If you’re looking for the top investment tracking journals, I suggest exploring options like guided logs for stocks, crypto, and forex, as well as all-encompassing notebooks for stock trading and futures. These journals help you track trades, analyze performance, and stay disciplined over time. Many feature in-depth layouts, technical analysis tools, and durable materials to support ongoing use. Keep going, and you’ll discover more about choosing the perfect journal to boost your portfolio management skills.

Key Takeaways

- They offer structured layouts for detailed trade logging, performance metrics, and technical analysis to monitor portfolio progress effectively.

- High-quality materials and durable bindings ensure long-term use and protection of investment records.

- Many journals support customization options, allowing traders to tailor sections to their specific strategies and assets.

- They cater to various asset classes like stocks, crypto, forex, and commodities, providing comprehensive portfolio coverage.

- Additional features such as motivational quotes, notes sections, and handy accessories help maintain disciplined and organized investing habits.

Trading Journal: Guided Trading Log Book for Stocks, Crypto, and Forex

If you’re looking to improve your trading skills and develop better discipline, the Trading Journal: Guided Trading Log Book for Stocks, Crypto, and Forex is an excellent choice. I’ve found that its 300 pages with prompts help me track trades, emotions, and strategies effectively. It encourages reflection on both wins and losses, making it easier to identify patterns and refine my approach. The well-organized layout and durable leather cover give it a professional feel, keeping me motivated and accountable. Whether you’re new or experienced, this journal boosts self-awareness, emotional control, and consistency—key ingredients for long-term success in any trading market.

Best For: traders of all experience levels seeking a structured, professional tool to track and improve their trading psychology, strategies, and risk management.

Pros:

- Well-organized layout with prompts that enhance reflection and self-awareness

- Durable leather cover and professional design suitable for daily use and gifting

- Supports goal-setting and emotional control, aiding long-term trading discipline

Cons:

- Some users may find minor typos or errors in the prompts

- Price may be a consideration for budget-conscious traders

- Limited customization options beyond the structured prompts

Trading Journal Notebook for Stock Trading and Investing

The Trading Journal Notebook for Stock Trading and Investing stands out as an essential tool for both beginners and seasoned traders seeking to guarantee their trading activities. With 120 pages of detailed layouts, it helps you organize, track, and analyze every trade efficiently. The large 8×10-inch size offers plenty of space for notes, insights, and charts, while premium materials ensure durability and a professional feel. Key sections include trade logs, watchlists, rules, and performance reviews. Whether you’re refining strategies or maintaining discipline, this journal supports your financial journey by making your trading process more structured and insightful. It’s a valuable resource to stay focused and improve your investing skills.

Best For: traders and investors at all experience levels seeking a comprehensive, organized way to track, analyze, and improve their stock trading activities.

Pros:

- Offers detailed layouts and sections for thorough trade and performance tracking.

- Made with high-quality materials for durability and a professional appearance.

- Supports customization of rules, watchlists, and personal organization features.

Cons:

- Large size (8×10 inches) may be less portable for on-the-go use.

- 120 pages might require regular updates to prevent running out of space.

- Designed primarily for stock trading; limited features for cryptocurrency or other asset classes.

Designed for active traders across stock, forex, options, and crypto markets, My Trading Journal stands out with its durable faux leather cover and professional A5 size, making it ideal for daily use. Weighing 13.1 ounces and measuring 8.43 x 5.83 inches, it’s portable yet sturdy. The journal features ruled sheets and a content page for easy navigation, supporting detailed documentation of up to 80 trades across eight review sections. It helps track win/loss ratios, emotional responses, and performance metrics, enabling continuous strategy refinement. Users praise its high-quality construction and balanced layout, making it a valuable tool for developing disciplined trading habits.

Best For: active traders in stock, forex, options, and crypto markets seeking a durable, professional log book to track and refine their trading strategies.

Pros:

- High-quality faux leather cover offers durability and a professional appearance

- Organized layout supports detailed documentation of up to 80 trades with easy navigation through a content page

- Facilitates comprehensive performance tracking including win/loss ratios, emotional responses, and strategy analysis

Cons:

- Slightly heavy at 13.1 ounces, which may be less convenient for portability during busy trading days

- Limited to 80 trades, which might be insufficient for highly active traders with extensive records

- No digital integration; purely a physical journal, which may not suit traders preferring electronic tracking

4X Trading Journal for Day Traders

For day traders seeking to refine their performance, the 4X Trading Journal stands out with its neuroscience-based approach that emphasizes discipline, psychological insight, and detailed trade tracking. It’s designed for all markets, including crypto, stocks, commodities, and forex. The journal features sections for creating extensive trading plans, tracking up to 80 trades, and reviewing performance and mindset weekly. Its focus on understanding oneself and managing risk helps develop consistent routines. Crafted with durable materials and thoughtful design, it fosters accountability and emotional control. Many traders find it invaluable for sharpening strategies, building discipline, and ultimately improving trading results over time.

Best For: day traders across all markets seeking to enhance discipline, psychological insight, and detailed trade tracking to improve their overall trading performance.

Pros:

- Comprehensive and structured trading plan development that promotes clarity and discipline.

- High-quality materials and thoughtful design foster durability and a professional appearance.

- Integrates neuroscience principles to improve emotional regulation and consistency.

Cons:

- May require a learning curve for beginners unfamiliar with structured journaling methods.

- Layout and template options could be more customizable to suit individual trading styles.

- Limited to 80 trades, which might be restrictive for very active traders.

Stock Market Trading Journal for Stocks, Futures, Options, Forex & Commodities

If you’re actively trading stocks, futures, options, forex, or commodities, this Stock Market Trading Journal is an essential tool to keep your investments organized and improve your strategies. It allows you to log every trade’s details—dates, symbols, quantities, entry and exit prices—and track your profit or loss. The journal encourages reflection by recording insights, mistakes, and lessons learned, helping you avoid repeat errors. With dedicated space for analysis, it empowers you to identify patterns and refine your approach. Its durable, high-quality design makes it suitable for daily use, whether you’re a beginner or a seasoned trader committed to optimizing your trading performance.

Best For: active traders and investors seeking a comprehensive tool to organize, analyze, and improve their trading strategies across stocks, futures, options, forex, and commodities.

Pros:

- Facilitates detailed trade tracking to monitor profit/loss and performance.

- Encourages reflection by recording insights, mistakes, and lessons learned for continuous improvement.

- Durable, high-quality design suitable for daily use by both beginners and experienced traders.

Cons:

- May require time investment to consistently log detailed trade information.

- Limited to physical format, which might not integrate with digital trading platforms.

- Not customizable for advanced traders needing complex analytics or automated features.

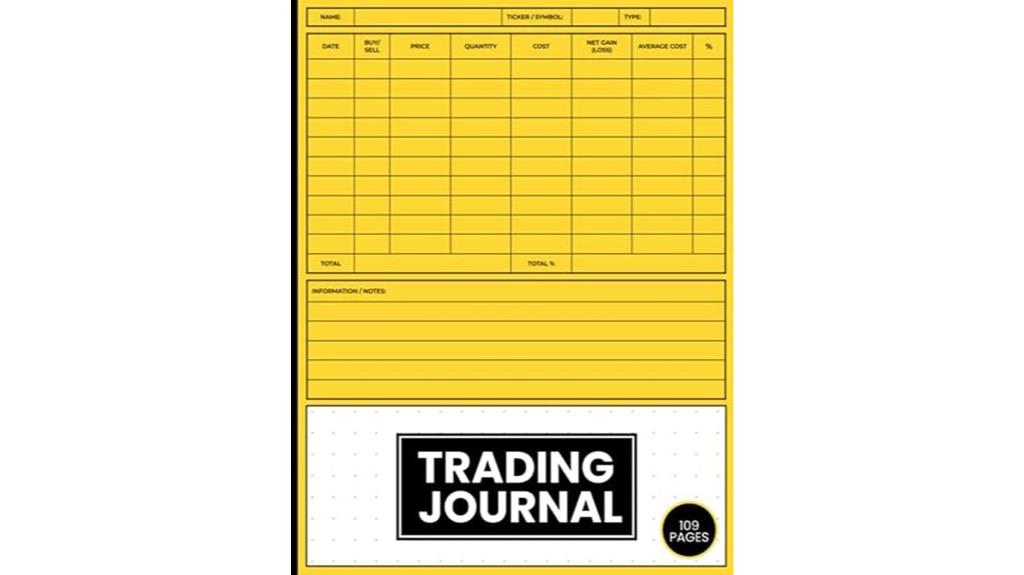

Trading Journal for Stocks, Forex, Options & Crypto Trading Log Book

The Trading Journal for Stocks, Forex, Options, and Crypto Trading Log Book stands out as an ideal choice for traders who want to organize up to 1000 trades within a single, easy-to-use format. Its large 8.5 x 11-inch pages and clear layout make tracking detailed trade information straightforward, including entry points, exit points, and notes. Designed for both beginners and experienced traders, it offers space for plotting support/resistance levels, candlestick patterns, and strategies. The journal also features a profit/loss tracker and dedicated sections for reflections, helping traders develop discipline, analyze patterns, and improve performance over time with minimal effort.

Best For: traders seeking an organized, comprehensive journal to track up to 1000 trades across stocks, forex, options, and crypto, whether they are beginners or experienced.

Pros:

- User-friendly layout with ample space for detailed trade entries and notes

- Supports plotting support/resistance levels, candlestick patterns, and strategies for in-depth analysis

- Helps develop disciplined trading habits and track performance over time

Cons:

- Large 8.5 x 11 inch pages may be less portable for on-the-go use

- Limited to 109 pages, which might require multiple journals for extensive trading histories

- May require additional tools or templates for advanced technical analysis beyond the journal’s scope

Clever Fox Habit Tracker Calendar (Black)

The Clever Fox Habit Tracker Calendar (Black) stands out with its vibrant, 24-month layout designed to keep learners motivated over the long haul. Measuring 10″ x 8″, it offers ample space to track up to 12 daily, 5 weekly, and 5 monthly habits, making it ideal for developing consistent routines. Its thick 120gsm paper prevents bleed-through, ensuring durability and a smooth writing experience. Motivational quotes sprinkled throughout inspire continued progress. With detailed guides and blank pages for customization, it’s versatile for all ages. This planner is perfect for anyone seeking to build habits, stay organized, and see tangible progress over two years.

Best For: individuals of all ages seeking a durable, visually engaging habit tracker to build and maintain long-term routines effectively.

Pros:

- Vibrant 24-month layout with motivational quotes to keep users inspired.

- Thick 120gsm paper prevents bleed-through, ensuring durability and smooth writing.

- Ample space to track multiple habits daily, weekly, and monthly, with customizable pages.

Cons:

- Some users find the size (10″ x 8″) a bit bulky for portability.

- The colorful design may not suit those preferring a minimalist aesthetic.

- Could benefit from clearer weekly separation for easier tracking navigation.

Crypto Trading Journal for Stocks, Forex, Options & Crypto Trading Log Book

A standout feature of this crypto trading journal is its ability to log up to 1,000 trades across stocks, forex, options, and cryptocurrencies, making it ideal for serious traders who want exhaustive record-keeping. It records key details like trade date, symbol, type, price, quantity, and gains or losses, with space for notes, support/resistance levels, and pattern analysis. The journal also helps you plan strategies, set goals, and track performance over two years with a monthly profit/loss tracker. Its grid pages facilitate technical analysis, supporting disciplined trading and continuous improvement. Designed as an 8.5 x 11-inch book, it’s perfect for both beginners and experienced traders.

Best For: Serious traders and investors seeking comprehensive record-keeping, technical analysis, and performance tracking across stocks, forex, options, and cryptocurrencies.

Pros:

- Capable of logging up to 1,000 trades, ideal for extensive trading activity.

- Includes dedicated pages for strategy planning, support/resistance analysis, and pattern recognition.

- Features a two-year monthly profit/loss tracker to monitor long-term performance.

Cons:

- Large 8.5 x 11-inch size may be less portable for on-the-go use.

- 109 pages might be more than needed for casual or infrequent traders.

- Requires dedicated space and time for thorough analysis and note-taking.

Trading Journal Log Book for Stocks, Crypto & Investments

If you’re serious about improving your trading performance, a Trading Journal Log Book designed for stocks, crypto, and investments can be an invaluable tool. It helps me track, analyze, and refine my trades across various markets, promoting discipline and organization. The journal includes fields for ticker symbols, trade dates, prices, quantities, fees, and notes, making it easy to review my progress over time. With coverage of up to two years, I can identify patterns, measure growth, and adjust strategies accordingly. Its versatility suits different trading styles, whether I’m into swing trades or long-term investing, helping me make smarter decisions every step of the way.

Best For: Traders and investors seeking a comprehensive, organized way to track and analyze their trades across stocks, crypto, options, and long-term investments to improve performance and decision-making.

Pros:

- Facilitates disciplined trading by providing detailed fields for all essential trade information

- Covers up to two years of trading data, allowing for long-term analysis and strategy refinement

- Versatile design suitable for various trading styles and experience levels

Cons:

- May require time to set up and consistently update for optimal benefit

- Limited to two years of trade tracking, which might be insufficient for some long-term investors

- Does not include digital or automated tracking features, relying on manual entry

Stock Trading Logbook for Traders and Investors

Designed specifically for traders and investors who want to stay organized, the Stock Trading Logbook offers extensive sections to track every detail of your trades. It features 150 pages covering trading rules, monthly goals, strategies, and a detailed trading log. You can record vital data like symbols, entry and exit points, quantities, prices, and profit or loss ratios. With ample space for notes and observations, it helps you analyze performance and refine your approach. Its large format and high-quality design make it easy to use daily. This logbook not only keeps your trading organized but also encourages goal setting to boost your success.

Best For: traders and investors seeking an organized, comprehensive tool to track, analyze, and improve their trading performance.

Pros:

- Extensive sections for rules, strategies, goals, and detailed trade logs to support comprehensive tracking.

- Large format with high-quality paper and design for comfortable daily use.

- Encourages goal setting and performance analysis to help refine trading strategies.

Cons:

- Limited number of log pages may require additional notebooks for very active traders.

- Primarily designed for manual entry, which may be time-consuming for some users.

- Slightly heavier or bulkier due to large size and premium paper, less portable for on-the-go use.

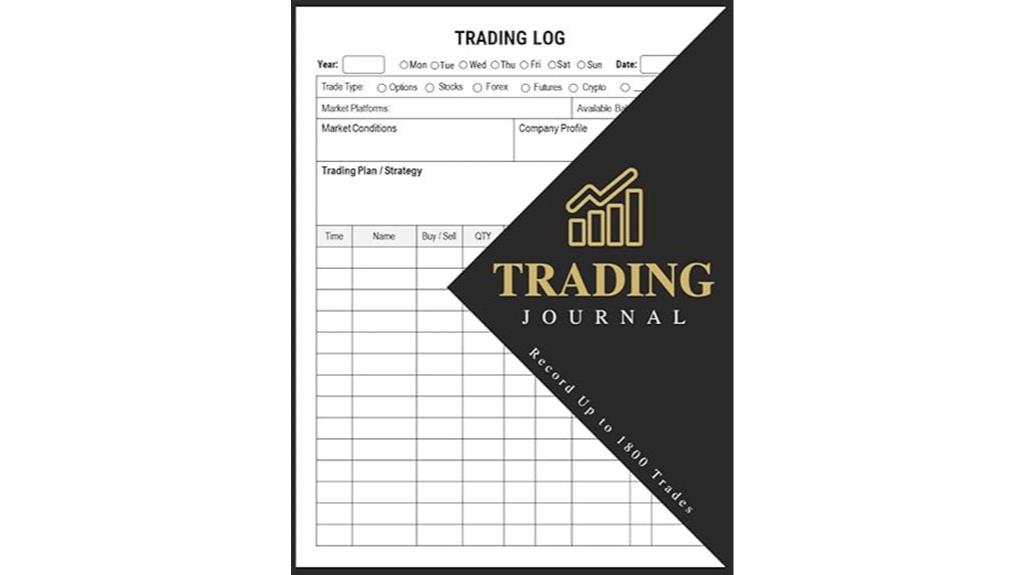

Trading Journal for Stocks, Futures, Options, and Forex

This trading journal is perfect for traders who want to meticulously track up to 1800 trades across stocks, futures, options, and forex. I find it invaluable for recording detailed trade data, including date, time, trade type, price, profit/loss, and strategies. Its all-encompassing sections help me set rules, goals, and note insights that improve my trading discipline. The journal’s analytical metrics, like win/loss ratio and profit/loss ratio, enable me to evaluate performance and refine strategies over time. With its user-friendly design and thorough tracking, it’s an essential tool for maintaining consistency and optimizing my trading results.

Best For: traders seeking a comprehensive and detailed trading journal to track and analyze up to 1800 trades across stocks, futures, options, and forex to improve their trading discipline and performance.

Pros:

- Covers extensive trade details including date, time, trade type, price, profit/loss, and strategies for thorough tracking.

- Features analytical metrics like win/loss ratio and profit/loss ratio to evaluate and refine trading performance.

- User-friendly design with sections for rules, goals, and notes, promoting disciplined trading and strategic planning.

Cons:

- Limited to 1800 trades, which may not suit traders with very high-frequency trading needs.

- Size and format (8.5×11 inches, 140 pages) may be bulky for portable use or quick referencing.

- Primarily designed for manual entry, which could be time-consuming for some users.

4X Trading Journal: Log Book for Day Traders

The 4X Trading Journal stands out as an ideal choice for day traders who want a structured, neuroscience-based tool to improve their performance across crypto, stocks, commodities, and forex markets. It offers detailed trade logging for up to 80 trades, with sections for entry rules, risk management, and setup reviews. The journal emphasizes developing a solid trading strategy through goal setting, routines, and discipline. Its weekly review pages help analyze progress and refine skills. Crafted with durable materials and a professional design, it fosters accountability, emotional control, and continuous improvement—making it perfect for traders seeking discipline and clarity in their daily trading routines.

Best For: day traders seeking a comprehensive, neuroscience-based journal to enhance discipline, strategy development, and performance tracking across multiple markets.

Pros:

- Structured templates for detailed trade logging and weekly reviews

- High-quality materials with durable cover and premium paper for long-term use

- Incorporates psychological and performance-focused sections to improve emotional regulation

Cons:

- May be overwhelming for complete beginners due to extensive sections

- Limited to 80 trades, which might be restrictive for very active traders

- Slightly higher price point reflecting premium quality and features

Clever Fox Income & Expense Tracker Large – Accounting & Bookkeeping Ledger Book for Small Business

If you’re a small business owner looking for a reliable way to organize your finances, the Clever Fox Income & Expense Tracker Large stands out as an excellent choice. This undated, A4-sized ledger offers 225 pages with weekly views, annual summaries, and note sections, making it perfect for two years of stress-free bookkeeping. Its eco-leather cover, thick no-bleed paper, and handy features like a receipt pocket, pen loop, and bookmark enhance usability. Designed for detailed expense tracking and financial analysis, it’s praised for quality, practicality, and style. Whether you run a retail shop or provide services, this tracker makes managing your finances straightforward and efficient.

Best For: small business owners, entrepreneurs, and service providers seeking an organized, durable, and easy-to-use bookkeeping solution for managing finances over two years.

Pros:

- Durable eco-leather cover and thick no-bleed paper ensure longevity and neatness.

- Comprehensive layout with weekly views, annual summaries, and note pages supports detailed financial tracking.

- Features like receipt pocket, pen loop, and bookmark add convenience and portability.

Cons:

- Larger A4 size may be less portable for some users needing a compact option.

- Undated format requires manual entry of dates, which might be time-consuming for some.

- Price may vary depending on retailer, potentially affecting affordability for budget-conscious buyers.

Trading Journal Log Book for Crypto & Futures Trading

For traders involved in crypto and futures markets, a dedicated trading journal can be a game-changer. This log book offers over 1000 watchlists and logs, making it suitable for both beginners and experienced traders. It helps track trades, analyze strategies, and improve performance with practical tools like trade ratings, trading plans, and daily analysis steps. The journal emphasizes honesty and reflection, which can boost your win rate considerably. With sections for detailed trade entries, risk management, and performance tracking, it encourages disciplined trading habits. Overall, it’s an essential resource to stay organized, learn from mistakes, and steadily grow your trading skills.

Best For: traders involved in crypto and futures markets seeking a comprehensive, organized journal to improve their trading performance and discipline.

Pros:

- Extensive collection of over 1000 watchlists and logs tailored for crypto and futures trading.

- Practical tools for trade analysis, risk management, and performance tracking to enhance trading strategies.

- Encourages honesty, reflection, and systematic review, leading to higher win rates and disciplined trading habits.

Cons:

- May be too detailed for very casual or beginner traders who prefer minimal tracking.

- Limited space for extensive notes or advanced analysis for highly experienced traders.

- Some users suggest adding features like binder holes or more customizable sections for personalized use.

2025 Trading Journal for Traders

Designed specifically for traders who want to stay organized and improve their performance, the 2025 Trading Journal offers extensive features tailored to active market participants. It helps you track every trade with detailed fields like symbol, trade type, price, gain/loss, and notes, ensuring thorough record-keeping. The stocks watchlist features allow monitoring of key data such as sector, market cap, P/E ratio, and dividend info, keeping you informed of potential investments. Its 8×10-inch size makes it easy to use and visualize your progress. Perfect for traders, investors, or beginners, this journal promotes disciplined trading and strategic analysis to elevate your results.

Best For: active traders, investors, and beginners seeking a comprehensive and organized way to track trades and monitor market data to improve their trading strategies.

Pros:

- Provides detailed trade tracking fields for thorough record-keeping and performance analysis

- Features a stocks watchlist to monitor key investment metrics like sector, market cap, and dividend info

- Sized at 8×10 inches with a premium matte cover, making it easy to handle and visualize progress

Cons:

- May be too large for traders who prefer compact or digital record-keeping solutions

- Limited to physical use, lacking digital or cloud-based accessibility for remote tracking

- Only 110 pages, which might require frequent replacements for active traders with many trades

Factors to Consider When Choosing an Investment Tracking Journal

When choosing an investment tracking journal, I consider how easy it is to use and whether the layout helps me stay organized. I also look for durability and customization options to suit my needs, along with compatibility for tracking different assets. These factors guarantee I select a journal that works well and lasts over time.

Ease of Use

Choosing an investment tracking journal that’s easy to use can make a significant difference in how effectively you monitor your trades. Look for one with a clear, organized layout that allows quick entry of trade details without confusion. Journals with prompts or checklists help guide you through recording essential information like dates, prices, and notes, reducing errors. A user-friendly design with large writing spaces and intuitive sections minimizes the learning curve and saves time. Durability matters too—select journals with high-quality paper and sturdy materials to ensure they last and remain easy to write in over time. Additionally, formats with a table of contents or numbered pages facilitate quick navigation, making reviewing and retrieving data effortless and keeping your portfolio on track.

Layout and Organization

A well-organized layout is essential for an investment tracking journal because it makes entering and finding data straightforward. Clear sections for different asset classes like stocks, options, and cryptocurrencies help keep records thorough and facilitate analysis. Designated areas for trade details, performance metrics, and notes promote consistent documentation and easy comparison over time. Including sections for monthly, quarterly, or annual summaries allows quick reviews of overall portfolio progress and goal tracking. A good organization system, with tables, checklists, and reference pages, supports disciplined tracking and simplifies managing complex data. When choosing a journal, look for a layout that’s logical, intuitive, and tailored to your investment style, making it easier to stay organized and informed.

Durability and Quality

Durability and quality are essential factors to contemplate because your investment journal needs to withstand frequent use and environmental challenges. High-quality binding materials like reinforced covers or leather ensure it holds up over time, even with daily handling. Thick, acid-free paper prevents bleed-through and keeps your notes legible after multiple entries. The binding style, whether sewn or spiral, also impacts longevity and ease of use during regular updates. Weather-resistant or water-resistant covers add extra protection, guarding against damage from spills or weather changes. Choosing a journal with sturdy pages and durable covers minimizes tears, smudges, and other wear and tear, helping it stay functional for the long haul. Prioritizing durability and quality ensures your investment tracking remains intact and reliable over time.

Customization Options

Customization options play a crucial role in making your investment tracking journal truly work for you. They allow you to tailor the journal to your specific asset classes, strategies, and personal preferences, making it more relevant and user-friendly. Features like personalized tables, adjustable sections, and custom prompts help create a layout that matches your workflow. Many journals also offer customizable cover designs, colors, and page layouts, letting you reflect your style or branding. The flexibility to add or remove sections, include personal notes, and choose tracking metrics ensures the journal evolves with your needs. Overall, these options boost engagement and consistency by aligning the journal with your habits, goals, and analytical approach, making it a more effective tool for managing your investments.

Compatibility With Assets

Choosing an investment tracking journal that aligns with your assets is essential for effective portfolio management. I look for journals with dedicated sections for different asset classes like stocks, crypto, forex, options, or commodities. This helps me stay organized and track each asset type accurately. I also check if the journal supports asset-specific metrics such as P/E ratios, dividend tracking, or technical levels like support and resistance. Customizable fields or templates tailored to each asset’s unique features are a big plus, allowing me to record leverage, volatility, or other performance indicators. Lastly, I want flexibility to add or modify sections as my portfolio diversifies. These features ensure my journal adapts to my evolving investment strategy and keeps my tracking precise.

Frequently Asked Questions

How Often Should I Update My Investment Tracking Journal?

You’re probably wondering how often you should update your investment tracking journal. I recommend updating it at least weekly to keep tabs on your portfolio’s performance and make timely adjustments. If you’re very active or markets are volatile, consider updating daily or bi-weekly. Regular updates help you stay informed, spot trends early, and make smarter investment decisions. Consistency is key to maintaining an effective tracking system.

What Features Distinguish a Good Trading Journal From a Basic One?

When I look for a good trading journal, I focus on key features that set it apart from a basic one. A good journal offers detailed data entry options, customizable categories, and easy-to-read charts. It also tracks emotions and decision-making reasons, helping me learn from mistakes. Plus, automation features save time, and secure backups guarantee my data stays safe. These features make tracking more insightful and effective.

Can These Journals Help Identify My Trading Strengths and Weaknesses?

They say knowledge is power, and investment journals are no different. I’ve found that these journals help me pinpoint my trading strengths and weaknesses by tracking patterns, emotions, and decision-making processes. When I review my entries regularly, it’s like shining a light on areas for improvement. This clarity enables me to refine my strategies and avoid repeating mistakes, ultimately making me a smarter, more disciplined trader.

Are There Digital Alternatives to Physical Investment Journals?

You’re wondering if there are digital alternatives to physical investment journals. I’ve found that apps like Personal Capital, Morningstar, and Excel spreadsheets are great options. They let me track my investments easily, analyze performance, and update information on the go. Digital tools make it simple to stay organized and access my data anytime, which is especially helpful when I want real-time insights or need to review my portfolio quickly.

What Is the Ideal Size and Format for an Investment Tracking Journal?

Imagine a quill and parchment in a digital age—that’s the ideal size and format for me. I prefer a compact, portable journal, around A5 to A6 size, to jot down quick updates and detailed notes. A hardcover helps it last through my busy days, and a dotted or grid layout keeps my entries neat. It’s all about balancing portability with enough space to track my investments effectively.

Conclusion

Choosing the right investment tracking journal truly streamlines my portfolio management and sharpens my trading insights. I know some might think it’s just extra clutter, but actually, it’s a smart way to stay disciplined and make informed decisions. By investing in a quality journal, you’re not just tracking your trades—you’re elevating your entire approach to investing. Trust me, the clarity and confidence it brings are well worth the small effort.