If you’re looking for the best kids’ financial literacy games that make learning money fun, I’ve got you covered. From colorful flashcards and board games to card matching and strategy games, these tools teach kids essential skills like saving, investing, and budgeting in engaging ways. They promote critical thinking and real-life decision-making. Keep exploring to discover top picks that suit different ages and learning styles, making finance education both effective and enjoyable!

Key Takeaways

- The top games feature interactive activities like matching, quizzes, and real-life scenarios to enhance engagement and practical money skills.

- Many titles are designed for various ages, from early childhood to middle school, covering foundational to advanced financial concepts.

- Durable materials and colorful visuals ensure longevity and appeal, making learning both fun and age-appropriate.

- These games promote critical thinking, budgeting, saving, investing, and responsible money habits through engaging gameplay.

- Selection should consider age suitability, educational value, ease of use, and whether the game fosters active participation.

Financial Literacy Flashcards for Kids & Teens

If you’re looking for an engaging way to teach kids and teens essential money skills, the Financial Literacy Flashcards from Financial Literacy Fun are an excellent choice. These 108 durable cards feature vibrant images and clear definitions, making complex financial concepts easy to understand. They’re categorized into different skill levels—beginner, intermediate, and advanced—so learners can progress gradually. Suitable for children aged 8 and up, these cards are designed to withstand years of use. Whether at home or in the classroom, they foster active learning through fun activities like matching games and quizzes, helping kids build a solid foundation in financial literacy.

Best For: parents, teachers, and guardians seeking a fun, engaging way to teach children and teens essential financial skills and concepts.

Pros:

- Durable and long-lasting cards suitable for frequent use by kids and teens

- Color-coded and categorized by skill level to support gradual learning progression

- Engaging visuals and straightforward definitions that simplify complex financial terms

Cons:

- May be more appropriate for older children due to the complexity of some concepts

- Limited to visual and verbal learning; may require additional activities for comprehensive understanding

- Some users might find the set less engaging for children under 8 or those with shorter attention spans

Financial Literacy Flash Cards for Kids in Middle School

Kids’ Financial Literacy Flash Cards are an excellent choice for middle school students who are beginning to explore essential money skills. These cards feature bright, engaging graphics that make learning about topics like saving, budgeting, investing, and cash flow fun and interactive. With 52 cards, they turn complex financial concepts into accessible, easy-to-understand ideas, helping kids build a solid foundation for smart money habits. The cards also promote critical thinking through thought-provoking questions, encouraging discussions with parents or teachers. Their versatile design caters to different learning styles, making financial literacy engaging and memorable for young learners.

Best For: middle school students and parents seeking an engaging, easy-to-understand way to introduce essential financial concepts and promote discussions about money.

Pros:

- Bright, engaging graphics make learning fun and visually appealing

- Simplifies complex financial topics into clear, accessible language

- Encourages critical thinking and meaningful conversations with thought-provoking questions

Cons:

- Limited to 52 cards, which may require additional resources for in-depth learning

- May not cover advanced financial topics suitable for older or more experienced learners

- Some children might need guidance to fully grasp abstract concepts presented on the cards

QUOKKA Financial Literacy Flash Cards for Teens

QUOKKA Financial Literacy Flash Cards for Teens stand out as an excellent resource for teenagers eager to improve their money skills. With 110-100 cards, they cover key concepts like budgeting, saving, investing, and understanding the economy. The cards feature simple definitions, real-life examples, and colorful visuals, making learning engaging and accessible. Organized into three color-coded levels—beginner, intermediate, and advanced—they support gradual progress. Designed for ages 5 and up, these cards are perfect for homeschooling, classroom use, or family activities. Their durability, variety, and interactive features make finance education fun and practical, helping teens develop smart money habits early on.

Best For: Teenagers and families seeking an engaging, comprehensive way to build early financial literacy skills through fun, visual learning tools.

Pros:

- Features 110-100 colorful, engaging cards with simple definitions and real-life examples.

- Organized into beginner, intermediate, and advanced levels to support gradual learning.

- Durable design with versatile use in homeschooling, classroom, and family activities.

Cons:

- Some reviews mention issues like double-sided printing making sorting difficult.

- Occasional printing errors, blurry images, and mismatched sequences can affect usability.

- The inclusion of basic concepts like sight words and shapes may be less relevant for older teens.

BeFree Strategy & Financial Literacy Board Game for Families and Teens

The BeFree Strategy & Financial Literacy Board Game stands out as an ideal choice for families and teens enthusiastic to learn essential money management skills in an engaging way. It focuses on modern financial education, covering budgeting, saving, investing, loans, and market analysis, making complex concepts accessible. The game incorporates real-world investment scenarios, teaching players how investments grow, risks impact returns, and strategic planning matters. With beautiful design and simple rules, it fosters family bonding and meaningful conversations about money goals. Plus, the bonus book adds extra insights, making BeFree a valuable tool for developing financial independence and responsible money habits in a fun, interactive format.

Best For: families, teens, and educators seeking an engaging and modern way to teach essential financial literacy and practical money management skills.

Pros:

- Incorporates real-world investment scenarios to enhance practical understanding of markets and risk.

- Beautiful, high-quality design with simple rules suitable for all ages, promoting family bonding and learning.

- Includes a bonus book that deepens financial knowledge and encourages thoughtful discussions about money and life goals.

Cons:

- May require adult facilitation for younger children to fully grasp complex concepts.

- The game’s investment simulations might be less relatable for players unfamiliar with financial markets.

- Some users may find the game’s setup and rules slightly lengthy for quick, casual play sessions.

QUOKKA Financial Literacy Flash Cards for Teens

Are you looking for an engaging way to teach teens essential financial skills? QUOKKA Financial Literacy Flash Cards are a fantastic option. With 110-100 cards, they cover topics like budgeting, saving, investing, and understanding the economy, using simple language, real-life examples, and colorful visuals. The cards are organized into three levels—beginner, intermediate, and advanced—so learners can progress at their own pace. Designed for ages 5 and up, they support solo, group, or family learning. Durable and well-crafted, these cards make financial education fun and accessible, helping teens develop smart money habits early on.

Best For: teens, parents, and educators seeking an engaging, comprehensive way to teach financial literacy concepts in a fun and accessible manner.

Pros:

- Color-coded levels facilitate gradual learning and skill building

- Includes real-life examples and engaging visuals to enhance understanding

- Durable construction and comprehensive content make it suitable for various learning environments

Cons:

- Double-sided printing can complicate sorting and organization

- Some images and print quality issues have been noted, affecting clarity

- Mismatched sequences and minor printing errors may require manual correction

Financial Literacy Memory Matching Game for Kids

If you’re looking to introduce young children to essential financial concepts in a fun, engaging way, the Financial Literacy Memory Matching Game is an excellent choice. It features 36 pairs of vibrant picture cards with simple words and easy definitions covering earning, saving, spending, investing, stocks, bonds, and financial risks. The game promotes memory, critical thinking, and problem-solving while encouraging discussions about money. Designed for kids 5+, it’s durable, with larger cards for easy handling, and simple instructions that make gameplay quick and intuitive. Perfect for family, classroom, or solo play, it makes learning about money both fun and practical.

Best For: Parents, educators, and caregivers seeking an engaging, educational tool to introduce children aged 5+ to fundamental financial concepts through a fun memory matching game.

Pros:

- Enhances memory, critical thinking, and problem-solving skills while teaching financial literacy

- Durable, with larger, thicker cards designed for easy handling and long-lasting use

- Easy-to-understand instructions facilitate quick setup and gameplay, suitable for solo or group play

Cons:

- Limited to 36 pairs, which may be less comprehensive for more advanced learners

- Requires physical space for gameplay, which might be a consideration in small areas

- As a game focused on foundational concepts, it may need supplemental resources for deeper financial education

Peaceable Kingdom Money Bunch Game — Cooperative Board Game for Teaching Saving, Sharing & Spending

Kids who enjoy cooperative play and want to learn about money will find the Peaceable Kingdom Money Bunch Game an excellent choice. This engaging board game teaches kids ages 6 and up about saving, sharing, and spending through teamwork. As players ride bikes around the neighborhood, they earn cash, set savings goals, buy snacks, and share funds to build a community playground. The game promotes financial literacy, critical thinking, and cooperation, making money concepts fun and understandable. With colorful components and simple rules, children quickly grasp key money skills while enjoying a collaborative, interactive experience that encourages generosity and responsible money management.

Best For: Families and educators seeking an engaging, educational game to teach children aged 6 and up about money management, savings, sharing, and teamwork through cooperative gameplay.

Pros:

- Promotes financial literacy, critical thinking, and teamwork in a fun, interactive way

- Easy to learn with colorful components that keep children engaged

- Encourages generosity and responsible money habits through collaborative play

Cons:

- May require adult supervision for younger children to fully grasp the concepts

- Limited to a small number of players, which could be less suitable for larger groups

- Some components or rules may be simplified, limiting depth for older or more advanced players

Financial Literacy Flash Cards for Kids in Middle School

Financial Literacy Flash Cards from Future Fortunes Academy are an excellent choice for middle school students who are just beginning to explore essential money skills. These colorful, engaging cards make learning about saving, budgeting, investing, and cash flow fun and interactive. With 52 thoughtfully designed cards, they simplify complex financial ideas into clear, easy-to-understand concepts. The prompts encourage discussions and critical thinking, helping kids develop smart money habits early. Plus, the cards cater to different learning styles—visual, auditory, or kinesthetic—making them a versatile tool that boosts comprehension and keeps kids motivated to learn about money.

Best For: middle school students and educators seeking a fun, interactive way to introduce essential financial concepts and develop smart money habits early.

Pros:

- Bright, engaging graphics that make learning about money enjoyable.

- Simplifies complex financial topics into clear, easy-to-understand concepts.

- Promotes critical thinking and meaningful discussions about money management.

Cons:

- May require adult guidance to facilitate deeper understanding.

- Limited to 52 cards, which might not cover all advanced financial topics.

- Some learners may need additional resources for comprehensive financial education.

Financial Literacy Flashcards for Kids & Teens

Looking for a fun, engaging way to teach essential money concepts to children and teens? Financial Literacy Fun for Future Minds offers 108 durable flashcards designed to make learning about money simple and enjoyable. Each card features vibrant images and clear definitions, catering to different skill levels—beginner, intermediate, and advanced—so kids can progress at their own pace. Suitable for ages 8 and up, these flashcards encourage active learning through games, quizzes, and discussions. With high ratings for durability and educational value, they’re perfect for use at home, in classrooms, or during family activities, helping kids build a strong financial foundation early on.

Best For: parents, teachers, and caregivers seeking an engaging, age-appropriate tool to introduce children and teens to essential financial concepts through interactive learning.

Pros:

- Durable, high-quality cards with vibrant images and clear definitions that make learning fun and accessible

- Categorized into skill levels (beginner, intermediate, advanced) to support progressive financial literacy development

- Versatile for use at home, in classrooms, or during family activities, encouraging active participation and conversation

Cons:

- Some users may find the complexity of advanced cards more suitable for older children or teens

- The set may be too extensive for those looking for a quick, simple introduction to financial concepts

- Being manufactured in China, some customers might have concerns about sourcing or availability in certain regions

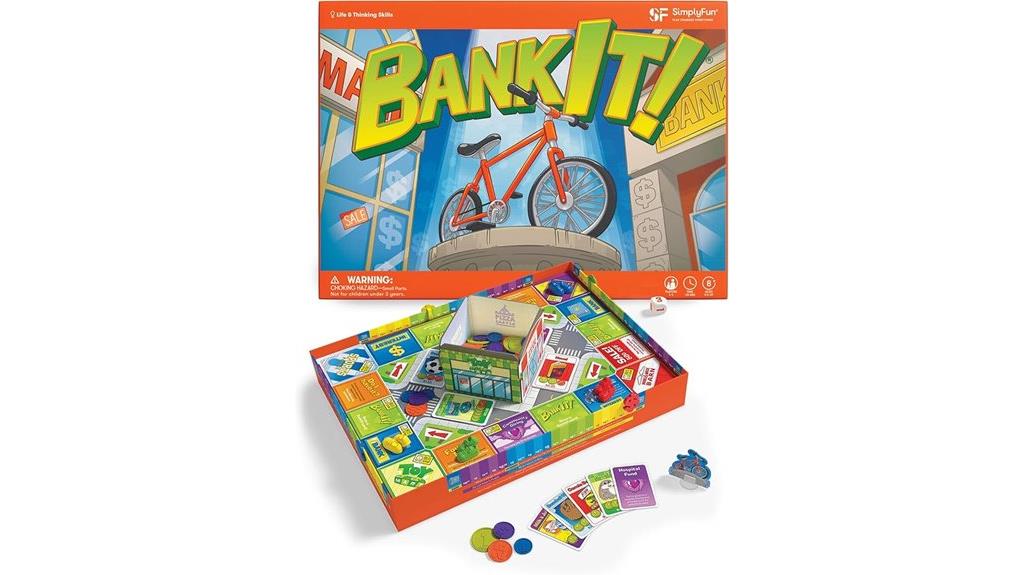

SimplyFun BankIt! Money Game for Kids

Are you searching for an engaging way to teach children essential money skills? I highly recommend the SimplyFun BankIt! Money Game for Kids. Designed for ages 8 and up, it’s perfect for family game nights and classroom fun. The game offers hands-on lessons in earning, saving, investing, and budgeting through real-life scenarios like paying bills and buying bikes. It’s easy to learn, with gameplay lasting about an hour, and features strategic choices that help kids understand personal finance. With a 4.5-star rating, parents praise its educational value and engaging design, making it a top choice for teaching money management skills to young learners.

Best For: families, educators, and children ages 8 and up seeking an engaging, educational game to teach fundamental money management skills.

Pros:

- Provides hands-on lessons in earning, saving, investing, and budgeting through real-life scenarios.

- Easy to learn with gameplay lasting about an hour, making it suitable for young children.

- Highly rated with a 4.5-star customer review, praised for its educational value and engaging gameplay.

Cons:

- Some users have noted minor issues with game design and interest mechanics.

- Limited to 1-4 players, which may not suit larger groups.

- Requires physical components and space, which may not be ideal for all settings.

Investing for Kids Activity Book

The Investing for Kids Activity Book stands out as an excellent resource for children aged 8 to 11 who are enthusiastic to grasp basic financial concepts through engaging activities. It presents topics like saving, investing, and credit scores in a fun, straightforward way, making complex ideas accessible. The book features well-designed exercises, quizzes, and real-life scenarios that foster financial confidence and independence. Kids learn practical skills such as brainstorming business ideas, saving, and making smart spending decisions. Many parents and educators praise its professional yet kid-friendly approach, considering it a valuable tool to build early financial literacy and prepare children for a successful financial future.

Best For: children aged 8 to 11 who are eager to learn foundational financial concepts through engaging, practical activities.

Pros:

- Offers clear, age-appropriate explanations of complex financial topics like saving, investing, and credit scores.

- Includes well-designed activities, quizzes, and real-life scenarios that promote practical financial skills.

- Praises for its professional, kid-friendly approach making financial literacy accessible and enjoyable.

Cons:

- Primarily focused on American dollar context, which may limit relevance for international audiences.

- Some users may desire more advanced investment strategies as children progress in financial understanding.

- As an activity book, it may require adult guidance to maximize learning outcomes for younger children.

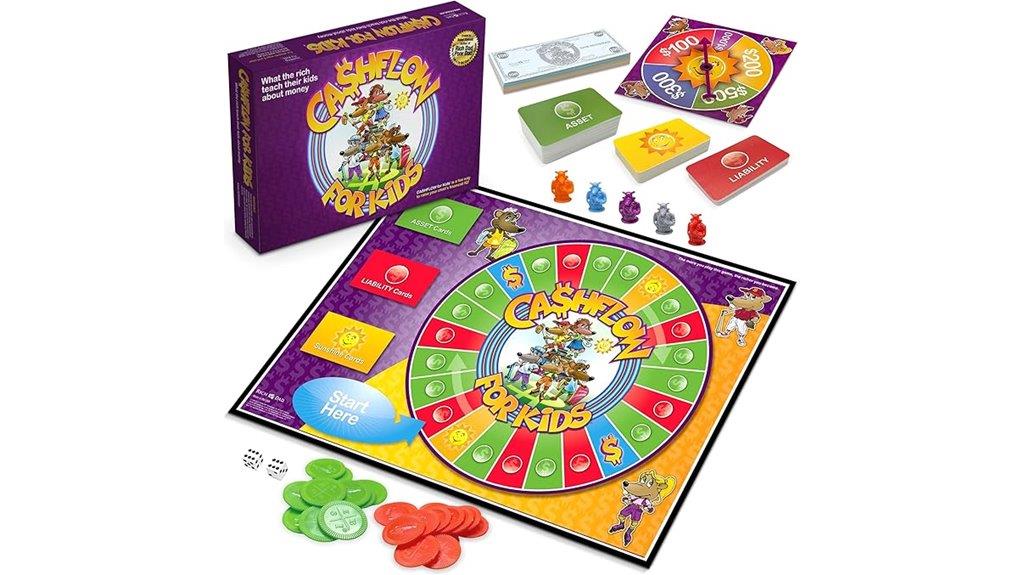

Rich Dad Cashflow Board Game for Kids

The Rich Dad Cashflow Board Game for Kids is an excellent choice for families seeking an engaging way to teach children as young as six essential financial skills. I love how it combines fun gameplay with lessons on investing, real estate, budgeting, taxes, and debt management. Designed for up to six players, it encourages strategic thinking and financial decision-making in a relatable way. The game’s colorful design, sturdy materials, and user-friendly guide make it accessible and durable. Plus, when paired with the mobile app, it becomes even more interactive. It’s a fantastic tool for fostering responsible money habits early, making financial learning a family adventure.

Best For: families and educators seeking an engaging, educational tool to teach children aged 6+ essential financial skills through fun gameplay.

Pros:

- Promotes early financial literacy by covering investing, real estate, budgeting, taxes, and debt management

- Durable, colorful design with user-friendly instructions suitable for young children and family play

- Enhances critical thinking, decision-making, and behavioral insights related to money management

Cons:

- Some rules may require interpretation or customized adjustments during initial play sessions

- The game setup and gameplay can take over 4 hours for first-time players, which may be lengthy for some families

- The cost is relatively high, though many users find the educational value justifies the price

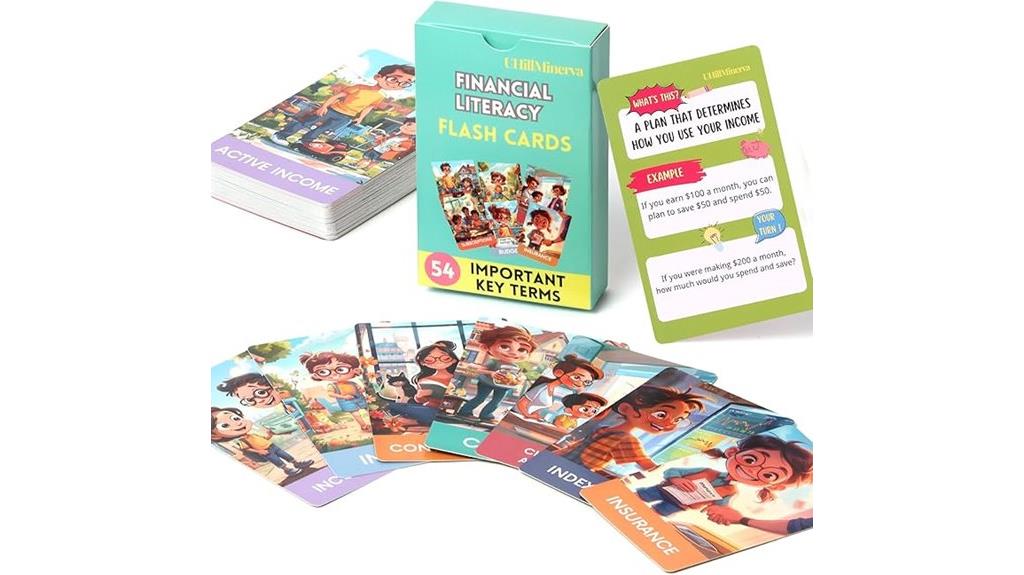

Financial Literacy Flash Cards for Kids and Middle School Students

Financial Literacy Flash Cards are an ideal choice for parents, teachers, and mentors seeking an engaging way to teach kids and middle school students essential money skills. These 54 colorful cards cover topics like saving, budgeting, investing, and stocks, making complex concepts easy to comprehend. Each card features a clear explanation, a real-life case study, and a thought-provoking question, encouraging critical thinking. The laminated, kid-friendly design guarantees durability and ease of use in various settings. These versatile cards turn financial lessons into fun, practical activities that help children develop healthy money habits and confidence, laying a strong foundation for their financial future.

Best For: Parents, teachers, and mentors seeking an engaging, durable, and visually appealing tool to teach children and middle school students essential financial concepts in various learning environments.

Pros:

- Bright, eye-catching graphics and clear, concise text make complex financial topics accessible and engaging for kids.

- The three-part system (explanation, case study, question) promotes critical thinking and practical application of money skills.

- Laminated, durable design with rounded edges ensures longevity and safety for young learners.

Cons:

- Some users suggest that adding game ideas or instructions could enhance the interactive nature of the cards.

- Limited to basic financial concepts, which may require supplemental materials for more advanced topics.

- Made in China, which might be a consideration for those seeking locally produced educational resources.

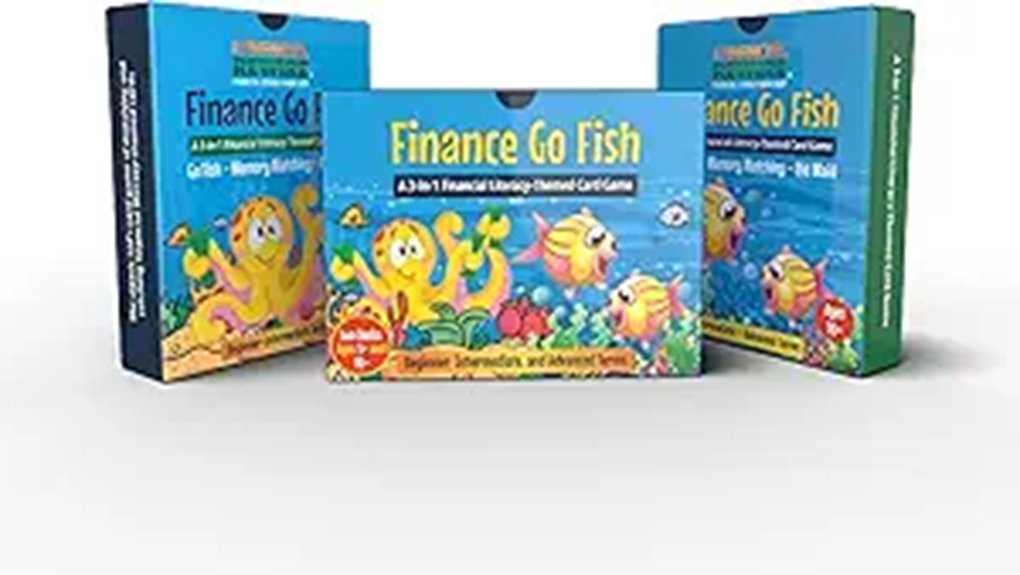

Finance Go Fish – 3-in-1 Financial Literacy Card Game for Kids

Looking for a versatile way to teach kids about money? Finance Go Fish is a 3-in-1 card game perfect for children aged 5 and up. It includes two decks with colorful artwork, covering basic to advanced financial terms with simple definitions. You can play Go Fish, Memory Matching, or Old Maid, making learning engaging and adaptable. The durable cardholder keeps everything organized, and a bonus digital coloring book extends the fun. Designed to build financial literacy, critical thinking, and decision-making skills, this game makes understanding money concepts enjoyable for kids while allowing parents to reinforce learning through play.

Best For: parents and educators seeking an engaging, age-appropriate tool to teach children aged 5 and up basic to advanced financial literacy concepts through versatile and fun gameplay.

Pros:

- Includes two decks with colorful artwork and simple definitions, suitable for progressive learning.

- Offers three different game modes—Go Fish, Memory Matching, and Old Maid—adding variety to play.

- Comes with a durable cardholder and a bonus digital coloring book to enhance organization and extended engagement.

Cons:

- Recommended for children 10+ but also suitable for 5+ with parental guidance, which may require adult supervision for younger kids.

- Limited to a total of 112 cards, which might restrict game variety over time.

- Manufactured in China, which may be a consideration for buyers seeking locally produced products.

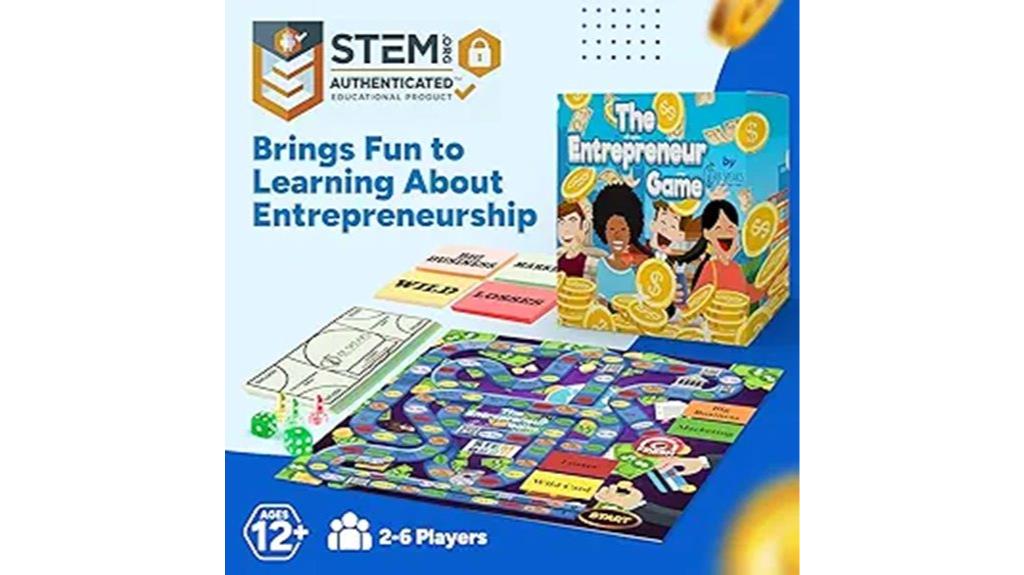

The Entrepreneur Game: STEM Board Game for Kids & Adults

If you’re seeking an engaging way to teach both kids and adults about money management and business strategy, the Entrepreneur Game stands out as an excellent choice. This award-winning STEM board game offers a hands-on experience with real-world business scenarios, helping players develop budgeting, investing, and negotiation skills. Suitable for ages 10 and up, it promotes financial literacy and ethical decision-making across generations. With dynamic gameplay that challenges players to adapt to market changes, it keeps everyone engaged. Although some find the instructions complex, its ability to foster creativity, strategic thinking, and global business understanding makes it a valuable educational tool for families and schools alike.

Best For: families, educators, and aspiring entrepreneurs seeking to teach or learn financial literacy and business skills in an engaging, hands-on way.

Pros:

- Recognized with awards like the Moms Choice Award 2024 and highly rated in STEM education.

- Promotes essential skills such as budgeting, investing, negotiating, and strategic decision-making through realistic gameplay.

- Suitable for a wide age range (10+) and encourages ethical decision-making and global business understanding.

Cons:

- Some users find the instructions complex and the setup challenging.

- Occasional quality issues with printing, components, or receiving used copies.

- Price and availability may vary, and some may find the game slightly overwhelming for younger or less experienced players.

Factors to Consider When Choosing a Kids’ Financial Literacy Game

When selecting a kids’ financial literacy game, I always consider factors like age appropriateness and learning complexity to ensure it matches the child’s development. I also look at how engaging the game is, along with its durability and overall quality, so it lasts through repeated play. Finally, I weigh the price against the value it offers to make a smart, long-term investment.

Age Appropriateness

Choosing the right financial literacy game for a child depends heavily on their age, as this guarantees the content matches their developmental stage and keeps them engaged without causing frustration. Check the recommended age range on the packaging to verify the game aligns with your child’s cognitive abilities and learning needs. For younger children under 8, opt for games with visual aids and simple money skills to build a solid foundation. These games introduce basic concepts in a fun, manageable way. As children grow into preteens and teens, select games that cover more advanced topics like investing, credit, and markets, which challenge their expanding understanding. Matching the game’s complexity to their age ensures they stay interested and learn effectively at their own pace.

Learning Complexity

Selecting a financial literacy game that matches a child’s learning level involves more than just picking age-appropriate options; it requires careful consideration of the game’s complexity. I look for games that present financial concepts suited to my child’s developmental stage, avoiding overly simple or confusing material. It’s important that the difficulty can be adjusted or that there are multiple skill tiers, allowing gradual mastery. I also check if the game uses clear, age-appropriate language for financial terminology, so my child isn’t overwhelmed. Additionally, I value games that incorporate activities promoting critical thinking, encouraging deeper understanding. Striking the right balance between educational depth and engagement ensures my child is challenged without cognitive overload, making learning both effective and enjoyable.

Engagement Level

Have you ever noticed how colorful visuals and interactive features can make a kids’ financial literacy game more engaging? Bright colors and hands-on gameplay keep children interested and motivated to learn. Incorporating fun elements like matching games, quizzes, or storytelling boosts active participation and helps reinforce concepts. When games include real-life scenarios or decision-making challenges, kids stay curious and find the lessons more relatable and memorable. Rewards such as points, badges, or progress tracking also encourage children to keep playing and learning across multiple sessions. A high engagement level is often reflected in positive reviews, with parents noting their kids’ enthusiasm and repeated interest. Ultimately, an engaging game makes financial education enjoyable and more effective for young learners.

Durability & Quality

When evaluating kids’ financial literacy games, durability and quality are essential factors that can greatly impact their long-term value. I recommend choosing games made from sturdy materials like thick cardstock or laminated cards, which resist wear and tear over time. It’s also important to check that all components are well-constructed, with secure edges and durable printing to prevent peeling or fading. Reinforced or rounded edges on cards and game pieces help reduce bending or breakage during frequent use. I always look at customer reviews for insights into the game’s durability, especially reports of damaged parts after extended play. Opting for games designed for repeated handling ensures they hold up in active learning environments, providing lasting educational value and fun.

Price & Value

Considering the price of a kids’ financial literacy game is essential to guarantee you’re getting good value for your money. I recommend comparing the cost to the number of educational features and the game’s durability. Look for reviews that mention how long the game lasts and whether it can be used repeatedly, ensuring ongoing learning without extra expenses. It’s also helpful to compare different options to find a balance between affordability and rich content. Keep in mind that higher-priced games often include extra resources like activity books or digital content, which can boost educational value. Finally, make sure the price aligns with your child’s age, learning level, and the complexity of financial concepts covered. This way, you ensure the game is a worthwhile investment for your child’s financial education.

Frequently Asked Questions

How Effective Are These Games in Improving Kids’ Financial Habits Long-Term?

You’re wondering how effective these games are in shaping kids’ long-term financial habits. From my experience, they can be quite impactful when used consistently, as they teach fundamental concepts in an engaging way. Kids often retain lessons better through play, and these games help develop good money habits early on. However, reinforcement at home and real-life practice are key to ensuring lasting financial responsibility.

Are These Games Suitable for Children With No Prior Financial Knowledge?

You’re wondering if these games are suitable for kids with no prior financial knowledge. I believe they are! These games are designed to be engaging and educational, starting with basic concepts that are easy for beginners to grasp. I’ve seen children with no background in money skills pick them up quickly and enjoy learning. They’re a great way to introduce financial literacy in a fun, approachable way.

What Is the Recommended Age Range for Each Game?

Did you know that early financial education can enhance kids’ money skills by up to 50%? When it comes to age ranges, I recommend checking each game’s guidelines. For example, some games are perfect for ages 3-6, while others suit kids 7-12. I always suggest selecting games that match your child’s developmental level to ensure they learn effectively and stay engaged.

Can These Games Be Adapted for Remote or Virtual Learning Environments?

Thinking about adapting these games for remote learning, I find it’s totally doable. I suggest using digital tools like video calls, shared documents, or online platforms to keep kids engaged. You can turn physical games into virtual ones or create interactive quizzes. With a little creativity, these games become even more flexible, making learning about money accessible and fun, no matter where kids are learning from.

How Do These Games Incorporate Real-World Financial Scenarios?

Imagine a child playing Monopoly and learning about budgeting—these games incorporate real-world scenarios by simulating everyday financial decisions like saving, spending, and investing. I see these games as interactive tools that teach kids about handling money responsibly. They often include challenges like managing a virtual grocery store or paying bills, making complex financial concepts accessible and engaging for young learners, preparing them for real-life financial situations.

Conclusion

In the end, finding the right financial literacy game is like hitting two birds with one stone—teaching kids valuable skills while making it fun. These games make learning about money feel less like a chore and more like an adventure. So, don’t wait too long—start exploring options today and set your kids up for financial success. After all, a little knowledge now can save a lot later!