If you’re looking to transform your financial future, these 12 top titles, including classics like “Rich Dad Poor Dad,” “Think and Grow Rich,” and curated collections, offer vital insights on mindset, investing, and wealth-building strategies. They focus on asset accumulation, overcoming fears, and taking practical action. By exploring these books, you’ll gain essential knowledge to shift your perspective and start creating long-term wealth. Keep going, and you’ll discover more proven tools to elevate your financial journey.

Key Takeaways

- The collection offers beginner-friendly books that emphasize assets over liabilities to build long-term wealth.

- Titles include “Rich Dad Poor Dad,” “Cashflow Quadrant,” and “Guide to Investing,” providing comprehensive financial insights.

- Books focus on mindset shifts, financial education, and practical strategies for wealth creation.

- The set is suitable for young adults, teenagers, and beginners seeking actionable financial knowledge.

- Reputable editions feature simple language, engaging stories, and tools like educational games to reinforce learning.

Rich Dad Poor Dad Book

If you’re new to financial education and want a clear, practical starting point, the “Rich Dad Poor Dad” book is an excellent choice. It reveals core concepts about wealth, like how the wealthy can stop working and survive without active income. The book emphasizes mastering taxes, overcoming fears, and taking risks. It also teaches you to distinguish assets from liabilities and develop a keen eye for opportunities. More importantly, it encourages surrounding yourself with smart, motivated people and taking action. Reading it transforms perceptions about money, inspiring you to focus on building cash-flowing assets and making smarter financial decisions.

Best For: beginners seeking a clear, practical introduction to financial education and wealth-building principles.

Pros:

- Easy-to-understand language making complex concepts accessible

- Offers practical strategies for asset recognition and opportunity spotting

- Inspires action and mindset shifts toward financial independence

Cons:

- May oversimplify some financial topics for advanced learners

- Focuses more on mindset than detailed investment techniques

- Requires readers to actively apply concepts for tangible results

Think and Grow Rich: The Original Book by Napoleon Hill

“Think and Grow Rich” by Napoleon Hill stands out as a must-read for anyone serious about transforming their mindset and achieving financial success. Published in 1937, it remains relevant in 2024, offering timeless principles that apply to spiritual, mental, emotional, and financial growth. The book outlines 13 Steps to Riches, emphasizing desire, goal-setting, and perseverance. Many readers report profound transformations, gaining clarity, hope, and a stronger faith in their potential. Its simple yet powerful language inspires persistent effort and self-belief, making it a cornerstone for those committed to manifesting wealth, happiness, and purpose. It’s truly a blueprint for success.

Best For: individuals committed to personal development, wealth-building, and transforming their mindset through timeless success principles.

Pros:

- Offers universal, timeless principles applicable across various aspects of success and growth.

- Inspires profound personal transformation, boosting confidence, clarity, and motivation.

- Easy to understand language that encourages consistent application and long-term results.

Cons:

- Some readers may find the language or concepts repetitive and in need of deeper interpretation.

- Requires dedicated effort and perseverance to fully implement its principles effectively.

- May seem idealistic or simplistic to those seeking more advanced or practical financial strategies.

Rich Dad, Poor Dad Book (Paperback, 2000)

The “Rich Dad, Poor Dad” paperback from 2000 stands out as an essential read for anyone enthusiastic to boost their financial literacy and reshape their approach to money. This book offers engaging stories and key lessons on managing finances, emphasizing the importance of understanding assets versus liabilities. It challenges conventional beliefs about wealth, highlighting that financial education is vital for independence. Many readers report it transformed their perspective, inspiring proactive financial decisions like investing and building assets. Despite its small size, it delivers powerful insights that can change your mindset and set you on a path toward financial freedom. It’s a must-read for aspiring entrepreneurs and anyone seeking financial growth.

Best For: individuals seeking to improve their financial literacy, aspiring entrepreneurs, and anyone interested in reshaping their mindset about money and wealth.

Pros:

- Engaging storytelling and practical lessons make complex financial concepts accessible.

- Emphasizes the importance of financial education, assets, and liabilities for wealth building.

- Inspires proactive financial decision-making and personal growth towards financial independence.

Cons:

- The print size may be small and difficult for some readers to comfortably read.

- As a relatively brief book, some may find the content lacks depth or detailed strategies.

- The focus on basic principles might not satisfy readers looking for advanced financial advice.

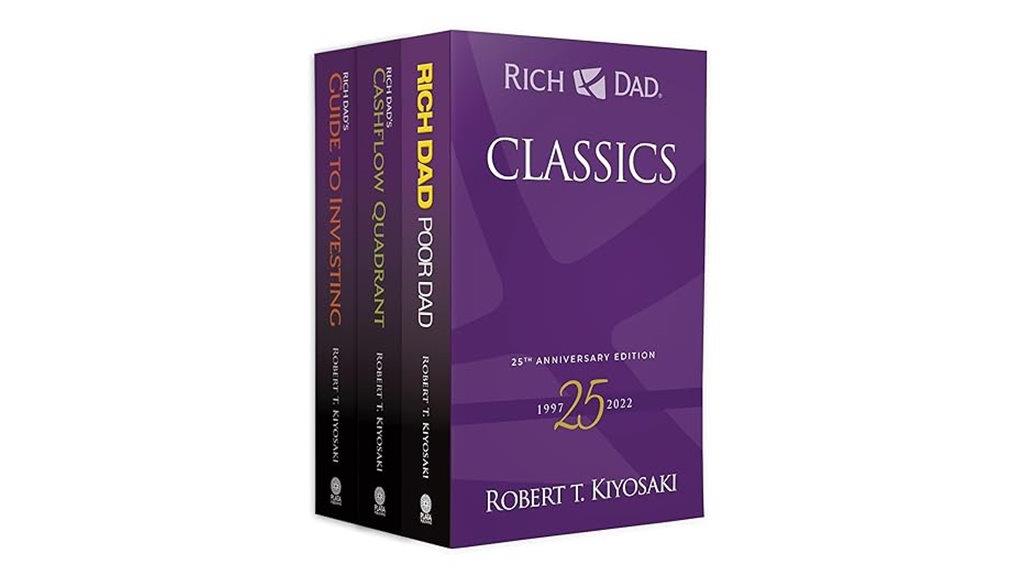

Rich Dad Classics Boxed Set

The Rich Dad Classics Boxed Set stands out as an excellent choice for beginners enthusiastic to build a solid foundation in personal finance and investing. I found this collection to be both engaging and insightful, arriving in sealed packaging that makes it a great gift option. It includes essential titles like “Rich Dad Poor Dad” and “Cashflow Quadrants,” offering an all-encompassing overview of wealth-building concepts. Many readers, including myself, have used these books to better understand how the rich accumulate wealth and how to start their own financial journey. The set’s good print quality and clear lessons make it a valuable resource for anyone eager to learn about financial independence.

Best For: beginners and anyone looking to build a strong foundation in personal finance and investing through accessible and comprehensive educational resources.

Pros:

- Arrives in sealed packaging, making it an ideal gift option

- Includes key titles like “Rich Dad Poor Dad” and “Cashflow Quadrants” for a well-rounded introduction

- Provides clear, engaging lessons on wealth-building and financial independence

Cons:

- Some titles, such as “Fake,” may be considered redundant or less innovative by experienced readers

- Opinions vary on the depth and novelty of recent publications within the series

- The set may be less suitable for advanced investors seeking more complex financial strategies

Rich Dad Poor Dad by Kiyosaki, Robert T 2nd (second) Edition (2011)

If you’re looking for an accessible introduction to financial education, the second edition of “Rich Dad Poor Dad” by Robert Kiyosaki stands out as an ideal choice. This book emphasizes the importance of changing your mindset about money, understanding assets versus liabilities, and escaping the rat race. It offers practical advice on starting investments, especially in real estate, and encourages immediate action. The CASHFLOW game helps internalize lessons through fun, real-world simulations. Many readers find it life-changing, inspiring them to pursue financial independence and adopt long-term wealth-building principles. It’s a straightforward, engaging starting point for anyone enthusiastic to transform their financial future.

Best For: individuals seeking an accessible and motivating introduction to financial education and wealth-building principles.

Pros:

- Provides clear, straightforward guidance suitable for beginners.

- Emphasizes mindset shifts and practical actions to improve financial health.

- Incorporates engaging tools like the CASHFLOW game to reinforce learning.

Cons:

- Focuses heavily on real estate, with limited coverage of other income streams.

- Some readers find the language abstract and desire more personal anecdotes.

- Lacks detailed step-by-step investment instructions, requiring further research.

Rich Dad Poor Dad for Teens: Money Secrets Not Taught in School

Young readers enthusiastic to grasp financial principles often find traditional school curricula lacking in real-world money lessons. “Rich Dad Poor Dad for Teens” stands out as an essential resource for teenagers who want to learn about investing, entrepreneurship, and managing assets early on. Written by Robert Kiyosaki, it highlights vital concepts like assets versus liabilities, rental properties, and investing strategies, filling gaps schools leave out. Despite its small size, many teens find the book clear and motivating, often internalizing ideas through passive listening. It encourages a proactive mindset toward wealth, inspiring young minds to develop healthy financial habits and pursue opportunities early, setting a strong foundation for future success.

Best For: Teenagers and young adults seeking an accessible, motivational introduction to financial principles, investing, and entrepreneurship to build a strong foundation for future wealth.

Pros:

- Concise and easy to understand, ideal for young readers new to financial concepts

- Inspires proactive financial thinking and goal setting early in life

- Reinforces key ideas through passive listening and repeated exposure, aiding internalization

Cons:

- Very small size may seem more appropriate for children than teenagers, potentially limiting its perceived value

- Limited content volume, with some readers feeling it offers only superficial information

- Recent works by Kiyosaki are sometimes criticized for lack of originality and over-commercialization

Rich Dad Poor Dad 3 Books Collection Set by Robert Kiyosaki

For anyone enthusiastic to deepen their financial knowledge, the Rich Dad Poor Dad 3 Books Collection Set by Robert Kiyosaki offers a compact and complete way to start. This set includes “Rich Dad Poor Dad,” “Rich Dad’s Cashflow Quadrant,” and “Rich Dad’s Guide to Investing,” all in nearly pocket-sized editions with clear print and sturdy binding. Customers rave about their practicality, ease of understanding, and inspiring content. Many find these books impossible to put down and valuable for improving money management and investing skills. Whether as a gift or personal resource, this collection provides essential insights that can truly transform your financial mindset and future.

Best For: individuals seeking a practical, beginner-friendly introduction to financial literacy and wealth-building principles through concise and inspiring books.

Pros:

- Compact, nearly pocket-sized editions with clear print and durable binding for lasting use

- Highly practical content offering real-world examples and actionable advice

- Well-loved by readers for being engaging, easy to understand, and motivational

Cons:

- Smaller size may be less ideal for those who prefer larger, more detailed texts

- Some readers might find the content too basic if they already have advanced financial knowledge

- Limited to three books, which may not cover all aspects of financial education in depth

Rich Dad Poor Dad Book about Money and Wealth

The “Rich Dad Poor Dad” book about money and wealth stands out as an essential resource for anyone seeking to transform their financial mindset and build lasting wealth. It emphasizes financial literacy, teaching you to identify assets that generate passive income and avoid liabilities that drain resources. The book contrasts working for money with making money work for you, highlighting the importance of investing early and continuously learning. It advocates behavioral change, discipline, and understanding tax advantages. By shifting your perspective from consumerism to asset accumulation, you’ll develop the habits and knowledge needed to achieve financial independence and long-term prosperity.

Best For: individuals seeking to improve their financial literacy, build wealth through asset investment, and adopt a proactive money mindset.

Pros:

- Teaches fundamental principles of asset accumulation and passive income generation.

- Encourages behavioral changes and discipline for long-term financial success.

- Provides practical strategies for investing early and understanding tax benefits.

Cons:

- Some strategies may be US-centric and less applicable in different countries.

- Requires commitment to continuous learning and risk-taking, which may be challenging for some.

- Lacks detailed step-by-step investment guides, focusing more on mindset and principles.

Think and Grow Rich Book by Napoleon Hill

“Think and Grow Rich” by Napoleon Hill stands out as an essential read for individuals enthusiastic to discover the secrets of wealth and success through proven principles. This book distills timeless lessons into practical steps, emphasizing the importance of desire, persistence, and faith. It’s a concise guide that offers actionable advice, encouraging deliberate effort and goal-setting. The updated edition includes references to current leaders and tools to help you stay motivated and focused. Many see it as a quick yet powerful resource to reinforce success habits, making it a must-have for anyone serious about transforming their financial future.

Best For: individuals seeking practical, motivational guidance on achieving financial success and personal growth through proven principles.

Pros:

- Offers timeless, actionable principles for wealth and success

- Easy-to-understand and concise, making it accessible for quick reference

- Includes updated references and tools to help maintain motivation and focus

Cons:

- Some editions may be incomplete or missing content, reducing its effectiveness

- May require supplementing with the full version for comprehensive understanding

- Focuses heavily on mindset and principles, which may need to be paired with practical action steps

Rich Dad, Poor Dad (Spanish Edition)

If you’re looking to deepen your understanding of financial education in Spanish, Rich Dad Poor Dad (Spanish Edition) stands out as an essential resource. It reshapes how you see money, emphasizing the importance of financial literacy often missing in traditional schooling. The book contrasts two mindsets—one focused on working for money, the other on making money work for you—offering practical advice on investing, asset creation, and managing finances. Many readers find it motivating and easy to understand, making complex concepts accessible through personal stories. It’s a powerful guide to transforming your mindset and gaining control over your financial future.

Best For: individuals seeking to improve their financial literacy, entrepreneurs, and anyone interested in transforming their mindset towards wealth creation through practical and accessible advice.

Pros:

- Simplifies complex financial concepts making them easy to understand

- Emphasizes the importance of financial education often missing in traditional schooling

- Motivates readers to take control of their financial future through personal stories and real-life examples

Cons:

- May oversimplify certain financial strategies not suitable for all circumstances

- Some concepts might require additional research or adaptation for individual situations

- Repetitive content could reduce engagement for some readers

Rich Dad Poor Dad

Anyone looking to transform their understanding of money and build lasting financial independence will find Rich Dad Poor Dad to be an invaluable resource. This book by Robert T. Kiyosaki emphasizes the importance of financial education, mindset shifts, and practical strategies for wealth building. It introduces core concepts like distinguishing assets from liabilities and highlights the value of investing, entrepreneurship, and taking calculated risks. I’ve personally found its stories and lessons inspiring, helping me rethink how I manage money. The book’s straightforward approach makes complex ideas accessible, empowering readers to take control of their finances and pursue financial freedom with confidence.

Best For: individuals of all ages seeking to improve their financial literacy, shift their mindset about money, and learn practical strategies for building wealth and achieving financial independence.

Pros:

- Simplifies complex financial concepts through engaging storytelling, making it accessible for beginners and experienced investors alike

- Emphasizes the importance of financial education, asset building, and entrepreneurial thinking to foster long-term wealth

- Inspires proactive financial management and mindset shifts that can lead to real-life financial improvements

Cons:

- Some readers may find the advice too general or lacking in specific actionable investment strategies

- The book’s age and certain outdated examples might require supplementing with more current financial information

- Occasional criticism regarding the quality of physical production, such as paper quality, which some feel does not match the book’s value

Rich Dad Poor Dad (Hindi Edition)

The “Rich Dad Poor Dad (Hindi Edition)” is an ideal choice for anyone new to personal finance who wants to grasp fundamental money management principles. This was the first finance book I read, and I absolutely loved it. Thanks to this book, I learned how to invest money wisely and understand the difference between assets and liabilities. It teaches that instead of chasing money, you should let money work for you. The book also reveals how the wealthy legally minimize taxes and build wealth. It’s a highly educational book and, in my opinion, the best finance education resource in the world. I highly recommend reading it to transform your financial future.

Best For: beginners in personal finance seeking fundamental money management and investment principles.

Pros:

- Highly educational and easy to understand for newcomers

- Teaches valuable concepts like asset management and tax minimization

- Inspires a mindset shift towards letting money work for you

Cons:

- May lack in-depth investment strategies for advanced learners

- Some readers might find the simplified approach too basic

- The book’s focus on mindset may require supplementary resources for practical application

Factors to Consider When Choosing a Rich Dad Poor Dad Book

When choosing a Rich Dad Poor Dad book, I consider factors like edition and translation quality to guarantee I get accurate information. I also look at how in-depth and clear the content is, along with how practical the advice feels for real-world application. Finally, I assess the author’s credibility and style to find a book that truly resonates with my learning preferences.

Edition and Version Variations

Choosing the right edition of “Rich Dad Poor Dad” requires paying attention to the specific features and updates each version offers. Different editions may include revised chapters, new introductions, or updated content that reflects current financial trends, making some editions more relevant than others. Language translations, such as Spanish or Hindi, broaden accessibility for a global audience, while special editions might offer bonus materials like workbooks or digital access codes for deeper engagement. Some versions contain additional forewords or author notes that provide further insights. When selecting an edition, consider the publication date and the features included to guarantee it aligns with your learning goals. The right edition can enhance your understanding and make your financial journey more effective.

Language and Translation Quality

Ensuring the translation of “Rich Dad Poor Dad” accurately reflects the original is vital for truly grasping its financial principles. A poor translation can distort key ideas, leading to misunderstandings. I look for high-quality translations that preserve the tone, clarity, and accessibility of the original, making complex concepts easier to understand. It’s also important that cultural or contextual nuances are adapted appropriately for the target audience without compromising the core messages. Proper grammar and idiomatic expressions should resonate naturally with native speakers, ensuring the book feels authentic. Ultimately, I consider the reputation of the translator or publisher; reputable sources are more likely to deliver faithful, reliable versions that maintain the integrity of Robert Kiyosaki’s lessons. Good translation quality makes a real difference in how effectively I learn from the book.

Content Depth and Clarity

A key factor in selecting a “Rich Dad Poor Dad” book is its ability to clearly explain essential financial concepts like assets, liabilities, and cash flow. I look for books that strike a balance between foundational principles and practical examples, making complex ideas easier to grasp. Avoiding overly technical jargon is vital, so I prefer versions that are accessible regardless of my current financial knowledge. Structured guidance or step-by-step strategies help me understand how to implement these lessons into my daily habits. I also pay attention to reviews highlighting the book’s clarity and ease of understanding. A clear, well-organized presentation ensures I can follow along and truly learn, which is indispensable for transforming my financial mindset and future.

Practical Application Focus

When selecting a “Rich Dad Poor Dad” book, I focus on how well it provides practical strategies I can directly apply to my financial life. I look for titles that include exercises, tools, or case studies that help turn theory into real habits. It’s important the book emphasizes skills like asset identification, cash flow management, and investment decision-making, so I can develop a strong financial foundation. I also prioritize resources that encourage proactive behaviors—spotting opportunities, embracing risks, and staying committed to ongoing financial education. Clear, step-by-step guidance is essential, especially for beginners or those at an intermediate level, as it makes applying new concepts less overwhelming. Virtually, I want a book that not only informs but actively helps me implement effective financial practices.

Author Credibility and Style

How do you determine if a Rich Dad Poor Dad book is trustworthy? First, I look at the author’s background—are they experienced in finance, investing, or entrepreneurship? A credible author should have real-world expertise and a solid reputation. I also consider their writing style—does it match my learning preferences? Whether it’s clear, engaging, or technical, the style should help me understand and apply concepts easily. Practical advice grounded in actual experience is vital, so I check for reviews or testimonials that highlight their helpfulness. Finally, I prefer authors with established authority—published works, industry recognition, or positive reader feedback—that guarantee I’m learning from someone who’s respected and reliable.

Price and Accessibility

Choosing the right Rich Dad Poor Dad book involves considering its price and how easily I can access it. I check if the cost fits my budget, especially since editions and sets can vary widely. I also look for the format I prefer—hardcover, paperback, audiobook, or e-book—to guarantee I can read or listen conveniently. Shopping around online or at local stores helps me find discounts or promotions that make the book more affordable. I also verify if it’s available in my language, which is important for understanding complex concepts. Ultimately, I consider delivery options, shipping costs, and regional availability to avoid delays. Making sure these factors helps me access the book easily and at a reasonable price, making my learning journey smoother.

Frequently Asked Questions

Which Rich Dad Poor Dad Edition Is Best for Beginners?

You’re wondering which edition of Rich Dad Poor Dad is best for beginners. I recommend starting with the original book by Robert Kiyosaki. It’s straightforward, easy to understand, and lays the foundation for financial education. The classic edition covers essential concepts without overwhelming details. Once you’re comfortable, you can explore newer editions or related books for deeper insights. This approach helps build confidence and understanding step by step.

Are There Specific Books for Teenagers to Learn About Money?

You’re asking if there are books designed specifically for teenagers to learn about money. I’ve found that books like “Rich Dad’s Guide to Investing for Teens” or “The Teen Investor” are fantastic choices. They break down complex concepts into simple, relatable ideas that resonate with young minds. I recommend these because they build a strong foundation early, helping teens develop smart money habits that last a lifetime.

How Do Cultural Editions of Rich Dad Poor Dad Differ?

This question about cultural editions of *Rich Dad Poor Dad* is fascinating—these versions are like different lenses revealing unique financial truths across cultures. I’ve seen how they adapt stories and lessons to resonate locally, making financial wisdom more relatable. While core principles stay the same, each edition highlights specific values and challenges. It’s incredible how one book can be a universal guide yet tailored to diverse audiences, making financial education truly global.

Which Book Offers the Most Practical Financial Strategies?

When it comes to practical financial strategies, I’d recommend “Rich Dad’s Guide to Investing.” It offers clear, actionable advice on building wealth through smart investments and mindset shifts. I’ve found it incredibly useful because it focuses on real-world tactics rather than just theory. If you’re serious about transforming your finances, this book breaks down complex concepts into easy steps you can start applying right away.

What Factors Should I Consider When Choosing a Rich Dad Poor Dad Book?

Did you know that choosing the right book can boost your financial IQ by up to 60%? When picking a Rich Dad Poor Dad book, I consider factors like the author’s credibility, the clarity of concepts, and practical advice offered. I also look for reviews from readers who’ve applied the lessons. These help me find a book that’s not just inspiring but also actionable, guiding me toward real financial growth.

Conclusion

Diving into these books feels like opening a treasure chest of financial wisdom, each page shining like a gem in the sunlight. As I turn each chapter, I see my future brighter, my mindset clearer, and my goals more within reach. These stories and lessons are like guiding stars, illuminating my path through the maze of wealth-building. I’m excited to embrace this journey, knowing that each book is a step closer to the financial freedom I envision.