If you’re looking to stay on top of your finances, I recommend checking out the 13 best daily expense log books that combine ease of use, durability, and regulatory compliance. From compact driver logs to accounting ledgers, these options help organize your spending and track your progress effortlessly. Many feature sturdy covers, clear layouts, and useful tools like recap sections. Keep going, and I’ll show you how to choose the perfect one for your needs.

Key Takeaways

- Look for FMCSA-compliant logs with clear layouts for easy daily expense and compliance tracking.

- Choose durable, multi-functional books that include sections for receipts, mileage, and notes.

- Opt for compact, portable sizes like 5.5×8.5 inches for on-the-go use and quick recording.

- Consider packs of multiple books with ample forms to support ongoing budget management.

- Prioritize features like reinforced pages, organizational tools, and easy-to-understand instructions for efficiency.

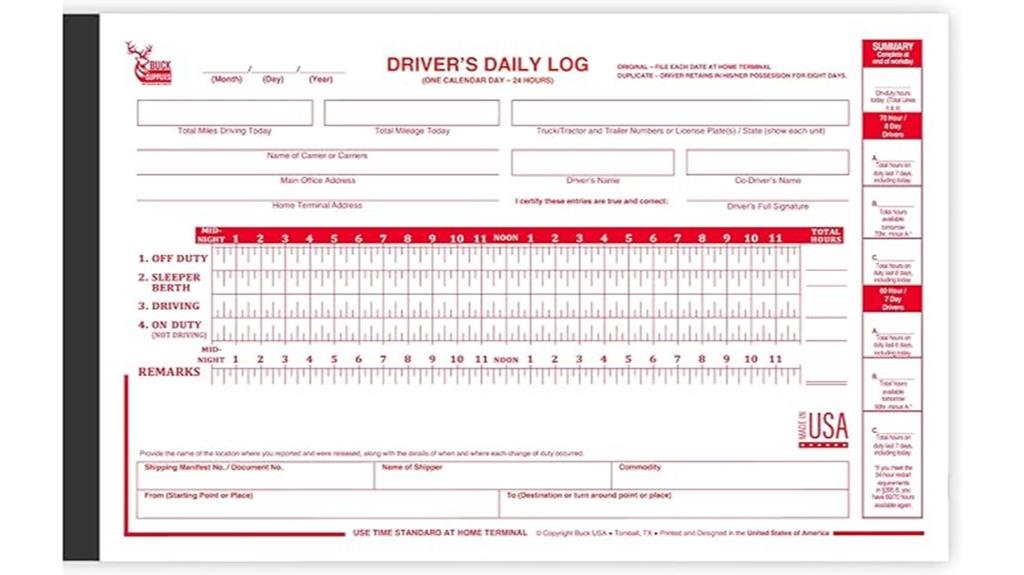

Buck Driver Log Book with 7 & 8 Day Recap

If you’re a truck driver looking for a reliable way to track your daily expenses and comply with federal regulations, the Buck Driver Log Book with 7 & 8 Day Recap is an excellent choice. Designed specifically for trucking, it’s FMCSA compliant and includes essential DOT regulations printed inside. The log features durable, 2-ply carbonless paper, making it easy to record and tear out pages quickly. Its compact 5.5 x 8.5-inch size fits comfortably on the road, and the simplified recap helps you track available hours efficiently. Built by Tradex Global USA, it’s tough, functional, and ideal for daily use, ensuring you stay organized and compliant.

Best For: truck drivers seeking a durable, FMCSA-compliant log book for easy daily record-keeping and regulation adherence.

Pros:

- Made with 2-ply carbonless paper for durability and easy tear-out pages

- Compact size (5.5 x 8.5 inches) fits comfortably on the road

- Includes printed DOT regulations for quick reference and compliance

Cons:

- Thinner paper may risk ripping with frequent use

- Prices can vary, with some retailers offering higher costs

- Some customers have received fewer books than ordered or found lower prices elsewhere

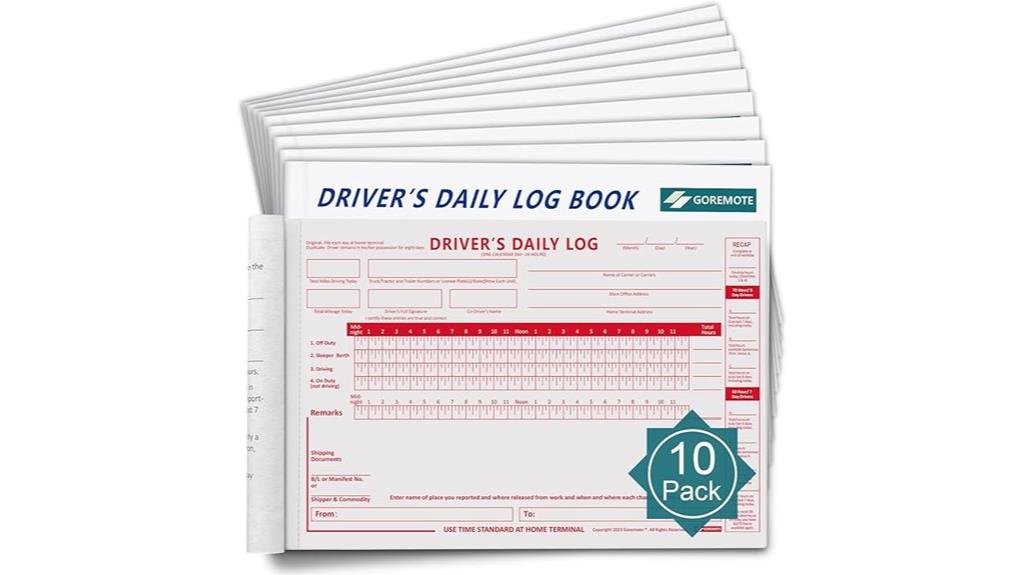

Daily Log Books for Truck Drivers (10 Pack, FMCSA Compliant)

For truck drivers who need reliable, FMCSA-compliant log books, the Daily Log Books for Truck Drivers (10 Pack) stand out as an essential tool. These logs meet all FMCSA requirements, including 49 CFR Section 395.8, ensuring accurate duty status records. Each set includes 10 books with 35 duplicate forms per book, totaling 350 forms. Made from durable carbonless paper, they’re built to withstand daily wear. The compact size (8.5 x 5.5 inches) makes handling easy, and instructions printed inside help prevent errors. Customers praise their affordability, ease of use, and compliance, making this pack a practical choice for maintaining legal, organized records on the road.

Best For: truck drivers and fleet managers seeking FMCSA-compliant, durable, and easy-to-use log books to maintain accurate duty status records.

Pros:

- Meets all FMCSA requirements, ensuring legal compliance

- Durable 2-ply carbonless paper withstands daily wear and tear

- Compact size and clear instructions simplify record-keeping and reduce errors

Cons:

- Glue binding may come apart over time, requiring staples for added durability

- Limited to 10 books per pack, which may not suffice for longer-term use

- Some users might prefer spiral binding for easier page flipping

10 Pack Driver Daily Log Book (8.5 x 5.5)

The Pack Driver Daily Log Book (8.5 x 5.5) is an excellent choice for truck drivers who need a durable, compact log book to meet federal regulations. Its size makes it easy to handle and store, while the high-quality, 2-ply carbonless paper guarantees long-lasting durability. With 31 sets of forms per book and a pack of 10, you’ll have plenty of supply to stay compliant without frequent replacements. The clear layout includes essential details like mileage and route lines, and the back cover offers helpful instructions to prevent errors. Overall, this log book combines practicality, resilience, and ease of use, making it ideal for busy drivers.

Best For: truck drivers and transportation professionals seeking a durable, compact, and compliant log book to efficiently record driving hours and vehicle inspections.

Pros:

- High-quality 2-ply carbonless paper ensures durability and easy duplication

- Compact size (8.5 x 5.5 inches) for easy handling and storage

- Includes detailed instructions on the back cover to help prevent record-keeping errors

Cons:

- Limited to 31 sets of forms per book, which may require frequent replenishment for heavy users

- Heavier weight (approximately 2.48 pounds) could be cumbersome for some users

- Basic design without additional features like digital integration or customizable layouts

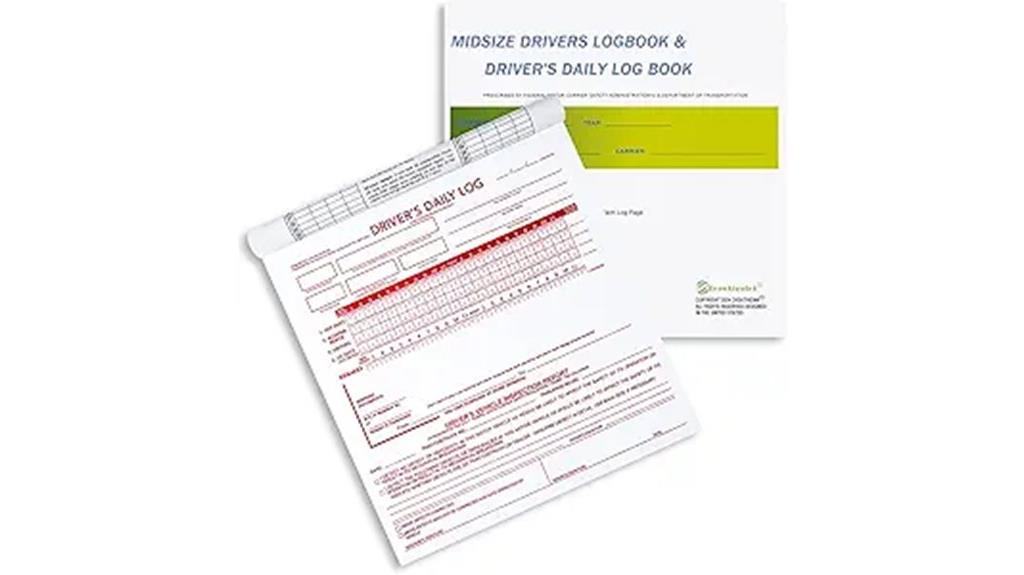

Midsize Drivers Logbook & DVIR (2-in-1), 7-8 Day Recap, 31 Forms, FMCSR Compliant

Designed specifically for midsize truck drivers and fleet operators, the Midsize Drivers Logbook & DVIR (2-in-1) simplifies compliance with U.S. DOT regulations. It combines daily driver logs, a recap, and a simplified vehicle inspection report into one compact book, featuring 31 forms in a durable, easy-to-use format. The snap-out, carbonless sheets make record-keeping accurate and efficient, helping you adhere to FMCSA rules and avoid costly fines. With clear instructions and a regulatory guide inside, it’s perfect for individual drivers or fleets seeking streamlined, compliant documentation. This all-in-one logbook keeps your records precise, organized, and ready for inspection.

Best For: midsize truck drivers and fleet operators seeking a compliant, efficient, and organized way to document driving hours and vehicle inspections.

Pros:

- Combines driver logs, recap, and vehicle inspection reports in one compact, easy-to-use book

- Made with durable, carbonless paper to withstand daily use and reduce record errors

- Helps ensure compliance with FMCSA regulations, minimizing the risk of costly fines

Cons:

- Limited to 31 log sets, which may require additional records for extended periods

- Slightly bulkier compared to digital logging options for tech-savvy users

- May not include advanced features like electronic record-keeping or GPS integration

Easy to Use Accounting Ledger Book

Looking for an expense tracker that’s straightforward and reliable? The ZICOTO Ledger Book is perfect for simple, organized financial management. Its stylish beige cover with golden floral accents makes it visually appealing, while the sturdy construction and thick paper guarantee durability. With easy-to-fill undated pages, it offers plenty of space for recording transactions, dates, descriptions, and notes. Its compact size slips easily into bags, making it portable for everyday use. Whether managing personal expenses or small business finances, this ledger simplifies tracking checks, income, and expenses without fuss. It’s an effective, attractive tool to keep your budget on track effortlessly.

Best For: individuals and small business owners seeking an easy, stylish, and reliable way to track expenses and manage finances effortlessly.

Pros:

- Simple, user-friendly layout ideal for quick financial recording

- Durable construction with high-quality materials ensuring longevity

- Attractive minimalistic design that enhances organization and motivation

Cons:

- Undated pages require manual date entry, which may be time-consuming for some users

- Limited to basic expense and income tracking, lacking advanced accounting features

- Compact size might be restrictive for extensive financial details or multiple accounts

Expense Tracker Notebook for Budget and Money Management

If you prefer a straightforward, organized way to manage your finances, the Expense Tracker Notebook is an excellent choice because it offers large spaces for clear entries and specific columns for income and expenses. With 105 pages in a compact 6×9 inch size, it’s perfect for personal or small business use. The notebook functions like a checking account register, making it easy to track payment methods like cash, credit, or checks. Users find it simple, effective, and more organized than digital apps or spreadsheets. Its practicality and large writing spaces make managing finances less stressful and more efficient, earning high customer satisfaction.

Best For: individuals or small business owners seeking a simple, organized way to track their finances without relying on digital tools.

Pros:

- Large spaces for clear, comfortable handwriting entries

- Specific columns for income, expenses, and payment methods enhance organization

- Compact 6×9 inch size makes it portable and easy to use on the go

Cons:

- Spiral binding could improve ease of use and page flipping

- Limited to 105 pages, which may require additional purchases for extended tracking

- No digital features or integration for those who prefer electronic record-keeping

Budget Planner – A6 Expense Budget Tracker

The Budget Planner – A6 Expense Budget Tracker is an ideal choice for anyone needing a compact, durable tool to manage daily expenses on the go. Its stylish pink design, sturdy polypropylene cover, and strong twin-wire binding make it both attractive and resilient. With 80 sheets, an annual overview, and dedicated pages for goals and contacts, it offers exhaustive financial tracking. The high-quality 100gsm paper prevents ink bleed and damage, ideal for gel pens. Its small size fits easily into bags, wallets, or envelopes, ensuring you can keep tabs on your finances anytime, anywhere. I find it perfect for staying organized and focused on my budget goals daily.

Best For: individuals seeking a portable, stylish, and reliable expense tracker to manage their daily finances on the go.

Pros:

- Durable polypropylene cover and strong twin-wire binding ensure long-lasting use.

- High-quality 100gsm paper minimizes ink bleed and damage, compatible with gel pens.

- Compact size with features like an elastic closure and inner pocket make it highly portable and convenient.

Cons:

- The calendar only covers 2023-2024, which may limit planning for future years.

- Limited to 80 sheets, which might require frequent replacement for extensive tracking needs.

- Some users may find the small size challenging for extensive note-taking or detailed entries.

Expense Tracker: Daily Expense Log Book and Budget Planner

For those who want a straightforward way to stay on top of daily expenses, the Expense Tracker: Daily Expense Log Book and Budget Planner offers a highly effective solution. It helps you organize daily spending, manage your budget, and record bill payments, credit, needs, and wants—all in one place. Users praise its simplicity, durability, and affordability, making it easy to stay organized without hassle. With numerous sheets, it functions as a ledger, logbook, and budget planner, providing all-encompassing tracking of your money flow. This product keeps your finances clear, helping you develop better money habits with minimal effort.

Best For: individuals seeking an easy-to-use, durable, and comprehensive tool to track daily expenses, manage budgets, and stay organized financially.

Pros:

- Simple and effective design that is easy to understand and use

- Durable quality at an affordable price, lasting long with frequent use

- Extensive sheets covering various aspects of expense management, including ledger, logbook, and budget planner

Cons:

- May lack advanced features for detailed financial analysis or reporting

- Limited customization options for specific budgeting needs

- Physical logbook may not be suitable for digital-savvy users preferring app-based solutions

S&O Income and Expense Tracker Notebook

Designed specifically for small business owners and entrepreneurs, the S&O Income and Expense Tracker Notebook offers a straightforward and professional way to manage finances on the go. With 104 pages, including weekly spreads, an annual summary, and note pages, it’s perfect for tracking income sources, expenses, and financial growth. Its undated layout allows flexibility for starting mid-year, while the sturdy cover and lay-flat spiral make it easy to use anywhere. The elegant mint cover with gold foil adds a professional touch. Overall, it simplifies bookkeeping, helps set goals, and keeps your business finances organized—whether at meetings, home, or on the move.

Best For: small business owners, entrepreneurs, and individuals seeking a simple, professional manual bookkeeping solution for tracking income and expenses on the go.

Pros:

- Durable, sturdy cover with lay-flat spiral design for easy use anywhere

- Elegant mint-colored cover with gold foil adds a professional appearance

- Undated layout offers flexibility to start at any time of the year

Cons:

- Limited note pages may not suit those needing detailed or extensive record keeping

- Small writing spaces require shorthand or abbreviations for detailed entries

- Basic layout may not meet the needs of more complex or larger businesses

5 Pack Drivers Daily Log Book with 7 & 8 Day Recap

Looking for a log book that keeps your driving records organized and compliant? The Pack Drivers Daily Log Book with 7 & 8 Day Recap is a great choice. It features durable, carbonless paper that creates two copies from one entry, making record-keeping simple and efficient. Each book measures 5.5×8.5 inches, fitting easily in your vehicle. With 35 forms per book, it provides plenty of space to track hours, fuel, mileage, and maintenance. Designed for truckers, bus drivers, and commercial vehicle operators, it helps guarantee compliance with safety regulations and keeps your logs clear, accurate, and ready for inspection.

Best For: truck drivers, bus drivers, and commercial vehicle operators needing organized, compliant logs for daily driving activities.

Pros:

- Durable carbonless paper creates two copies from a single entry, simplifying record-keeping.

- Compact size (5.5×8.5 inches) fits easily in vehicles for convenience.

- Contains 35 forms per book, providing ample space for tracking hours, fuel, mileage, and maintenance.

Cons:

- Basic format may lack advanced features or customization options.

- Limited to 35 forms per book, which may require frequent replacements for high-mileage drivers.

- Customer reviews indicate a moderate rating, suggesting some users may seek more specialized or detailed logging options.

Heveboik Income & Expense Log Book (A5, 5.5 x 8.5)

If you need a portable and flexible bookkeeping tool, the Heveboik Income & Expense Log Book (A5, 5.5 x 8.5) stands out thanks to its undated pages, allowing you to start tracking your finances at any time without waiting for a new year. Its compact size fits easily into bags, making it perfect for on-the-go use. The book includes 53 weekly spreads, an annual overview, and extra notes pages, supporting detailed daily tracking. Durable materials like high-quality paper and a spiral binding guarantee longevity. With its user-friendly design, it helps small business owners and individuals maintain organized financial records effortlessly throughout the year.

Best For: small business owners and individuals seeking a portable, flexible, and organized way to track their income and expenses throughout the year.

Pros:

- Undated pages allow for flexible start times and ongoing use without waiting for a new year.

- Compact A5 size with durable materials makes it highly portable and long-lasting.

- Includes comprehensive weekly spreads, annual overview, and notes pages to support detailed financial tracking.

Cons:

- Some users report pages being upside down or backwards, affecting usability.

- Limited space in columns may make detailed entries challenging.

- The calendar is outdated (e.g., 2022-2023), which might require manual adjustments or notes.

10 Pack Log Books for Truck Drivers

Are you a truck driver needing a reliable way to keep your records organized on the go? I recommend the 10 Pack Log Books for Truck Drivers. Each compact book (8.5 x 5.5 inches) is durable and includes 32 sets of duplicate forms, totaling 320 sets. The 2-ply carbonless paper makes copying easy and long-lasting, while the reference guide on the back helps you follow proper procedures. These logs simplify tracking duty status, vehicle inspections, and recaps, ensuring you stay compliant with regulations. Lightweight and practical, they’re perfect for busy trucking schedules and help keep your records neat and accessible everywhere you go.

Best For: truck drivers and self-employed operators seeking a durable, organized, and regulation-compliant way to record and manage their daily logs on the go.

Pros:

- Durable, high-quality 2-ply carbonless paper ensures long-lasting copies and easy duplication.

- Compact size (8.5 x 5.5 inches) makes it convenient for daily use and portability during busy schedules.

- Includes detailed instructions and reference guides, simplifying record-keeping and ensuring compliance.

Cons:

- The transfer paper may require firm pressing for effective copying, which could take extra effort.

- Limited to 320 sets of forms in total, which may necessitate additional purchases for extended use.

- Some users might find the layout too basic for advanced record-keeping needs or specific regulatory requirements.

Receipt Envelopes with Mileage Log Book

Receipt envelopes with mileage log books are ideal for small business owners and frequent travelers who need an all-in-one solution for organizing receipts and tracking mileage. This 12-pack set combines receipt envelopes with built-in expense ledgers and detailed mileage logs, making it easy to manage monthly expenses. The mileage logs include odometer readings, business purpose, parking, tolls, and IRS rate calculations for accuracy. The pre-printed expense ledger simplifies documentation, while the colorful design and ample writing space ensure clarity. Compact and portable at 9.5 x 6.5 inches, these sets are perfect for keeping your receipts, expenses, and mileage organized on the go.

Best For: small business owners and frequent travelers seeking an all-in-one solution for organizing receipts and tracking mileage efficiently.

Pros:

- Combines receipt storage, expense ledger, and mileage logging in a convenient set.

- Includes detailed mileage logs with odometer readings, business purpose, parking, tolls, and IRS rate calculations for accuracy.

- Compact, portable design with colorful printing and ample writing space for easy on-the-go use.

Cons:

- Limited to a 12-pack set, which may not be sufficient for very high-volume users.

- Medium size (9.5 x 6.5 inches) may not fit all larger filing systems or storage solutions.

- Color printing and detailed logs might be overwhelming for users preferring minimalistic record-keeping.

Factors to Consider When Choosing a Daily Expense Log Book

When selecting a daily expense log book, I consider factors like size and portability to fit my needs on the go. I also look at paper quality and layout to guarantee it’s durable and easy to use daily. Finally, I compare costs to find a book that offers good value while meeting my budgeting and compliance requirements.

Size and Portability

Choosing the right size for a daily expense log book is essential because it directly impacts how easily you can carry and use it throughout your day. Smaller sizes, like 5.5 x 8.5 inches, fit easily into bags or pockets, making them perfect for quick, on-the-go recording. They’re lightweight and unobtrusive, so you won’t feel burdened during your commute or errands. Larger log books, such as 8.5 x 11 inches, provide more space for detailed entries but can be bulky and less convenient to transport. Finding a balance between sufficient writing space and portability ensures you can record expenses consistently without sacrificing comfort or accessibility. The right size makes budgeting a seamless part of your daily routine.

Paper Quality and Durability

Selecting high-quality paper is crucial because it directly affects how long your expense log book lasts and how easily you can record your daily expenses. I look for thick, acid-free paper—ideally 100gsm or higher—to prevent ink bleed-through and ensure my entries stay clear over time. Durable options like carbonless or laminated pages withstand frequent handling and resist tearing, especially when I’m on the go. A smooth, consistent surface makes writing effortless and reduces smudging or feathering of ink. Reinforced or tear-resistant pages help maintain the book’s integrity after daily use. Additionally, quality paper that resists moisture, stains, and fading keeps my records legible and intact for future reference or audits, giving me confidence in my expense tracking.

Layout and Ease

A well-organized layout is essential for making daily expense tracking straightforward and efficient. I look for log books with clear, structured columns for date, description, amount, and category, so I can quickly record expenses accurately. Sufficient space for handwritten notes is a must, preventing clutter and ensuring legibility. Pre-printed headers or prompts help me stay consistent and make entries faster. I also prefer a design with easy tear-out pages or removable sheets, which makes reviewing and filing simpler without damaging the whole book. Additionally, a layout that includes summary sections or recaps helps me keep an eye on my overall spending and simplifies weekly or monthly reviews. A thoughtful layout truly makes managing expenses less of a chore.

Regulatory Compliance

When picking a daily expense log book, ensuring it meets regulatory standards is just as important as its layout. You want a log book that complies with relevant regulations, like FMCSA rules for trucking or IRS requirements for business expenses. Check that it includes designated sections for essential data points such as date, purpose, and amount, which are often mandated. It’s also helpful if the book offers clear instructions or guidelines to minimize recording errors that could lead to penalties or audits. Make sure the format supports accurate, legible entries to meet documentation standards during inspections or financial reviews. Finally, choose a durable, tamper-resistant book that maintains record integrity and satisfies legal or regulatory retention periods, ensuring your records stay compliant over time.

Cost and Value

Considering the cost of a daily expense log book is essential, but it’s equally important to evaluate whether the features and quality justify the price. I look at the page count, durability, and any included tools—these can add value and make the book more cost-effective over time. Higher-priced options might offer pre-printed categories, tabs, or organizational features that save time and improve accuracy, which can be worth the investment. I also consider the quality of materials like thick paper and sturdy binding, as these ensure the book lasts longer and withstands daily use. Comparing prices across different sellers helps me find the best deal for the level of quality and features I need, ensuring I get good value for my money.

Additional Features

Additional features can considerably enhance how easily I can organize and access my expense records. For example, elastic bands, back pockets, or bookmark ribbons help me keep my log book tidy and quickly find important pages. Some books include pre-printed categories or prompts, guiding me to record specific expenses or income accurately. Perforated pages or tear-out sheets make sharing or filing my records straightforward without damaging the book. Built-in sections for notes, goals, or contacts consolidate all my financial info in one place, saving time. Extras like color coding, tabs, or an index improve navigation, allowing me to locate entries quickly. These thoughtful features make managing my budget more efficient and less stressful.

User Experience

Choosing a daily expense log book that offers a smooth user experience can make managing your budget much less stressful. A user-friendly book features clear, straightforward layouts that allow quick data entry without confusion, saving you time and frustration. It should also have ample space for detailed descriptions and notes, so you can customize entries based on your expenses. The format matters too—whether it’s undated pages or pre-printed categories—since flexibility helps tailor the log to your needs. Durability is key; sturdy paper and secure binding prevent damage and ensure longevity through daily use. An intuitive design that guides you step-by-step minimizes mistakes and makes recording expenses more efficient, turning budgeting from a chore into a manageable routine.

Frequently Asked Questions

How Do I Choose the Right Size for My Expense Log Book?

When choosing the right size for your expense log book, I consider where I’ll keep it and how often I’ll use it. If I want something portable, I go for a smaller, lightweight book that fits in my bag. For daily tracking at home, a larger one offers more space. I balance convenience with enough room to record all my expenses clearly and comfortably.

Are There Digital Alternatives to Physical Expense Log Books?

Imagine lugging around a hefty ledger like a financial bodyguard—sounds exhausting, right? Luckily, digital alternatives save us from that chaos. I use budgeting apps on my phone; they’re quick, organized, and sync across devices. No more paper clutter or lost receipts. Digital tools make tracking expenses effortless and even fun, helping me stay on top of my budget without turning my wallet into a paperweight.

Can These Log Books Be Used for Personal and Business Expenses?

Absolutely, these log books can be used for both personal and business expenses. I find them versatile because I can easily track my daily spending, whether it’s groceries or office supplies. Just make sure to keep different sections or color-code entries to stay organized. Using a single log book helps me see my overall financial picture clearly, making managing both areas much simpler and more efficient.

How Often Should I Update My Expense Log for Accuracy?

I recommend updating your expense log daily to guarantee accuracy. By recording expenses right away, you minimize forgetting details or making mistakes. If daily updates aren’t possible, aim for at least once a week to keep your budget on track. Consistency is key, so find a routine that works for you. Regular updates help you stay aware of your spending habits and make better financial decisions.

Do Expense Log Books Support Tax Deduction Tracking?

I’d say keeping track of expenses in a log book can be a real lifesaver come tax time. While the log itself doesn’t automatically support deductions, it provides a detailed record of your expenses, making it easier to identify deductible items. If you’re diligent and organized, your log becomes a handy tool that keeps your financial ducks in a row, ensuring you don’t miss out on potential tax benefits.

Conclusion

Choosing the right expense log book is like finding a trusty compass on a wild journey—guiding you steadily toward financial clarity. With these tools in hand, you’ll turn chaos into order, making your budget feel less like a storm and more like a smooth sailing voyage. So, pick the one that speaks to your needs, and watch your financial worries drift away like clouds on a clear sky. Your brighter, organized future awaits!