If you’re looking to turn your financial dreams into reality, I recommend exploring top planners like the Full Focus series, Clever Fox, and FranklinCovey, which offer structured layouts for goal setting, expense tracking, and reflection. Whether you prefer undated, flexible options or detailed daily planning, these tools are designed to keep you motivated and organized. Keep going, and you’ll discover tips to choose the perfect planner to match your style and needs.

Key Takeaways

- Look for planners with comprehensive expense tracking, budgeting tools, and visual progress indicators to stay motivated and organized.

- Choose undated planners for flexibility to start anytime and adapt to changing financial goals.

- Prioritize planners with goal templates, reflection prompts, and milestone celebrations to maintain focus and celebrate progress.

- Select options with high-quality, bleed-resistant paper and engaging features like stickers for a personalized experience.

- Consider planners tailored for high achievers or beginners, matching complexity and features to your financial management needs.

Full Focus Gray Linen Planner by Michael Hyatt

If you’re serious about achieving your financial goals and need a structured way to stay focused, the Full Focus Gray Linen Planner by Michael Hyatt is an excellent choice. I’ve found it incredibly effective for organizing daily tasks, setting clear priorities, and tracking progress. With dedicated sections for scheduling, high-impact activities, and reflection, it keeps me aligned with my long-term goals without feeling overwhelming. Its durable linen cover and layout that lays flat make it easy to use daily. Many users, including myself, appreciate its focus on intentional planning, making it a powerful tool to stay motivated and on track toward financial success.

Best For: high achievers and goal-oriented individuals seeking an organized, intentional planner to manage daily tasks, reflect on progress, and stay focused on long-term ambitions.

Pros:

- Durable linen cover and lay-flat design enhance ease of use and longevity

- Comprehensive sections for daily scheduling, high-impact tasks, and reflection support goal alignment

- Strong user reviews highlight its effectiveness in increasing focus and reducing overwhelm

Cons:

- Premium price point may be a concern for budget-conscious users

- Designed for those committed to daily reflection; less suitable for casual planners

- Some users find the weekly planning sections could be more flexible or customizable

Full Focus Black Vegan Leather Planner by Michael Hyatt

The Full Focus Black Vegan Leather Planner by Michael Hyatt is an ideal choice for high achievers who want to turn their big goals into actionable daily steps. I love how it connects long-term ambitions with daily routines, reducing overwhelm and boosting focus. The goal templates, weekly planning tools, and quarterly review sections help me stay on track and motivated. Its sleek vegan leather cover adds a professional touch, and the structured layout ensures I prioritize what truly matters. With its research-backed system, I find it easier to maintain momentum and make consistent progress toward my financial and personal goals. This planner truly keeps me purpose-driven every day.

Best For: high achievers and goal-oriented individuals seeking to turn big ambitions into actionable daily steps while maintaining focus and momentum.

Pros:

- Connects long-term goals with daily routines, reducing overwhelm

- Includes comprehensive planning tools like goal templates, weekly and quarterly reviews

- Sleek vegan leather cover adds a professional and durable touch

Cons:

- May be too structured for those who prefer more flexibility in planning

- Price point might be higher compared to basic planners

- Limited color options, available only in black vegan leather

Full Focus Leather Coil Planner by Michael Hyatt

Are you a high achiever looking for a structured way to turn your financial goals into reality? The Full Focus Leather Coil Planner by Michael Hyatt is designed to help you stay focused, prioritize effectively, and track your progress daily. With its durable leather cover and quarterly setup, it encourages intentional living, breaking down big ambitions into manageable steps. Features like weekly reviews, habit trackers, and reflection prompts keep you aligned with your goals and eliminate overwhelm. Many users find it boosts productivity and clarity, helping them make steady advances toward their money dreams. If you’re committed to strategic planning, this planner offers the tools to turn ambitions into achievements.

Best For: high achievers and goal-oriented individuals seeking a structured, strategic daily planner to turn their ambitions into actionable steps and track progress effectively.

Pros:

- Encourages intentional living with quarterly setup and reflection prompts

- Includes habit trackers and review templates to maintain focus and accountability

- Crafted with durable leather for a professional and high-quality feel

Cons:

- Higher price point may be a barrier for some users

- Limited customization options and a learning curve for new users

- Spiral binding version may be less user-friendly compared to traditional binding

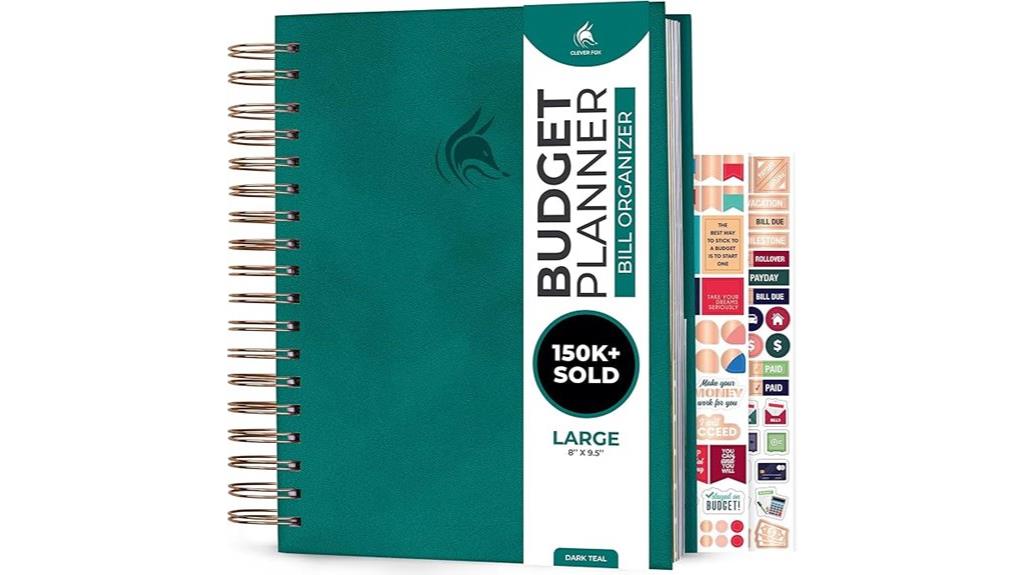

Clever Fox Budget Planner & Organizer (Dark Teal)

Looking for a budgeting planner that combines style with extensive organization tools? The Clever Fox Budget Planner & Organizer in dark teal is a fantastic choice. Its large 8×9.5-inch faux leather cover feels durable and stylish, with spiral binding for easy use. Inside, you’ll find 12 monthly sections with blank calendars, goal-setting areas, expense categories, and pockets for receipts and notes. The planner includes budgeting stickers, motivational pages, and detailed expense trackers. It’s perfect for managing household finances, tracking savings, and monitoring debts. Highly rated for quality and usability, it’s a comprehensive tool that helps you stay organized and motivated on your financial journey.

Best For: individuals seeking a stylish, comprehensive, and durable budgeting planner to organize personal and household finances with flexibility and motivation.

Pros:

- High-quality faux leather cover and sturdy spiral binding for durability and elegance

- Ample space with detailed expense trackers, goal-setting areas, and pockets for receipts and notes

- Includes fun budgeting stickers and motivational pages to enhance engagement and customization

Cons:

- Large size and spiral binding may feel awkward or cumbersome for some users

- Some users report missing or pre-filled pages, impacting the overall experience

- The stickers can be difficult to peel due to their size and may require patience

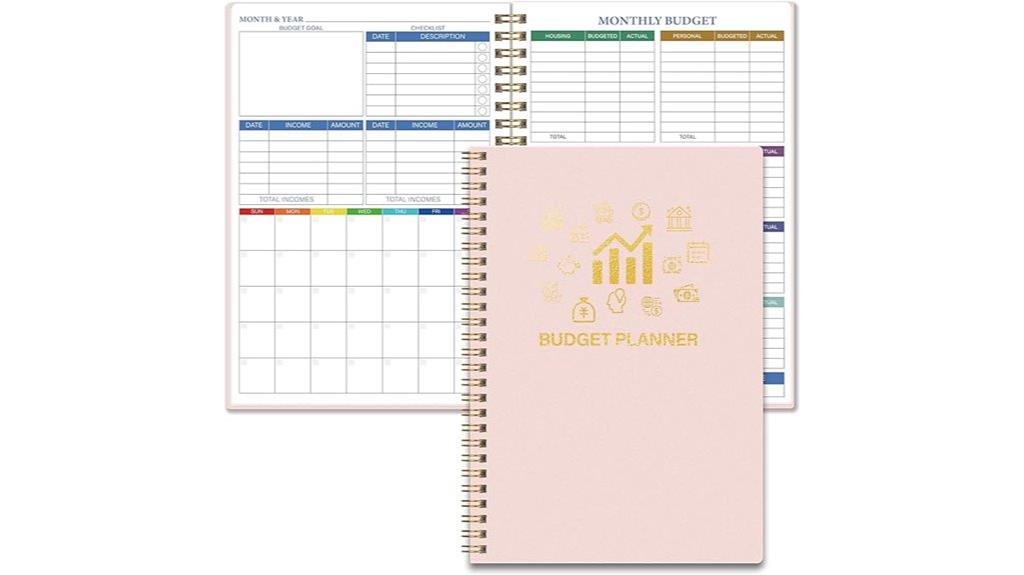

Budget Planner, Monthly Expense Tracker & Finance Organizer (Pink)

If you want a budget planner that simplifies managing your finances, the Budget Planner 2025-2026 is an excellent choice, especially if you’re new to budgeting or prefer a structured yet flexible system. This undated planner combines expense tracking, bill organization, savings goals, and debt monitoring into one user-friendly tool. It features dedicated monthly pages for setting goals, tracking income, and planning expenses, along with full-page calendars for important dates. Its durable, water-resistant cover and compact size make it perfect for daily use. Plus, with helpful guidance and fun stickers, it motivates you to stay disciplined and achieve your financial dreams.

Best For: individuals new to budgeting or those seeking a structured yet flexible way to manage their finances easily and effectively.

Pros:

- Combines multiple financial management features in one planner, including expense tracking, bill organization, and savings goals.

- Durable, water-resistant cover and compact size make it ideal for daily use and portability.

- Comes with helpful guidance and fun stickers to motivate disciplined budgeting and financial goal achievement.

Cons:

- As an undated planner, it requires users to manually record dates, which may be time-consuming for some.

- Limited color options available, primarily focusing on a pink design.

- May not have advanced features for experienced budgeters seeking detailed financial analytics or digital integrations.

Monthly Budget Planner – 14 Months Undated Financial Organizer

The Monthly Budget Planner’s undated, 14-month format makes it an ideal choice for anyone who prefers flexible, long-term financial planning without the pressure of fixed dates. Its spacious full-page monthly calendars let you mark paydays, bills, and important events at your own pace. The planner includes fun stickers to personalize your experience, making budgeting more engaging. Compact and portable, it easily fits in bags for on-the-go use. With dedicated sections for setting goals, tracking savings, managing debts, and recording expenses, it adapts to changing financial situations. Its undated design offers unmatched flexibility, helping you stay organized and motivated over an extended period.

Best For: individuals seeking a flexible, long-term financial organizer that easily adapts to their unique budgeting needs and on-the-go lifestyles.

Pros:

- Undated format allows start planning anytime without being restricted to specific dates.

- Spacious full-page calendars and dedicated sections promote comprehensive financial management.

- Portable size and included stickers make budgeting engaging and convenient for on-the-go use.

Cons:

- Thin paper quality may cause bleed-through with markers or wet pens.

- Some users suggest adding more space for weekend days to accommodate longer months.

- The 14-month span may be more than needed for users with shorter-term financial planning needs.

Monthly Bill Payment Checklist & Financial Planner Notebook

A key feature of the Monthly Bill Payment Checklist & Financial Planner Notebook is its all-encompassing design, making it ideal for anyone committed to maintaining detailed financial records over several years. I love how it tracks 960 bills, payments, due dates, and balances, helping me stay organized and avoid late fees. Its sections for income, expenses, debt payoff, and savings goals keep my finances transparent. The large format and high-quality pages make writing easy, and the long-term records motivate me by celebrating milestones. With versatile pages for notes and ideas, it’s a exhaustive tool that keeps my financial journey clear and manageable.

Best For: individuals seeking a comprehensive, long-term financial organization tool to track bills, income, expenses, debts, and savings over multiple years.

Pros:

- Extensive record-keeping with 960 bill entries and detailed tracking sections

- Large, high-quality pages that facilitate easy writing and organization

- Celebrates financial milestones, motivating users over a four-year period

Cons:

- Can be somewhat complicated to use for those new to financial planning

- The large format may be less portable for on-the-go use

- Slightly higher price point compared to basic budget planners

The 100-Day Financial Goal Journal: Build a Plan for Your Financial Future

Looking to take control of your finances and see measurable progress in just 100 days? The 100-Day Financial Goal Journal is designed to help you do exactly that. It guides you through setting achievable targets—whether building an emergency fund, saving for a big purchase, or reducing debt—tailored to your lifestyle. With daily expense tracking, reflection prompts, and progress charts, it keeps you focused and accountable. The attractive, user-friendly design makes it easy to stay motivated. This journal not only encourages mindful spending but also helps develop healthy financial habits, making your path to financial security clearer and more attainable.

Best For: individuals seeking a straightforward, motivating tool to improve their financial habits and achieve measurable progress within 100 days.

Pros:

- Encourages mindful spending and accountability through daily tracking and reflection prompts

- User-friendly design with attractive graphics, charts, and lay-flat binding for ease of use

- Helps develop healthy financial habits and boosts confidence in managing money

Cons:

- Minor issues with damage or dirt upon receipt may occur, requiring careful handling

- May be too simplified for advanced financial planning or complex debt management needs

- Limited space for detailed financial analysis or long-term planning beyond 100 days

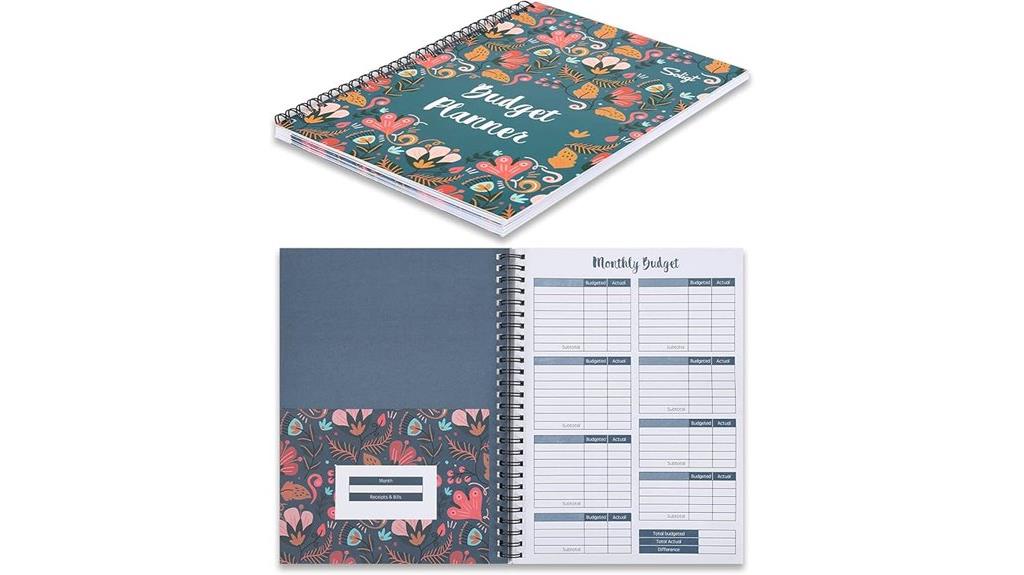

Soligt Budget Planner 2025, Monthly Budget Book

Are you seeking a flexible and customizable budgeting tool that adapts to your unique financial situation? The Soligt Budget Planner 2025 is just that. It’s undated, spiral-bound, and offers 12 colorful pockets for bills, receipts, and envelopes. With blank pages and no pre-set categories, you can tailor it to fit your needs, whether for personal or small business use. It includes sections for income, expenses, savings, debt, and a bills calendar. Plus, stickers and tabs make organization easy. Its bright design and practical layout help me stay on top of my finances, celebrate progress, and keep motivated throughout the year.

Best For: individuals and small business owners seeking a highly customizable, user-friendly budgeting planner that helps organize finances with flexibility and visual appeal.

Pros:

- Undated design allows for year-round flexibility and personalization.

- Bright, colorful layout and stickers increase motivation and organization.

- Multiple storage pockets and tabbed sections make managing bills, receipts, and documents easy.

Cons:

- Smaller spaces for bills and subscriptions may feel crowded for some users.

- Preference for calendar layouts starting on Sundays rather than Mondays may influence usability.

- Limited space for detailed charts and larger writing areas could restrict in-depth tracking.

Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook

If you’re seeking a flexible and all-encompassing tool to manage your finances throughout the year, the Budget Planner with Expense Tracker Notebook is an excellent choice. This undated planner supports 12 months of detailed financial tracking, with dedicated pages for goals, strategies, savings, and debt management. Its color-coded monthly sections and end-of-month reviews help you stay organized and adjust your plans. Made with high-quality paper and durable materials, it’s built for ease of use and longevity. The inner pocket and customizable pages make it practical, whether you’re budgeting for holidays or tracking daily expenses. It’s a comprehensive, stylish way to take control of your money.

Best For: individuals seeking a versatile, comprehensive, and customizable financial planning tool to manage their monthly budgets, savings, and debts throughout the year.

Pros:

- Undated format offers flexibility to start anytime and plan for 12 months.

- High-quality 100gsm paper reduces ink bleed and provides smooth writing and erasing.

- Features multiple dedicated sections for goals, strategies, savings, debts, and end-of-month reviews for thorough financial management.

Cons:

- The planner’s size (5.82×8.25 inches) may be less suitable for those who prefer larger or more compact organizers.

- Limited color options (teal and rose) might not appeal to all aesthetic preferences.

- Requires manual input and regular maintenance, which may be time-consuming for some users.

PLANBERRY Budget Planner—Undated Monthly Finance Organizer, Expense & Bill Tracker, 6.1×8.1″ Softcover

The PLANBERRY Budget Planner is an excellent choice for anyone who values flexibility and simplicity in managing their finances. Its undated format lets you start anytime, avoiding wasted pages and fitting seamlessly into your routine. The compact 6.1×8.1 inch size makes it portable, perfect for carrying in a handbag. It features expense and bill trackers, budgeting sections, and fun stickers for customization, helping you stay organized without feeling overwhelmed. Customers love its all-encompassing approach and portability, making it ideal for disciplined spenders. Despite the softcover design, many find it durable and effective in keeping their financial goals on track.

Best For: individuals who seek a flexible, portable, and straightforward way to organize their personal finances and stay disciplined with budgeting.

Pros:

- Undated format allows for flexible starting points and no wasted pages

- Compact size (6.1×8.1 inches) makes it highly portable and easy to carry in a handbag

- Includes expense and bill trackers along with customizable stickers for personalization

Cons:

- Softcover design may be less durable than hardcover options

- Smaller size might be less comfortable for users who prefer larger writing space

- Lacks features like pockets found in some hardcover versions for storing additional documents

Bloom Daily Planners Academic Year Goal & Vision Planner (2025-2026)

The Bloom Daily Planners Academic Year Goal & Vision Planner (2025-2026) is ideal for students, professionals, or anyone who values detailed organization and goal setting. It covers July 2025 through July 2026, with sturdy construction, colorful design, and motivational quotes. The planner features monthly and weekly layouts with dedicated sections for focus areas, habit and water tracking, and reflections. It encourages personal growth with goal pages, vision boards, and self-care prompts. Extras like stickers, a magnetic bookmark, and notes pages enhance usability. Its high-quality paper supports smooth writing, making it a versatile tool for managing finances, goals, and life plans throughout the academic year.

Best For: students, professionals, or anyone seeking a detailed, motivational planner to organize goals, life, and work throughout the academic year.

Pros:

- Durable hardcover with metal corners and high-quality construction ensures longevity.

- Includes helpful features like goal pages, vision boards, habit and water trackers, and motivational quotes to promote personal growth.

- Extras such as stickers, a magnetic bookmark, and notes pages enhance usability and customization.

Cons:

- Starts in July 2025, which may be inconvenient for those planning from the beginning of the calendar year.

- Slightly heavier weight at 1.28 pounds might be less portable for some users.

- The size (7.5” W x 9” H) may be too large for minimalistic or pocket-sized preferences.

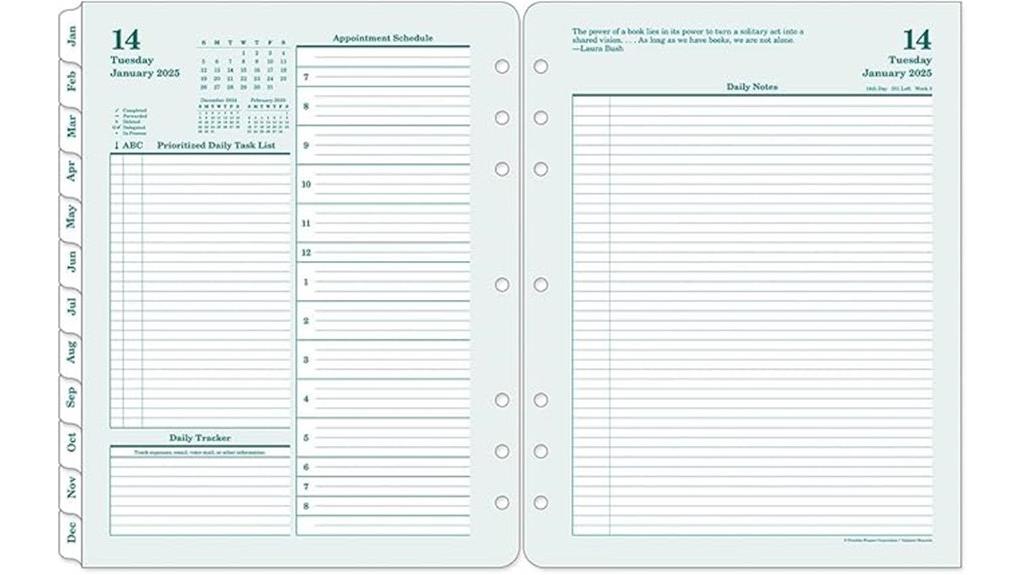

FranklinCovey Two Page Per Day Ring-Bound Planner

Designed for those who need ample space to plan every detail of their day, the FranklinCovey Two Page Per Day Ring-Bound Planner offers an extensive layout that supports thorough scheduling and organization. Sized at 8.5 x 11 inches, it provides two pages per day with prioritized task lists, appointment slots, and notes. Its durable cover combines plastic and metal, ensuring longevity. The ring-bound design with pre-punched holes makes it easy to customize with Monarch-sized binders. With motivational quotes and exhaustive monthly calendars, this planner keeps me on track without digital tools. Many users, including myself, appreciate its durability, clarity, and ability to help organize even the busiest schedules effectively.

Best For: individuals who require extensive daily planning space, detailed organization, and prefer a durable, offline scheduling system.

Pros:

- Large 8.5 x 11-inch layout provides ample space for detailed daily planning and notes.

- Durable cover made of plastic and metal ensures long-lasting use.

- Pre-punched holes compatible with Monarch-sized binders allow easy customization and organization.

Cons:

- The size may be cumbersome for portable use or carrying around frequently.

- The two-page daily layout might be excessive for users with minimal scheduling needs.

- Price and shipping costs can vary, potentially making it less accessible for some customers.

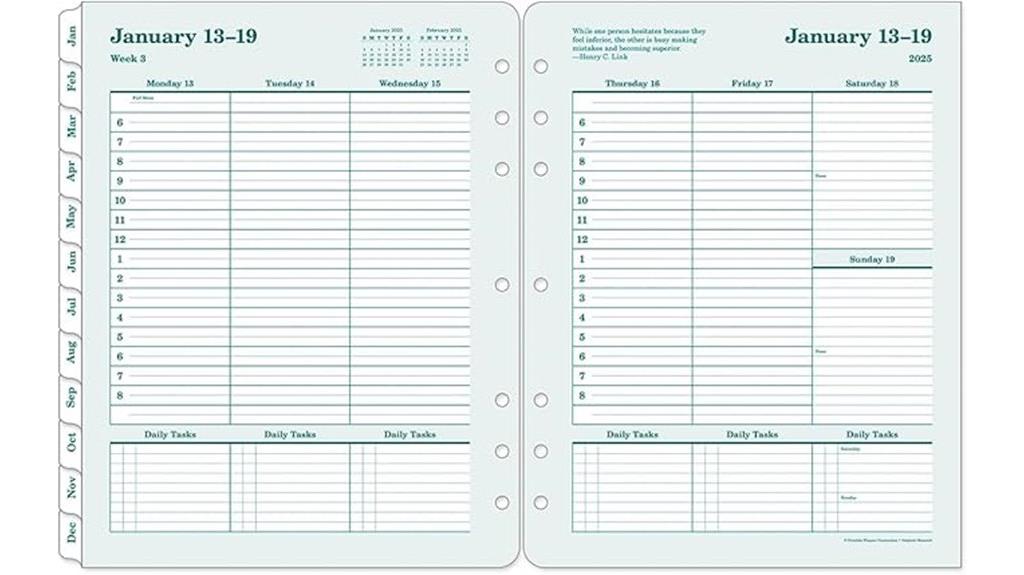

FranklinCovey Weekly Ring-Bound Planner (Monarch, 2025)

If you prefer straightforward planning with space for detailed notes, the FranklinCovey Weekly Ring-Bound Planner (Monarch, 2025) is an excellent choice. Its size—8.5 by 11 inches—provides plenty of room for organization, notes, and detailed planning. The pages feature daily motivational quotes to keep you inspired. With a year’s worth of two-page weekly spreads and monthly tabs, it helps you stay on track with both short-term and long-term goals. The ring binding allows easy customization and insertion into compatible binders, which are sold separately. Refills and binders let you tailor your system to suit your planning style perfectly.

Best For: individuals seeking a spacious, straightforward planner with motivational support and customizable options for detailed weekly and monthly organization.

Pros:

- Ample 8.5 x 11 inch size offers plenty of space for notes and detailed planning

- Daily motivational quotes help maintain focus and inspiration

- Ring binding allows easy customization and insertion into compatible binders

Cons:

- Large size may be less portable for on-the-go use

- Requires separate purchase of binders and refills for full system customization

- Less detailed than highly structured planners, which may not suit those needing extensive scheduling features

ZICOTO Monthly Budget Planner, 12-Month Financial Organizer with Expense Tracker

For anyone seeking a straightforward and portable way to manage their finances, the ZICOTO Monthly Budget Planner stands out as an excellent choice. Its compact size (5.5×8.3 inches) makes it easy to carry, while its minimalist, modern design keeps your focus on your money goals. The planner offers practical features like monthly income, savings, debt, bill tracking, daily expense logs, and reflection sections to review your progress. Undated and flexible, it lets you start anytime. Customers praise its durability, simplicity, and motivational elements, making it perfect for both beginners and seasoned budgeters who want a clear, organized way to stay on top of their finances.

Best For: individuals seeking a portable, easy-to-use, and minimalist financial organizer to help manage their monthly income, expenses, and savings effectively.

Pros:

- Compact size (5.5×8.3 inches) makes it highly portable and suitable for on-the-go use

- Undated format allows flexible start times and year-round use

- Stylish, minimalist design with motivational quotes and stickers enhances engagement

Cons:

- Slightly smaller writing space may be limiting for users with extensive notes or detailed entries

- Lacks digital or interactive features for those preferring tech-based budgeting tools

- Some users might find the lack of specific categories or customization options restrictive

Factors to Consider When Choosing a Financial Goal Planner

When selecting a financial goal planner, I focus on how clearly it helps me define my goals and whether the planning format suits my style. I also consider its track record features and how easy it is to use, so I stay motivated and on track. Ultimately, I look for flexibility and customization options to make sure it adapts to my changing needs.

Clarity of Goals

Have you ever felt overwhelmed by vague financial goals that seem impossible to achieve? That’s because unclear goals lack direction, making it hard to stay motivated or see progress. When your goals are specific, they guide your planning, helping you prioritize tasks and allocate resources effectively. Clear goals also make it easier to measure progress, so you can stay accountable and adjust strategies if needed. Without clarity, you risk confusion, procrastination, and losing focus over time. Setting explicit, achievable objectives boosts your confidence and strengthens your commitment, increasing your chances of reaching financial milestones. A good financial planner emphasizes defining clear goals from the start, ensuring your path to success is focused, manageable, and motivating.

Planning Format Type

Choosing the right planning format is essential because it directly influences how effectively you’ll track and stay committed to your financial goals. Undated formats offer flexibility, allowing you to start anytime and adapt as your plans evolve. Dated formats provide a structured timeline, helping you stay on schedule. Daily, weekly, and monthly layouts cater to different planning styles—more detailed or broader overviews. Two-page per day planners give you plenty of space for detailed tasks, while one-page layouts keep things quick and focused. Monthly and quarterly formats are ideal for long-term tracking and reflection, making it easier to review progress and adjust your strategies. Your choice impacts how seamlessly the planner fits into your routine and how motivated you’ll stay.

Track Record Features

A solid track record is a key factor to contemplate because it reflects a planner’s proven ability to help users achieve their financial goals. When a planner has consistently earned high ratings and positive reviews, it shows that many users trust its effectiveness. Established planners often showcase documented success stories and measurable results, giving me confidence in their reliability. Products with a strong history tend to feature durable construction and well-tested layouts, refined through user feedback over time. Repeated positive feedback and long-term usage further demonstrate credibility and actual results. Choosing a planner with an impressive track record ensures I’m investing in a tool that has proven its ability to support my financial journey and deliver on its promises.

Ease of Use

When selecting a financial goal planner, ease of use is essential because it determines how comfortably I can incorporate the tool into my daily routine. A clear, intuitive layout helps me record and review goals, expenses, and progress without confusion. Features like undated pages or customizable sections allow me to start anytime without hassle, making planning flexible. Simple prompts and guided questions keep me focused on actionable steps instead of overwhelming details. User-friendly elements such as large writing spaces, visual trackers, and straightforward navigation make daily use smooth and efficient. An uncomplicated design reduces the learning curve, making it accessible regardless of my financial experience. Ultimately, a planner that’s easy to use keeps me motivated and consistent in achieving my money goals.

Flexibility & Customization

Since my financial situation and goals can change unexpectedly, I need a planner that’s flexible and easy to adapt. A good financial goal planner should allow me to start anytime and modify plans without being tied to fixed dates or templates. Customization options, like adding personal categories, notes, or goals, help me tailor the planner to my unique needs. Undated layouts give me the freedom to skip months or extend planning periods, accommodating life changes. Features like customizable stickers, tabs, or sections make organizing my financial journey more engaging and motivating. The best planners support ongoing adjustments, making it simple to revise goals and strategies as my circumstances evolve. Flexibility and customization guarantee my plan remains relevant and effective over time.

Visual Motivation Tools

Incorporating visual motivation tools into your financial goal planner can considerably boost engagement and help you stay focused on your targets. Charts, progress bars, and stickers make tracking progress more rewarding and tangible. Color-coded sections or symbols allow me to quickly identify where I stand and what needs attention, keeping me motivated. Visual prompts like vision boards or goal images serve as constant reminders of my long-term aspirations, inspiring continued effort. Graphs and summaries of expenses and savings give me a clear overview, encouraging consistency and accountability. Habit trackers and milestone markers reinforce positive behaviors and help sustain motivation over time. These visual cues transform abstract goals into concrete, visual achievements, making it easier to stay committed and motivated on my financial journey.

Size & Portability

Selecting the appropriate size and portability features for your financial goal planner is crucial to guarantee it fits seamlessly into your daily routine. I recommend considering the overall dimensions to ensure it fits comfortably in your bag or workspace, especially if you plan to carry it frequently. Small planners, around 5-6 inches, are highly portable and perfect for quick access on the go. Larger options, 7-9 inches, offer more space for detailed entries but can be less convenient for daily transport. Weight also matters—aim for under a pound to avoid extra bulk. Features like spiral binding or flexible covers can improve portability by allowing the planner to lay flat or fold easily, making it easier to store and carry without hassle.

Budget & Price

How much should you expect to spend on a financial goal planner? Prices vary based on features and quality. Premium options often range from $50 to over $100, while more affordable choices can be under $20. Consider whether the price includes extras like stickers, pockets, or digital resources, which can boost value. It’s also smart to compare prices across retailers and look for discounts, bundle deals, or seasonal sales to save money. Keep in mind the long-term cost if the planner is multi-year or needs multiple volumes — it adds up. Ultimately, choose a planner that balances cost with quality, durability, and features. A higher price isn’t always better, but investing in a well-made planner that meets your needs ensures you get the most out of your financial planning journey.

Frequently Asked Questions

How Do Planners Help Improve Long-Term Financial Discipline?

When I think about how planners boost long-term financial discipline, I realize they help me stay organized and focused. They break down big goals into manageable steps, remind me of deadlines, and track my progress. By having a clear plan, I avoid impulsive decisions and stay committed. Planners keep me accountable, making it easier to develop consistent habits that lead to financial stability over time.

Can These Planners Accommodate Multiple Income Sources?

Did you know that over 60% of people have multiple income sources? These planners are designed to handle such complexities by allowing me to track various income streams and set tailored goals. They’re flexible enough to accommodate multiple jobs, side gigs, or investments, helping me stay organized and on track. With these tools, I can visualize my overall financial picture and make certain all my income sources contribute toward my dreams.

Are Digital Options More Effective Than Physical Planners?

I believe digital planners can be more effective than physical ones because they offer easy access, instant updates, and seamless integration with other tools. I can track multiple income sources effortlessly and adjust my goals on the go. Plus, digital options often come with reminders and analytics, helping me stay motivated and organized. However, some still prefer physical planners for their tangibility and reduced screen time.

How Often Should I Review and Update My Financial Goals?

I believe reviewing and updating your financial goals should happen at least quarterly. Life changes, market fluctuations, and new opportunities mean your goals need to be adaptable. I recommend setting a reminder every three months to assess your progress, adjust your strategies, and stay aligned with your long-term dreams. Regular check-ins help you stay motivated and ensure you’re on track to achieve your financial aspirations.

Do Planners Include Tips for Debt Reduction Strategies?

Absolutely, many planners include tips for debt reduction strategies. I’ve found that a good financial planner often offers practical advice on tackling debt, whether it’s prioritizing high-interest debts or creating manageable repayment plans. They help me stay focused and motivated. If debt reduction is a priority for you, look for planners that specifically address debt management or offer detailed strategies to help you cut down your debt efficiently.

Conclusion

Choosing the right financial goal planner is like planting a seed—you nurture it, and with time, it blossoms into financial freedom. Whether you prefer sleek leather or vibrant covers, the key is consistency and commitment. Remember, the best planner isn’t just about organization but about inspiring you to turn your money dreams into reality. So, pick one, start today, and watch your financial garden flourish. Your future self will thank you.