If you want to stay on top of your finances in 2025, I recommend checking out the 14 best expense tracker notebooks. These include stylish designs, durable covers, and user-friendly layouts that make tracking easy and organized. Whether you prefer undated formats, compact sizes, or many customization options, there’s a perfect planner for you. Keep going to discover detailed reviews and find the ideal notebook to suit your budgeting style.

Key Takeaways

- Durable, water-resistant covers and high-quality paper ensure longevity and reliable use throughout 2025.

- Undated, flexible layouts allow for year-round customization and start-anytime convenience.

- Compact sizes like A5 balance portability with ample space for detailed expense tracking.

- Stylish designs with additional features such as pockets, stickers, and goal pages enhance organization and engagement.

- Suitable for small business owners, entrepreneurs, and individuals seeking manual, comprehensive financial management tools.

Clever Fox Income & Expense Tracker Notebook

If you’re a small business owner looking to streamline your finances, the Clever Fox Income & Expense Tracker Notebook is an excellent choice. It helps you organize transactions, create balance summaries, and plan for financial success. With 113 pages, including weekly views and an annual summary, it makes tracking income and expenses straightforward. The undated layout lets you start anytime, and the spacious pocket keeps receipts handy. Its durable eco-leather cover, no-bleed paper, and thoughtful features like a pen loop and elastic band ensure long-lasting use. Plus, the included guide simplifies bookkeeping, giving you confidence to manage your finances efficiently all year.

Best For: small business owners seeking a durable, comprehensive, and user-friendly financial tracking solution to organize transactions and plan for financial success.

Pros:

- Undated layout allows flexibility to start anytime during the year

- Durable eco-leather hardcover and no-bleed 120gsm paper ensure longevity and ease of use

- Includes a helpful guide and ample storage with a back pocket for receipts and notes

Cons:

- Limited to one year of tracking, requiring additional tools for multi-year financial planning

- The A5 size, while portable, may be small for detailed data entry for some users

- No digital integration or electronic features, which might be preferred by some modern small business owners

Clever Fox Budget Planner, Expense Tracker Notebook

The Clever Fox Budget Planner is an ideal choice for anyone looking for an all-encompassing, reusable tool to organize their finances over a year. Its undated design makes it flexible, with sections for budgeting, expense tracking, savings, and debt management. The hardcover vegan leather cover and high-quality paper give it a premium feel, while features like bookmarks, a receipt pocket, and stickers add convenience and motivation. I appreciate how it guides you through goal setting and provides space for monthly reviews, helping you visualize cash flow and stay accountable. Whether you’re a beginner or experienced budgeter, this planner makes financial organization simple and stylish.

Best For: individuals seeking a stylish, flexible, and comprehensive budgeting planner to manage their finances over a year, whether they are beginners or experienced budgeters.

Pros:

- Undated format allows for year-round use with customizable start times

- Premium features like vegan leather cover, stickers, and high-quality paper enhance durability and aesthetics

- Includes detailed sections for goal setting, expense tracking, savings, and debt management, fostering financial discipline

Cons:

- Some sections like holiday budgets and check registers are less utilized or deemed unnecessary by users

- Lacks integrated investing or net worth tracking features for a more holistic financial overview

- Certain review pages and visual summaries could be improved for better progress visualization

Clever Fox Budget Planner, Rose Gold Finance Journal

Looking for a stylish and complete way to manage your finances? The Clever Fox Budget Planner in Rose Gold is a fantastic choice. Its large-format pages and colorful layouts make tracking expenses, bills, savings, and debts straightforward. The spiral binding allows it to lay flat, and the eco-leather hardcover adds durability and elegance. With tools like stickers, a user guide, and multiple trackers, it helps you set goals and monitor progress effortlessly. Designed for long-term use, many find it reduces stress and keeps them disciplined. If you want a beautiful, all-in-one planner to stay on top of your finances in 2025, this journal is worth considering.

Best For: individuals seeking a stylish, comprehensive, and easy-to-use physical planner to manage their personal finances, savings, and debt over the long term.

Pros:

- Large-format pages and colorful layouts make tracking and planning clear and visually appealing.

- Spiral binding allows the planner to lay flat, making writing and referencing easier.

- Includes useful tools like stickers, trackers, and a user guide for a customizable and guided budgeting experience.

Cons:

- Limited space for detailed bill tracking may require supplemental tools like spreadsheets.

- No weekly breakdown sections, which could be a drawback for those preferring weekly planning.

- Slightly higher price point compared to basic planners, but justified by features and quality.

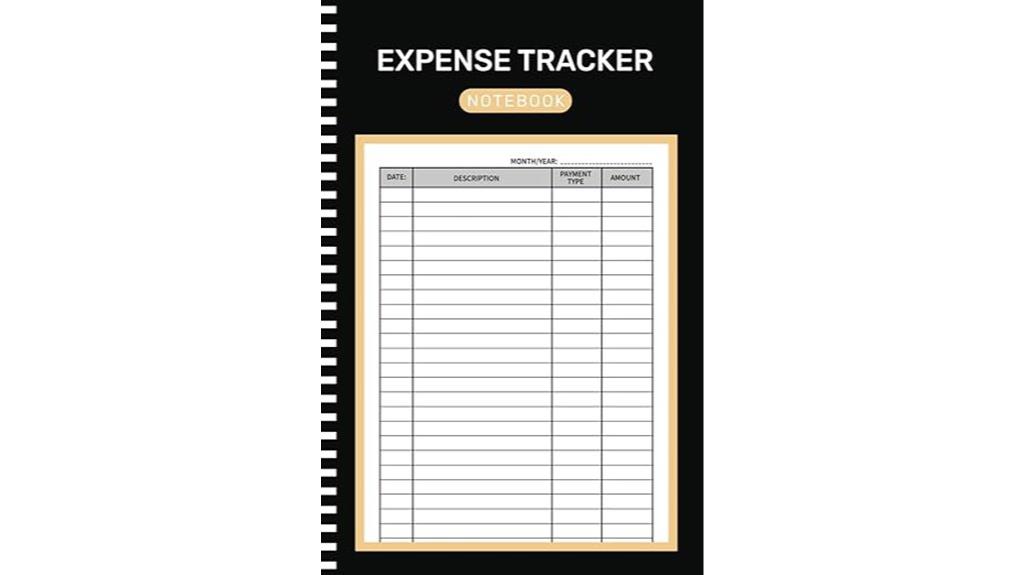

Expense Tracker Notebook for Personal and Small Business Budgeting

Designed with both individuals and small business owners in mind, the Expense Tracker Notebook offers large spaces that make it easy to record detailed financial entries, even for those with bigger handwriting. Its 105 pages, in a compact 6×9-inch size, include columns for income, expenses, and payment methods like cash, credit, or check. Users find it simple, practical, and more organized than digital apps or traditional methods. Many appreciate its straightforward layout and ample space, making tracking finances clear and manageable. Customers love its affordability and plan to buy multiple copies, praising it as a perfect tool to stay organized without relying on technology.

Best For: individuals and small business owners seeking a simple, organized, and practical way to track their finances manually without relying on digital tools.

Pros:

- Large spaces accommodate big handwriting and detailed entries.

- Clear columns for income, expenses, and payment methods enhance organization.

- Affordable price point with multiple pages suitable for ongoing financial tracking.

Cons:

- Spiral binding could improve ease of use and page turning.

- Limited to 105 pages, which may require frequent replacement for extensive tracking.

- No digital features, which might be a drawback for those preferring electronic records.

Easy to Use Accounting Ledger Book

If you want a straightforward way to keep your finances organized, an easy-to-use accounting ledger book like this one is perfect. It offers plenty of space to record checks, income, expenses, bills, and savings, making it simple to track your financial flow. The undated format gives you the flexibility to use it as needed, whether for debit and credit entries or trial balances. Its modern, minimalistic design features a stylish sage green cover with a golden floral pattern, adding a touch of elegance. Built with durable materials, it’s compact and lightweight, ideal for daily use at home or on the go.

Best For: small business owners and individuals seeking an elegant, durable, and easy-to-use tool to organize their financial records efficiently.

Pros:

- Ample space for recording checks, income, expenses, bills, and savings, ensuring comprehensive financial tracking.

- Stylish modern design with a sage green cover and golden floral accents that adds aesthetic appeal.

- Durable construction with thick paper and ring binding, suitable for frequent handling and long-term use.

Cons:

- Undated format requires manual date entry, which may be time-consuming for some users.

- Compact size might limit the amount of information that can be recorded on each page.

- Limited to 120 pages, which may necessitate additional record-keeping over extended periods.

Budget Planner Notebook with Expense Tracker and Finance Organizer

The Budget Planner Notebook with Expense Tracker and Finance Organizer is perfect for anyone seeking a thorough yet portable tool to manage their finances effectively. I love how it combines detailed sections for income, expenses, savings, and goals, making it easy to stay organized. Its intuitive layout features full-page monthly calendars, so I can mark paydays, bills, and important dates at a glance. The durable, water-resistant cover and elastic band keep everything secure, while the bonus stickers add a personal touch. Compact enough to carry around, this planner helps me track spending, set goals, and stay motivated without feeling overwhelmed. It’s a smart investment for financial peace of mind.

Best For: individuals seeking a comprehensive, portable, and durable tool to effectively manage and organize their personal finances and budgeting goals.

Pros:

- User-friendly layout with full-page monthly calendars for easy tracking of paydays, bills, and appointments

- Durable, water-resistant cover and secure elastic band enhance longevity and portability

- Includes helpful features like expense and debt trackers, stickers, and a detailed guidebook for improved financial management

Cons:

- Undated format may require manual date entry each month, which could be time-consuming for some users

- Limited space for extensive notes or additional financial details beyond core categories

- Price point may be higher compared to basic budget notebooks, though justified by quality and features

Easy to Use Accounting Ledger Books Set of 2

For small business owners and individuals managing personal finances, the Easy to Use Accounting Ledger Books Set of 2 offers a straightforward and dependable way to keep track of transactions. Its modern, minimalistic design features sage green and beige covers with golden floral accents, making it both functional and aesthetically pleasing. The sturdy covers, thick paper, and reliable ring binding ensure durability for long-term use. Compact at 8.6×6.1 inches, it’s portable enough to carry anywhere. With ample space for detailed entries—including income, expenses, and notes—this set simplifies bookkeeping and helps monitor financial health effortlessly.

Best For: small business owners, entrepreneurs, and individuals seeking an easy, durable, and stylish way to manage personal or business finances.

Pros:

- Elegant, modern design with sage green and beige covers accented by golden floral details.

- Durable construction with sturdy covers, thick paper, and reliable ring binding for long-term use.

- Compact size makes it portable and easy to carry for on-the-go bookkeeping.

Cons:

- Limited to 50 pages per ledger, which may require frequent replacements for extensive record-keeping.

- Minimalist layout might lack advanced features found in digital accounting tools.

- Set includes only two ledgers, so additional books may be needed for larger or more complex finances.

Bill Tracker Notebook with Spiral Binding, 8.5 x 11, 132+ Pages

This Bill Tracker Notebook with spiral binding and 8.5 x 11-inch size is perfect for anyone who wants a straightforward, easy-to-use tool to stay on top of their bills. It features over 132 pages, including dedicated sections for monthly bill tracking, contacts, and receipts. The spiral binding allows easy access to each line without squeezing, making updates quick and hassle-free. The thick paper handles pens and highlighters well, while the softcover keeps it lightweight and desk-friendly. Designed for simple organization, it helps verify payments, avoid late fees, and maintain clear records—making bill management efficient and stress-free.

Best For: individuals seeking a simple, reliable paper-based system to organize and track their bills, payments, and contacts efficiently.

Pros:

- Easy to use with clear sections for monthly tracking, contacts, and receipts

- Durable thick paper that handles pens and highlighters well

- Spiral binding allows full line access for quick updates and easy flipping

Cons:

- Softcover made of thin cardboard, not highly resistant to water or bending

- Limited durability against rough handling or moisture exposure

- Not suitable for digital integration or electronic record keeping

Bill Payment Tracker Notebook with Spiral Binding and Back Pocket

Looking for a reliable way to keep your bills organized and payments on schedule? The Bill Payment Tracker Notebook with Spiral Binding and Back Pocket is perfect for that. Its durable polyvinyl cover and thick 100 gsm paper make it sturdy and ink-friendly. The spiral binding allows easy flipping, while the back pocket stores receipts and documents securely. With dedicated sections for descriptions, due dates, and payments, it simplifies bill management. Its compact size fits comfortably on your desk or in your bag. Many users praise its practicality and durability, making it a long-term, stylish solution for personal or small business finances.

Best For: individuals seeking a durable, organized, and manual solution for tracking personal or small business bills and payments.

Pros:

- Sturdy spiral binding and durable polyvinyl cover enhance longevity and ease of use

- Thick 100 gsm paper prevents ink bleed, suitable for fountain pens and various writing tools

- Dedicated sections simplify bill management, helping to avoid missed or late payments

Cons:

- Size may be too small for users who prefer larger planners or more detailed entries

- Limited formatting options might not meet users needing customized or expanded layouts

- Some users may prefer digital tools for easier data backup and remote access

Income & Expense Log Book for Small Business and Personal Tracking

If you’re seeking a practical and portable way to manage your finances, the Income & Expense Log Book for Small Business and Personal Tracking is an excellent option. Its compact A5 size and lightweight design make it easy to carry in your bag or purse. The stylish pink cover with teal accents and sturdy binding add to its appeal. Inside, you’ll find undated pages for daily income and expenses, weekly spreads, and an annual summary—perfect for developing consistent bookkeeping habits. With space for notes and receipt storage, it’s suitable for beginners, small business owners, or anyone looking to stay organized and track their financial progress throughout the year.

Best For: small business owners, students, and individuals seeking a portable, stylish tool to organize and track their income and expenses throughout the year.

Pros:

- Compact and lightweight, easy to carry anywhere.

- Stylish design with durable materials and high-quality paper.

- Organized layout with space for notes and receipts, fostering good bookkeeping habits.

Cons:

- Slightly limited writing space in columns for detailed entries.

- Some users have experienced minor defects, such as backward covers.

- Undated format requires manual date entry, which may be less convenient for some users.

Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook

The Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook is an ideal choice for anyone seeking a flexible, customizable tool to manage their finances effectively. Its undated, portable A5 size fits easily in your bag, making it perfect for on-the-go use. Made with high-quality paper and a sturdy cover, it’s built to last and prevent ink bleed-through. The planner features sections for goals, budgets, expenses, debts, and bill reminders, allowing detailed financial oversight. Its layout encourages goal setting and habit tracking, helping you build better money habits. Plus, the motivational quotes and customizable categories make it a practical, inspiring tool for long-term financial success.

Best For: individuals seeking a customizable, portable, and effective tool to organize their personal finances and develop better money habits.

Pros:

- Undated format allows flexible start times and personalized use.

- High-quality thick paper prevents ink bleed-through and shading issues.

- Compact size and durable cover make it convenient for on-the-go financial management.

Cons:

- The small calendar boxes may be too tiny for some users to write in comfortably.

- Limited color options and features like tabs or stickers may restrict customization preferences.

- Pre-filled categories are absent, requiring users to manually label or adjust sections for their needs.

SUNEE Budget Planner, Monthly Expense Tracker & Finance Organizer (A5, Pink)

The SUNEE Budget Planner, Monthly Expense Tracker & Finance Organizer (A5, Pink) is ideal for anyone seeking a thorough and visually engaging way to manage their finances. Its colorful, user-friendly layout provides dedicated pages for tracking income, expenses, savings, and debt, along with full-page monthly calendars for quick reference. The undated format allows flexibility, and features like bill trackers, savings goals, and stickers make budgeting enjoyable. Built with durable, water-resistant materials, it’s portable and designed to last a year. With positive reviews and helpful extras like a guidebook, this planner simplifies financial organization and keeps you motivated throughout 2025.

Best For: individuals seeking a comprehensive, durable, and visually engaging tool to organize their personal finances and achieve their budgeting goals throughout the year.

Pros:

- User-friendly, colorful layout that makes tracking finances engaging and easy to understand.

- Durable, water-resistant cover with a compact size for portability and long-term use.

- Includes helpful accessories like stickers and a guidebook to enhance usability and motivation.

Cons:

- Undated format requires users to set up new pages each year, which may be less convenient for some.

- Limited to one-year use, necessitating a new planner for continued financial management.

- May be too colorful or busy for users preferring a minimalist or more subdued design.

Monthly Bill Payment Checklist Organizer & Planner for Personal Budgeting

Designed for anyone who wants to stay on top of their monthly bills, the Monthly Bill Payment Checklist Organizer & Planner offers a complete and easy-to-use solution. Its spiral-bound design, lightweight build, and high-quality paper make it perfect for on-the-go tracking. With space for over 3,600 entries, it helps you monitor bill due dates, amounts, paid dates, and balances, ensuring nothing slips through the cracks. The organizer’s sections simplify managing recurring expenses and planning payments. Plus, its back pocket and elastic band keep everything secure. It’s a practical, affordable tool to streamline your finances and boost your budgeting confidence in 2025.

Best For: individuals or small business owners seeking an organized, portable, and comprehensive tool to manage and track monthly bills and expenses efficiently.

Pros:

- Easy-to-use spiral-bound design with high-quality paper for durability and convenience.

- Offers extensive capacity with over 3,600 entry lines to track multiple bills over several years.

- Features a back pocket and elastic band closure, enhancing portability and security of notes and receipts.

Cons:

- Limited in digital integration, lacking electronic features for automatic reminders or syncing.

- Might be too large or bulky for those preferring minimalist or digital-only budgeting tools.

- Some users may desire additional features such as comparison of income versus expenses for better financial analysis.

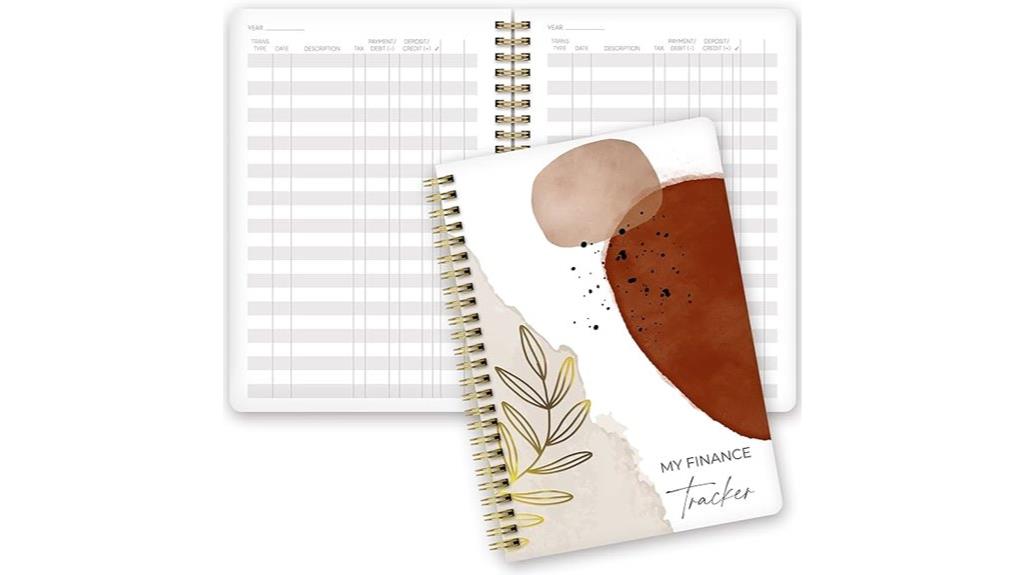

Easy to Use Accounting Ledger Book

Are you looking for an expense tracker that’s simple to use and doesn’t overwhelm you with complexity? The ZICOTO accounting ledger book is perfect. It features a sleek, modern design with a durable cover and thick paper, making it both stylish and practical. Its compact size fits easily into bags, so you can track finances on the go. The layout is minimalist, with dedicated columns for transactions, dates, descriptions, and notes, simplifying data entry. Whether for personal use or small business, this ledger helps you monitor income, expenses, and financial patterns effortlessly. Its durability and ease of use make bookkeeping less stressful and more organized.

Best For: small business owners, entrepreneurs, and individuals seeking an easy-to-use, portable ledger for managing expenses and tracking finances effortlessly.

Pros:

- Stylish modern design with durable cover and thick paper for longevity

- Compact size fits easily into bags, ideal for on-the-go use

- Minimalist layout simplifies data entry and helps organize financial information

Cons:

- Limited to 120 pages, which may require frequent replacement for extensive use

- Basic layout may not accommodate highly detailed or complex accounting needs

- Does not include digital features or integrations for automated tracking

Factors to Consider When Choosing an Expense Tracker Notebook

When choosing an expense tracker notebook, I consider factors like size and portability to guarantee it fits my lifestyle. I also look at the layout and design to make tracking expenses simple and intuitive. Finally, I weigh durability, usability, and price to find the best balance of quality and value for my needs.

Size and Portability

Have you ever considered how the size and weight of your expense tracker notebook can impact your daily routine? Choosing a size that fits your lifestyle is key. Compact notebooks like A5 (5.8 x 8.3 inches) are portable and easy to carry around, ideal for on-the-go use. Larger options, such as 8.5 x 11 inches, offer more space for detailed entries but can be bulky and less convenient for daily carry. Weight also matters—lightweight notebooks (around 6-9 ounces) are easier to slip into bags or pockets without adding bulk. Spiral-bound or softcover designs tend to be more flexible and portable, making handling and storage simpler. Pick a size and binding style that aligns with your routine, whether you need something portable or more spacious.

Layout and Design

Choosing the right layout and design for your expense tracker notebook can make a significant difference in how easily you record and review your finances. Look for a design that clearly separates income, expenses, and categories with dedicated columns or sections, making entries straightforward. Visual elements like color coding or icons can help you quickly spot spending patterns and understand your financial habits at a glance. Consider whether you prefer weekly or monthly views, as the page structure impacts how comfortably you can track data without clutter. Undated formats offer flexibility for starting anytime, while dated layouts provide a chronological record. Bonus features like note sections, receipt pockets, or motivational prompts can also boost usability and keep you motivated to stay consistent.

Durability and Material

A durable expense tracker notebook is essential for keeping your records intact over time, especially if you plan to use it daily or carry it around frequently. High-quality materials like thick 120gsm paper prevent ink bleed-through and improve longevity, ensuring your notes stay clear and legible. The cover material, whether eco-leather or sturdy cardboard, protects against wear, spills, and bending. Reinforced binding methods, such as spiral or ring binding, allow the notebook to lay flat and resist damage from frequent opening and closing. Water-resistant or waterproof covers are a great addition, guarding against spills and moisture that could ruin your records. Heavyweight paper not only boosts durability but also offers a smoother writing experience, reducing tearing and ghosting over time.

Usability and Ease

When selecting an expense tracker notebook, usability and ease of use are essential factors that can make managing your finances much simpler. A clear, organized layout helps you record data quickly and reduces errors, making the process smoother. Spacious columns accommodate different handwriting styles, ensuring everyone can log expenses comfortably. Features like undated pages and flexible sections let you tailor the notebook to your unique financial routine without feeling constrained. A portable size and durable binding allow for easy access on the go and long-term use without damage. Additional tools like pre-designed categories, checkboxes, or note sections streamline tracking, minimize confusion, and save time. These usability features make the notebook more intuitive, encouraging consistent and accurate expense management.

Price and Value

Evaluating the price and features of expense tracker notebooks helps you find options that fit your budget while still meeting your needs. I recommend comparing costs carefully to guarantee you’re getting good value. Higher-priced notebooks often include extras like stickers, guides, or larger pages, which can boost usability. However, affordable options may still be sufficient if they offer enough pages and durability for basic tracking. Investing in a well-priced notebook with quality materials, such as thick paper and sturdy binding, can make it last longer and improve tracking accuracy. By considering the cost relative to the notebook’s capacity and any extras included, you can select a product that aligns with your financial management goals without overspending. This balance ensures you get the best value for your money.

Features and Extras

Choosing an expense tracker notebook with the right features and extras can make managing your finances much easier. Look for notebooks that include helpful additions like stickers, guidebooks, or built-in pockets to personalize and streamline tracking. Durability is key, so consider water-resistant covers, thick paper, or reinforced binding to guarantee your notebook lasts. Additional sections such as goal-setting pages, review prompts, or monthly calendars can support a detailed financial plan. Specific functionalities like dedicated expense categories or space for receipts help keep things organized. Helpful tools like pre-printed checklists, color-coded sections, or flexible undated formats allow customization to fit your needs. These extras enhance usability and ensure your expense tracking remains efficient and adaptable.

Flexibility and Customization

Flexibility and customization are crucial factors to consider because they determine how well an expense tracker notebook can adapt to your unique financial habits. A flexible notebook lets you easily modify categories and labels, so it reflects your specific goals. Customizable layouts allow you to add or remove sections as your financial needs change, keeping the tracker relevant. Personalization options like stickers, color-coding, or notes make tracking more engaging and intuitive. An undated format provides maximum freedom, letting you start recording expenses anytime without restrictions. A highly adaptable notebook supports different recording methods, whether you prefer daily logs, weekly summaries, or detailed transactions. Choosing a versatile tracker ensures it remains useful as your financial situation evolves, making organization effortless and tailored to you.

Tracking Capabilities

When selecting an expense tracker notebook, it’s crucial to take into account its tracking capabilities to make sure it meets your financial management needs. Look for notebooks with dedicated columns for income, expenses, payment methods, and notes, so you can record details accurately. Features like weekly, monthly, or yearly summaries are helpful for spotting trends and managing budgets over time. An undated format offers flexibility, allowing you to start anytime and use it continuously. Spacious pages are essential for clear, legible entries, especially if you prefer large handwriting. Additionally, consider extras like receipt pockets, stickers, or note pages that can help keep everything organized and personalized. These features ensure your tracking remains thorough, easy to review, and tailored to your financial goals.

Frequently Asked Questions

What Features Differentiate Premium Expense Tracker Notebooks From Basic Ones?

When comparing premium expense tracker notebooks to basic ones, I notice that premium options often have features like high-quality paper, durable covers, and stylish designs that make tracking more enjoyable. They might also include dedicated sections for budgets, savings goals, or detailed expense categories. These added features help me stay organized and motivated, making the process smoother and more efficient than with simple, basic notebooks.

How Often Should I Update My Expense Tracker for Optimal Accuracy?

Thinking about how often to update your expense tracker? I’d say, a little consistency goes a long way. I find that reviewing and updating my tracker at least once a week keeps my finances in check without feeling like a chore. It helps me catch any little slips and stay on top of my budget. So, find a rhythm that feels manageable, and stick with it for the best results!

Are There Specific Layouts Better Suited for Small Business Versus Personal Finance?

When I choose an expense tracker layout, I consider whether it’s for personal or small business use. For personal finances, I prefer simple, straightforward formats like monthly summaries and expense categories. Small business trackers benefit from detailed layouts that include income, expenses, invoices, and profit margins. This way, I keep everything organized and accessible, making it easier to analyze my finances and make informed decisions.

Can These Notebooks Accommodate Digital and Manual Expense Entries Simultaneously?

Most expense tracker notebooks are designed primarily for manual entries, but some are flexible enough to accommodate digital tracking too. I look for notebooks with blank or grid pages that let me jot down expenses by hand, plus space for digital records or links. While not all notebooks are perfect for both, I find those with extra notes sections or pockets work well for managing both manual and digital expense entries simultaneously.

What Are the Best Practices for Maintaining Privacy in Expense Tracking Notebooks?

Privacy is essential when managing my finances, and I take steps to keep my expense notebooks secure. I use passwords or lockable notebooks, avoid sharing my details, and keep physical copies in safe places. I also shred outdated records and limit access to my financial info. By staying vigilant and organized, I protect my sensitive data while keeping my expenses transparent and manageable.

Conclusion

Did you know that people who track their expenses are 30% more likely to save effectively? Choosing the right expense tracker notebook can make a huge difference in staying organized and reaching your financial goals. Whether you prefer a sleek planner or a simple ledger, there’s a perfect option for you. So, immerse yourself and find the one that motivates you to keep your finances on track—your future self will thank you!