Keeping my finances organized is essential, and I’ve found great organizers that help track bills, expenses, and financial goals. The top options include versatile planners like the Mead 2019 Home Finance Organizer and budget notebooks with pockets and checklists. Envelopes for receipts and bill payers like Soligt and HautoCo make managing money easier. If you want to discover the best tools for staying on top of your finances, continue here to find out more.

Key Takeaways

- Look for organizers with dedicated sections for income, expenses, savings, debt, and milestones to ensure comprehensive financial tracking.

- Prioritize durable, high-quality materials like waterproof covers and reinforced pockets for long-term usability.

- Choose formats with customizable categories, stickers, and color coding to enhance organization and personalization.

- Opt for compact, portable designs for easy handling and quick access during daily financial management.

- Consider organizers with clear indexing, quick-access pockets, and flat-laying features to streamline record retrieval and usability.

Mead 2019 Home Finance Organizer

Are you looking for a practical, user-friendly organizer that simplifies your bill management and expense tracking? The Mead 2019 Home Finance Organizer is an excellent choice. Its size, about 9.2 by 11.2 inches, fits comfortably on your desk or shelf. The wirebound design and large elastic band keep everything secure, while the clear front pocket provides quick access to important notes. With monthly pockets for receipts and bills, plus space for notes and a 3-year reference calendar, it’s perfect for staying organized year-round. Customers praise its usability, though some reinforce pockets for added durability. Overall, it’s a reliable tool for managing your finances efficiently.

Best For: individuals seeking a durable, easy-to-use home finance organizer for managing bills, receipts, and expenses throughout the year.

Pros:

- User-friendly layout with dedicated pockets and monthly pages for organized expense tracking

- Secure wirebound design with elastic band closure and clear front pocket for quick access

- Recognized for durability and reliability, with customizable options for reinforcement

Cons:

- Pockets may require reinforcement for long-term durability

- Slightly higher price compared to some retail stores, which may affect budget-conscious buyers

- Capacity limitations compared to older models, potentially restricting the number of receipts and documents stored

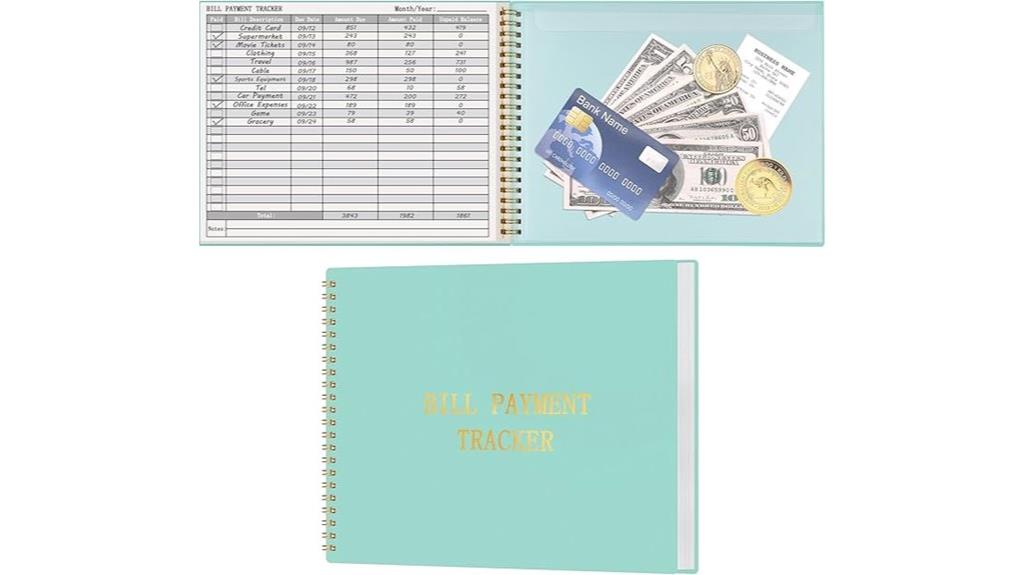

Bill Payment Tracker Notebook with Spiral Binding and Back Pocket

The Bill Payment Tracker Notebook with Spiral Binding and Back Pocket is an ideal choice for anyone who prefers managing finances manually and values durability. Its sturdy polyvinyl cover and spiral binding make it easy to flip through pages and keep receipts secure. Made with thick 100 gsm paper, it prevents ink bleed, perfect for detailed notes. The size fits comfortably on a desk, with simple ruled pages for organized tracking of bills, due dates, and payments. Its dedicated sections help me stay on top of subscriptions and invoices, while the back pocket keeps important documents handy. Overall, it’s a practical, reliable tool for maintaining financial discipline.

Best For: Individuals who prefer manual financial management, need a durable, organized way to track bills and payments, and appreciate an easy-to-use planner with a professional appearance.

Pros:

- Durable polyvinyl cover and spiral binding for long-lasting use and easy page flipping

- Thick 100 gsm paper prevents ink bleed, suitable for various writing instruments

- Dedicated sections for bills, due dates, and payments help maintain organization and prevent missed payments

Cons:

- Size may be less portable for those needing a pocket-sized option

- Limited formatting options, which might not suit users seeking more customizable layouts

- Some users might prefer a larger planner for more detailed notes or additional sections

The Essential Information Organizer

If you’re looking for a straightforward way to organize essential household and financial details, the Essential Information Organizer is an excellent choice. This spiral-bound 10×8 book consolidates critical data like medical info, prescriptions, vehicle details, banking, and contacts, making it easy to access during emergencies. It features ruled lines, pockets, and dedicated pages for different categories, all within a compact design weighing about 5.6 ounces. While some users find its space limited, it’s ideal for basic documentation needs. Priced around $5.99, it offers a practical solution for keeping crucial information organized and readily available when it matters most.

Best For: individuals or families seeking a compact, easy-to-use organizer for essential household and financial information to prepare for emergencies.

Pros:

- Convenient spiral-bound design that is portable and easy to handle

- Includes dedicated pages and pockets for organizing various critical data types

- Affordable price point around $5.99, offering practical value

Cons:

- Limited space may not accommodate extensive or detailed information for larger families

- Only one vehicle entry per page, restricting detailed vehicle documentation

- Some users find the number of pages insufficient for comprehensive record-keeping

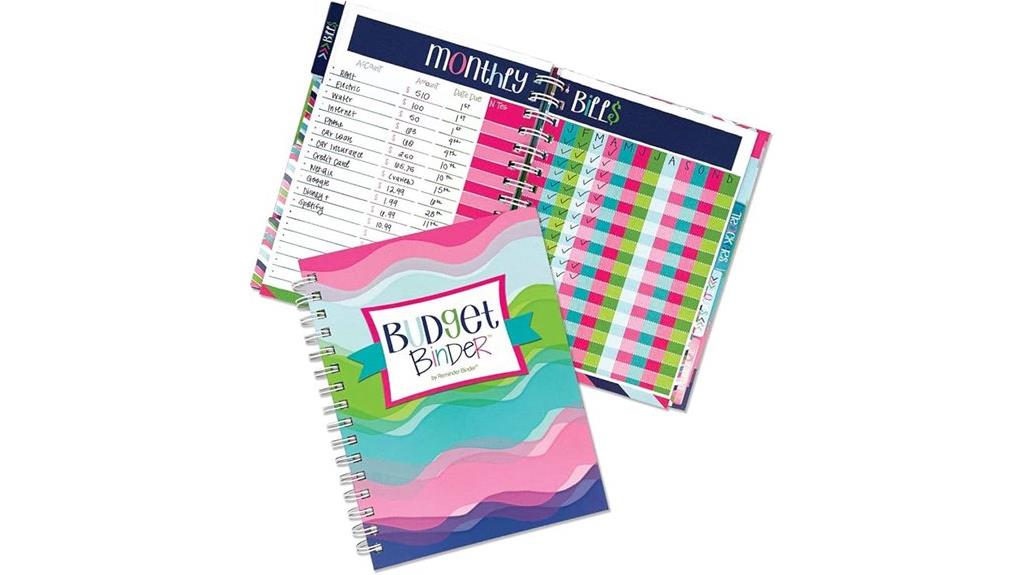

Monthly Bill Payment Checklist & Financial Planner Notebook

For anyone serious about gaining control over their finances, the Monthly Bill Payment Checklist & Financial Planner Notebook offers an excellent solution. This 4-year organizer helps me stay on top of bills with detailed checklists for paid, unpaid, and auto-paid bills, along with due dates and amounts. It also tracks income, expenses, debt payoff, and savings goals, making financial management straightforward. Its large pages and high-quality paper make writing easy and comfortable. I appreciate how it documents milestones and provides space for notes and bank details, turning everyday tracking into a long-term record of my progress. It’s a practical, motivating tool to keep finances organized and on track.

Best For: individuals seeking a comprehensive, long-term financial management tool to organize bills, expenses, and savings over four years.

Pros:

- Includes detailed checklists for paid, unpaid, and auto-paid bills with due dates and amounts.

- Offers ample space for income, expenses, debt payoff, savings goals, notes, and bank details.

- High-quality, thick paper and large pages ensure comfortable writing and durability.

Cons:

- The extensive 4-year format may be overwhelming for users preferring short-term planning.

- Some users might find the detailed layout initially complicated or time-consuming.

- Limited digital features, relying solely on physical record-keeping.

Soligt Budget Planner 2025, Monthly Expense Organizer with 12 Pockets

Looking for a budget organizer that keeps your bills and receipts neatly stored and easily accessible? The Soligt Budget Planner 2025 is perfect for personal and small business use. Its undated, spiral-bound design features 12 pockets for bills, receipts, and envelopes, making organization simple. With customizable pages, sections for income, expenses, savings, and debt, plus a bills calendar, it helps you track progress and set goals. The bright, cheerful design is complemented by colored stickers for easy navigation. Lightweight and portable, it’s ideal for on-the-go budgeting. While starting the calendar on Monday may be a minor drawback, its overall quality and usability make it a popular choice.

Best For: individuals and small business owners seeking a portable, customizable budgeting planner with organized pockets for bills and receipts.

Pros:

- Durable hardcover and high-quality paper ensure long-lasting use and a pleasant writing experience.

- Bright, cheerful design with colored stickers enhances navigation and makes budgeting more engaging.

- Multiple sections for income, expenses, savings, and debt tracking facilitate comprehensive financial management.

Cons:

- Calendar pages starting on Monday may be less intuitive for some users who prefer Sunday starts.

- Limited space on calendar and notes pages can restrict detailed entries and planning.

- Concerns about durability over multiple years due to wear and tear from frequent handling.

Undated Monthly Bill Payment Organizer (48-Month)

The Undated Monthly Bill Payment Organizer (48-Month) stands out as an ideal tool for individuals seeking a thorough and flexible way to manage their finances without being tied to specific dates. Its 8×10-inch design features high-quality paper and a waterproof PVC cover, ensuring durability and smooth writing. This planner combines sections for income, expenses, savings, debt payments, and goals, making it all-encompassing. The twin-wire binding allows it to lay flat, enhancing usability. With 48 undated months, you can adapt it to your schedule, track progress, and stay motivated, all while keeping your financial goals organized and in sight.

Best For: individuals seeking a flexible, comprehensive, and durable financial organizer to track income, expenses, savings, and debt over an extended period without fixed dates.

Pros:

- Combines multiple financial management features in one planner, including debt tracking, goal setting, and expense monitoring.

- Undated format allows for flexible use across 48 months, accommodating various schedules.

- High-quality materials like waterproof PVC cover and smooth paper enhance durability and writing experience.

Cons:

- Some users may find the limited space per entry challenging for detailed notes or large amounts of data.

- The 8×10-inch size, while portable, might still be bulky for some users to carry daily.

- Price potential varies, and some may find similar products at lower costs elsewhere.

Budget Planner with Expense Tracker Notebook and Finance Organizer

A thorough Budget Planner with Expense Tracker Notebook and Finance Organizer is perfect for anyone aiming to take control of their finances with a structured, easy-to-use tool. I love how it offers dedicated sections for income, expenses, savings, and goals, making tracking straightforward. The full-page calendars help me keep track of paydays, bills, and important dates at a glance. Its durable, water-resistant cover and compact size make it practical for daily use. Plus, the included guidebook provides clear instructions on setting goals and improving my budgeting skills. This planner keeps me organized, motivated, and confident in managing my financial future.

Best For: individuals seeking a comprehensive, organized, and durable tool to manage their finances, track expenses, and set financial goals with ease.

Pros:

- User-friendly layout with dedicated sections for income, expenses, and savings, making tracking straightforward

- Durable water-resistant cover and compact size enhance portability and long-term use

- Includes helpful features like full-page calendars, stickers, and a detailed guidebook to improve budgeting skills

Cons:

- Undated format may require manual setup each month, which could be less convenient for some users

- Slightly larger than standard notebooks, which might be less portable for very limited space

- Price point, while reasonable, may still be a consideration for budget-conscious buyers

ZICOTO Monthly Budget Planner and Expense Tracker

If you want a simple, portable way to stay on top of your finances, the ZICOTO Monthly Budget Planner and Expense Tracker is an excellent choice. Its minimalistic design and compact size make it easy to carry everywhere, fitting comfortably into your bag. This undated planner covers all essential areas, from income and savings to debt and bill management, with dedicated sections for goal setting and reflection. The included stickers, motivational quotes, and clear instructions keep you motivated and organized. Many users find it helps reduce financial stress, improve oversight, and build lasting habits—all in a stylish, user-friendly package.

Best For: individuals seeking a portable, user-friendly budgeting tool to manage their finances effectively and develop long-term financial habits.

Pros:

- Compact size and minimalistic design make it easy to carry and use on the go.

- Covers essential financial areas with dedicated sections for goals, reflection, and tracking.

- Includes helpful stickers, motivational quotes, and clear instructions to keep users engaged.

Cons:

- Slightly smaller writing space may be limiting for users who prefer more room for notes.

- Undated format requires users to manually fill in dates, which might be less convenient for some.

- Limited size options; some users may prefer a larger planner for more detailed entries.

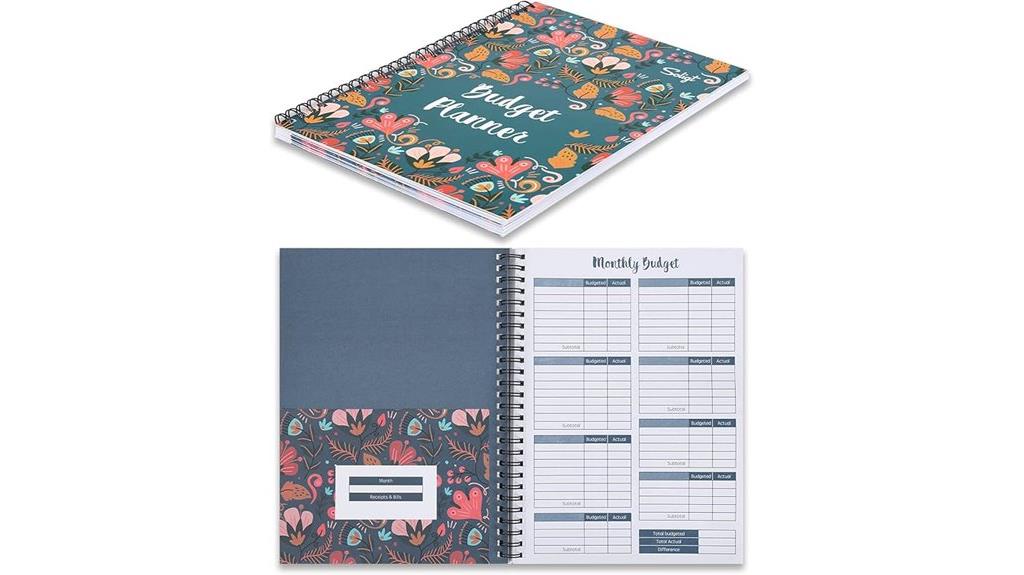

Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook

Are you looking for a thorough yet user-friendly way to stay on top of your finances? The Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook, is perfect for managing your money efficiently. It’s an undated, 1-year planner with high-quality paper, durable cover, and flexible binding. You can set goals, track savings and debts, plan monthly budgets, and review progress all in one place. Its colorful pages make navigation easy, and the inner pocket keeps receipts handy. Whether you’re goal-oriented or want to control spending, this organizer helps develop better financial habits while being practical and stylish.

Best For: individuals seeking a comprehensive, durable, and easy-to-use financial planner to organize their monthly expenses, savings, debts, and financial goals over a year.

Pros:

- High-quality, thick paper prevents ink leakage and ensures smooth writing.

- Durable, flexible cover with twin-wire binding enhances longevity and lay-flat usability.

- Color-coded monthly pages and additional sections facilitate easy navigation and comprehensive tracking.

Cons:

- Slightly heavier than typical notebooks due to sturdy materials, which may affect portability.

- Limited color options (rose and teal) may not suit all aesthetic preferences.

- As an undated planner, it requires users to fill in dates manually, which could be time-consuming for some.

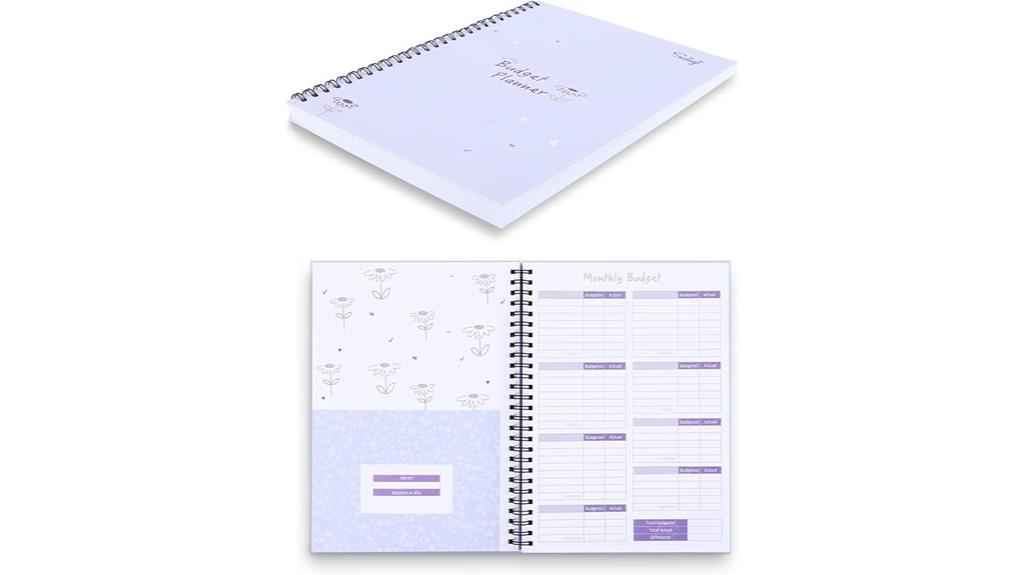

Monthly Budget Planner Book (Undated) with 12 Pockets

The Monthly Budget Planner Book (Undated) with 12 Pockets is an ideal choice for anyone seeking flexible and organized financial management. Its spiral-bound design measures 9.25 x 6.81 inches, with a durable hardcover and ink-resistant 100 gsm paper. The purple floral cover adds charm, while bonus month tabs with colored stickers make navigation easy. The 12 pockets help you store receipts, bills, and envelopes neatly. The undated format allows you to start anytime, and its sections cover income, expenses, savings, and debt. Lightweight and portable, it’s perfect for daily use, helping you stay on top of your finances with customizable, all-encompassing planning.

Best For: individuals or small business owners seeking a flexible, organized, and aesthetically pleasing budget planner that allows for customizable financial tracking and storage.

Pros:

- Undated format offers flexibility to start anytime and tailor to individual needs

- Includes 12 storage pockets for receipts, bills, and envelopes, promoting organization

- Durable hardcover and quality paper resist ink bleed, ensuring long-lasting use

Cons:

- Small or flimsy pockets for bills may require reinforcement for durability

- Monthly calendar starts on Monday, which may not suit all users’ preferences

- Limited pre-filled categories may require extra effort for detailed budgeting

SOLIGT Large Budget Planner and Monthly Bill Organizer

Looking for a budget planner that offers ample space and detailed tracking capabilities? The SOLIGT Large Budget Planner and Monthly Bill Organizer might be just what you need. Its 8.5×11-inch hardcover design features thick, durable pages and a chic boho cover, making it both stylish and sturdy. With plenty of space for tracking debts, expenses, bills, and savings, plus sections for monthly reviews and strategies, it keeps everything organized. The undated, spiral-bound format allows flexible start times, and the 12 pockets help store receipts and documents. Including stickers and customizable categories, it’s a practical, attractive tool for managing your finances effectively.

Best For: individuals or households seeking a spacious, durable, and customizable budget planner to effectively track expenses, debts, savings, and financial goals with a stylish design.

Pros:

- Large 8.5×11-inch size provides ample space for detailed financial tracking and notes.

- Durable hardcover with thick, high-quality pages ensures longevity and a premium feel.

- Includes pockets, stickers, and customizable categories to enhance organization and personalization.

Cons:

- Slightly heavy at 2.76 pounds, which may be less portable for on-the-go use.

- Some users have reported initial missing items like stickers or manuals, requiring customer service support.

- The undated format, while flexible, may require extra effort to set up at the start of each new period.

Busy Family Bill Organizer

Busy families seeking an easy-to-use and affordable way to organize their monthly bills will find the Bill Organizer especially helpful. It offers dedicated pockets for each month, making it simple to store bills, receipts, and documents separately. Its straightforward design appeals to those who prefer practicality over unnecessary features, helping avoid missed payments. While some users note it can’t fit standard-sized papers and isn’t designed for heavy daily handling, many appreciate its affordability and simplicity. It’s a versatile tool that can also be customized for receipts or expense tracking. Overall, it’s an effective solution for keeping your family’s finances organized without fuss.

Best For: busy families and small households seeking an affordable, straightforward way to organize monthly bills and receipts without unnecessary complexity.

Pros:

- Simple design that is easy to use and helps prevent missed payments

- Dedicated pockets for each month facilitate organized storage of bills and receipts

- Affordable and versatile, suitable for personal and small business expense tracking

Cons:

- Pockets may not fit standard 8.5 x 11 inch paper, limiting document size options

- Made from heavier paper rather than durable materials, less suitable for frequent handling

- Some versions may have missing pockets or previous modifications, affecting completeness

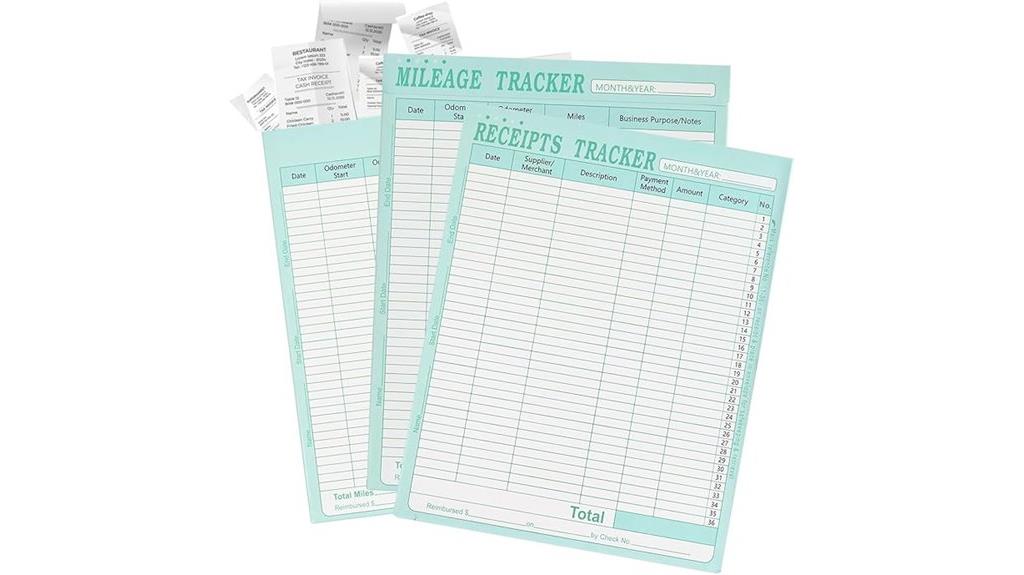

12/Pack Receipt Storage & Expense Organizer Envelopes

Are you tired of rummaging through cluttered drawers or piles of receipts? I’ve been there, which is why I love these 12-pack Receipt Storage & Expense Organizer Envelopes. Made of durable cardstock, they fit full-size receipts without folding, keeping everything neat. Each envelope has an adhesive strip for secure sealing and space for detailed expense and mileage logs. They streamline your record-keeping, making tax time easier and helping you stay on top of your budget. Plus, their sturdy design means your receipts stay protected long-term. These envelopes are perfect for small business owners or anyone wanting a simple, reliable way to organize expenses throughout the year.

Best For: Small business owners and individuals seeking a straightforward, durable solution for organizing full-size receipts and detailed expense tracking throughout the year.

Pros:

- Made of durable 110 lb. cardstock, ensuring long-term protection for receipts

- Large size (11.4 W x 9 H inches) fits full-size receipts without folding

- External recording areas for detailed expense and mileage logs enhance organization and ease of retrieval

Cons:

- Gummed closure may require moistening for secure sealing, which could be less convenient than self-adhesive options

- Larger envelopes may take up more storage space compared to standard-sized options

- Not waterproof; paper material may be vulnerable to moisture or damage if not stored carefully

12-Month Budget Planner and Bill Organizer with Calendar and Pockets

The Month Budget Planner and Bill Organizer with Calendar and Pockets is an ideal choice for individuals who want a flexible, easy-to-use tool to manage their finances. It offers 12 months of non-dated planning, so you can start anytime. The organizer includes sections to track income, expenses, savings, and debt, along with helpful graphs to monitor progress. Its durable hardcover, colorful design, and pockets make it portable and engaging. With stickers, dividers, and space for bill due dates and account info, this planner simplifies budgeting and bill management. It’s perfect for beginners, students, or anyone looking to stay organized and motivated in their financial journey.

Best For: individuals seeking a colorful, flexible, and easy-to-use budgeting tool to improve their financial organization and habits.

Pros:

- User-friendly layout with clear categories for tracking income, expenses, and savings

- Portable and durable hardcover design with pockets and stickers for enhanced organization and motivation

- Non-dated format allows for flexible start times and year-round use

Cons:

- Slight shipping damages or misplaced tabs reported by some users

- Limited customization options beyond provided stickers and dividers

- May be too simple for advanced budgeting needs or detailed financial analysis

HautoCo Bill Tracker Notebook for Personal Budgeting

Looking for a reliable way to organize your personal or small business expenses? The HautoCo Bill Tracker Notebook makes tracking bills simple and efficient. It features undated pages with sections for paid and unpaid bills, descriptions, due dates, amounts, and balances. Its large, 10.1 x 7.8-inch pages provide plenty of space for detailed entries, and the spiral binding lets it lie flat while you write. Made with high-quality, waterproof materials and thick paper to prevent ink bleed, it also includes pockets for receipts and loose papers. This durable, functional notebook helps you stay on top of your finances with ease and clarity.

Best For: Individuals or small business owners seeking a durable, organized, and detailed system for tracking and managing bills and expenses efficiently.

Pros:

- High-quality, waterproof cover and thick paper prevent ink bleed and protect against spills

- Large pages with ample space for detailed entries and multiple transactions per entry

- Spiral binding allows the notebook to lie flat, making writing more comfortable and accessible

Cons:

- Undated pages require manual date entry, which may be time-consuming for some users

- Slightly larger size may be less portable for those needing a compact option

- Limited to 120 pages, which might require replacement or additional tools for long-term use

Factors to Consider When Choosing a Financial Statements Organizer

When choosing a financial statements organizer, I consider several key factors to guarantee it meets my needs. Things like storage capacity, durability, and how easy it is to access my documents are vital. Additionally, I look at organizational features, size, and portability to find the best fit for my workflow.

Storage Capacity Needs

Choosing a financial statements organizer requires careful attention to storage capacity to avoid overcrowding or frequent reorganizing. First, I assess how many documents I need to store regularly, including statements, receipts, and tax papers, to determine the right size. It’s important that the organizer can hold multiple years of records without becoming cluttered. I also check the size and number of pockets or compartments to ensure they fit common document dimensions like full-size reports or bills. Additionally, I look for organizers with expandable storage or extra pages for future documents, so I won’t need to switch organizers often. Matching the organizer’s maximum capacity to my storage needs helps keep everything organized and accessible without constant re-sorting.

Durability of Materials

Selecting a financial statements organizer isn’t just about storage capacity; durability of materials plays a key role in ensuring it stands up to daily use. I look for organizers made with thick, high-quality paper—120 gsm or more—to prevent ink bleed and tearing, which extends the lifespan of my documents. Waterproof covers made from PVC or similar plastics protect against spills and moisture, keeping my finances safe over time. Reinforced pockets and sturdy binding options like metal twin-wire or spiral binding add to the organizer’s strength, making it more resistant to wear and tear. A tear-resistant cover and reinforced stitching are essential if I want my organizer to withstand frequent handling and transport, ensuring my financial records stay intact and accessible for the long haul.

Ease of Access

Have you ever spent too much time searching for a specific financial statement? An effective organizer makes this frustration disappear. Features like labeled pockets, categorized sections, and color-coded tabs help you find documents instantly. A flat-laying design or open pages allow you to view multiple statements at once, saving time. Digital or physical organizers with clear indexing or referencing systems streamline navigation through large volumes of papers. The size and layout should support quick handling, making it easy to insert or remove statements without damage or clutter. Prioritizing ease of access ensures you spend less time searching and more time analyzing your finances. Choose an organizer that simplifies retrieval and keeps everything within reach, so your financial management remains smooth and efficient.

Organizational Features

What key features should I look for in a financial statements organizer to guarantee it keeps my documents well-structured and easily accessible? First, check for categorized sections like income, expenses, assets, liabilities, and investments, which make finding information quick and straightforward. Physical features like pockets, dividers, and labeled tabs help separate and secure different documents. Clear, labeled headings and dedicated spaces for dates, amounts, and descriptions streamline record-keeping and reviewing. Visual cues like color-coding or charts can help differentiate categories and monitor progress at a glance. Durability is also important—look for high-quality binding, sturdy covers, and thick paper to ensure your organizer withstands regular use and protects sensitive information. These features keep your finances organized and accessible when you need them most.

Size and Portability

Choosing the right size for your financial statements organizer is vital to guarantee it fits comfortably in your workspace or bag. If you need portability, a compact organizer is ideal—it’s easy to carry and store, perfect for on-the-go use. However, keep in mind that smaller models might have limited space for detailed entries. On the other hand, larger organizers offer more room for thorough financial data, but they can be cumbersome to carry or fit into tight spaces. Also, consider the weight; heavier options may be less practical if you need to transport them frequently. Finally, check the dimensions to ensure they match your storage or filing system. An organizer that fits well will make accessing and managing your financial statements seamless and stress-free.

Compatibility With Records

Selecting a financial statements organizer that fits your records properly is essential for easy access and efficient management. I look for organizers with designated sections for different document types like bills, receipts, bank statements, and tax papers, which makes categorizing straightforward. It’s important to check if the size and format can hold all your records without excessive folding or trimming—nothing more frustrating than trying to force documents into an ill-fitting space. Clear labeling or tabs help me quickly locate specific categories, saving time during busy periods. Durability matters too; I want a sturdy binding and durable material to protect records over time, especially with frequent handling. Finally, an organizer that allows for expansion ensures I can add new documents as my financial situation evolves.

Security and Privacy

When organizing your financial records, security and privacy should be at the forefront of your considerations. Look for organizers that offer password protection or encryption features to keep sensitive information safe from unauthorized access. Physical security is just as important—choose options with lockable compartments or secure pockets to prevent theft or accidental exposure. Durability also matters; select organizers made from tamper-proof materials to protect your documents from damage. Additionally, consider whether the organizer supports data backup, like digital copies or cloud storage, for extra privacy and security. Finally, review the manufacturer’s privacy policies to ensure they prioritize data confidentiality and handle your information securely. Prioritizing these factors will help you safeguard your financial details effectively.

Budget and Cost

Ever wonder how to get the best value when investing in a financial statements organizer? The key is to take into account the overall cost, including the purchase price, reinforcement materials, and any accessories needed for durability. Think about whether the organizer offers long-term value through features like refillability, built-in storage pockets, and capacity for future documentation. Also, factor in potential expenses for customization, reinforcement, or digital backups if modifications are necessary. Be sure to compare prices across different retailers and read customer reviews to ensure the cost aligns with quality and organizational benefits. Ultimately, investing in a higher-priced, durable organizer can save you money over time by reducing the need for frequent replacements, making it a smart financial decision.

Frequently Asked Questions

How Do I Choose the Right Organizer for My Financial Goals?

When choosing the right organizer for my financial goals, I start by identifying what I need most—whether it’s budgeting, tracking expenses, or planning savings. I look for tools that are simple to use and fit my lifestyle. I also consider whether I prefer digital or paper formats. Ultimately, I pick an organizer that keeps me motivated, organized, and aligned with my financial priorities, making it easier to reach my goals.

Can These Organizers Help With Debt Management Strategies?

Absolutely, these organizers can help with debt management strategies. They offer a clear view of your debts, payments, and progress, making it easier to create repayment plans. By tracking your income and expenses, I find I can identify areas to cut costs and allocate more toward debt. Using these tools keeps me accountable and motivated, ensuring I stay on top of my debt reduction goals effectively.

Are Digital Options Better Than Traditional Paper Organizers?

When it comes to choosing between digital and traditional paper organizers, I find digital options often better for my needs. They’re more accessible, easy to update, and help me track my finances in real-time. Plus, I can access them anywhere. That said, some people prefer paper for its tangibility. Ultimately, it depends on your style, but I recommend trying digital first for convenience and efficiency.

How Often Should I Review and Update My Financial Organizer?

When it comes to reviewing and updating my financial organizer, I believe consistency beats frequency. I try to do it monthly, like checking in with a good friend, so I stay aware of my financial health. This way, I catch mistakes early and adjust as needed, rather than waiting until problems pile up. Regular updates keep my finances on track and give me peace of mind, knowing I’m in control.

Do Organizers Include Sections for Investment Tracking?

Many financial organizers do include sections for investment tracking. I find that having a dedicated space helps me monitor my stocks, mutual funds, and other assets. It keeps me organized and aware of my progress. Whether it’s through spreadsheets or planners, including investment details ensures I stay on top of my financial goals. I recommend choosing an organizer that prioritizes investment tracking if that’s important to you.

Conclusion

Choosing the right financial statements organizer keeps my finances tidy and stress-free. With all these options, I feel confident I can find one that suits my needs—like having a trusty quill in a modern world. It’s about staying organized, avoiding chaos, and feeling secure about my financial future. Don’t wait for a “big bang” to get your finances in order—start today and take control like a true captain of your ship.