivating and helpful for starting their credit journey. Despite its brevity, it provides valuable insights that can empower you to make smarter financial decisions and improve your credit health effectively.

Best For: beginners or individuals seeking a straightforward, quick introduction to credit management and financial literacy.

Pros:

- Simplifies complex credit concepts for easy understanding.

- Offers practical tips to build and maintain good credit.

- Motivates and encourages readers to take control of their credit health.

Cons:

- Very short (around 24 pages) with limited depth.

- Contains spelling errors and minimal writing, affecting overall quality.

- Some may find it lacks comprehensive details or advanced strategies.

The Illustrated Guide to Financial Independence: Young Adult Edition

The Illustrated Guide to Financial Independence: Young Adult Edition is perfect for high school and college students enthusiastic to take control of their finances early. I love how it simplifies complex concepts like budgeting, saving, and managing loans with relatable stories, visuals, and game-like levels. It encourages good habits and shows how to build credit and plan investments, making finance engaging and accessible. This book not only boosts financial literacy but also motivates young adults to see money management as an empowering skill. If you’re looking to start your financial journey confidently, this guide is an invaluable resource to help you succeed now and later.

Best For: high school and college students eager to learn foundational financial skills and build confidence in managing their money.

Pros:

- Simplifies complex financial concepts with relatable stories and visual aids.

- Uses a game-like approach to make learning engaging and fun.

- Emphasizes the development of good financial habits for long-term success.

Cons:

- May not cover advanced investment strategies for experienced investors.

- Focuses primarily on early financial education, less on detailed retirement planning.

- Some readers might find the illustrative style less suitable for those preferring more technical content.

Personal Finance for Beginners Book

Are you someone new to personal finance who feels overwhelmed by complex jargon and unsure where to start? I get it—that world can seem intimidating. That’s why I recommend the *Personal Finance for Beginners* book. It shifts your mindset from scarcity to abundance, making money feel less stressful and more approachable. With humor, relatable stories, and practical advice on budgeting, saving, and debt, it’s designed for real life. Amy Yorks simplifies tough topics, helping you gain confidence and control. This book isn’t just about wealth; it’s about creating happiness and trust in your financial journey. It’s a friendly, empowering guide to taking that first step.

Best For: Beginners feeling overwhelmed by financial jargon who want a friendly, accessible, and practical guide to start their personal finance journey.

Pros:

- Simplifies complex financial concepts with humor and relatable stories

- Focuses on mindset shifts to foster confidence and reduce stress

- Offers practical, easy-to-implement strategies suitable for any income level

Cons:

- May not delve deeply into advanced investing or wealth-building techniques

- Some readers might prefer more detailed financial planning tools

- The conversational style might feel too casual for those seeking a strictly professional tone

Host Coach Book: Creating Financial Freedom with Short-Term Rentals

For aspiring short-term rental hosts seeking straightforward, actionable guidance, “Host Coach” stands out as an ideal resource. This book offers practical advice, real-life examples, checklists, and insider tips that make launching and managing rentals accessible—even for beginners. Authors Culin and Danielle draw from their entrepreneurial experience, helping readers maximize profits, improve guest experiences, and reduce risks. Many hosts report quick success—covering expenses within months—thanks to the strategies shared. With personalized coaching, community support, and motivational insights, “Host Coach” goes beyond finances, inspiring a purpose-driven approach to building financial freedom through short-term rentals.

Best For: aspiring or new short-term rental hosts seeking practical, step-by-step guidance to launch and grow their rental businesses with confidence and purpose.

Pros:

- Clear, straightforward advice with real-life examples and checklists that simplify complex concepts

- Personalized coaching and community support to enhance success and confidence

- Focus on purpose-driven living, motivation, and financial freedom beyond just profits

Cons:

- May require additional investment for coaching or resources beyond the book itself

- Some strategies might need adaptation based on local regulations or market conditions

- Less focus on advanced investment techniques, making it more suitable for beginners than experienced investors

The Money Noose: Jon Corzine and the Collapse of MF Global

If you’re interested in understanding how risky financial decisions can lead to catastrophic failures, “The Money Noose: Jon Corzine and the Collapse of MF Global” is an essential read. It clearly explains futures trading and repurchase-to-maturity investing, making complex concepts accessible. The book details MF Global’s final week in October 2011, revealing how hubris, risky liquidity management, and irresponsible choices—rather than a rare market event—caused its collapse. Corzine’s reckless positions, similar to big banks but with a lower credit rating, triggered margin calls and bankruptcy. It’s a stark reminder of systemic vulnerabilities, greed, and the importance of oversight in preventing financial disasters.

Best For: readers seeking a clear, accessible explanation of financial failures, systemic risks, and the importance of oversight in complex markets, suitable for both novices and professionals.

Pros:

- Well written, engaging storytelling that makes complex financial concepts easy to understand

- Detailed analysis of MF Global’s collapse, market psychology, and systemic vulnerabilities

- Offers valuable lessons on risk management, accountability, and the consequences of reckless ambition

Cons:

- Some readers might find the technical details overwhelming if they lack basic finance knowledge

- Focused heavily on one case, which may limit broader applicability to other financial crises

- May be somewhat critical of certain individuals and systemic practices, potentially biasing the narrative

Factors to Consider When Choosing a Financial Magazine Subscription (Print)

When selecting a financial magazine subscription, I focus on how well the content matches my interests and how in-depth the analysis is. I also consider the magazine’s target audience and its focus areas to guarantee it aligns with my goals. Finally, I evaluate the design quality, accessibility options, and whether the subscription offers good value for the price.

Content Relevance and Depth

Determining whether a financial magazine’s content aligns with your specific interests and knowledge level is crucial to making a worthwhile subscription choice. I look for magazines that cover my areas of focus, whether it’s investing, personal finance, or industry analysis, to guarantee I find relevant insights. I also evaluate the depth of coverage—does it provide thorough analysis or just surface-level summaries? Reviewing sample issues helps me gauge if the articles match my technical or practical needs. I also check how often the magazine updates its content to stay current with market trends and news. Most importantly, I seek publications that include actionable insights and detailed data, allowing me to apply the information directly to my financial decisions and stay ahead in 2025.

Audience and Focus Area

Understanding who the magazine is designed for is essential before subscribing, as it guarantees the content matches your interests and expertise. Knowing the target audience’s demographics and professional backgrounds helps you determine if the publication addresses your needs. For example, if you’re focused on personal finance, a magazine specializing in individual financial strategies will be more relevant. Conversely, if you’re in corporate finance or investment banking, look for publications that emphasize industry trends and market analysis. Additionally, consider the readership’s expertise level—some magazines are beginner-friendly, while others cater to seasoned professionals. Finally, assess the publication’s editorial focus, whether it’s news, analysis, or educational content, to ensure it aligns with your learning goals and helps you stay ahead in 2025.

Visual and Design Quality

Have you ever noticed how the design of a magazine can influence your reading experience? High-quality financial magazines use professional layouts with clear typography and a balanced mix of images and graphics. Consistent color schemes and aesthetic elements make the content more engaging and easier to follow. When photos are high-resolution and illustrations are custom, the magazine feels more credible and visually appealing. Good design also employs visual hierarchy, guiding your eyes smoothly through articles and highlighting key information without clutter. For digital versions, fast-loading images and responsive layouts ensure a seamless experience across devices. Overall, well-designed magazines not only look great but also enhance understanding, keeping you engaged and making your reading more effective.

Accessibility and Format Options

When choosing a financial magazine subscription, considering the available formats is essential to match your reading habits and lifestyle. I look for magazines that offer both print and digital versions so I can read on my preferred device or in print. It’s also important to check if the print edition comes in different sizes or binding options like hardcover or magazine format for durability and convenience. Readability matters, so I pay attention to font size, layout, and paper quality to ensure comfortable, long-term reading. I also consider whether the magazine provides access to current issues and archives, which helps with research. Finally, I check how often the magazine publishes and if delivery schedules align with my need for timely financial news.

Subscription Cost and Value

How do you determine if a financial magazine subscription is worth the cost? First, I evaluate whether the content’s depth and frequency justify the price. Does it deliver timely, insightful analysis that keeps me informed? I also consider if the topics match my personal or professional interests, maximizing my investment. Checking for additional resources like digital access or online tools can boost value. Comparing the subscription cost to similar magazines helps guarantee I get competitive or superior value. Lastly, I assess the magazine’s credibility and quality—does it provide exhaustive, reliable information worth the expense? If the benefits outweigh the costs, then I see the subscription as a worthwhile investment in my financial knowledge and growth.

Publication Frequency and Updates

Choosing the right publication frequency for a financial magazine depends on how quickly I need updates and how deeply I want to analyze market trends. Monthly publications keep me current with recent market developments, offering timely news and analysis. Quarterly magazines tend to focus on in-depth reports and long-term outlooks, providing a broader perspective but fewer updates. Weekly magazines strike a balance, delivering timely insights into market movements, economic indicators, and corporate news. The publication schedule directly impacts content relevance; more frequent issues guarantee I stay ahead in fast-changing markets. Additionally, I need to align my subscription timing with the magazine’s release cycle to maintain continuous access to the latest insights. Choosing the right frequency helps me stay informed without feeling overwhelmed.

Frequently Asked Questions

Which Magazine Offers the Most Up-To-Date Market Analysis?

You’re wondering which magazine provides the most up-to-date market analysis. I recommend subscribing to The Wall Street Journal. It consistently offers timely, in-depth insights into global markets, financial trends, and economic developments. I rely on it to stay informed and ahead of the curve. Its thorough reporting helps me make smarter investment decisions. If staying current is your goal, The Wall Street Journal is definitely worth considering.

Are There Any Free Trial Options for These Subscriptions?

Many financial magazines offer free trials, giving you a sneak peek before committing. I recommend checking their websites directly, as offers can change like quicksand. Usually, you can get a trial for one to three months, often with special online promotions. It’s a smart way to test if their insights are worth your investment, helping you stay ahead without sinking your finances upfront.

Do These Magazines Include Digital or Online Content Access?

You’re curious if these magazines include digital or online content access. I’ve found that most reputable financial magazines now offer digital versions or online access with their print subscriptions, making it easy to stay updated on the go. This hybrid approach helps me stay informed, whether I prefer flipping through pages or browsing articles on my device. I recommend checking each magazine’s website for specific digital access options included with your subscription.

How Often Do These Magazines Update Their Financial Strategies?

I understand you’re curious about how often these magazines update their financial strategies. Picture flipping through a magazine and finding fresh insights every month—most top publications do just that, releasing new issues regularly. They stay current by incorporating the latest market trends, economic shifts, and expert opinions. This frequent updating helps me stay ahead, and I’m confident it’ll do the same for you, keeping your financial game sharp.

Are Special Editions or Industry-Specific Publications Available?

You’re wondering if special editions or industry-specific publications are available. I can tell you, many financial magazines do offer these options. They often release special editions focused on trending topics or industry-specific insights, which are invaluable for staying ahead. Subscribing to both general and niche publications helps me keep up with the latest developments, ensuring I’m well-informed to make smart financial decisions in 2025 and beyond.

Conclusion

Staying ahead in finance is like steering a river—you need the right boat and a good map. These magazines are my trusted guides, offering insights and strategies to keep you afloat. Remember, knowledge is power, and in finance, it’s the wind in your sails. So, pick your subscription, stay curious, and keep steering toward your financial goals. After all, a wise sailor never stops learning.