Looking to boost your financial skills? I recommend checking out the best money management flashcards, like colorful, durable options that simplify complex concepts and include real-life photos. They’re great for kids, teens, and beginners, promoting recognition, critical thinking, and practical skills. Some come with activities and self-checking answers to reinforce learning. If you’re curious about the top picks and how each can help, there’s more to discover that can truly enhance your financial education.

Key Takeaways

- Look for flashcards with clear, simple visuals and real-world examples to enhance understanding and engagement.

- Choose sets that cover essential topics like budgeting, saving, investing, and time management for comprehensive skills.

- Prioritize durable, high-quality cards with interactive features like self-check answers to promote independent learning.

- Opt for age-appropriate sets that match the learner’s developmental stage, from elementary to teen levels.

- Consider customizable or activity-rich flashcards to encourage critical thinking and practical application of financial concepts.

Financial Literacy Flash Cards: Educational Money Learning Resources

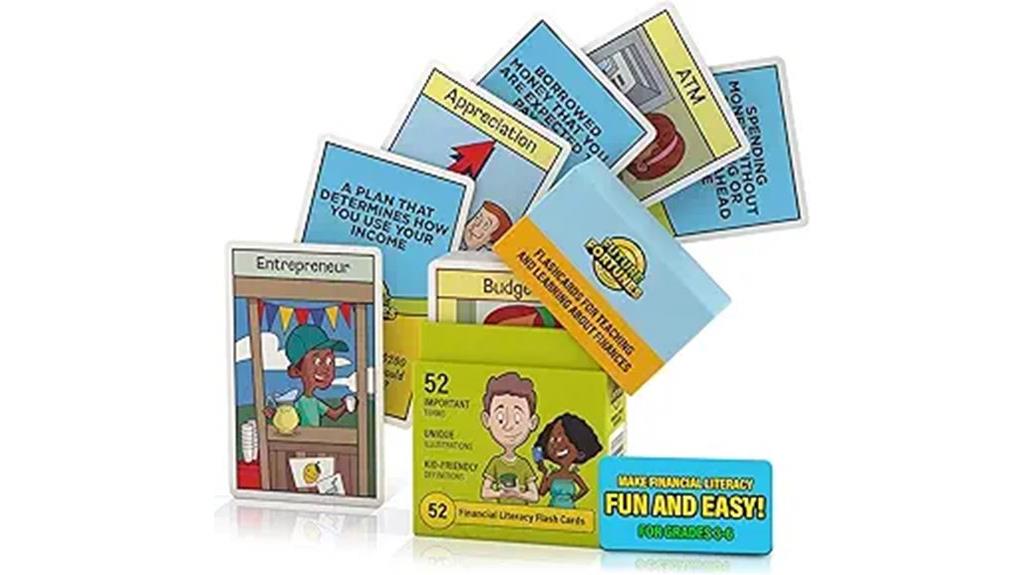

Are you looking for an engaging way to teach kids about money? Financial Literacy Flash Cards from Future Fortunes Academy are perfect for making learning fun and interactive. With 52 colorful cards, they simplify complex ideas like saving, budgeting, and investing into easy-to-understand concepts. These cards promote critical thinking with thought-provoking questions that spark meaningful conversations. They’re versatile, catering to visual, auditory, and kinesthetic learners, ensuring every child can grasp essential financial skills. By turning financial education into an enjoyable activity, these flashcards help children develop smart money habits early—building a solid foundation for future financial success.

Best For: parents, teachers, and guardians seeking an engaging and effective way to teach children essential financial concepts through fun and interactive learning tools.

Pros:

- Bright, colorful graphics make learning about money enjoyable and engaging for kids

- Simplifies complex financial topics into clear, easy-to-understand language suitable for young learners

- Promotes critical thinking and meaningful discussions about money with thought-provoking questions

Cons:

- Limited to 52 cards, which may require supplementing with additional resources for in-depth financial education

- May not fully address advanced financial topics for older or more experienced learners

- Some children might need guidance to fully grasp certain concepts depending on their age or learning style

Teacher Created Resources Money Flash Cards (EP62047) 3-1/8 x 5-1/8

The Teacher Created Resources Money Flash Cards (EP62047) are an excellent choice for educators and students looking to enhance financial literacy through engaging, visual tools. These durable, full-color cards measure 3-1/8 by 5-1/8 inches and include 56 double-sided cards with teaching tips, activities, and blank options for customization. Designed for various educational levels, they help teach money recognition, math, vocabulary, and more. The cards feature unique corner shapes for quick sorting and organization, making them user-friendly. With high ratings and positive reviews, these flash cards make learning about money practical, versatile, and engaging for classroom or individual use.

Best For: educators, parents, and students seeking a versatile and engaging tool to teach money recognition, math, and vocabulary skills effectively.

Pros:

- Durable, full-color, double-sided cards with engaging visuals.

- Includes teaching tips, activities, and blank cards for customization.

- Designed with unique corner shapes for quick sorting and organization.

Cons:

- Some users note that lamination and paper quality could be improved.

- Slightly higher price point compared to basic flash card sets.

- Limited to money-related content, which may require supplementary materials for broader financial literacy.

TREND Time and Money Skill Drill Flash Cards

TREND Time and Money Skill Drill Flash Cards are an excellent choice for educators and parents seeking a durable, engaging tool to teach essential math skills. These sturdy, no-see-through cards come in a convenient two-pack, each with 96 rounded-corner cards covering money, time, numbers, and words. They feature real-life photos and self-checking answers on the back, making learning interactive and confidence-boosting. Ideal for classroom or home use, students can practice telling time, counting coins, and understanding dollar amounts independently or in groups. Many educators praise their quality and engaging design, making them a versatile and effective resource for reinforcing key math concepts.

Best For: educators and parents seeking a durable, engaging tool to teach essential math skills to elementary school students.

Pros:

- Made with sturdy, no-see-through cards that withstand frequent use

- Features real-life photos and self-check answers to boost engagement and independence

- Versatile for various activities such as time-telling, money counting, and number recognition

Cons:

- Limited to basic skills, may require supplementary materials for advanced concepts

- Packaged only in a two-pack, which might require additional sets for larger groups

- Some users report the design and appearance could be more visually appealing

QUOKKA Financial Literacy Flash Cards for Teens

Looking for a fun and effective way to teach teens essential money skills? QUOKKA Financial Literacy Flash Cards are perfect. With 110-100 colorful cards, they cover topics like budgeting, saving, investing, and understanding the economy. The cards use simple definitions, real-life examples, and engaging visuals to make learning accessible and enjoyable. Organized into three color-coded levels—beginner, intermediate, and advanced—they guide teens through increasing complexity. Whether for homeschooling, classroom use, or family activities, these cards promote early financial literacy and smart habits. Despite some minor printing issues, they’re highly rated and versatile, making financial education both fun and practical.

Best For: Teens and educators seeking a fun, engaging way to build foundational financial literacy skills through interactive learning tools.

Pros:

- Color-coded levels facilitate gradual learning and skill progression.

- Bright visuals and simple language make concepts accessible and engaging.

- Versatile for homeschooling, classroom activities, and family learning sessions.

Cons:

- Some cards may have printing errors or blurry images that affect clarity.

- Double-sided printing can complicate sorting and organization.

- Limited advanced content may require supplementary materials for deeper financial topics.

Financial Literacy Flash Cards for Kids and Teens

Are you searching for a fun, engaging way to introduce kids and teens to essential money skills? Financial Literacy Flash Cards are perfect for this. The 54-card set features vibrant graphics and simple text to make complex ideas like saving, budgeting, and investing approachable. Designed for children ages 5 and up, each card includes explanations, real-life case studies, and thought-provoking questions, turning abstract concepts into practical lessons. These cards promote critical thinking and help kids connect financial ideas to everyday situations. They’re versatile tools for homeschooling, classroom learning, or family discussions, making financial education both fun and impactful from a young age.

Best For: parents, teachers, and mentors seeking an engaging, age-appropriate tool to teach children and teens fundamental financial concepts in a fun and practical way.

Pros:

- Vibrant graphics and simple text make complex financial topics accessible and engaging for young learners

- The three-part system (explanation, case study, question) promotes critical thinking and real-world application

- Versatile for use in homeschooling, classroom settings, or family discussions

Cons:

- Some users suggest adding game ideas or instructions to enhance interactivity

- Limited to basic concepts; may require supplementary materials for advanced financial topics

- Made in China, which may be a concern for buyers preferring locally produced educational tools

Trend Enterprises Money Skill Flash Cards for Kids

For children ages 6 and up learning about money, the Trend Enterprises Money Skill Flash Cards provide an engaging and practical way to master key concepts. This set includes 96 sturdy, no-see-through cards featuring real-life photos of U.S. coins and bills from $1 to $20. The cards are designed for skill building and test prep, helping kids recognize money, perform addition, and improve math skills in a fun format. They’re easy to handle and store, with answers on the back for self-checking. Perfect for classroom or homeschool use, these cards make learning about money accessible and enjoyable for young learners.

Best For: educators and parents seeking an engaging, practical tool to teach children aged 6 and up about money recognition, addition, and basic math skills.

Pros:

- Includes real-life photos of U.S. coins and bills to enhance understanding and recognition

- Durable, no-see-through cards with rounded corners ensure safety and long-lasting use

- Self-checking answers on the back facilitate independent learning and test prep

Cons:

- Contains more cards than some users might need, including less common coins like 50-cent pieces and $2 bills

- Limited to U.S. currency, which may not be suitable for international or diverse classroom settings

- Some users desire more variety or scenarios reflecting everyday money transactions

Carson Dellosa Time and Money Flash Cards for Kids 5-7

Carson Dellosa Time and Money Flash Cards for Kids 5-7 are an excellent choice for parents and educators seeking to build foundational math skills in young children. These sets include activities and games that make learning addition and subtraction engaging for kindergarteners. They also feature US states, capitals, and geography facts, making social studies fun and interactive. Made with glossy cardstock and rounded edges, these cards are durable and easy to handle. With over 45 years of educational experience behind them, Carson Dellosa’s resources aim to foster hands-on learning and support continued curiosity beyond the classroom. They’re a versatile tool for early learners.

Best For: parents and educators seeking engaging, durable flashcards to teach young children ages 5-7 foundational math and social studies skills through interactive activities and games.

Pros:

- Promotes hands-on learning with durable, glossy cardstock cards that are easy to handle and flip

- Combines math and social studies topics in one resource, encouraging comprehensive early education

- Includes bonus activity cards with additional games and tips to extend learning beyond initial use

Cons:

- Limited to ages 5-7, may not suit older children needing more advanced content

- Some users might find the number of cards insufficient for extensive lesson plans

- The glossy finish, while durable, may cause glare under certain lighting conditions, making it slightly harder to read at times

BAZIC Money Flash Cards for Counting and Recognizing U.S. Currency

If you’re looking for an engaging way to help children recognize and count U.S. currency, BAZIC Money Flash Cards are an excellent choice. These compact, durable cards include 36 vibrant, double-sided cards that show bills and coins with their amounts and written values, making self-checking easy. They’re suitable for ages 5 and up, ideal for school, home, or group activities. The pack features a blank card for customization, supporting hands-on, visual, and kinesthetic learning. BAZIC’s focus on quality and affordability makes these flashcards a practical tool to make money recognition both fun and educational.

Best For: parents, teachers, and homeschoolers seeking an engaging and practical tool to help children aged 5 and up recognize and count U.S. currency in a fun, interactive way.

Pros:

- Vibrant, double-sided cards enhance visual learning and self-checking.

- Includes a blank card for customization to suit specific learning activities.

- Compact and durable design makes them portable and long-lasting for repeated use.

Cons:

- Limited to U.S. currency, may not be suitable for international learners.

- Price and availability can vary across stores, potentially affecting accessibility.

- Designed primarily for early learners; might be less engaging for older children or advanced students.

Carson Dellosa 54 Time and Money Flash Cards

The Carson Dellosa 54 Time and Money Flash Cards are an excellent choice for parents and educators looking to reinforce fundamental financial and time-telling skills in children aged 5 to 7. These cards are praised for their educational value, helping kids recognize coins, bills, and tell time through engaging, hands-on activities like matching coins and earning rewards. Made from durable, glossy paper with vibrant graphics, they withstand frequent use. While great for quick review, they work best alongside other teaching methods due to some limitations, such as random time displays and currency regional differences. Overall, they boost confidence and independence in young learners.

Best For: Parents and educators seeking a durable, engaging tool to reinforce basic time-telling and money recognition skills in children aged 5 to 7.

Pros:

- Highly educational, promoting practical understanding of coins, bills, and clock reading.

- Made from thick, glossy, and durable material suitable for frequent handling.

- Bright, engaging graphics that boost visual appeal and motivate children to learn independently.

Cons:

- Random time displays may limit systematic learning of clock reading skills.

- Content may not align with regional currencies, e.g., US dollars versus British pounds.

- Should be used as a supplementary tool alongside other teaching methods for comprehensive understanding.

Money Pocket Flash Cards

Money Pocket Flash Cards are an excellent choice for young learners who are just starting to grasp U.S. currency and basic addition. These cards feature 56 two-sided images of coins, with activities that cover amounts up to $1.91, making learning engaging and practical. Their durable, no-see-through design with rounded corners ensures safety and longevity, while their portable size makes them perfect for school, home, or travel. With four activity cards included, they support hands-on practice that aligns with common math standards. I find these cards helpful for making money concepts tangible, encouraging kids to develop confidence and foundational skills in a fun, interactive way.

Best For: young learners ages 6 and up who are beginning to understand U.S. currency and basic addition skills.

Pros:

- Durable, no-see-through cards with rounded safety corners for long-lasting use.

- Portable size ideal for school, home, or travel to promote hands-on learning.

- Includes diverse activities up to $1.91 to reinforce money recognition and addition skills.

Cons:

- May be too simple for older students or those with advanced money skills.

- Limited to U.S. coins, so less suitable for learners studying other currencies.

- Only four activity cards included, which might require additional resources for extended practice.

A Modern Guide to Financial Literacy for Teens

Are you a teen enthusiastic to grasp essential financial concepts without feeling overwhelmed? A Modern Guide to Financial Literacy for Teens is perfect for you. It breaks down key topics like budgeting, saving, investing, and managing debt into simple, actionable steps. The book uses clear explanations, real-life examples, and helpful worksheets to make learning engaging and practical. It also covers modern tools like crypto and robo-advisors, preparing you for today’s financial landscape. Designed to boost confidence, it encourages responsible money habits early. Whether you’re starting college, entering the job market, or just want to be smarter with money, this guide makes financial literacy accessible and relevant.

Best For: teenagers and young adults seeking an accessible, practical introduction to essential financial concepts and habits.

Pros:

- Clear, straightforward explanations make complex topics easy to understand.

- Includes practical worksheets and actionable steps to foster real-world application.

- Covers modern financial tools like crypto and robo-advisors, keeping content current.

Cons:

- Might feel more like a textbook than an engaging story, which could challenge sustained attention.

- Some topics, such as cryptocurrencies, could benefit from more cautious guidance to prevent overconfidence.

- Lacks storytelling or gamified elements to boost engagement and make learning more interactive.

Financially Lit Personal Finance Guide for Teens and Young Adults

Looking for an easy way to introduce teens and young adults to essential financial concepts? Bryan Nicholson’s *Financially Lit Personal Finance Guide* is perfect. It breaks down budgeting, saving, investing, credit use, and inflation in simple, relatable terms. The book emphasizes starting early—like building emergency funds or saving for retirement—showing how small efforts grow over time. With practical tips, real-life examples, and actionable steps, it makes complex topics accessible and engaging. Perfect for beginners, it motivates young people to develop healthy financial habits, gain confidence, and set a strong foundation for long-term wealth and independence.

Best For: Teens and young adults who are new to personal finance and seeking straightforward, practical guidance to build foundational money management skills.

Pros:

- Simplifies complex financial concepts with relatable language and real-life examples

- Focuses on early financial habits like saving, budgeting, and investing to promote long-term wealth

- Practical, actionable tips that are easy to implement for beginners

Cons:

- May lack depth for readers already familiar with basic financial principles

- The straightforward style offers limited narrative or personal storytelling elements

- Less suitable for advanced learners seeking detailed investment or financial planning strategies

PERSONAL FINANCE FOR TEENAGERS: Teen Money Management Skills Guide

Wondering how to help teens grasp essential financial skills quickly and engagingly? I recommend the Teen Money Management Skills Guide from The Teen Advantage Series. It simplifies complex topics like earning, saving, investing, budgeting, and credit management into relatable, friendly language. The book’s interactive approach, including budgeting exercises and stock market simulations, makes learning fun and practical. It’s perfect for teens, parents, and educators seeking to build a strong financial foundation. By focusing on responsible habits early, it helps teens develop confidence and independence in managing money—an essential skill for their future success.

Best For: Teenagers, parents, and educators seeking an engaging, practical guide to developing essential financial skills for future independence.

Pros:

- Simplifies complex financial topics into relatable, easy-to-understand language.

- Uses interactive activities like budgeting exercises and stock market simulations to enhance learning.

- Suitable for a wide audience, including teens, parents, and educators, providing practical tools for financial literacy.

Cons:

- May require adult guidance for younger teens to fully benefit from some activities.

- Some topics might be too basic for older or more financially experienced teens.

- The friendly tone, while engaging, may not appeal to those preferring a more formal or detailed financial approach.

Financial Literacy Flash Cards for Kids in Middle School

These financial literacy flashcards are an excellent choice for middle school students enthusiastic to learn about money in a fun and engaging way. I love how Future Fortunes Academy’s cards feature bright, eye-catching graphics that make complex topics like saving, investing, and budgeting easy to understand. With 52 cards, they turn financial concepts into interactive activities that spark curiosity. These cards introduce essential skills such as creating budgets, understanding cash flow, and making smart money decisions. Plus, their simple language and thought-provoking questions encourage meaningful conversations, helping kids develop confidence and a solid financial foundation early on.

Best For: middle school students and educators seeking a fun, interactive way to teach foundational financial concepts.

Pros:

- Bright, engaging graphics make complex topics accessible and appealing to young learners

- Includes thought-provoking questions that promote critical thinking and meaningful discussions

- Versatile design caters to different learning styles, enhancing understanding and retention

Cons:

- Limited to 52 cards, which may require supplementing with additional resources for in-depth coverage

- Some concepts might be too simplified for advanced learners seeking deeper financial knowledge

- The physical cards may be less effective for remote or digital-only learning environments

Teacher Created Resources Power Pen Learning Cards: Money (6461)

Teacher Created Resources Power Pen Learning Cards: Money (6461) are an excellent choice for educators and parents seeking an engaging, interactive way to teach students in grades 1-4 about money concepts. With 106 problems on 53 double-sided cards, these materials make learning fun and self-paced. When used with the Power Pen device (sold separately), they provide instant audio and visual feedback, reinforcing understanding. Kids enjoy practicing key skills like counting and subtraction, and teachers report increased enthusiasm and progress. The set includes instructions and answer keys, making it perfect for independent practice or classroom reinforcement, ultimately boosting confidence and math skills in young learners.

Best For: educators, parents, and tutors seeking an interactive, self-paced way to teach children in grades 1-4 about money concepts and reinforce math skills.

Pros:

- Provides immediate audio and visual feedback to enhance learning engagement

- Includes a variety of problems to reinforce key skills like counting and subtraction

- Suitable for independent practice and classroom reinforcement, boosting confidence

Cons:

- Power Pen device sold separately, which may add to overall cost

- Requires compatible devices for full interactive features

- Some users may find the set limited without additional cards or resources

Factors to Consider When Choosing Money Management Flashcards

When choosing money management flashcards, I always consider factors like age appropriateness and how complex the concepts are. I also look for designs that are visually appealing and engaging, along with features that encourage interaction. Finally, I check if they’re durable and made from quality materials to guarantee they last.

Age Appropriateness

Choosing the right money management flashcards depends heavily on the child’s age, as it guarantees the content matches their developmental level and understanding of financial concepts. For young children, I recommend cards with simple language, bright visuals, and basic skills like recognizing coins and bills. These help build foundational money awareness. As kids grow older, I look for flashcards that introduce more complex topics such as budgeting, saving, investing, and financial decisions, aligning with their cognitive development. It’s also important to ascertain the content fits their current curriculum or learning goals to reinforce what they’re already studying. Additionally, I pay attention to design features like large print and engaging graphics, which keep their interest and make learning more effective for their age.

Concept Complexity

How do you guarantee that the complexity of money management flashcards matches a learner’s current abilities? First, I assess whether the concepts are suited to the learner’s age and understanding level, avoiding overwhelm or under-challenge. Clear, concise explanations are essential—they simplify complex topics without losing necessary details. I also look for materials where difficulty gradually increases, supporting steady learning progress and comprehension. Including relevant examples, explanations, and questions tailored to the learner’s skill level ensures alignment with their goals. By evaluating these factors, I ensure the flashcards provide an appropriate challenge, fostering confidence and mastery without causing frustration. This thoughtful approach helps maximize the educational value and keeps learning engaging and effective.

Visual Appeal

The visual appeal of money management flashcards plays a significant role in engaging learners and reinforcing their understanding. Bright, colorful graphics instantly capture attention and make learning more enjoyable. Visually appealing designs help children connect images with financial concepts, improving memory retention. Clear illustrations and icons simplify complex ideas like savings or investments, making them easier to grasp. Attractive visuals also motivate students to interact more frequently with the flashcards, reinforcing their learning process. Well-designed visual elements cater to different learning styles—whether visual, auditory, or kinesthetic—ensuring that a wider range of learners benefit. Overall, selecting flashcards with compelling visuals enhances engagement, comprehension, and motivation, making financial education both effective and enjoyable.

Interactivity Features

Incorporating interactivity features into money management flashcards can substantially boost engagement and reinforce learning. Features like self-checking answers, quizzes, or audio feedback make the experience more dynamic and help solidify key concepts. Devices such as Power Pen learning cards offer immediate audio and visual responses, making lessons more lively. Including thought-provoking questions or real-life scenarios encourages critical thinking and meaningful discussions about financial topics. Interactive elements also cater to different learning styles—whether you’re kinesthetic or auditory—by providing hands-on or auditory feedback. Additionally, customizable blank cards or game-based activities increase participation and make learning about money more enjoyable. These features turn passive memorization into active, engaging learning, ensuring better retention and comprehension.

Durability and Material

Choosing durable money management flashcards is essential because they often withstand frequent handling, especially when used by children. I look for cards made from thick cardstock or laminated materials, as these resist tearing, bending, and staining. High-quality laminated paper or plastic ensures the cards last longer, even with daily use. Rounded edges and sturdy construction help reduce wear and tear, keeping the cards in good shape over time. I also pay attention to double-sided printing and high-quality ink, which improve clarity and prevent smudging or fading. Reinforced holes or binding options are a bonus, making it easier to organize and store the flashcards securely. Overall, durable materials guarantee that my investment in learning tools pays off in the long run.

Content Customization

When selecting money management flashcards, considering their customization options is crucial because it allows me to tailor the content to fit specific learning needs. Customizable flashcards often feature blank or write-on areas, making it easy to personalize questions or scenarios that resonate with the learner’s experiences. I can add local currency, relevant financial concepts, or real-world examples, increasing relevance and engagement. Flexible designs, such as refillable or erasable surfaces, support ongoing updates and repeated use without needing new cards. This adaptability ensures the material aligns with different age groups, skill levels, and curriculum goals. Ultimately, customizable options help me create a more effective, engaging learning experience that addresses individual learning styles and specific financial education objectives.

Educational Alignment

Selecting the right money management flashcards requires more than just engaging content; it’s important to guarantee they align with educational standards and curriculum goals. I look for flashcards tailored to the target age group or grade level, ensuring they cover fundamental concepts like saving, budgeting, investing, and cash flow that suit learners’ developmental stages. The language and complexity should match their reading and comprehension abilities, making the material accessible without oversimplifying. I also check for supplemental features, such as discussion questions or activities, which promote active learning and reinforce key financial skills. finally, I verify that the flashcards incorporate current financial practices and terminology, providing relevant, up-to-date information that prepares learners for real-world financial decision-making.

Price and Value

Ever wondered how to get the best value when buying money management flashcards? To do that, I recommend comparing prices across different sets to see which offers the most for your budget. Pay attention to the number of cards included—more cards for a fair price usually mean better value. Also, check the quality; durable, high-quality materials will last longer and provide a better learning experience. Don’t forget to see if extra resources, like activity guides or customization options, come with the set at no extra cost—they add a lot of value. Finally, read customer reviews and ratings to gauge if the price matches the perceived quality and educational benefits. A good deal balances cost, quality, and added features for maximum learning.

Frequently Asked Questions

How Do Flashcards Improve Long-Term Financial Habits?

Using flashcards helps me reinforce key financial concepts and stay consistent with my money goals. They make it easier to review important topics regularly, which builds my financial knowledge over time. By actively recalling information, I develop better habits and make smarter decisions. Plus, the quick, focused sessions keep me engaged and motivated, ultimately turning small daily habits into long-term financial success.

Are Digital Flashcards More Effective Than Physical Ones?

Imagine I’m trying to learn about budgeting; I find digital flashcards more effective because I can easily review them on my phone during breaks, reinforcing my knowledge. Digital flashcards often include interactive features and quick updates, making learning more engaging and accessible. For me, they’re more convenient and versatile than physical cards, helping me stay consistent with my financial education whenever I have a few spare moments.

What Age Group Benefits Most From Money Management Flashcards?

I believe that teenagers and young adults benefit most from money management flashcards. They’re at a vital age to learn financial skills early on, and flashcards make complex concepts easier to understand and remember. I’ve seen how engaging and interactive tools like these can boost confidence in handling money. If you’re guiding someone in this age group, these flashcards are a fantastic resource to help them build solid financial habits.

How Often Should I Review Flashcards to Maximize Learning?

I recommend reviewing your flashcards at least once a day to reinforce your learning. After the initial study, try spacing out reviews every 2-3 days, then weekly, to strengthen retention. Consistency is key. If you find certain concepts tricky, review those more frequently. I personally find that regular, short sessions work best for me, helping me stay engaged and retain financial skills effectively.

Can Flashcards Replace Comprehensive Financial Education Programs?

Imagine trying to build a house with just a few bricks—that’s what relying solely on flashcards feels like for replacing full financial education. While flashcards are great for quick recall and reinforcing key concepts, they can’t replace the depth, context, and personalized guidance a thorough program offers. I believe combining both provides the best chance to truly understand and manage your finances effectively, rather than depending on flashcards alone.

Conclusion

Whether you’re just starting out or looking to sharpen your financial skills, these flashcards are like keys revealing a brighter money-savvy future. Picture each card as a stepping stone across a stream of financial knowledge, guiding you smoothly toward confidence and independence. With every flip, you’re building a sturdy bridge to smarter money habits, making your financial journey not just easier but truly empowering. Let these tools light your path to financial mastery.