If you’re looking to master index fund investing, I recommend starting with classics like *The Little Book of Common Sense Investing* and *The Bogleheads Guide to the Three-Fund Portfolio* for simple, proven strategies. Books like *Index Funds: The 12-Step Recovery Program* and *The Lifestyle Investor* offer practical advice on risk management and passive income. To gain a clear, all-encompassing understanding, check out this list—you’ll find insights that can guide your investment journey well into 2025 and beyond.

Key Takeaways

- Focus on books that explain low-cost, passive index fund strategies suitable for beginners and experienced investors alike.

- Prioritize titles that emphasize long-term, buy-and-hold investing, diversification, and risk management.

- Seek recent publications or updated editions to ensure the latest insights and market strategies for 2025.

- Look for resources that balance practical guidance with credible author expertise and empirical data.

- Include a mix of beginner-friendly guides and advanced analyses to cover all levels of index fund investing.

Index Fund Investing Guide for Safe and Profitable ETFs

If you’re looking for a straightforward guide to safe and profitable ETF investing, “Index Fund Investing” is an excellent choice. I found it helpful for understanding the basics of choosing low-risk, high-reward ETFs. The book emphasizes diversification, low costs, and strategic asset allocation, which are essential for building wealth over time. It explains the pros and cons of index funds and ETFs clearly, making it easy to grasp for beginners. I appreciated its focus on long-term, passive strategies that help investors stay disciplined and goal-oriented. Overall, it’s a practical resource that boosts confidence and guides you toward smarter investment decisions.

Best For: Beginners and experienced investors seeking a clear, goal-oriented guide to low-risk, profitable ETF investing and long-term wealth building.

Pros:

- Provides straightforward explanations suitable for newcomers.

- Emphasizes essential investment principles like diversification and cost-efficiency.

- Focuses on long-term, passive strategies that promote disciplined investing.

Cons:

- Writing style may be considered simplistic or superficial by some readers.

- Lacks detailed data and in-depth analysis for advanced investors.

- Discusses practical hurdles like trading restrictions that may limit active trading options.

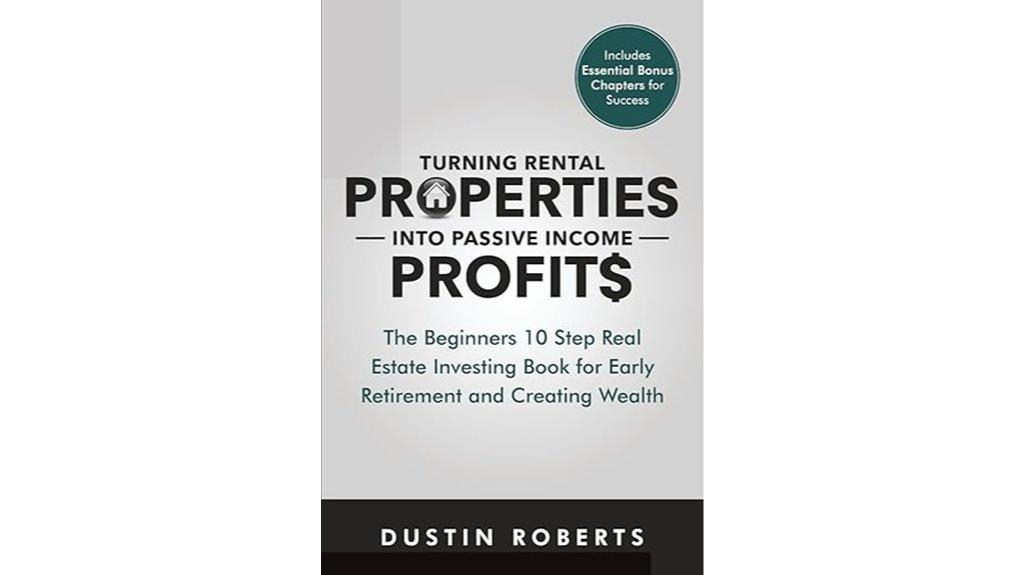

Turning Rental Properties into Passive Income Profit

Turning rental properties into passive income profit offers a strategic way to build long-term wealth with steady cash flow. I’ve learned that success depends on understanding market trends like rising housing demand and urbanization, which create investment opportunities. It’s vital to stay adaptable, especially during economic downturns or market fluctuations. I focus on practical steps like choosing the right properties, screening tenants, and managing operations efficiently. Whether you’re just starting or expanding your portfolio, clear goals and smart management are key. With the right approach, rental properties can generate reliable passive income, helping you achieve financial independence over time.

Best For: beginners and intermediate investors looking to build passive income through rental properties and seeking practical, step-by-step guidance on property selection, management, and financial strategies.

Pros:

- Provides clear, actionable steps suitable for newcomers to real estate investing

- Emphasizes practical tips on property management and tenant screening

- Balances motivation with real-world lessons, helping build confidence and resilience

Cons:

- May not cover advanced financing techniques or complex market analysis in detail

- Focuses primarily on residential rentals, with limited insights into commercial or multifamily properties

- Might require additional resources for in-depth legal or tax advice specific to certain regions

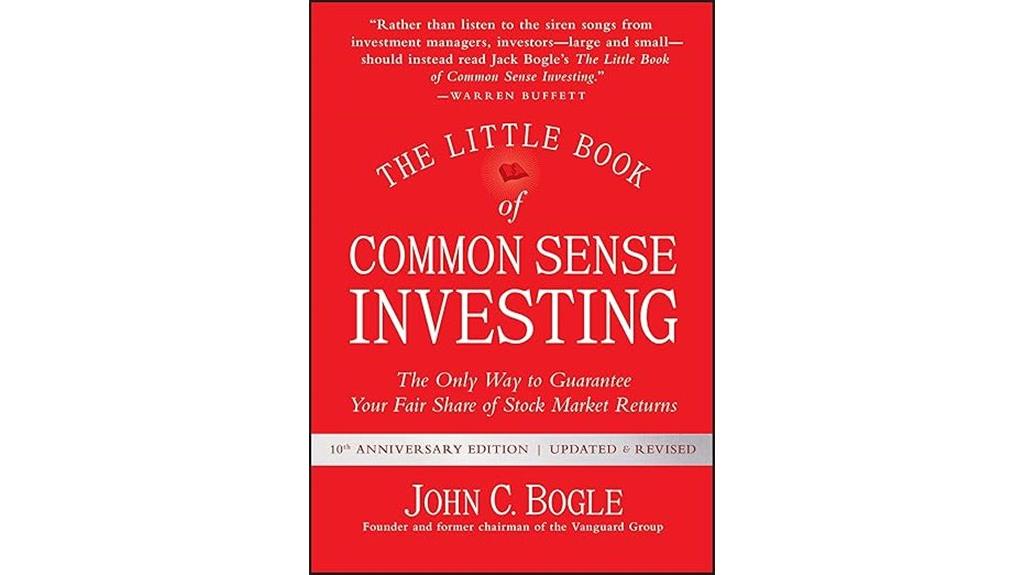

The Little Book of Common Sense Investing

The Little Book of Common Sense Investing stands out as an essential read for individual investors seeking straightforward, proven strategies to build long-term wealth. John Bogle, founder of Vanguard, champions passive investing through low-cost index funds that track entire markets like the S&P 500. He stresses that costs, fees, and active management often hinder returns, with less than 1% of mutual funds beating the market over decades. Bogle advocates buy-and-hold, diversification, and avoiding market timing. His advice is simple yet powerful—focus on broad-market index funds, minimize expenses, and stay disciplined for consistent growth. This book offers timeless wisdom for anyone committed to long-term financial success.

Best For: individual investors, especially beginners or those seeking a straightforward, long-term, low-cost investment strategy.

Pros:

- Emphasizes low-cost, passive index investing that can outperform actively managed funds over time.

- Simple, clear advice suitable for investors of all experience levels.

- Encourages disciplined, long-term investing, reducing emotional decision-making.

Cons:

- May not appeal to investors looking for active management or stock picking.

- Some readers might find the emphasis on broad-market funds too conservative or limiting.

- The book promotes Vanguard funds, which could be perceived as biased toward specific providers.

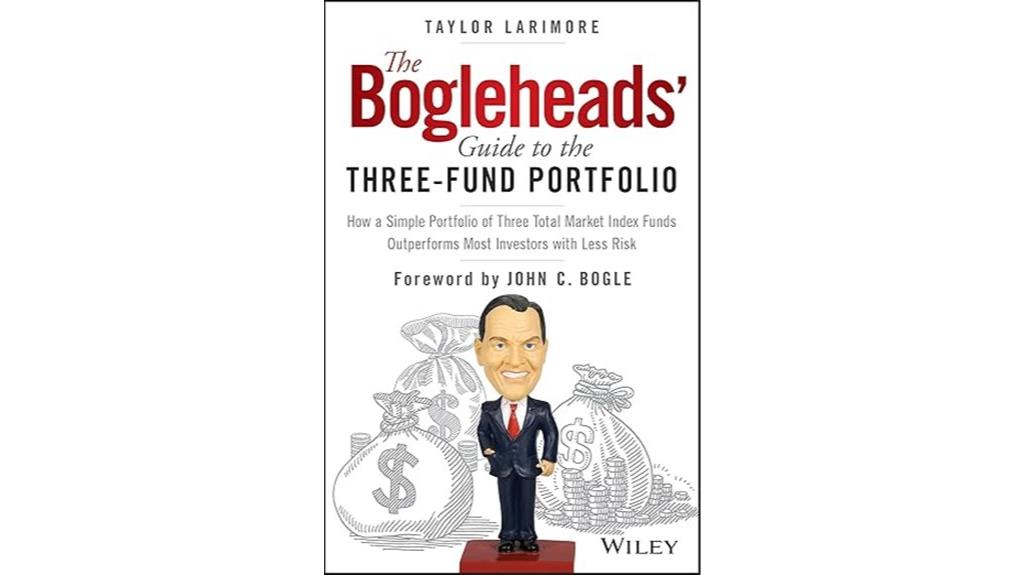

The Bogleheads Guide to the Three-Fund Portfolio

The Bogleheads Guide to the Three-Fund Portfolio stands out as an ideal resource for beginner investors and those seeking a straightforward, low-cost investment approach. Taylor Larimore, a seasoned investor and close associate of Vanguard founder John Bogle, champions simplicity and societal benefit. He advocates for building a portfolio with just three total market index funds, which minimizes fees, reduces risks, and simplifies decision-making. This approach suits investors at all levels, especially those new to investing or aiming for a worry-free strategy. Larimore’s clear, practical advice encourages taking control of your financial future without industry bias or complex analysis.

Best For: beginner investors, retirement savers, and those seeking a simple, low-cost, long-term investment strategy.

Pros:

- Simple and easy to understand, making it accessible for newcomers.

- Low fees due to the use of broad market index funds, maximizing net returns.

- Reduces risk through diversification across three comprehensive funds.

Cons:

- Lacks detailed technical analysis and advanced investment strategies.

- May be perceived as too basic for experienced investors seeking customization.

- The promotional tone and emphasis on Vanguard ETFs might limit perceived objectivity.

The Lifestyle Investor Book: Cash Flow Investing for Passive Income

Are you looking for a straightforward way to generate reliable passive income without taking on excessive risk? *The Lifestyle Investor* by Justin Donald offers a practical, step-by-step approach designed for those who want to build cash flow and achieve financial independence quickly. Donald shares his personal success story of reaching financial freedom in just 21 months, focusing on low-risk, cash flow-driven strategies. The book emphasizes disciplined deal structuring, negotiating, and leveraging safe investments to create consistent income streams. Its clear, accessible style makes it perfect for beginners and seasoned investors alike, helping you live life on your terms with less stress and more freedom.

Best For: individuals seeking a practical, low-risk approach to building passive income and achieving financial independence quickly, whether beginners or experienced investors.

Pros:

- Clear, accessible guidance suitable for both beginners and seasoned investors

- Emphasizes cash flow and risk mitigation for steady income streams

- Motivational storytelling and real-life examples inspire confidence and action

Cons:

- Focuses primarily on low-risk strategies, which may limit higher-return opportunities

- May require disciplined deal negotiation skills that could be challenging for some

- Less emphasis on traditional investments like stocks and bonds, which might not suit all investors

Index Funds and ETFs: What They Are and How to Make Them Work for You

If you’re looking to understand how index funds and ETFs can help grow your wealth passively, then these books are perfect for you. I’ve learned that they track market indices, offering diversification and low costs, making them attractive for long-term investing. However, it’s important to recognize their risks, like overconcentration or bubbles, which can threaten your portfolio. While generally safe, they aren’t foolproof. The key is to understand their mechanics, benefits, and limitations. A balanced approach—combining passive with some active strategies—can help you make these tools work effectively for your financial goals.

Best For: beginner investors seeking a low-cost, diversified way to grow wealth passively over the long term while understanding the importance of balancing strategies and recognizing potential risks.

Pros:

- Low fees and expenses enhance overall returns over time

- Diversification reduces individual stock risk and spreads exposure across markets

- Simplicity and ease of use make them accessible for retail investors

Cons:

- Potential overconcentration in high-flyer stocks or sectors can increase risk

- They do not guarantee protection against market bubbles or downturns

- Relying solely on passive strategies may lead to complacency and missed opportunities for active management

Index Investing For Dummies

“Index Investing For Dummies” stands out as an ideal starting point for beginners who want a clear, easy-to-understand introduction to index fund investing. I appreciate how it breaks down complex concepts into simple language, emphasizing long-term, disciplined investing. The book highlights the advantages of index funds—low costs, diversification, and proven performance—backed by examples like Warren Buffett’s bet. It also warns about fees and industry practices that can erode returns. While a bit dated, its practical advice and accessible style make it perfect for newcomers seeking a solid foundation before exploring more advanced strategies or newer resources.

Best For: Beginners seeking a straightforward, easy-to-understand introduction to index fund investing with practical advice and foundational knowledge.

Pros:

- Clear and accessible language suitable for newcomers to investing

- Emphasizes long-term, disciplined investment strategies and benefits of index funds

- Provides real-world examples like Warren Buffett’s bet to illustrate key concepts

Cons:

- Content is somewhat outdated, published in 2008, and may lack recent market insights

- Focuses primarily on US-based investment options, limiting relevance for UK/EU investors

- Lacks updated data and coverage of newer investment options or market developments

Lazy Investor Smart Investor Book on Stock Market and Trading

The Lazy Investor Smart Investor Book on Stock Market and Trading stands out as an essential resource for beginners and those who prefer a straightforward, approachable guide to investing. As a 63-year-old who’s learned from past mistakes, I appreciate how John Bax’s book simplifies complex concepts like value investing, diversification, and modern trading tools. It’s easy to read and packed with practical advice, especially for those exploring crypto and stock markets. I found it invaluable as a quick reference, helping me understand charts, setups, and strategies. If you want smarter investing without the jargon, this book is a must-have to build confidence and improve your financial journey.

Best For: Beginners and intermediate investors seeking a clear, practical guide to stock market and crypto investing without the jargon.

Pros:

- Simplifies complex investment concepts for easy understanding

- Provides practical, step-by-step guidance and strategies

- Serves as a quick reference for trading setups and tools

Cons:

- May lack in-depth technical analysis for advanced traders

- Focused primarily on foundational knowledge, less on niche strategies

- Some readers might prefer more detailed or specialized investment techniques

All About Index Funds: The Easy Way to Get Started (All About Series)

This book, part of the All About Series, is an excellent starting point for new investors enthusiastic to understand the fundamentals of index fund investing. It explains why index funds outperform individual stocks, bonds, and managed mutual funds over time, mainly due to lower costs and diversification. Ferri covers the history, tax advantages, and how to choose the right funds for long-term growth. The book emphasizes a disciplined, low-cost approach aligned with Warren Buffett’s advice, encouraging investors to focus on steady, diversified investments rather than risky strategies. Despite some outdated details, its clear explanations make it a valuable primer for those beginning their index fund journey.

Best For: Beginners and new investors seeking a clear, disciplined introduction to index fund investing with a focus on long-term growth.

Pros:

- Provides comprehensive, easy-to-understand explanations of index funds and their benefits

- Emphasizes low-cost, diversified, and disciplined investment strategies aligned with Warren Buffett’s advice

- Covers historical context, tax advantages, and practical guidance for selecting funds

Cons:

- Some content may be outdated, especially regarding recent market performance after 2008

- Contains typos and grammatical errors that can detract from professionalism

- Lacks detailed, up-to-date analysis of current market conditions and recent developments

Mutual Funds For Dummies

Mutual Funds For Dummies stands out as an ideal starting point for beginners enthusiastic to grasp the essentials of mutual fund investing. I found this book incredibly helpful for understanding key concepts, strategies, and common pitfalls, all explained clearly and accessibly. It emphasizes the importance of making informed decisions and avoiding costly mistakes. I especially appreciated its practical advice on how to use mutual funds effectively to grow savings over time. While it doesn’t cover advanced topics, its straightforward approach makes it perfect for new investors looking to build a solid foundation and navigate the world of mutual funds with confidence.

Best For: beginners and new investors seeking a clear, practical introduction to mutual fund investing without diving into complex technical details.

Pros:

- Provides straightforward, easy-to-understand explanations suitable for novices.

- Emphasizes the importance of informed decision-making and avoiding common pitfalls.

- Offers practical advice on how to effectively utilize mutual funds to grow savings over time.

Cons:

- Does not cover advanced topics such as risk analysis or fund screening techniques.

- Lacks in-depth coverage of performance evaluation methods.

- Focuses mainly on foundational concepts, which may be too basic for more experienced investors.

Investing in U.S. Financial History Book

If you’re looking to deepen your understanding of how the U.S. financial system evolved and want practical insights that connect history to today’s markets, “Investing in U.S. Financial History” is a must-read. It offers a thorough overview of key events, reforms, and crises from Alexander Hamilton’s era to COVID-19, highlighting recurring themes like booms and busts. The book explains how foundational systems still shape modern markets, including the Federal Reserve and credit mechanisms. Carefully researched and engagingly written by Mark Higgins, it helps investors see patterns, avoid past mistakes, and better understand current economic challenges—making it essential for anyone serious about investing wisely.

Best For: investors, finance students, and financial professionals seeking a comprehensive understanding of U.S. financial history and its relevance to modern markets.

Pros:

- Highly thorough and well-researched, offering detailed historical insights and practical lessons.

- Engaging storytelling with anecdotes, quotes, and visuals that make complex topics accessible.

- Connects historical patterns to current financial issues, aiding in informed decision-making.

Cons:

- Digital formats, particularly Kindle versions, may have readability issues due to small font size.

- The extensive depth might be overwhelming for casual readers or those seeking quick summaries.

- Some readers may find the detailed notes and references dense or time-consuming to review.

Index Fund Investing Guide for Safe and Profitable ETFs

Looking for a straightforward guide to investing safely and profitably in ETFs through index funds? This book offers clear advice on choosing secure, high-performing ETFs, highlighting the importance of diversification, low costs, and strategic asset allocation. It emphasizes long-term, passive investing strategies like buy-and-hold, which help build wealth steadily. The book also covers practical hurdles, such as brokerage minimums and trading approval processes, so you’re aware of potential challenges. Many readers say it boosted their confidence and understanding of smart investing. Although it’s simple and sometimes superficial, it’s an excellent resource for beginners and seasoned investors aiming for goal-oriented, low-risk growth.

Best For: beginners and experienced investors seeking a straightforward, goal-oriented approach to safe and profitable ETF investing through index funds.

Pros:

- Clear and easy-to-understand guidance suitable for all experience levels

- Emphasizes long-term, passive investment strategies that promote wealth building

- Highlights practical considerations like costs, diversification, and strategic asset allocation

Cons:

- Simplistic writing style may lack depth for advanced investors

- Circular definitions and superficial explanations might reduce clarity for some readers

- Lacks detailed data and in-depth analysis, limiting its usefulness for those seeking comprehensive insights

Index Funds: The 12-Step Recovery Program for Active Investors

Index Funds: The 12-Step Recovery Program for Active Investors is an essential read for anyone serious about building wealth through a straightforward, research-backed approach. I find it reinforces that passive index investing outperforms active management, especially over the long term. The book highlights how attempting to outsmart the market is costly and futile because collective investor intelligence keeps markets efficient. It advocates for broad diversification, low fees, and a buy-and-hold mindset—simple strategies backed by extensive research and historical data. Its engaging visuals and clear layout make complex ideas accessible, making it a must-read for both novices and seasoned investors seeking sustainable success.

Best For: investors of all experience levels seeking a clear, research-backed strategy to build wealth through passive index investing.

Pros:

- Emphasizes the long-term benefits of broad diversification and low fees.

- Uses engaging visuals and straightforward language to make complex concepts accessible.

- Supported by extensive academic research and historical data, reinforcing its credibility.

Cons:

- Artwork and visuals are small due to the pocket-sized format; some may prefer larger illustrations.

- The book heavily favors Dimensional Funds and DFA, which may introduce potential bias.

- Lacks a 2014 edition update at the time of review, possibly missing the latest market insights.

10-Minute Options Trading and ETF Investing Book

This book stands out for investors seeking a straightforward, low-maintenance approach to growing wealth through options trading and ETFs. Travis Wilkerson shares a simple, passive strategy focused on minimal trades, long-term growth, and risk protection. His approach combines options and ETFs to accelerate gains while shielding against losses, emphasizing a buy-and-hold mindset with hedging techniques. Designed for investors with significant capital, it promotes wealth preservation and steady growth without emotional trading pitfalls. The book simplifies complex concepts through storytelling, case studies, and clear explanations, making it accessible for beginners and experienced investors alike. It’s an excellent resource for those prioritizing safety and efficiency.

Best For: investors seeking a simple, low-maintenance strategy that combines options trading and ETFs for steady, long-term wealth growth with risk protection.

Pros:

- Emphasizes a passive, buy-and-hold approach suitable for busy investors or those with significant capital.

- Simplifies complex financial concepts through storytelling and real-life case studies, making it accessible for all experience levels.

- Focuses on risk management and hedging techniques to protect assets during market downturns, promoting peace of mind.

Cons:

- May require initial understanding of options and ETFs, which could be challenging for complete beginners without further study.

- The strategy emphasizes patience and long-term growth, which might not appeal to investors seeking quick profits.

- Limited focus on active trading or short-term opportunities, possibly restricting those interested in more frequent trades.

Common Sense Investing with Index Funds

If you’re new to investing or seeking a straightforward approach to building wealth, the book on common sense investing with index funds offers invaluable guidance. It clearly explains what index funds are and why they’re better than mutual funds and ETFs for most investors. The book highlights how index funds, especially from Vanguard, outperform active management with lower fees. It provides practical advice on saving money, allocating funds, and maintaining a simple, long-term strategy. Despite some repetition, it’s a concise, easy-to-reference resource that motivates beginners and experienced investors alike to invest wisely and confidently grow their wealth.

Best For: Beginners and experienced investors seeking a simple, practical guide to investing in index funds for long-term wealth growth.

Pros:

- Clear, straightforward explanations ideal for newcomers

- Emphasizes low-cost, high-performance index funds from Vanguard

- Practical advice on saving, allocation, and maintaining a long-term strategy

Cons:

- Some repetition and minor editing issues in the text

- Lacks in-depth analysis of specific market conditions or alternative investment options

- May oversimplify complex investment concepts for readers seeking detailed technical guidance

Factors to Consider When Choosing an Index Fund Investing Book

When choosing an index fund investing book, I look for clear explanations of concepts and practical tips that I can apply. I also consider the author’s expertise and whether the information is current, so I stay well-informed. These factors help me pick a book that’s both trustworthy and useful for my investing journey.

Clarity of Concepts

Choosing an index fund investing book with clear concepts is essential for building a solid understanding of how these funds work. I look for books that explain core ideas like diversification, expense ratios, and passive management in simple, straightforward language. Effective books use concrete examples, charts, or analogies to make complex ideas accessible, which helps me grasp how index funds track markets. Avoiding jargon overload is vital, so I prefer books that define technical terms clearly. A well-structured book presents information logically, with step-by-step explanations that build on each other without confusion. Additionally, it should address common misconceptions, clearly differentiate index investing from active management, and highlight long-term benefits, ensuring I develop a solid foundation.

Depth of Content

A thorough index fund investing book should explore deeply into core concepts like asset allocation, diversification, and risk management, going beyond basic definitions to provide detailed explanations that help both beginners and advanced investors make informed decisions. It needs to include data-backed insights, historical performance analysis, and empirical evidence supporting passive strategies. An ideal book discusses various index fund types—sector, bond, and international funds—with enough depth to compare their roles within a portfolio. It should also cover nuanced topics like tax efficiency, cost structures, and market cycles, offering a complete understanding. Such content ensures readers grasp the complexities of index investing, empowering them to optimize their strategies and navigate market fluctuations confidently. Depth of content is essential for truly mastering passive investing.

Practical Application Tips

To effectively select an index fund investing book, I look for resources that offer clear, actionable guidance on applying strategies in real-world portfolios. I focus on books that emphasize long-term, buy-and-hold approaches, teaching how to choose funds based on cost, diversification, and market coverage. Practical tips on asset allocation, rebalancing, and risk management are essential, helping me implement disciplined investment practices. I also value titles that incorporate real data, performance metrics, and case studies, so I can grasp how fees and strategy choices impact results over time. Ultimately, I seek resources that balance theory with practical advice, enabling me to translate knowledge into consistent, goal-oriented investing. These factors ensure I can confidently apply what I learn and build a resilient investment portfolio.

Author Expertise and Bias

When evaluating index fund investing books, examining the author’s expertise and potential biases helps me determine the reliability of their advice. I look for authors with strong professional backgrounds, like CFAs, CFPs, or those with extensive investing experience, as these credentials indicate credibility. I also watch for signs of bias, such as promoting specific funds or investment philosophies, which can skew advice. Authors with academic or long-standing industry credibility tend to offer more balanced, evidence-based insights. It’s important to deliberate any affiliations or financial interests that might influence their recommendations. A well-qualified author will cite reputable sources, include supporting data, and openly disclose personal or financial biases, helping me judge the objectivity and trustworthiness of their guidance.

Up-to-Date Information

Staying current is essential when choosing an index fund investing book because the financial landscape evolves rapidly. I look for books that include recent market data and performance figures to reflect today’s economic conditions and trends. Updated content should cover recent regulatory changes, technological advances, and new fund options that have emerged since previous editions. It’s also important that the book discusses recent events like market downturns, bull runs, or crises, providing relevant strategies for current situations. I prioritize sources that cite the latest research, benchmarks, and industry developments, ensuring the advice is accurate and actionable. An up-to-date book helps me navigate the complexities of today’s markets and makes my investment decisions more informed and confident.

Accessibility for Beginners

Choosing an index fund investing book that’s accessible for beginners makes a big difference in how confidently you start your investment journey. A good book should use clear, simple language, avoiding complex jargon that can overwhelm newcomers. It should offer practical explanations and real-life examples to show how index funds work and why they’re ideal for beginners. Step-by-step guidance on starting out, selecting funds, and maintaining a long-term plan is essential, especially if you have no prior financial knowledge. Visual aids like charts, diagrams, and summaries can reinforce understanding and make complex ideas easier to grasp. Ultimately, an accessible book focuses on core principles like low-cost, buy-and-hold strategies, helping you build confidence and develop a solid foundation for your investing future.

Cost and Value

Evaluating the cost and value of an index fund investing book helps guarantee you’re getting a worthwhile resource without overspending. I look for books that offer a good balance of practical advice and in-depth information relative to their price, ensuring I get solid value for my money. The content should thoroughly cover essential concepts without unnecessary filler or superficial explanations. I also check reviews and summaries to see if the book provides reliable, actionable insights that can genuinely help improve my investment decisions or save money. Considering the edition and update frequency is important too—newer editions often include recent market developments. Finally, I compare the book’s length and detail level to its cost, making sure I’m not overpaying for content I could find in more affordable or free resources.

Frequently Asked Questions

How Do Index Funds Compare to Actively Managed Funds?

When comparing index funds to actively managed funds, I find index funds often outperform because they have lower fees and are more diversified. Actively managed funds try to beat the market but can struggle to do so consistently, especially after fees. I prefer index funds for their simplicity, cost-efficiency, and steady returns. They’re a great choice for investors like me who want reliable growth with less hassle.

What Are the Tax Implications of Index Fund Investing?

Ever wondered about the tax side of index fund investing? I find that they’re generally more tax-efficient than actively managed funds because they have lower turnover, which means fewer capital gains distributions. This can help you keep more of your money working for you. However, you’ll still owe taxes on dividends and capital gains, so it’s smart to take into account tax-advantaged accounts like IRAs or 401(k)s to maximize your gains.

How Often Should I Rebalance My Index Fund Portfolio?

When it comes to rebalancing my index fund portfolio, I usually do it once a year or when my allocations drift more than 5% from my target. I find that regular check-ins help me stay on track without overtrading. You should choose a schedule that fits your comfort level and investment goals, but consistency is key to maintaining a balanced, diversified portfolio over time.

Are Index Funds Suitable for Short-Term Investors?

Your question about index funds for short-term investing is like asking if a bicycle can win a race against a sports car. Honestly, I wouldn’t recommend them for quick gains because they’re designed for steady, long-term growth. If you’re looking to make quick money, index funds might not be the best fit—they shine over years, not months. For short-term goals, consider other investment options that match your timeline.

What Fees Should I Look for in Index Fund Investments?

When choosing index funds, I always check the fees first. Look for low expense ratios, ideally under 0.20%, to keep costs down. Also, watch out for any additional charges like load fees or transaction fees, which can eat into your returns. The lower the fees, the better your chances of building wealth over time. Always compare funds and read the prospectus to understand all associated costs.

Conclusion

Diving into these books is like planting seeds for a thriving investment garden. Each page offers tools to help your portfolio grow strong and resilient. Whether you’re after safe, steady gains or passive income streams, these reads will guide you through the lush landscape of index fund investing. So grab your favorite book, start sowing knowledge today, and watch your financial future blossom into a vibrant, fruitful forest.