If you’re looking for the 13 best financial planning workbooks, I’ve got you covered. These tools help you visualize goals, track expenses, set milestones, and stay motivated—all in a structured, engaging way. Whether you need a simple budget planner or a thorough guide for debt repayment and savings, there’s an option for you. Keep exploring to discover how the right workbook can transform your financial future and keep your goals within reach.

Key Takeaways

- Highlight top-rated workbooks designed to improve budgeting, savings, debt management, and financial goal achievement.

- Focus on features like practical worksheets, visual aids, and organized layouts for effective planning.

- Include options suitable for beginners to advanced users, emphasizing usability and comprehensive content.

- Consider design elements such as portability, durability, and engaging visuals to enhance user motivation.

- Provide insights into selecting workbooks based on personal goals, ease of use, and long-term financial benefits.

Long Term Care Essentials Book

Are you looking for a straightforward, practical resource to help you prepare for long-term care? The Long Term Care Essentials Book is exactly that. It emphasizes the importance of early planning, so you can handle legal, financial, and emotional aspects before they become overwhelming. I found its breakdown of care options, legal protections, and financial strategies incredibly helpful. It guides you step-by-step, making complex decisions manageable. The book also highlights family communication and emotional preparedness, which are often overlooked. This resource empowers you to take control, reduce stress, and create a solid plan for aging gracefully and securely.

Best For: individuals and families seeking a clear, practical guide to proactively plan for long-term care, covering legal, financial, and emotional aspects to ensure peace of mind.

Pros:

- Provides comprehensive, step-by-step guidance on care options, legal protections, and financial planning

- Emphasizes the importance of early planning to avoid stress and high costs later on

- Accessible language and well-organized content suitable for all stages of planning

Cons:

- May require additional resources for in-depth legal or financial advice

- Focuses primarily on the U.S. elder care landscape, limiting relevance in other countries

- Some readers might find the scope broad and need to supplement with more specialized information

The Total Money Makeover Workbook

The Total Money Makeover Workbook is an excellent choice for individuals who want straightforward, practical guidance to overhaul their personal finances. I’ve found Ramsey’s approach invigoratingly simple and honest, making complex financial concepts easier to grasp. Since retiring, I’ve used the free EveryDollar app to gain better control over my spending and develop healthier habits. The workbook complements the book perfectly, providing actionable steps to stay on track. Despite some disagreements with Ramsey’s views on religion and politics, I appreciate his candor. Overall, I believe this workbook can help anyone—especially older adults—make steady progress toward financial stability and freedom.

Best For: individuals seeking straightforward, practical guidance to improve their personal finances, especially older adults nearing or in retirement.

Pros:

- Offers clear, honest, and simple financial advice that is easy to understand and implement

- Complements the book with actionable steps through the workbook to maintain financial discipline

- Proven tools like the EveryDollar app aid in tracking spending and developing healthier financial habits

Cons:

- Some readers may disagree with Ramsey’s views on religion and politics, which could affect their engagement

- The approach may be too basic for those with advanced financial knowledge or complex situations

- The workbook and methods are primarily focused on debt repayment and budgeting, possibly overlooking investment strategies

The Financial Planning Workbook (2024 Edition)

If you’re someone who prefers managing your finances independently and values a structured, self-guided approach, the Financial Planning Workbook (2024 Edition) is an excellent choice. It emphasizes self-awareness, helping you uncover hidden beliefs, emotional triggers, and childhood experiences that influence your financial decisions. The workbook offers practical tools to track your finances, create a personalized plan, and make ongoing adjustments—all accessible online for free. Many users find it eye-opening and practical, especially those seeking clarity and control over their finances. While it might be pricey for some, its structured guidance makes it a valuable resource for self-directed financial planning.

Best For: individuals who prefer managing their finances independently and seek a structured, self-guided approach to achieve financial clarity and control.

Pros:

- Encourages self-awareness by uncovering hidden beliefs and emotional triggers affecting financial decisions

- Provides practical, easy-to-use tools for tracking and adjusting finances online for free

- Suitable for ongoing self-directed financial management and personal growth in financial planning

Cons:

- Can be considered expensive relative to its content for some users

- May offer limited additional value for those already well-organized in retirement planning

- Designed primarily for DIY enthusiasts, potentially less useful for those preferring professional guidance

Financial Planning Workbook: Family Budgeting Guide

Looking for a practical tool to help your family create and stick to a budget? The Financial Planning Workbook: Family Budgeting Guide is exactly that. It offers clear, easy-to-follow instructions rooted in biblical principles, complete with helpful handouts. Many users find it perfect for starting their budgeting journey, even sharing it with friends. It’s proven to help families, including those living on a single income or managing larger households, stay financially disciplined. I’ve seen it transform lives, making budgeting accessible and manageable. If you’re seeking a straightforward, effective resource to improve your family’s finances, this workbook is a great choice.

Best For: families seeking a practical, biblical-based tool to establish and maintain a manageable and disciplined budget.

Pros:

- Easy-to-follow instructions with helpful handouts for clarity.

- Proven effectiveness in transforming families’ financial habits and achieving financial freedom.

- Suitable for various household sizes, including single-income families and larger households.

Cons:

- May require a commitment to consistently apply principles for best results.

- Not as feature-rich as digital budgeting tools or apps.

- Some users might prefer more advanced financial planning resources as their needs grow.

The Total Money Makeover Book

Readers overwhelmed by debt or struggling to manage their finances will find The Total Money Makeover especially helpful. Authored by Dave Ramsey, this straightforward guide offers proven strategies to eliminate debt and build financial stability. Ramsey shares real-life success stories and emphasizes practical steps, like paying off credit cards and avoiding scams. The book encourages a mindset shift about debt and provides clear, action-oriented advice suitable for anyone, from recent graduates to families. With 13 chapters, worksheets, and a no-nonsense approach, it’s a valuable resource for gaining control over your money and creating a solid financial foundation.

Best For: individuals overwhelmed by debt or seeking practical, no-nonsense guidance to achieve financial stability and eliminate debt.

Pros:

- Provides clear, step-by-step strategies to pay off debt and build savings.

- Shares real-life success stories to motivate and inspire readers.

- Emphasizes practical, actionable advice suitable for a broad audience.

Cons:

- Offers minimal detailed guidance on investment options and strategies.

- Some content may be US-centric, limiting relevance for international readers.

- The initial chapters can be challenging for readers new to financial concepts.

ZICOTO Monthly Budget Planner and Expense Tracker Notebook

The ZICOTO Monthly Budget Planner and Expense Tracker Notebook is an excellent choice for anyone seeking an intuitive, portable tool to manage their finances effectively. Its minimalistic, sage green design makes it visually appealing, while the compact size (5.5×8.3 inches) guarantees easy portability. This undated planner covers all essential areas—income, savings, debts, bills, and expenses—plus goal setting and reflection sections. It’s versatile enough to start anytime, helping you develop consistent budgeting habits. Many users find it simplifies financial tracking, reduces stress, and boosts confidence. The included stickers, motivational quotes, and practical layout make it a stylish, functional companion for everyday money management.

Best For: individuals seeking a stylish, portable, and easy-to-use financial planner to develop consistent budgeting and expense tracking habits.

Pros:

- Compact size (5.5×8.3 inches) for portability and convenience on-the-go

- Minimalist design with motivational quotes and stickers to enhance user engagement

- All-in-one coverage of income, savings, debts, bills, expenses, and goal setting for comprehensive financial management

Cons:

- Slightly smaller writing space may limit detailed entries for some users

- Undated format requires manual date entry, which might be less convenient for some

- Limited customization options beyond the included stickers and layout

Budget Planner with Expense Tracker and Finance Organizer

If you want a straightforward way to stay on top of your finances, the Budget Planner with Expense Tracker and Finance Organizer is an excellent choice, especially for beginners or anyone seeking an all-in-one system. It helps you monitor income, expenses, savings, and goals in one organized place. The planner features full-page monthly calendars, sections for debt tracking, bill management, and practical tips in a helpful guidebook. Its durable, water-resistant cover and sleek design make it easy to carry and use daily. With user-friendly layouts and bonus stickers, this planner makes managing your finances engaging and accessible, setting you up for financial success in 2025.

Best For: Beginners and anyone seeking an all-in-one, visually appealing, and easy-to-use budget planner to manage finances effectively in 2025.

Pros:

- User-friendly layout simplifies tracking income, expenses, and savings

- Durable, water-resistant cover ensures longevity and portability

- Includes bonus stickers and a comprehensive guidebook for engaging and effective budgeting

Cons:

- Limited space on monthly pages may be challenging for users with complex finances

- Undated format requires manual date entry each month, which may be less convenient

- Slightly heavier weight (11 ounces) might be less ideal for those seeking ultra-light planners

The Financial Peace Planner Book

Looking for a straightforward, faith-based guide to get your finances under control? The Financial Peace Planner by Dave Ramsey offers practical, no-nonsense steps to review and improve your money management. It includes useful forms for budgets, cash flow, and expense tracking, making it easy to put his advice into action. Ramsey emphasizes disciplined habits like tracking spending, using cash, and canceling credit cards to reduce debt and gain control. Suitable for anyone, whether you’re overwhelmed or just starting out, this book inspires confidence and hope. Many readers report paying off debt, saving more, and feeling more empowered after applying his proven strategies.

Best For: individuals seeking a practical, faith-based approach to gaining control over their personal finances, especially those who need straightforward tools and motivation to reduce debt and build savings.

Pros:

- Provides clear, easy-to-follow steps and practical forms for budgets and expense tracking

- Emphasizes disciplined habits like cash management and debt reduction, fostering financial responsibility

- Motivational tone that helps readers feel hopeful and confident about improving their financial situation

Cons:

- Some content may feel dated or overly religious for certain readers

- Basic concepts might not be sufficient for those with advanced financial knowledge or complex situations

- Cultural relevance can vary outside the U.S., requiring adaptation for different contexts

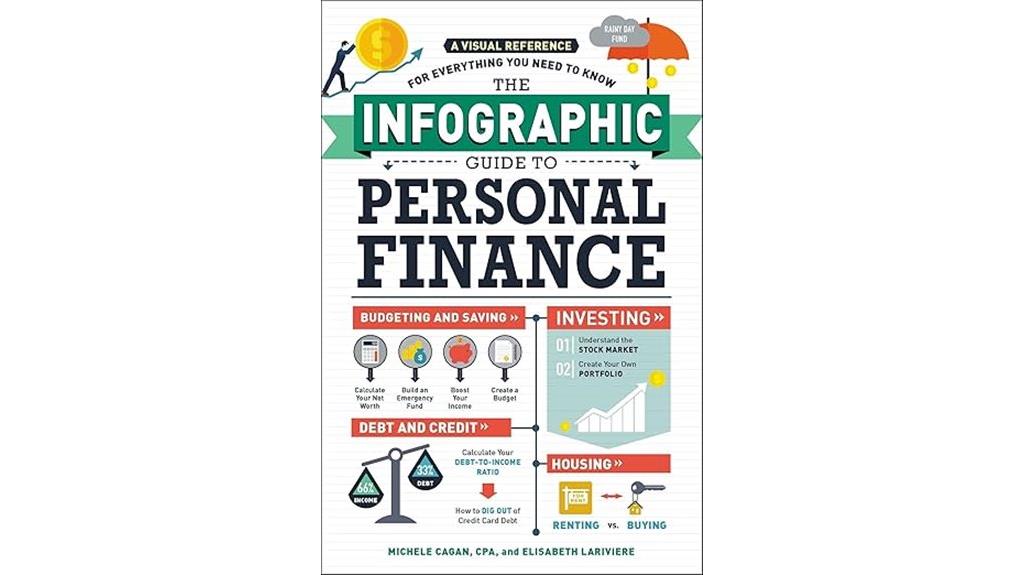

The Infographic Guide to Personal Finance

Are you new to personal finance and need a clear, straightforward starting point? The Infographic Guide to Personal Finance is an excellent choice. It’s praised for being thorough, easy to understand, and perfect for beginners or those with short attention spans. At just 122 pages, it offers practical advice on budgeting, home buying, and managing money, supported by colorful infographics and illustrations that simplify complex topics. While it’s mostly USA-focused and may lack depth for advanced learners, it’s a fantastic resource for teenagers, immigrants, and anyone wanting a solid financial foundation. It’s a quick, accessible way to start your financial literacy journey.

Best For: beginners, teenagers, and those seeking a quick, accessible introduction to personal finance within the US context.

Pros:

- Highly thorough, easy to understand, and beginner-friendly with practical illustrations

- Short, 122-page guide that covers essential topics like budgeting and home buying

- Visually engaging infographics and colorful design aid comprehension and retention

Cons:

- Primarily US-centric, limiting relevance for international audiences

- Lacks depth and advanced insights for experienced or more knowledgeable readers

- Infographic approach may not be as effective for data-driven or emotionally impactful learning

The F.I.R.E. Planner: Financial Workbook

The F.I.R.E. is a practical, interactive workbook by Michael Quan that guides you toward financial independence and early retirement. Its engaging worksheets, prompts, and real-life examples make complex concepts easy to understand, whether you’re a beginner or experienced saver. The book’s durable binding and user-friendly layout make it a favorite for planning and a thoughtful gift. It emphasizes mindset alongside tactics, encouraging you to reflect on your beliefs about money and align your goals with personal values like family and hobbies. With straightforward strategies for debt, investing, and savings, the F.I.R.E. Planner empowers you to take active, confident steps on your financial journey.

Best For: individuals seeking a comprehensive, interactive guide to achieve financial independence and early retirement through practical exercises and mindset shifts.

Pros:

- Engaging worksheets and prompts facilitate active learning and goal setting

- Durable binding with lay-flat pages enhances usability for planning sessions

- Suitable for all experience levels, from beginners to seasoned savers

Cons:

- Some users report physical issues like damaged spines, suggesting packaging improvements

- May require dedicated time commitment to complete the exercises effectively

- Focus on mindset and values might be less appealing to those seeking only tactical financial advice

The Total Money Makeover Book

If you’re feeling overwhelmed by debt and searching for a straightforward plan to regain control of your finances, *The Total Money Makeover* by Dave Ramsey might be your best starting point. This book offers practical, no-nonsense strategies to eliminate debt and build a solid financial foundation. Ramsey shares real-life success stories and clear steps, focusing on debt reduction, avoiding scams, and changing your mindset about money. It’s especially helpful if you’re living paycheck to paycheck or drowning in student loans. The book is easy to understand and re-visit, making it a valuable resource to kickstart your journey toward financial peace and discipline.

Best For: individuals overwhelmed by debt seeking straightforward, practical strategies to regain financial control and build a solid foundation.

Pros:

- Clear, easy-to-understand guidance suitable for beginners.

- Focuses on practical steps to eliminate debt and develop financial discipline.

- Includes real-life success stories for motivation and encouragement.

Cons:

- Limited detailed investment advice for long-term wealth building.

- Some content is US-centric, which may not fully apply to international readers.

- Requires full commitment and consistency to see significant results.

Clever Fox Budget Planner & Monthly Bill Organizer

Looking for a budgeting tool that combines style, flexibility, and all-encompassing features? The Clever Fox Budget Planner & Monthly Bill Organizer might be just what you need. Its large, durable faux leather cover and thick paper give it a premium feel, while the undated format offers flexibility to start anytime. With 12 monthly sections, bill pockets, expense trackers, and goal-setting pages, it helps you stay organized and motivated. Users praise its quality, comprehensive layout, and stylish design. Whether you want to manage expenses, reduce debt, or save for goals, this planner offers the tools to keep you on track and build better financial habits.

Best For: individuals seeking a stylish, flexible, and comprehensive budgeting planner to organize finances, track expenses, and achieve savings goals.

Pros:

- Durable faux leather cover and thick 120gsm paper for a premium feel and longevity

- Undated format allows flexibility to start anytime and tailor to personal schedule

- Includes multiple features such as bill pockets, stickers, goal-setting pages, and expense trackers for complete financial management

Cons:

- Large spiral binding may be awkward to handle or carry around comfortably

- Some sections like savings and debt pages could be integrated into monthly pages for efficiency

- Lack of appointment or calendar tracking features might require additional planning tools

Peace of Mind Planner for Personal and Business Information

For individuals seeking a straightforward way to organize their personal and business information, the Peace of Mind Planner stands out as an essential tool. It consolidates crucial details like medical history, last wishes, account info, passwords, and document locations in one accessible place. Designed to be simple yet thorough, it helps loved ones manage affairs smoothly during emergencies or after passing. Especially valuable for those living alone or abroad, it encourages open communication and reduces family stress. While not a legal will, it complements estate planning by organizing additional information, offering peace of mind and reassurance for everyone involved.

Best For: individuals who want a simple, comprehensive way to organize personal and business information to ease family communication and manage emergencies effectively.

Pros:

- Helps organize vital information like medical history, last wishes, and account details in one accessible location.

- Enhances peace of mind by reducing stress for loved ones during emergencies or after passing.

- User-friendly design that is easy to update and understand, suitable for all household types.

Cons:

- Not a legal document or substitute for a formal will or estate plan.

- Some editions lack features such as pockets or plastic sleeves for storing important documents.

- Primarily designed for American users, may not fully cater to UK or other regional legal and cultural requirements.

Factors to Consider When Choosing a Financial Planning Workbook

When selecting a financial planning workbook, I consider how well it aligns with my personal goals and how easy it is to use daily. I also look at the depth of content to verify it covers what I need without overwhelming me, and I compare costs to find the best value. These factors help me choose a tool that keeps me organized and motivated on my financial journey.

Personal Relevance and Goals

Choosing the right financial planning workbook hinges on how well it aligns with your personal goals and current financial situation. Start by identifying your priorities, whether it’s paying off debt, saving for retirement, or managing daily expenses. Make certain the workbook’s focus areas, like investment planning or expense tracking, match where you are in your financial journey. Consider your comfort level with financial concepts—select a workbook that fits your knowledge so you can use it effectively. Also, look at its features, such as worksheets or reflection sections, to see if they support your preferred style of active learning and self-assessment. Finally, ensure the scope and depth match your long-term plans, whether you need a straightforward guide or a thorough resource tailored to your circumstances.

Ease of Use

Ever wondered what makes a financial planning workbook truly easy to use? It all starts with a clear, intuitive layout that guides you step-by-step through budgeting, goal setting, and tracking. Well-designed workbooks feature straightforward instructions, minimal jargon, and visual cues like charts or prompts, making complex concepts easier to grasp quickly. Accessibility also matters—large fonts, simplified language, and organized sections help users of all ages and skill levels navigate comfortably. Flexibility is another key factor; undated pages or modular sections let you customize the workbook to your unique financial situation and schedule. Additionally, practical tools like checklists, templates, and quick-reference guides reduce the effort needed to apply financial ideas, making your planning experience smoother and more efficient.

Content Depth and Detail

How do you determine if a financial planning workbook provides the right level of detail for your needs? First, consider if it covers all relevant topics like budgeting, investing, debt, and retirement clearly and thoroughly. Think about your experience level—do you need simple, beginner-friendly explanations or more advanced insights? Check if the workbook offers practical tools such as worksheets, checklists, and step-by-step exercises that encourage active participation. Look for enough examples, scenarios, or case studies that deepen understanding without overwhelming you. Lastly, verify the content matches your preferred learning style—whether that’s visual aids, interactive prompts, or detailed narratives—so you stay engaged and can effectively apply what you learn.

Design and Layout

A well-designed financial planning workbook features a clear and organized layout that logically guides you through each step of evaluating your finances and setting goals. I look for dedicated sections on income, expenses, debts, savings, and investments, which help me track everything thoroughly. User-friendly formatting, like prompts, checklists, and space for notes, makes the process engaging and easy to follow. Visual elements such as charts, tables, or infographics are helpful for understanding complex concepts at a glance. I also pay attention to the physical layout—page size, spacing, and binding—to guarantee it’s comfortable to write in, accessible, and durable for ongoing use. A thoughtfully designed workbook makes the entire financial planning journey smoother and more effective.

Cost and Value

When choosing a financial planning workbook, it’s vital to weigh the cost against the value it offers. I look at whether the price matches the content, features, and my budget to make certain I get good value. I assess the depth and practicality of tools like worksheets and trackers, making sure they’re worth the expense. Comparing prices with similar resources helps me determine if it’s competitively priced and justified. I also consider the quality—durable binding and a clear layout can make a difference in long-term usability. Ultimately, I reflect on how much the workbook can improve my financial understanding and management. If it helps me stay organized and make smarter decisions, I see it as a worthwhile investment in my financial health.

Flexibility and Adaptability

Flexibility and adaptability are essential qualities to contemplate when selecting a financial planning workbook because personal circumstances and goals can change over time. A good workbook should have undated pages, allowing you to start anytime and use it long-term without restrictions. Customizable sections enable you to tailor content to your specific goals, whether saving for a house, paying off debt, or investing. The ability to add, remove, or rearrange pages makes it easier to adapt as your financial situation evolves. Compatibility with digital and print formats ensures you can access and update your plan anytime, anywhere. Additionally, versatile templates and prompts for budgeting, debt, or investments let you reshape your plan as your needs shift, keeping your financial goals within reach.

Supporting Resources

Have you considered how supporting resources can boost the effectiveness of your financial planning workbook? These tools, like worksheets, checklists, and guides, make managing your finances more practical and organized. Access to supplementary items such as budgeting stickers, online tracking options, or instructional videos can boost engagement and help you understand complex concepts better. Compatibility with digital platforms lets you update and monitor your plan easily, making sure it stays relevant. Additional materials like educational articles or expert advice deepen your understanding and provide valuable context. Finally, quality features such as durable binding and clear instructions ensure your workbook remains a reliable, long-term resource. Incorporating these supporting resources can make your financial planning experience more efficient, enjoyable, and successful.

Frequently Asked Questions

How Do I Choose the Best Workbook for My Financial Goals?

When choosing a workbook, I start by identifying my specific financial goals—whether saving for a house, paying off debt, or planning for retirement. Then, I look for workbooks that focus on those areas, offering practical exercises and clear steps. I also consider reviews and whether the style matches my learning preferences. This helps me pick a tool that keeps me motivated and on track to reach my goals.

Can Workbooks Help With Debt Reduction Strategies?

Imagine flipping through a workbook, each page like a stepping stone over turbulent waters. Yes, workbooks can really help with debt reduction strategies. They guide you through tracking expenses, setting realistic repayment plans, and staying motivated. I’ve found that having a structured plan makes tackling debt less overwhelming. With the right workbook, you’ll feel more in control and motivated to reach your financial goals.

Are Digital or Physical Workbooks More Effective?

I believe both digital and physical workbooks can be effective, but it really depends on your learning style. I find digital workbooks convenient because I can access them anywhere and easily update my progress. However, physical workbooks offer a tactile experience that helps me stay engaged. Ultimately, choose the one that feels most natural and motivating for you, so you stay committed to your financial goals.

How Often Should I Update My Financial Planning Workbook?

You might think updating your workbook every few months is enough, but honestly, I update mine every week! Life changes fast, and your finances can change even faster. Staying on top of updates helps me catch missing goals or overspending before it spirals, and I bet it’ll do the same for you. So, don’t wait—make it a weekly habit, and watch your financial goals become reality!

Do Workbooks Include Personalized Financial Advice?

Workbooks generally don’t include personalized financial advice because they’re designed for general use. I like to think of them as tools that help you organize your own financial details and goals. While they provide guidance and prompts, I recommend consulting a financial advisor for tailored advice. Using a workbook alongside professional guidance guarantees you’re making the best decisions for your unique situation.

Conclusion

No matter which workbook you choose, taking action is key. These tools can be your roadmap, but only if you’re willing to put in the effort. Remember, the early bird catches the worm, so start now and stay consistent. With a little dedication, you’ll turn your financial dreams into reality. Don’t let the grass grow under your feet—your future self will thank you for taking those first steps today.