If you’re looking to secure your financial future, I recommend exploring top retirement planning books that cover everything from money management to lifestyle choices. These include all-encompassing guides on estate planning, strategic investment tips, and emotional wellbeing in retirement. Whether you’re near retirement or just starting to plan, these books offer actionable advice and tools to help you feel confident about your future. Keep going to discover which titles can truly make a difference for you.

Key Takeaways

- Highlight comprehensive guides covering financial strategies, estate planning, and lifestyle considerations tailored for different retirement stages.

- Emphasize books that include practical tools like checklists, worksheets, and step-by-step instructions for actionable planning.

- Include titles focusing on emotional wellbeing, relationships, and personal growth to promote a fulfilling retirement experience.

- Prioritize resources designed for specific audiences such as near-retirees, women, and those seeking holistic or beginner-friendly approaches.

- Select books that address recent legislative updates, Social Security strategies, healthcare options, and risk management for a secure future.

Retirement Planning Guidebook

Are you looking for a retirement planning book that covers both financial and non-financial aspects in detail? The Retirement Planning Guidebook is exactly that. It offers a thorough framework, helping you set clear goals for lifestyle, health, and legacy while understanding risks like market volatility and longevity. It guides you through budgeting, evaluating your readiness, and organizing estate plans to protect your assets. This book also explains key concepts like withdrawal rules and risk management tools, empowering you to appraise your financial preparedness. It’s a practical resource that blends detailed strategies with personal planning, making it ideal for anyone serious about a secure, fulfilling retirement.

Best For: Individuals seeking a comprehensive and practical guide to retirement planning that covers both financial strategies and non-financial lifestyle considerations.

Pros:

- Provides an extensive overview of both financial and non-financial aspects of retirement planning.

- Offers practical tools and clear explanations of complex concepts suitable for intermediate learners.

- Emphasizes personalized strategies and encourages ongoing education and adaptation.

Cons:

- May require readers to have some prior knowledge or willingness to learn complex topics.

- Not a quick read; the detailed content may be overwhelming for those seeking a brief overview.

- Focuses more on strategic planning; less emphasis on specific step-by-step implementation.

Living Trusts + Wills, Retirement, Tax & Estate Planning Book

If you’re looking for a thorough guide to safeguard your assets and guarantee a smooth estate transfer, the Retirement Planning Books focusing on Living Trusts, Wills, and Tax & Estate Planning is an excellent choice. It covers estate planning essentials like trusts, wills, probate avoidance, and legal forms, making complex processes straightforward with checklists and templates. The book emphasizes reducing legal costs, preventing family conflicts, and avoiding probate delays. It also offers strategies for tax savings, wealth preservation, and passing assets efficiently. Practical case studies and tools help you organize your estate, ensuring your legacy is protected and transferred seamlessly to your loved ones.

Best For: individuals seeking comprehensive guidance on estate, retirement, and tax planning to protect their assets and ensure smooth transfer to heirs.

Pros:

- Provides detailed checklists, templates, and step-by-step instructions to simplify complex legal processes.

- Covers a wide range of topics including trusts, wills, probate avoidance, tax strategies, and wealth preservation.

- Includes real-life case studies and practical tools to help organize and implement estate plans effectively.

Cons:

- May be overwhelming for complete beginners without prior legal or financial knowledge.

- Some templates and forms might require customization by a legal professional for specific situations.

- The extensive content could be time-consuming for users seeking quick, straightforward solutions.

The Art of Women’s Retirement Planning Guide

The Art of Women’s Retirement Planning Guide stands out as an essential resource for women seeking practical, empowering advice to navigate their retirement journey. It offers clear guidance, real-life stories, and organized tools like The Map to The Art of Women’s Retirement, which helps set goals, track progress, and address key areas like finances, health, and relationships. The book encourages starting planning at any stage and emphasizes building confidence, managing emotional challenges, and embracing the next chapter with purpose. Its straightforward approach makes complex topics manageable, inspiring women to take control and turn retirement dreams into achievable realities.

Best For: women of all ages seeking practical, confidence-boosting guidance to plan and enjoy a fulfilling retirement.

Pros:

- Provides clear, organized tools like The Map to The Art of Women’s Retirement for goal setting and progress tracking.

- Combines real-life stories and motivational insights to foster confidence and emotional resilience.

- Covers a comprehensive range of topics including finances, health, relationships, and personal fulfillment in retirement.

Cons:

- May require reading multiple chapters to fully grasp complex financial strategies.

- Some readers might find the self-reflection questions time-consuming or challenging to answer.

- The book’s focus on women may make it less directly applicable to men seeking retirement guidance.

Uncommon Financial Planning Wisdom for Retirement

Retirement planning books that focus on uncommon wisdom are ideal for individuals who want to move beyond standard industry advice and develop a more resilient, personalized strategy. Todd Tresidder’s approach challenges traditional models, emphasizing practical, robust methods over unreliable predictions. Instead of obsessing over uncertain market forecasts, he advocates calculating a “magic savings number” and building multiple scenario-based models to understand potential outcomes. His Simple 3 Rule System simplifies planning by focusing solely on passive income versus expenses, empowering you to take control. This wisdom encourages flexibility, risk management, and active goal setting—key ingredients for a secure, adaptable retirement plan built on real-world principles.

Best For: individuals seeking a practical, resilient retirement planning approach that moves beyond conventional models and emphasizes active control and real-world strategies.

Pros:

- Emphasizes simplicity and robustness over complex, unreliable forecasts.

- Encourages active goal setting and control of savings and lifestyle.

- Uses scenario analysis and valuation-based models to improve the accuracy of long-term planning.

Cons:

- May require a shift away from traditional financial advice, which could be challenging for some.

- Focuses on passive income strategies that might not suit everyone’s risk tolerance or preferences.

- Less emphasis on detailed investment selection or specific asset allocation guidance.

Retirement Planning Guidebook

A Retirement Planning Guidebook is an ideal choice for individuals who want a thorough, practical roadmap to prepare for their future. It offers a complete framework covering financial and non-financial aspects, including goal setting, risk management, and estate planning. The book explains key concepts like the 4% withdrawal rule and sequence-of-return risk while providing tools to assess financial readiness. It also explores investment strategies, insurance options, healthcare planning, and lifestyle considerations. Designed to be practical and adaptable, it helps readers tailor strategies to their unique situations, empowering them to make confident decisions and build a secure, fulfilling retirement.

Best For: individuals seeking a comprehensive, practical, and customizable guide to retirement planning that covers both financial and non-financial aspects for confident decision-making.

Pros:

- Offers an extensive overview of key retirement concepts and strategies, enhancing understanding for intermediate learners.

- Provides practical tools and frameworks to evaluate financial readiness and tailor plans to personal situations.

- Emphasizes holistic planning, including estate, healthcare, lifestyle, and psychological well-being for a well-rounded approach.

Cons:

- May require additional research or professional advice for complex topics like discount rates or advanced estate planning.

- Assumes a certain level of prior knowledge, which might be challenging for complete beginners.

- The breadth of topics could be overwhelming without focused guidance on specific areas of interest.

The Five Years Before You Retire Retirement Planning Guide

If you’re within five years of retiring and want a clear roadmap, this guide is especially helpful. It offers a thorough overview of retirement preparation, with worksheets, resources, and timelines to keep you on track. The book emphasizes maximizing your savings now, understanding key decisions like 401(k) matches and housing options, and planning family discussions. It covers essential topics such as healthcare, Medicare, and budgeting for retirement expenses. Whether you’re just starting or close to retirement, it shows you the actions needed to secure a comfortable future. With practical advice, it helps you navigate the final stretch confidently.

Best For: individuals within five years of retirement seeking a clear, practical roadmap with worksheets and resources to confidently prepare for their retirement.

Pros:

- Provides comprehensive guidance with actionable steps and detailed worksheets.

- Emphasizes critical retirement decisions like savings, healthcare, and housing.

- Suitable for both beginners and those close to retirement, offering tailored advice.

Cons:

- Based on data from 2021, potentially outdated without updates.

- May be too simplistic or incomplete for readers with complex retirement plans.

- Some readers find the content less detailed about current costs and specific financial figures.

The Ultimate Retirement Guide for 50

Are you approaching your 50s and feeling uncertain about how to secure a comfortable retirement? I understand how overwhelming it can be, but Suze Orman’s “The Ultimate Retirement Guide for 50+” offers clear, practical advice tailored for this essential decade. Updated for 2025, it covers recent legislative changes, strategies for delaying Social Security, downsizing, and managing your savings effectively. Orman’s empathetic approach helps you navigate complex decisions confidently, letting go of fears and regrets. This book is a reassuring resource for those wanting to make informed choices today, ensuring a more secure and fulfilling retirement tomorrow.

Best For: individuals approaching or in their 50s who want practical, up-to-date guidance on securing a financially stable and fulfilling retirement.

Pros:

- Offers comprehensive strategies tailored for the 50+ age group, including recent legislative updates for 2025.

- Combines financial expertise with empathetic advice, addressing emotional concerns about retirement.

- Provides actionable steps to help readers confidently make informed retirement decisions.

Cons:

- May be less suitable for younger individuals just beginning to plan for retirement.

- The focus on legislative changes for 2025 might require supplementary updates for future years.

- Some readers might find the material dense if they prefer quick, simplified advice.

Medicare Mamas Guide to Medicare and Social Security Retirement

Medicare Mamas Guide to Medicare and Social Security Retirement stands out as the perfect resource for individuals approaching or already in retirement who want straightforward, practical advice. As someone who’s navigated these complex systems myself, I know how confusing it can be. Sylvia Gordon breaks down everything—from enrollment deadlines to avoiding costly penalties—making it easy to understand. She covers recent updates like the Inflation Reduction Act and offers strategies to maximize benefits while minimizing expenses. Whether you’re new to Medicare or planning your Social Security benefits, this guide equips you with the tools to make confident, informed decisions, ensuring you get the most out of your retirement years.

Best For: individuals approaching or in retirement seeking clear, practical guidance on Medicare and Social Security to make informed decisions and maximize benefits.

Pros:

- Simplifies complex Medicare and Social Security topics with easy-to-understand explanations.

- Offers practical strategies to avoid penalties, reduce costs, and optimize benefits.

- Includes valuable tools and resources like checklists, comparison charts, and planning worksheets.

Cons:

- May require additional research for personalized planning beyond the book’s scope.

- Some updates, such as policy changes, might not be reflected immediately in future editions.

- The comprehensive nature of the book could be overwhelming for complete newcomers without prior research.

Retirement Planning Book: Achieve Financial Freedom & Stress-Free Retirement

Looking for a retirement planning book that simplifies complex financial concepts and offers practical strategies? This book provides a clear roadmap to achieve financial freedom and enjoy a stress-free retirement. It covers essential topics like Social Security optimization, estate planning, and managing inflation, making strategies accessible no matter your age. The author emphasizes early planning and offers actionable advice on reducing taxes, managing healthcare costs, and ensuring savings last. With helpful tools like checklists and quick-start guides, I found it empowering and easy to follow. Whether you’re just starting or nearing retirement, this book makes creating a secure financial future straightforward and achievable.

Best For: individuals of all ages seeking a straightforward, comprehensive guide to retirement planning and financial independence.

Pros:

- Simplifies complex financial concepts making strategies accessible for all readers

- Offers practical tools like checklists and quick-start guides for easy implementation

- Emphasizes early planning to enhance retirement readiness and decision-making

Cons:

- May be more beneficial for those starting their retirement journey rather than current retirees

- Some readers might find the content too basic if they have advanced financial knowledge

- Limited focus on specific niche topics such as investment options or detailed estate law

Retirement Planning For Dummies (For Dummies (Business & Personal Finance))

Retirement Planning For Dummies is an ideal starting point for anyone seeking clear, straightforward guidance on preparing financially for retirement. I find it invaluable because it covers everything from managing savings, pensions, and insurance to understanding current regulations like the SECURE Act and withdrawal rules. Whether you’re just starting your career or nearing retirement, this book offers practical advice on maximizing contributions to 401(k)s and HSAs, balancing investments, and planning for future expenses. Its beginner-friendly approach, written by an experienced author, helps demystify complex topics, empowering you to make informed decisions and secure your financial future with confidence.

Best For: Individuals at any stage of their career seeking clear, practical guidance on preparing financially for retirement.

Pros:

- Provides comprehensive, beginner-friendly advice on retirement planning.

- Covers recent regulatory updates like the SECURE Act and withdrawal rules.

- Emphasizes effective saving strategies, including maximizing 401(k) and HSA contributions.

Cons:

- May be too basic for advanced investors seeking in-depth financial strategies.

- Focuses primarily on U.S. regulations, limiting applicability in other countries.

- Some topics may require supplementary resources for detailed planning.

Golden Years Together: A Practical Guide to Thriving Through Retirement

If you’re approaching retirement and want to make certain your golden years are fulfilling and harmonious, “Golden Years Together: A Practical Guide to Thriving Through Retirement” is an excellent resource. It helps you navigate emotional shifts, redefine your identity, and manage relationship dynamics with your partner. The book offers practical advice on planning finances, balancing daily routines, and embracing new opportunities like hobbies and travel. Most importantly, it emphasizes building meaningful connections with family, friends, and community. This guide encourages you to see retirement as a time for growth, renewal, and shared purpose, ensuring your later years are truly rewarding.

Best For: individuals approaching or experiencing retirement who seek practical guidance on emotional wellbeing, relationship strengthening, and lifestyle planning to ensure a fulfilling and harmonious later life.

Pros:

- Provides comprehensive strategies for emotional and psychological transition into retirement

- Offers practical advice on managing finances, routines, and new opportunities for growth

- Emphasizes the importance of relationships, community, and shared purpose for a meaningful retirement

Cons:

- May require time and effort to implement all suggested lifestyle and relationship changes

- Some readers might find certain sections too general or not tailored to specific retirement scenarios

- The focus on relationship reconnection might be less applicable to those already experiencing significant conflicts

Retirement Planning Roadmap: 7-Step Guide to Financial Security

For anyone feeling overwhelmed by the idea of retirement planning, “Retirement Planning Roadmap” offers a clear, step-by-step guide to achieve financial security. I’ve found this approach invaluable, as it breaks down complex tasks into seven manageable steps. From setting realistic retirement goals and calculating your “magic number,” to choosing the right savings strategies and avoiding common pitfalls, the roadmap keeps you focused. It emphasizes early planning, smart investing, and lifestyle considerations beyond finances. This guide helps you build confidence and develop a personalized plan, ensuring you’re prepared for retirement’s emotional, social, and financial aspects—so you can enjoy a secure, fulfilling future.

Best For: individuals of all ages seeking a straightforward, comprehensive guide to retirement planning that covers financial, emotional, and lifestyle considerations.

Pros:

- Provides a clear, step-by-step approach making complex planning tasks manageable

- Offers practical strategies, tools, and resources tailored for diverse needs and circumstances

- Emphasizes early planning and holistic preparation to ensure a secure, fulfilling retirement

Cons:

- May require additional research for personalized investment options and specific financial details

- Some readers might find the general advice less tailored to unique individual situations

- The book’s broad scope might be overwhelming for those looking for quick, simplified tips

Not Your Parents Retirement Workbook

Looking to redefine what retirement means for you? Not Your Parents’ Retirement Workbook guides you beyond traditional ideas, helping you discover what truly matters. It encourages reflection on your values, passions, and goals, enabling you to design a fulfilling, purposeful future. With practical worksheets and planning tools, it empowers you to take control of your finances, explore new opportunities, and turn inspiration into action. Whether you’re interested in second careers, volunteering, or simply living actively, this workbook challenges outdated myths about retirement. It’s perfect for those seeking independence, growth, and a vibrant, customized retirement experience.

Best For: individuals and couples seeking a modern, proactive approach to redefining retirement, focusing on fulfillment, independence, and personal growth.

Pros:

- Encourages reflection on personal values, passions, and goals to create a meaningful retirement vision

- Offers practical worksheets and planning tools for financial management and lifestyle design

- Promotes exploration of new opportunities such as encore careers, volunteering, and active living

Cons:

- May require a significant time investment to complete exercises and planning activities

- Some users might find the content too broad or general without tailored advice

- Not a substitute for professional financial or retirement planning guidance

Retirement Planning Guide for a Secure Future

Are you seeking a straightforward, practical guide to secure your retirement, no matter your age or income level? This Retirement Planning Guide for a Secure Future offers clear, step-by-step advice to help you build a solid financial foundation. It covers investment strategies, budgeting, saving, and managing withdrawals, with easy-to-follow templates and checklists. The book simplifies complex topics like IRAs, 401(k)s, Social Security, and healthcare costs, making them accessible for everyone. It encourages proactive planning, even if you think you’ve fallen behind, emphasizing that it’s never too early or late to start. With practical exercises and relatable examples, it’s a valuable resource for your retirement journey.

Best For: individuals of all ages and income levels seeking a clear, practical, and accessible guide to building a secure retirement plan.

Pros:

- Provides step-by-step instructions, templates, and checklists for personalized planning

- Demystifies complex financial topics like IRAs, 401(k)s, and Social Security with relatable examples

- Emphasizes proactive planning and offers motivational exercises to boost confidence

Cons:

- May require some readers to seek additional information for highly specific financial situations

- Focuses primarily on general strategies, which might need tailoring for complex or unique circumstances

- As a comprehensive guide, it may be lengthy for those seeking quick, concise advice

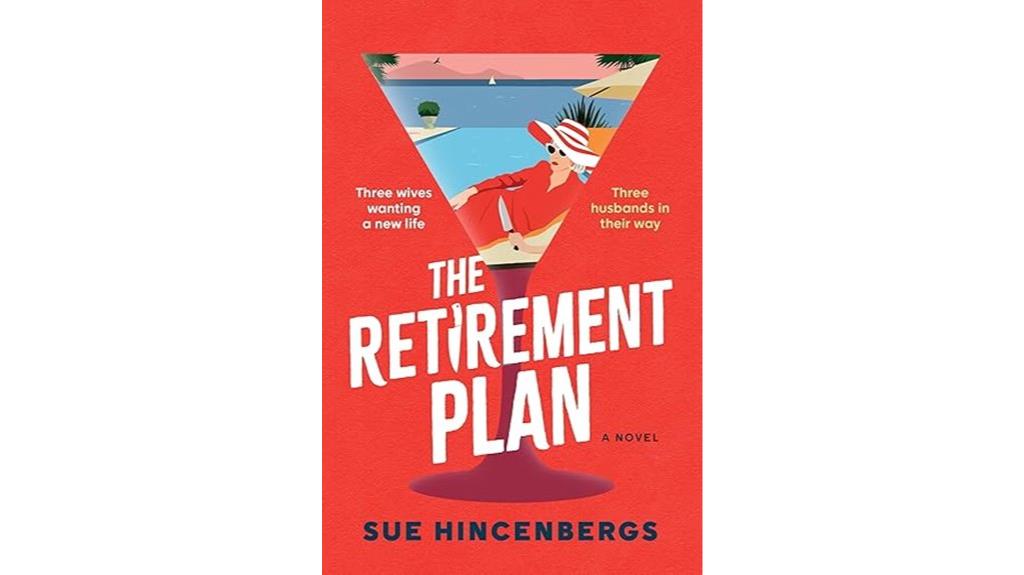

The Retirement Plan Book

If you’re seeking a retirement planning book that blends humor with practical strategies, *The Retirement Plan Book* stands out as an engaging choice. While it’s a fictional story filled with dark comedy, it cleverly highlights the complexities and unexpected twists of aging and retirement. Through lively characters and layered secrets, it explores relationships, financial struggles, and the lengths people will go to secure their future. The novel’s satire and suspense make it a captivating read, reminding us that planning for retirement isn’t just about numbers but also about steering through life’s unpredictable surprises with wit and resilience.

Best For: readers who enjoy dark humor, layered mysteries, and satirical takes on retirement and aging.

Pros:

- Engaging blend of comedy, suspense, and satire that keeps readers hooked.

- Well-developed, relatable characters with moral complexity and humor.

- Clever plot twists and unpredictable storytelling that add excitement and depth.

Cons:

- May contain dark themes and humor that are not suitable for all readers.

- The layered secrets and plot twists could be confusing for some audiences.

- As a debut novel, some readers might find the pacing uneven or the tone inconsistent.

Factors to Consider When Choosing a Retirement Planning Book

When selecting a retirement planning book, I focus on how well the content matches my needs and how practical the advice is. I also consider the author’s expertise and whether the book offers useful tools for real-life application. Finally, I look for a balance between financial strategies and non-financial aspects to guarantee a thorough plan.

Content Relevance and Depth

Choosing a retirement planning book requires careful attention to its content relevance and depth. I look for books that match my current knowledge level and address my specific concerns, like healthcare or estate planning. It’s essential that the book offers all-encompassing coverage, addressing both financial and non-financial aspects of retirement, so I get a well-rounded view. I also seek practical tools, such as worksheets and checklists, that help me apply concepts directly to my situation. In-depth explanations of key topics like withdrawal rules, risk management, and tax strategies are a must—superficial overviews won’t cut it. Finally, I verify that the content is up-to-date, reflecting current laws, economic conditions, and recent legislative changes affecting retirement planning.

Personalization and Flexibility

A highly effective retirement planning book adapts to my unique goals and circumstances, offering strategies I can tailor to my risk tolerance, income sources, and lifestyle priorities. Flexibility is vital; a good guide should be easy to update as laws, markets, or my personal situation change. Features like worksheets and self-assessment tools help me create a customized plan aligned with my priorities. A flexible resource also considers diverse income streams, healthcare needs, and estate planning, making it practical for different retirement scenarios. Additionally, a book that emphasizes ongoing education and encourages revisiting my plan ensures I stay responsive and in control over time. This adaptability makes my retirement strategy more resilient and aligned with my evolving needs.

Expert Credibility and Sources

To guarantee I’m relying on accurate and trustworthy advice, I look for a retirement planning book written by an author with credible credentials, industry experience, or professional certifications like a CFP designation. This ensures the guidance is rooted in expertise and real-world knowledge. I also verify that the book references reputable sources, such as IRS guidelines, academic research, or recognized financial institutions, which adds to its credibility. Checking for citations of current laws and economic data helps confirm the information is up-to-date. Endorsements from respected financial experts or organizations further validate the book’s reliability. In conclusion, I look for practical tools, like templates or case studies, grounded in well-established principles, to make the advice actionable and trustworthy.

Practical Tools Provided

When selecting a retirement planning book, I look for those that include practical tools designed to make the planning process more manageable. These resources, like checklists, worksheets, and templates, help me organize my goals and track my progress. Step-by-step guides, calculators, and quizzes are especially useful, as they allow me to assess my financial readiness and customize my plan. Visual aids such as charts and diagrams make complex concepts easier to understand and help me stay focused on my milestones. Some books even offer downloadable resources or digital tools, enabling ongoing updates and personalized adjustments. Overall, these practical tools simplify decision-making, boost my confidence, and empower me to take actionable steps toward securing my financial future.

Coverage of Financial and Non-Financial

Practical tools in retirement books are invaluable, but choosing the right resource also means guaranteeing it covers both financial and non-financial factors. A well-rounded book addresses key financial strategies like investing, income management, and risk assessment, helping you build a secure financial foundation. Equally important are non-financial aspects such as health, housing, relationships, and personal growth, which influence overall well-being. Books that explore finding purpose, maintaining social connections, and managing psychological shifts provide a more complete picture of retirement. Covering both areas allows you to craft a holistic plan that prioritizes fulfillment, health, and security. This balanced approach ensures you’re prepared not just financially but emotionally and socially, fostering a meaningful and sustainable retirement.

Frequently Asked Questions

How Do I Choose the Best Retirement Planning Book for My Needs?

Choosing the right retirement planning book depends on my specific financial goals and knowledge level. I look for books that are clear, practical, and up-to-date. I consider reviews and recommendations from trusted sources, and I skim the table of contents to see if the topics cover what I need. Ultimately, I pick a book that makes me feel confident and motivated to take actionable steps toward my retirement.

What Are Common Mistakes to Avoid in Retirement Planning Books?

When exploring retirement planning books, I’ve learned to avoid common mistakes like trusting overly optimistic projections or ignoring personalized advice. I steer clear of books that lack credible authors or practical strategies. It’s essential to stay critical of any material promising quick riches or guaranteed results. I focus on balanced, well-researched content that offers actionable steps, helping me make smarter, more informed decisions for my future.

Do These Books Cover Planning for Unexpected Healthcare Costs?

Ever wonder if your retirement plan has a safety net for unexpected healthcare costs? Many of these books do cover this vital topic, emphasizing the importance of insurance, emergency funds, and flexible planning. They guide you through preparing for surprises that could otherwise derail your savings. I’ve found that understanding and planning for healthcare surprises is essential—just like building a sturdy house before a storm hits.

Are There Books Specifically Focused on Retirement Planning for Self-Employed Individuals?

You’re asking about retirement planning books specifically for self-employed individuals. I’ve found that many books focus on general strategies, but some target self-employed needs, like managing irregular income and solo retirement plans. I recommend checking out titles that cover solo 401(k)s, SEP IRAs, and tax strategies tailored for self-employed folks. These resources can help you craft a solid retirement plan that fits your unique financial situation.

How Often Should I Update My Retirement Planning Strategies According to These Books?

Ever heard the saying, “Change is the only constant”? I believe that applies perfectly to retirement planning. I update my strategies at least once a year, or whenever there’s a significant life change or new financial law. Staying proactive keeps me prepared for anything life throws my way. Regular reviews help me stay aligned with my goals and adapt to economic shifts, ensuring a secure retirement plan.

Conclusion

Just like Robin Hood aimed to secure his future and support the needy, you too can take control of your retirement with the right knowledge. These books are your arrows, guiding you through the forest of financial planning. Whether you’re building your castle or safeguarding your treasure, remember that the key to a peaceful retirement lies in your hands. Start today, and let your journey to financial freedom be legendary.