Looking to boost your money knowledge in 2025? I recommend exploring a mix of practical guides and psychology-focused books that simplify complex financial ideas. Popular titles like *I Will Teach You to Be Rich* and *The Psychology of Money* blend mindset and strategies, while resources tailored for young adults and visual learners help build solid habits early. If you keep exploring, you’ll discover more ways to master your finances and grow lasting wealth.

Key Takeaways

- Focus on books that simplify complex financial concepts for beginners and underserved communities.

- Prioritize titles that emphasize mindset, behavioral finance, and practical strategies for wealth-building.

- Look for resources with visual aids, step-by-step guidance, and real-life success stories.

- Include a mix of foundational, technical, and motivational books suitable for diverse audiences.

- Select titles that are up-to-date and applicable for mastering financial literacy in 2025.

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness

As an affiliate, we earn on qualifying purchases.

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness

If you’re looking to understand how psychology influences financial decisions, “The Psychology of Money” is a must-read. It reveals that wealth isn’t just about smart choices but aligning money with personal values, emotions, and habits. The book emphasizes long-term thinking, patience, and the power of compounding, showing wealth results from consistent, disciplined investing. It also highlights that true wealth isn’t visible through possessions but through a mindset that recognizes luck, risk, and storytelling. Understanding your own psychology—like greed and fear—can prevent poor decisions. Ultimately, humility, empathy, and planning for the unexpected are key to building and maintaining lasting wealth.

Best For: individuals seeking to understand the psychological factors behind financial decision-making and how to build sustainable wealth aligned with personal values.

Pros:

- Offers timeless insights on patience, long-term thinking, and the power of compound interest.

- Emphasizes the importance of understanding personal psychology, emotions, and habits in managing money.

- Encourages humility and risk-awareness, helping readers develop resilient financial plans.

Cons:

- May oversimplify complex financial strategies for some readers.

- Focuses more on behavioral principles than on specific investment tactics or market analysis.

- The concepts can be abstract and require self-awareness and discipline to implement effectively.

Financial Literacy For All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle Class

As an affiliate, we earn on qualifying purchases.

Financial Literacy for All Book

Financial Literacy for All by John Hope Bryant stands out as an essential read for anyone seeking practical, accessible guidance on personal finance, especially those from underserved communities. This book’s concise, easy-to-understand approach makes complex financial concepts approachable. Bryant shares personal stories, research, and experience to inspire hope and motivate change. It emphasizes the importance of financial literacy in disrupting struggles and building wealth, particularly for minorities and underserved groups. While not a step-by-step guide, it encourages tailored strategies and understanding economic principles. Overall, it’s a powerful tool to empower individuals, families, and communities to take control of their financial futures.

Best For: individuals from underserved communities, parents, teachers, and adults seeking accessible financial education to empower themselves and others.

Pros:

- Concise and easy-to-understand format makes complex financial concepts accessible

- Inspires hope and motivation through personal stories and practical insights

- Advocates for integrating financial literacy into education and community programs

Cons:

- Lacks detailed step-by-step financial strategies or specific investment advice

- Focuses more on storytelling and motivation than on comprehensive financial tips

- May require supplementary resources for in-depth financial planning

I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

It can be a gift option

As an affiliate, we earn on qualifying purchases.

I Will Teach You to Be Rich: No Guilt, No Excuses, 6-Week Program (Second Edition)

Ramit Sethi’s “I Will Teach You to Be Rich: No Guilt, No Excuses, 6-Week Program (Second Edition)” stands out as an ideal choice for anyone who wants a practical, straightforward approach to personal finance that emphasizes automation and conscious spending. I love how Ramit encourages living a “Rich Life” by prioritizing happiness and intentional spending, not deprivation. His focus on automating bills and investments makes managing money effortless. Plus, his practical scripts boost confidence in financial conversations, from negotiating fees to discussing money with partners. This book helps you shift your mindset from restriction to strategic enjoyment, making it a powerful tool for financial freedom.

Best For: individuals seeking a practical, automated, and happiness-focused approach to personal finance that emphasizes strategic spending and confidence in financial conversations.

Pros:

- Emphasizes automation to streamline financial management and save time

- Focuses on conscious spending and aligning expenses with personal happiness

- Provides practical scripts for negotiating fees, waivers, and financial discussions

Cons:

- Less detailed guidance on real estate investing and major asset purchases like cars

- Minimal discussion of specific stock picking strategies beyond index funds

- Some readers may find the lack of deep dive into certain investment topics limiting

Financial Literacy for Young Adults Simplified: Discover How to Manage, Save, and Invest Money to Build a Secure & Independent Future

As an affiliate, we earn on qualifying purchases.

Financial Literacy for Young Adults

Young adults just starting their financial journey will find “Financial Literacy for Young Adults” an invaluable resource. This straightforward guide offers practical tips on managing, saving, and investing money, making complex topics easy to understand. It emphasizes the importance of budgeting, controlling spending, and developing good financial habits early. Whether you’re a student or just beginning to build your financial future, the book helps you gain control over your money and avoid common mistakes. Its clear language and actionable advice motivate you to take charge of your finances now, setting the foundation for long-term financial independence and security.

Best For: young adults, students, and beginners seeking straightforward guidance to manage, save, and invest money effectively.

Pros:

- Clear, simple language making complex financial concepts easy to understand.

- Practical, actionable advice that helps develop good financial habits early.

- Highly motivational, encouraging readers to take control of their financial future.

Cons:

- May lack in-depth coverage of advanced investment strategies.

- Focuses mainly on basic financial skills, which might not satisfy those seeking detailed financial planning.

- Some readers may find it too simplified if they already have some financial knowledge.

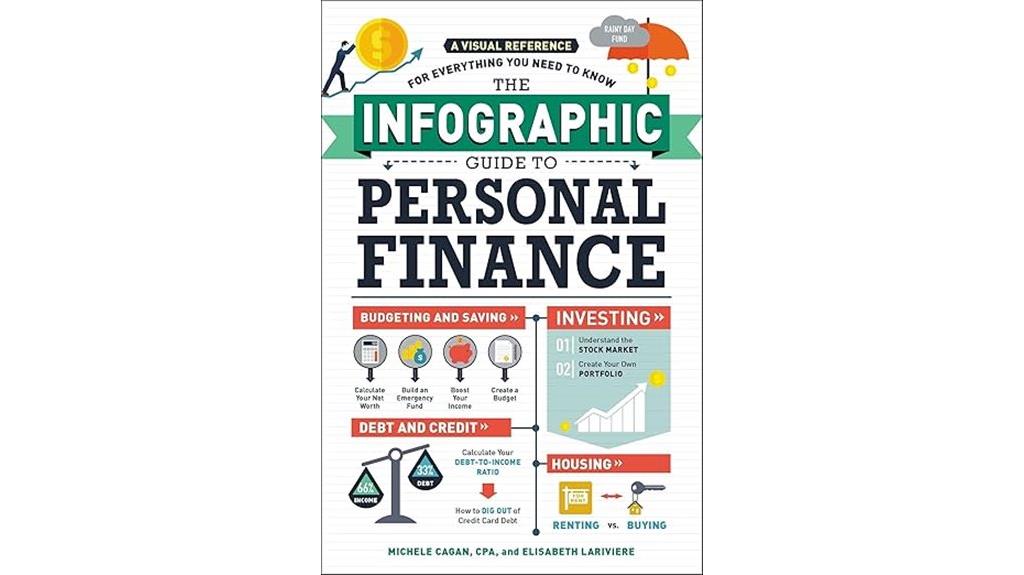

The Infographic Guide to Personal Finance

If you’re just starting your journey into personal finance or need a clear, straightforward overview, “The Infographic Guide to Personal Finance” is an excellent resource. It’s praised for being thorough, easy to understand, and perfect for beginners or those with short attention spans. At just 122 pages, it offers practical advice on budgeting, home buying, and managing money, enhanced with colorful infographics and illustrations. Many readers find it helpful for steering through adulting, teaching kids, or gaining confidence in financial decisions. While USA-centric, its step-by-step guidance makes complex topics accessible, making it a valuable starting point for building financial literacy.

Best For: beginners, teens, and those seeking a quick, easy-to-understand introduction to personal finance, especially within the US context.

Pros:

- Clear, straightforward explanations with practical infographics that aid understanding

- Accessible and well-suited for beginners or those with limited attention spans

- Useful as an educational tool for young learners, families, and individuals new to financial literacy

Cons:

- Primarily US-centric, limiting relevance for international audiences

- Some readers find the depth insufficient for more advanced or experienced learners

- Infographic style may lack emotional or data-driven impact for certain learning preferences

The Total Money Makeover Book

The Total Money Makeover by Dave Ramsey stands out as an essential read for anyone overwhelmed by debt and enthusiastic to regain financial control. Ramsey offers straightforward, proven strategies to eliminate debt, avoid scams, and make smarter financial choices. His no-nonsense approach emphasizes discipline, mindset shifts, and practical steps like paying off credit cards and student loans. The book is packed with real-life success stories, worksheets, and clear guidance tailored for those seeking debt relief or better money management. Whether you’re a recent graduate or a family aiming for financial stability, this book can motivate and equip you to achieve lasting financial peace.

Best For: individuals overwhelmed by debt who want practical, straightforward strategies to regain financial control and achieve lasting financial peace.

Pros:

- Clear, actionable steps that simplify debt elimination and money management

- Motivational real-life success stories that encourage commitment

- Emphasis on discipline and mindset shifts that promote long-term financial health

Cons:

- Limited detailed investment advice for wealth building

- Some content is US-centric, which may not fully apply to international readers

- The initial chapters can be challenging for those new to financial concepts

Rich Dad Poor Dad Book on Money and Wealth

Rich Dad Poor Dad stands out as a must-read for anyone enthusiastic to grasp the fundamentals of money and wealth creation. I found its core ideas eye-opening—understanding that the wealthy focus on building cash-flowing assets, mastering taxes, and taking calculated risks. The book clarifies the difference between assets and liabilities, inspiring me to analyze my finances differently. It emphasizes surrounding yourself with knowledgeable people, acting quickly on opportunities, and not letting fear hold you back. Many readers, including myself, experience a shift in mindset that encourages continuous learning and action. Ultimately, it’s a powerful guide to creating lasting financial independence.

Best For: individuals seeking a clear, accessible introduction to financial principles and wealth-building strategies, especially beginners eager to change their mindset about money.

Pros:

- Provides easy-to-understand concepts on assets, liabilities, and cash flow.

- Motivates proactive financial actions and continuous learning.

- Offers practical advice on overcoming fears and leveraging opportunities.

Cons:

- Some readers may find the advice too simplified or basic.

- The focus is more on mindset and principles rather than detailed investment strategies.

- May require additional resources for in-depth financial planning or advanced investing.

Think and Grow Rich Book

“Think and Grow Rich” stands out as a must-read for anyone serious about transforming their mindset and achieving financial success. This classic bestseller has changed countless lives by emphasizing the power of desire, faith, persistence, and connecting with infinite intelligence. I’ve seen its principles inspire major breakthroughs—whether losing weight, doubling income, or overcoming mental barriers. The book’s focus on mental discipline and focused thoughts makes success achievable across all areas of life. Its practical, motivational approach pushes you to take full control of your destiny. If you’re committed to growth and abundance, this book is an essential tool for your journey.

Best For: individuals seeking practical guidance and motivation to transform their mindset, achieve financial success, and unlock their full potential through proven success principles.

Pros:

- Provides timeless, practical principles rooted in the law of attraction and mental discipline that can be applied across all areas of life

- Highly motivational and inspiring, encouraging persistent effort and self-empowerment

- Has transformed countless lives with testimonials of major breakthroughs in wealth, health, and personal growth

Cons:

- The audiobook narration quality is often criticized, which may hinder understanding and engagement

- The physical book’s small size and thick pages can be difficult to read comfortably without proper formatting

- Some readers may find the language or presentation somewhat dated or repetitive, requiring multiple readings for full comprehension

Get Good with Money: Ten Simple Steps to Becoming Financially Whole

If you’re looking for a practical, relatable guide to take control of your finances, “Get Good with Money” offers ten straightforward steps to help you become financially whole. Tiffany Aliche shares her journey and proven strategies to build confidence, manage money wisely, and create sustainable habits. The book’s friendly, jargon-free style makes complex topics like budgeting, saving, and investing easy to understand. It emphasizes practical action over abstract goals, empowering you to make meaningful progress. Perfect for beginners and seasoned learners alike, it’s a valuable resource to help you develop lifelong financial skills and achieve your money goals.

Best For: beginners seeking an accessible, practical guide to improve their financial literacy and build sustainable money habits.

Pros:

- Clear, jargon-free writing makes complex financial concepts easy to understand.

- Practical, actionable steps that can be implemented immediately for real progress.

- Engaging and relatable style that motivates and empowers readers of all ages and backgrounds.

Cons:

- Some readers may find moments of redundancy throughout the book.

- As a broad overview, it may lack in-depth coverage of advanced topics for seasoned investors.

- The personal anecdotes, while inspiring, might not resonate with everyone seeking purely technical guidance.

Financial Intelligence, Revised Edition

Financial Intelligence, Revised Edition stands out as an essential resource for anyone new to business finance or seeking a clear, approachable introduction. I appreciate how it breaks down complex topics into short, engaging chapters suitable for all levels. The book focuses on practical understanding, emphasizing why financial concepts matter in real-world decisions, using real-world examples and illustrations. Whether you’re a manager, non-financial professional, or just curious, it helps you interpret financial statements and grasp core principles confidently. Its straightforward language makes learning accessible and enjoyable, making it an invaluable guide to improving financial literacy and making smarter business choices.

Best For: individuals new to business finance or seeking a clear, practical introduction to financial principles to enhance decision-making skills.

Pros:

- Highly readable and engaging, suitable for all levels including beginners and non-financial professionals

- Focuses on practical understanding and real-world application of financial concepts

- Uses straightforward language, illustrations, and examples to clarify complex topics

Cons:

- May not delve deeply into advanced or technical financial analysis for experienced professionals

- Some readers might desire more detailed coverage of accounting standards and regulations

- The simplified approach might overlook nuanced financial strategies used by experts

Financial Literacy for Teens and Young Adults 101

Are you a teen or young adult enthusiastic to master money management skills early on? If so, “Financial Literacy for Teens and Young Adults 101” is a must-have. It covers personal finance basics like developing healthy money beliefs, handling debt responsibly, and understanding credit scores. The book emphasizes early savings through fun methods like the Challenge Savings Plan, saving over a year. It introduces budgeting with digital tools and creative saving strategies. Plus, it explores investing, retirement planning, earning extra income, and understanding the economy. This guide prepares you for real-world financial decisions, helping you build confidence, avoid mistakes, and set a solid financial foundation for the future.

Best For: teens and young adults seeking a comprehensive, accessible guide to developing responsible money habits, understanding credit, investing, and preparing for financial independence.

Pros:

- Covers a wide range of topics from budgeting to investing, making it a one-stop resource.

- Uses interactive elements like QR codes to engage learners with apps, quizzes, and videos.

- Emphasizes early financial habits, saving strategies, and responsible debt management to build a strong foundation.

Cons:

- May be overwhelming for complete beginners without prior financial knowledge.

- Some advanced topics like FIRE and real estate are briefly touched on, possibly requiring additional research.

- Digital tools and apps mentioned may require internet access and familiarity with technology, which could be a barrier for some users.

Financial Literacy Lessons & Activities for Grade 6 Teacher’s Resource Book

The “Financial Literacy Lessons & Activities for Grade 6 Teacher’s Resource Book” stands out as an essential tool for educators and homeschooling parents aiming to equip sixth graders with practical money management skills. It covers key topics like saving, banking, budgeting, and paying bills, ensuring students understand each concept thoroughly before moving on. The book is praised for its engaging, easy-to-understand activities that promote real-world application. With all-encompassing teacher instructions and reproducible worksheets, it supports effective instruction. Students enjoy the lessons, and teachers report noticeable improvements in their understanding of money management, making it a valuable resource for building financial responsibility early on.

Best For: educators and homeschooling parents seeking a comprehensive, engaging resource to teach sixth graders essential financial management skills through practical activities.

Pros:

- Covers a wide range of relevant financial topics with clear, step-by-step instructions.

- Includes reproducible worksheets and engaging activities that reinforce learning.

- Highly praised for its ease of use, practicality, and ability to improve students’ understanding of money management.

Cons:

- May require additional preparation time for teachers to implement all activities effectively.

- Some users might find the content slightly more comprehensive than needed for certain grade levels.

- As a printed resource, it may not include digital or interactive components for tech-savvy classrooms.

The Complete Guide to Financial Literacy for Teens

If you’re a teen enthusiastic to take control of your financial future, this guide offers the perfect starting point. It covers essential concepts like budgeting, saving, investing, and managing credit, breaking them down into simple, actionable steps. You’ll learn how to set realistic goals, avoid debt, and build wealth responsibly. The book also explains banking basics, taxes, and responsible borrowing, making complex topics approachable. Plus, it includes practical tools like templates and activities to help you apply what you learn immediately. By developing strong money habits now, you’ll set yourself up for long-term financial independence and success.

Best For: Teenagers and young adults seeking an accessible, comprehensive introduction to financial literacy to build responsible money habits early.

Pros:

- Simplifies complex financial topics into easy-to-understand steps suitable for beginners

- Includes practical tools like templates and activities for immediate application

- Emphasizes responsible money management, fostering independence and long-term success

Cons:

- May lack in-depth coverage of advanced investing or financial planning topics for older teens

- Some readers might find the material too basic if they already have foundational knowledge

- Does not include personalized financial advice or one-on-one coaching options

Financial Literacy & Ownership: What They Dont Want Us to Know

Looking for a resource that truly empowers Black communities to take control of their financial futures? Dameon V. Russell’s book is that tool. Praised as a compelling, must-read powerhouse, it opens eyes to financial realities most don’t want us to see. The core message is clear: financial literacy is essential for increasing ownership of assets and building wealth. It exposes the gap created by ignorance and emphasizes that understanding asset ownership can transform lives. Although some chapters lack immediate action steps, the practical advice offered helps readers set and achieve financial goals. This book is a crucial step toward empowering Black individuals to claim their economic future.

Best For: Black individuals seeking to understand and improve their financial literacy and ownership skills to build wealth and economic empowerment.

Pros:

- Highly praised for its captivating and impactful messages that resonate deeply with readers.

- Provides practical guidance and insights on wealth creation and asset ownership tailored for the Black community.

- Encourages collective learning and action, fostering community empowerment and financial literacy growth.

Cons:

- Some initial chapters lack immediate actionable steps, which may require additional resources or guidance.

- Not a strict step-by-step blueprint, so readers may need to supplement with other financial education tools.

- The focus is primarily on awareness and understanding, which might require further application efforts for tangible results.

The ABCs of Financial Literacy for Young Adults

Young adults just starting their financial journey will find “The ABCs of Financial Literacy for Young Adults” especially helpful. It provides a straightforward introduction to essential money skills like budgeting, saving, investing, and managing credit. The book breaks down complex concepts into simple lessons, making them accessible for beginners. With practical strategies, worksheets, and checklists, it encourages applying what you learn to real life. The content is engaging and logical, covering topics like money mindset and risk tolerance, while offering valuable resources. This book is an excellent starting point for anyone enthusiastic to build a strong financial foundation and achieve long-term success.

Best For: Young adults and beginners seeking a clear, practical introduction to financial literacy to build a strong foundation for long-term financial success.

Pros:

- Simplifies complex financial concepts into easy-to-understand lessons suitable for beginners

- Provides practical strategies, worksheets, and checklists to facilitate real-world application

- Covers a wide range of topics including budgeting, saving, investing, credit, and mindset with engaging and logical content

Cons:

- Some sections may contain outdated information or lack references, affecting reliability

- The abundance of financial options presented can be overwhelming without clear guidance

- Certain examples and topics might feel dense or overly ambitious for casual readers or absolute beginners

Factors to Consider When Choosing a Financial Literacy Book

When selecting a financial literacy book, I consider how well it matches my needs, whether the content is detailed enough, and if it offers practical tips I can apply. I also look at the readability level to make certain I can follow along easily and check if the cultural context resonates with my background. These factors help me find a book that’s both useful and engaging for my financial journey.

Audience Relevance

How do you choose a financial literacy book that truly fits your needs? First, consider whether the content matches your age and knowledge level—what works for teens may not suit adults. Think about your background; a book that reflects your cultural or socioeconomic context will feel more relevant and relatable. Also, assess if the material aligns with your goals—whether you’re learning basic money management or aiming to master investing. Check if the language and teaching style are easy for you to understand and stay engaged with. Ultimately, look for books that offer practical, actionable advice tailored to real-world challenges you face. Picking a book that resonates with your specific situation makes learning more effective and enjoyable.

Content Depth

Choosing a financial literacy book that matches your needs also means paying attention to its depth of content. I look for books that thoroughly cover core concepts like budgeting, saving, investing, and credit, ensuring I get a well-rounded understanding. It’s important that the material includes practical examples, worksheets, or real-world scenarios that help reinforce what I learn and make it applicable. I also check if the book explores into advanced topics like risk management or commodities, matching my current knowledge level. Ideally, the content goes beyond surface explanations, exploring underlying principles, data, and reasoning behind financial practices. A good book balances foundational knowledge with detailed insights, avoiding overly simplistic or overly technical material that could hinder my comprehension.

Practical Strategies

Selecting a financial literacy book with practical strategies means looking for resources that offer clear, actionable steps you can apply immediately. I focus on books that include tools like worksheets, checklists, or real-life scenarios, which make applying concepts straightforward. It’s vital to prioritize books that cover foundational skills such as budgeting, saving, and responsible credit use, especially for beginners. I also look for resources with specific strategies for managing debt, investing, and building wealth, rather than vague theories. Updated data and relevant examples tailored to today’s financial environment help make lessons more applicable. Additionally, I value books that emphasize the behavioral and psychological aspects of money management, as fostering good habits and mindsets is imperative for long-term success.

Readability Level

The readability level of a financial literacy book plays a crucial role in how effectively you can learn and apply its lessons. Choosing a book that matches your reading skills ensures the concepts are clear without causing frustration. For beginners or young learners, clear, simple language reduces cognitive overload and makes complex ideas more approachable. If you’re more advanced or familiar with financial terminology, books with technical terms and detailed explanations might be better suited. Visual aids like illustrations and infographics can also boost understanding, especially for visual learners. Selecting a book with an appropriate readability level keeps you engaged and makes learning enjoyable. Ultimately, the right balance helps you absorb knowledge efficiently and stay motivated throughout your financial education journey.

Cultural Context

Since financial practices and norms differ widely across cultures, understanding the cultural context is essential when choosing a financial literacy book. A book tailored to your cultural background will address local economic systems, currency, financial products, and societal expectations, making the advice more relevant. Recognizing how your community views debt, savings, and investment helps ensure the strategies align with your values and norms. Culturally specific examples and scenarios make the material more relatable, boosting engagement and practical application. Selecting a book that reflects your cultural experiences and challenges enhances its effectiveness, encouraging responsible financial behaviors within your community. Ultimately, a culturally aware approach guarantees the information resonates deeply, empowering you to make informed financial decisions that fit your unique context.

Author Expertise

How can you tell if an author truly knows their stuff? Start by reviewing their professional background, educational credentials, and practical experience in finance. Authors with recognized certifications or affiliations with reputable financial organizations often bring credibility and deeper insight. Look for proven experience in teaching, consulting, or managing finances—these suggest they understand real-world applications. Publications, awards, or contributions to financial education initiatives are strong indicators of industry recognition. Additionally, consider how well they’ve translated complex concepts into accessible language; this shows their skill in educating diverse audiences. An author with a solid track record demonstrates authority and a genuine grasp of financial literacy. Choosing books by such experts ensures you’re learning from credible, knowledgeable sources.

Visual Aids

Choosing an author with proven expertise guarantees you’re learning from credible sources, but how that knowledge is conveyed also matters. Effective visual aids like infographics and charts can make complex financial concepts easier to grasp and remember. Well-designed visuals should accurately represent data, avoiding misleading or confusing elements, to assure clarity. Incorporating color coding and visual hierarchy helps highlight key information and guides you logically through topics. Illustrations and graphics cater to visual learners, making concepts more engaging and easier to retain. However, cluttered or poorly executed visuals can hinder understanding, so simplicity and clarity are essential. When choosing a financial literacy book, look for those that balance informative content with clear, effective visuals to enhance your learning experience.

Frequently Asked Questions

How Do I Choose the Best Financial Literacy Book for My Learning Style?

When choosing a financial literacy book, I focus on my learning style first. If I prefer visuals, I pick books with charts and diagrams. If I learn by doing, I look for practical exercises. I also consider the author’s tone—whether I want straightforward advice or a detailed explanation. Reading reviews helps me see if the book matches my needs. Ultimately, I choose one that feels engaging and easy to understand.

Are These Books Suitable for Complete Beginners in Finance?

You might worry these books are too advanced if you’re a complete beginner. I get it, but many of these books are designed for all levels, starting with basics and gradually building up your knowledge. I’ve found that even if you’re new to finance, these books can help you understand fundamental concepts without feeling overwhelmed. Just pick one that matches your comfort level, and you’ll see your confidence grow!

Which Books Cover Advanced Investing and Wealth-Building Strategies?

You’re asking about books that delve into advanced investing and wealth-building strategies. I recommend “The Intelligent Investor” by Benjamin Graham for value investing, and “Unshakeable” by Tony Robbins for broader financial strategies. “The Little Book of Common Sense Investing” by John C. Bogle is also excellent for understanding index funds. These books challenge you to think strategically and deepen your financial expertise, perfect for those ready to elevate their investing game.

Do These Books Include Practical Exercises or Action Plans?

Many of these books do include practical exercises and action plans to help you apply what you learn. I find that exercises like budgeting, goal-setting, or investment simulations are common, making the concepts more tangible. They encourage you to take immediate steps toward financial growth. So, if you’re looking to actively improve your money skills, these books often provide valuable tools to guide your progress.

How Often Should I Revisit These Books to Maintain Financial Knowledge?

Did you know that 85% of people forget what they learn in a book within a month? I recommend revisiting financial books every three to six months. This keeps concepts fresh and helps you implement strategies effectively. I personally set reminders to review key chapters or notes. Consistent revisiting reinforces good habits and deepens your understanding, making your financial knowledge more resilient and adaptable over time.

Conclusion

Diving into these books is like planting seeds in your financial garden—each one helps you grow stronger and more confident. With the right knowledge, you’ll be better equipped to navigate the twists and turns of money management. So, pick a book, start reading, and watch your financial landscape flourish. Remember, the seeds you plant today will bloom into your financial freedom tomorrow. Let’s cultivate that wealth together!