If you’re looking for the best family finance board games to teach money skills while having fun, I’ve found some great options. From the engaging Rich Dad CASHFLOW to the easy-to-learn The Game of Pay Day, these games cover budgeting, investing, and strategic thinking across all ages. Durability and educational value are key. Keep exploring these top choices, and you’ll discover how to make learning about money both effective and enjoyable for everyone.

Key Takeaways

- Top family finance games combine engaging gameplay with real-life financial concepts like budgeting, investing, and saving.

- They cater to different age groups, from children to teens and adults, ensuring inclusive family learning.

- Many games emphasize critical thinking, decision-making, and strategic planning to build practical money skills.

- Durability, ease of understanding, and fun factor are key considerations for selecting effective educational games.

- Award-winning options like BeFree, Rich Dad CASHFLOW, and Grandpa Beck’s offer proven educational value and entertainment.

BeFree Strategy & Financial Literacy Board Game for Families and Teens

If you’re looking for a fun and practical way to teach teens and family members about money management, the BeFree Strategy & Financial Literacy Board Game is an excellent choice. It offers modern financial education through engaging gameplay that covers budgeting, saving, investing, and analyzing real-market deals. The game emphasizes practical skills like risk assessment and strategic decision-making, making complex concepts accessible. Its high-quality design and simple rules guarantee durability and ease of play. Most importantly, it sparks meaningful conversations about finances, helping players develop real-life skills while enjoying quality family time or group activities.

Best For: families, teens, and group learners seeking engaging, practical financial education through a high-quality, interactive board game.

Pros:

- Offers up-to-date financial concepts and real-life scenarios to develop practical money management skills.

- Durable, well-designed components with simple rules suitable for beginners and children.

- Promotes meaningful conversations about money, investments, and life goals, fostering family and group bonding.

Cons:

- The game can be lengthy, which may challenge players with limited attention spans.

- Some users find the gameplay less interactive and monotonous at times.

- It may be less suitable for very young children under 14 due to the complexity of some concepts.

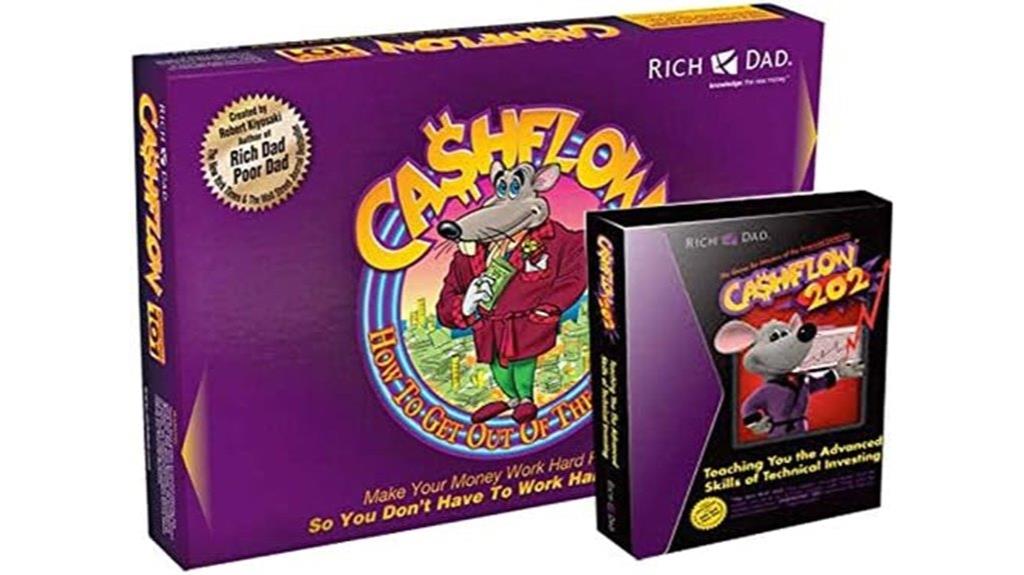

Rich Dad CASHFLOW Board Game for Family and Adults

The Rich Dad CASHFLOW Board Game stands out as an engaging educational tool for families and adults enthusiastic to improve their financial literacy together. I find it a fun way to learn about investing, real estate, stocks, debt, and budgeting while fostering strategic thinking. Designed for ages 14 and up, it supports up to six players and uses vibrant, easy-to-understand components. The game simulates real-world financial decisions, sparking meaningful conversations about wealth-building and financial independence. Its updated third edition reflects current financial realities, making it a relevant and practical resource for families seeking to develop healthy money habits through interactive play.

Best For: families and adults aged 14 and up who want to enhance their financial literacy through interactive and engaging gameplay.

Pros:

- Promotes understanding of key financial concepts like investing, budgeting, and assets versus liabilities in a fun, strategic way.

- Encourages meaningful discussions about wealth-building and financial independence across generations.

- Supports up to six players with vibrant, easy-to-understand components and durable materials for repeated use.

Cons:

- Some users find the rules around card management and asset selling confusing initially, requiring a learning curve.

- The game board and components may be less durable over time, particularly with frequent use.

- The price is considered premium, which might be a barrier for some families seeking budget-friendly options.

The Game of Pay Day Board Game for 2-4 Players

The Game of Pay Day is an excellent choice for families or small groups looking to combine fun with financial education. Designed for 2-4 players aged 8 and up, it mimics real-life money management through a lively gameplay experience. Players earn income, pay bills, invest, and handle expenses across a 31-day calendar, learning essential skills like budgeting and financial planning. With its nostalgic 1970s artwork and engaging mechanics, the game makes financial concepts accessible and enjoyable for all ages. It’s a great way to teach kids about money while fostering family bonding, all without screens or electronics.

Best For: families and small groups seeking an engaging, educational game that teaches kids and adults about financial management through fun, real-life scenarios.

Pros:

- Offers valuable lessons in budgeting, investing, and managing expenses in an interactive way

- Nostalgic 1970s artwork and engaging gameplay appeal to both children and adults

- Easy to understand and suitable for ages 8 and above, making it accessible for a wide age range

Cons:

- Limited to 2-4 players, which may not suit larger groups or parties

- The game duration can vary depending on the number of players and gameplay style

- Some players might find the game less challenging once they understand the mechanics, potentially reducing replay value

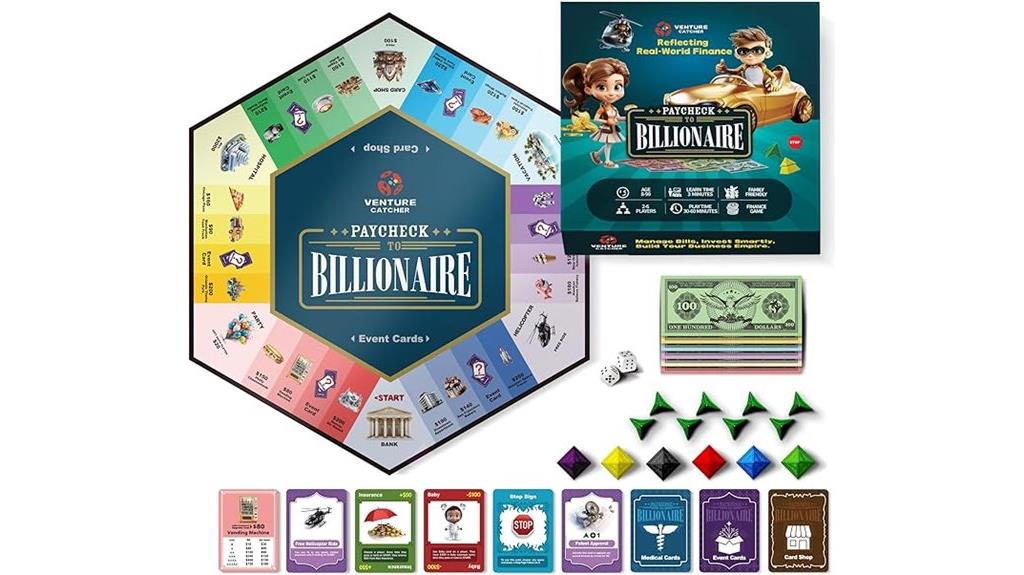

Paycheck to Billionaire Board Game for Financial Education

Paycheck to Billionaire stands out as an ideal choice for families and educators seeking an engaging way to teach financial literacy. This game simplifies complex economic concepts like investments, market dynamics, and profit calculation, making them accessible for players aged 8 and up. It encourages critical thinking, strategic planning, and adaptability—skills useful in real life. Perfect for classroom, homeschool, or family game nights, it promotes fun while building money management and entrepreneurial skills. With vibrant visuals and modern themes, it keeps players interested and motivated. Overall, Paycheck to Billionaire offers an effective, interactive way to introduce kids and teens to financial concepts in a lively, educational environment.

Best For: families, educators, and individuals aged 8 and up seeking an engaging, educational tool to improve financial literacy and strategic thinking.

Pros:

- Simplifies complex financial and economic concepts for accessible learning.

- Encourages critical thinking, strategic planning, and adaptability in a fun environment.

- Versatile for classroom, homeschool, family game nights, and social gatherings.

Cons:

- Can be time-consuming to play, especially for younger players.

- Occasional inconsistencies in gameplay may affect the experience.

- Requires careful management of game components to ensure longevity and optimal play.

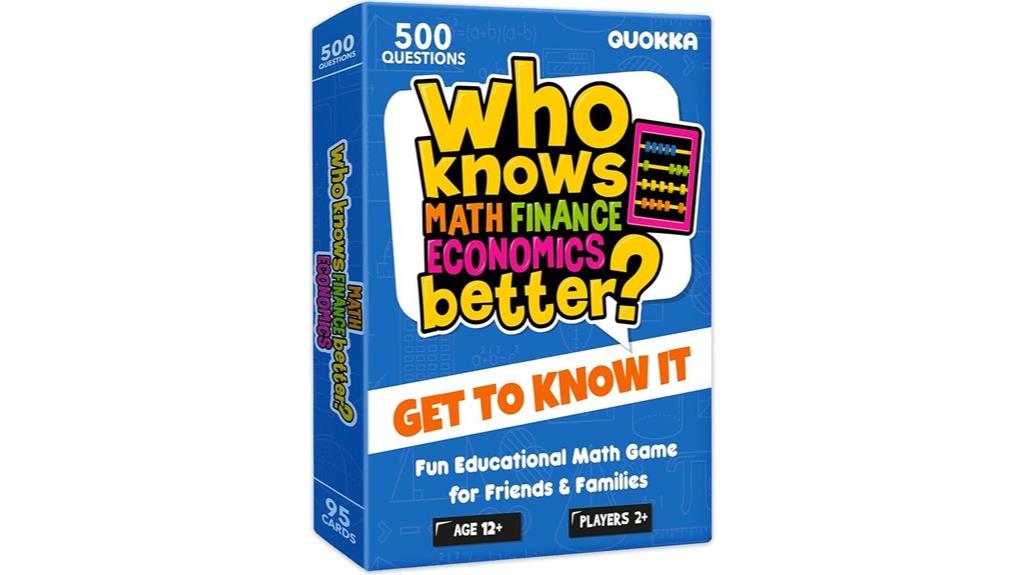

QUOKKA Board Games for Kids 8-12 and Family

Looking for a family-friendly game that combines fun with learning about finance and economics? QUOKKA Board Games for Kids 8-12 and Family is a STEM-themed card game featuring over 500 questions across math, economics, biology, culture, and physics. It’s easy to learn, with quick 15-minute rounds, making it perfect for family nights or travel. Players answer multiple-choice questions, with options to increase difficulty and spark discussion. The colorful, sturdy cards are portable, and the game’s flexible rules suit all ages. While some questions may contain minor errors, most find it engaging and educational, offering hours of fun while expanding knowledge across various subjects.

Best For: families, educators, and science enthusiasts looking for an educational yet fun game to challenge knowledge across STEM and culture topics suitable for kids aged 8 and up.

Pros:

- Easy to learn with quick 15-minute gameplay rounds.

- Promotes learning and discussion across diverse subjects like math, biology, and economics.

- Portable and durable design makes it ideal for travel and family game nights.

Cons:

- Some cards may be thin and susceptible to bending with frequent use.

- Occasional errors or inaccuracies in questions and answers.

- Limited answer choices (usually two), which can make guessing easier and reduce challenge for some players.

Renegade Acquire Strategy Board Game for 2-6 Players

If you’re searching for a strategic family game that challenges players’ negotiation and planning skills, Renegade Acquire is an excellent choice for 2 to 6 players. In this game, players act as real estate tycoons competing to build hotel chains, merge companies, and trade stocks for profit. The game emphasizes strategic decision-making over luck, with engaging mechanics like resource management and tactical planning. Its sleek design and clear components make it accessible, while the depth keeps players captivated. Whether you’re balancing risk or negotiating deals, Acquire offers a fun, educational experience that fosters critical thinking and financial concepts suitable for families and casual gamers alike.

Best For: families, casual gamers, and strategy enthusiasts looking for a classic, engaging board game that emphasizes negotiation and strategic planning.

Pros:

- Offers deep strategic gameplay with minimal luck involved, encouraging critical thinking.

- Features visually appealing components and a clear, user-friendly design.

- Suitable for a wide range of players (2-6), making it versatile for various gaming groups.

Cons:

- The two-player rules can introduce too much luck, which may frustrate strategic players.

- Paper money components can be sticky and difficult to handle, affecting gameplay flow.

- The game may require additional components or modifications for optimal experience, especially for two players.

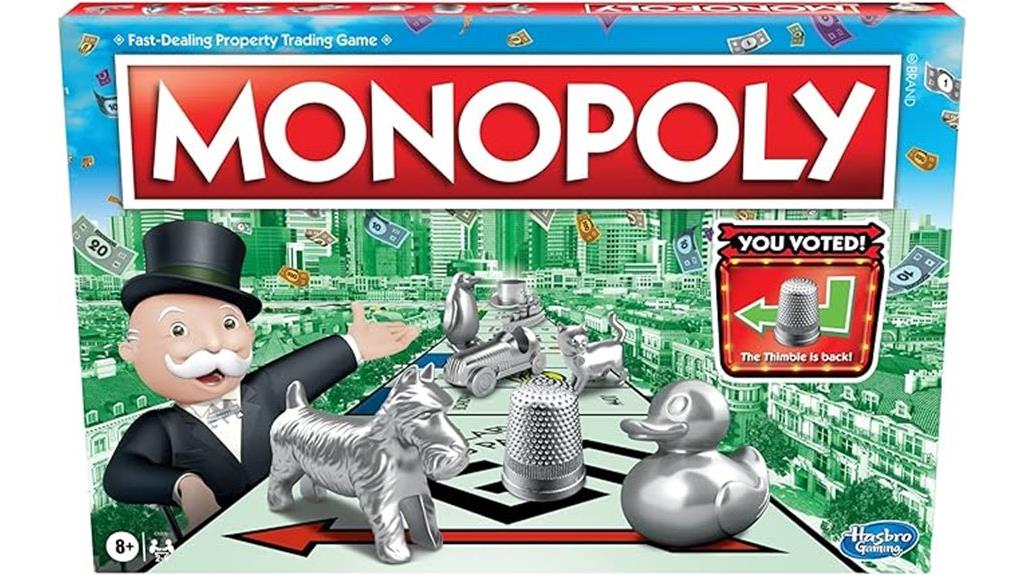

Monopoly Family Board Game for 2-6 Players

The Monopoly Family Board Game for 2-6 players is an ideal choice for families seeking a fun, engaging way to teach kids about money management and strategic thinking. It features classic gameplay where players buy, sell, and trade properties, aiming to accumulate wealth. With building houses and hotels, Chance and Community cards, and colorful tokens like Top Hat and Race Car, the game encourages negotiation, risk assessment, and planning. Designed for ages 8+, it fosters family bonding and friendly competition. Though the foldable board has some drawbacks, its durability and timeless appeal make Monopoly a top choice for indoor fun and learning about financial concepts.

Best For: families and friends seeking a fun, educational, and engaging board game experience that promotes strategic thinking and money management for players aged 8 and up.

Pros:

- Classic Monopoly gameplay with familiar and timeless appeal

- Encourages negotiation, strategic planning, and social interaction

- Durable components and colorful tokens enhance gameplay enjoyment

Cons:

- Foldable board may not flatten easily, affecting game setup

- Missing printed starting pay details can cause confusion for new players

- Game duration of 2-3 hours might be lengthy for some players

BeFree Strategy & Financial Literacy Board Game

The BeFree Strategy & Financial Literacy Board Game stands out as an excellent choice for families and groups seeking an engaging way to teach essential money management skills. It offers modern financial education by simulating real-world scenarios like budgeting, investing, and analyzing returns. The game emphasizes practical skills such as saving, loans, and risk assessment, making complex concepts accessible and fun. Its high-quality design and simple rules keep players engaged without stress. Many praise its ability to spark meaningful conversations about money and future goals. Overall, BeFree makes learning about finance interactive, realistic, and enjoyable for players of all ages.

Best For: families, educators, and group leaders seeking an engaging, hands-on way to teach essential financial literacy and real-world money management skills.

Pros:

- Provides modern financial education through realistic scenarios like investing, budgeting, and risk assessment.

- High-quality, durable components with simple, easy-to-understand rules suitable for beginners and children.

- Encourages meaningful conversations about money, life goals, and financial planning in a fun, interactive manner.

Cons:

- The game can be lengthy, which may challenge players with limited time.

- Some users find the gameplay less interactive, with monotonous elements that reduce engagement.

- Designed for ages 14 and up, which may limit accessibility for younger children without adult guidance.

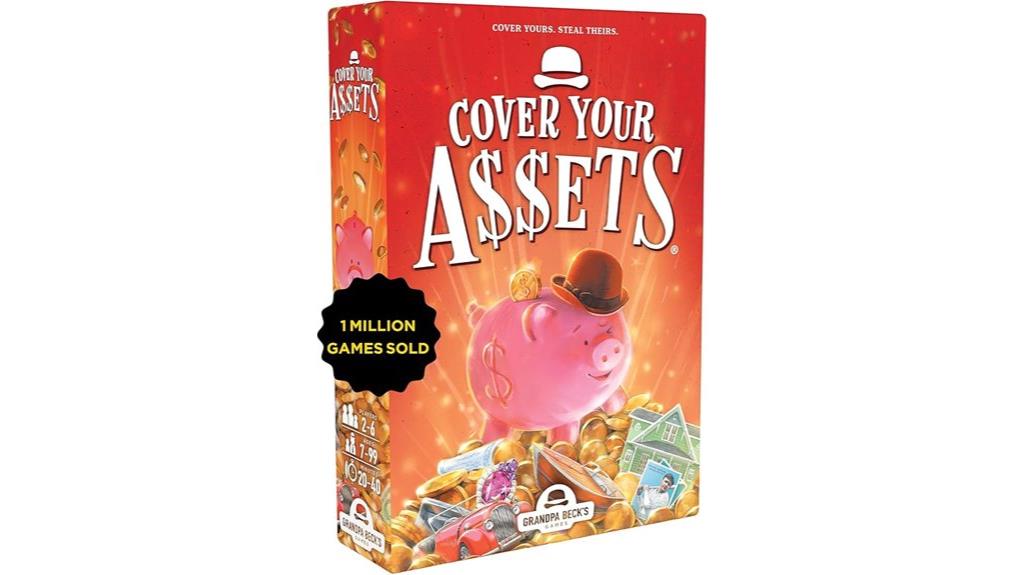

Grandpa Becks Cover Your Assets Card Game

Grandpa Beck’s Cover Your Assets Card Game stands out as an excellent choice for families seeking quick, engaging fun that everyone can enjoy. It’s easy to learn and perfect for 2-6 players aged 7 and up, making it ideal for family game nights or gatherings. The game combines strategy and luck as players collect and protect asset stacks, competing to outsmart each other. With fast-paced gameplay lasting about 20-40 minutes, it’s both entertaining and educational. The colorful artwork and simple rules appeal to children and adults alike, encouraging strategic thinking and friendly rivalry while creating memorable moments. It’s a trusted, worldwide favorite for family fun.

Best For: families, casual gamers, and groups seeking quick, fun, and engaging card games suitable for all ages.

Pros:

- Easy to learn and quick to play, making it accessible for children and adults alike.

- Encourages strategic thinking while maintaining a fun, light-hearted atmosphere.

- Highly replayable with colorful artwork and multiple versions, keeping players entertained for hours.

Cons:

- Some players may experience frustration if luck doesn’t favor them during gameplay.

- Limited complexity might not satisfy more serious or strategy-focused gamers.

- Slight issues like missing cards in initial shipments can affect the overall experience.

SimplyFun BankIt! Money Game for Kids

Are you looking for a fun, educational game that teaches kids essential money skills? SimplyFun BankIt! is a fantastic choice for children aged 8 and up. It combines engaging gameplay with lessons on saving, spending, donating, earning interest, and investing. As players race to buy a bike, they learn real-life financial concepts like budgeting and decision-making. The game is simple to pick up and offers a meaningful way for families or classrooms to introduce personal finance. With positive reviews and a focus on practical skills, BankIt! makes learning about money both fun and memorable. It’s a great addition to any family game night.

Best For: families, educators, and children aged 8 and up seeking an engaging, educational way to teach basic money management skills.

Pros:

- Promotes practical financial skills such as saving, investing, and budgeting in a fun, interactive format

- Easy to learn and suitable for children as young as 5, making it accessible for a wide age range

- Encourages family or classroom engagement with positive reviews highlighting its educational value and entertainment factor

Cons:

- Some users find the game design lacking or not as engaging as other board games

- The interest feature may be less appealing or harder to understand for younger players

- The price point might be considered high for some families or educational settings

The Entrepreneur Game: STEM Board Game for Kids & Adults

If you’re looking for a family-friendly game that combines fun with real-world financial lessons, the Entrepreneur Game is an excellent choice. This award-winning, STEM-accredited board game teaches kids and adults about money management, business strategy, and ethical decision-making through realistic scenarios. Designed for ages 10 and up, it promotes skills like budgeting, investing, and marketing while encouraging teamwork and strategic thinking. With engaging gameplay that simulates market fluctuations, negotiations, and entrepreneurship challenges, it offers a meaningful learning experience. Despite some complexity, it’s a valuable tool for fostering financial literacy and entrepreneurial spirit in a fun, interactive way.

Best For: families, educators, and aspiring young entrepreneurs seeking an engaging way to teach financial literacy and business skills through interactive gameplay.

Pros:

- Recognized with awards like Best in STEM and Moms Choice Award 2024, indicating quality and educational value

- Promotes essential skills such as budgeting, investing, marketing, and ethical decision-making in a fun, interactive format

- Suitable for a wide age range (10+), making it versatile for family, classroom, or individual learning

Cons:

- Complexity and rules can be confusing, especially for younger children, requiring adult guidance or rule modifications

- Some users have reported receiving used or poorly printed copies, affecting the overall quality experience

- Instructions may have gaps, necessitating additional clarification or support for smooth gameplay

Stock Exchange Game – Family Friendly (10+) Board Game.

The Stock Exchange Game is an excellent choice for families seeking an engaging way to introduce kids aged 10 and up to basic investing concepts. This family-friendly board game simulates stock market dynamics without heavy math or economics, making it accessible for beginners. With three modes—family, strategy, and team—it caters to different skill levels and promotes decision-making, luck, and strategic thinking. Players buy stocks and bonds, aiming for retirement, while market prices fluctuate based on their choices. Over 22 countries and all US states play it, and reviews highlight its fun, educational value, and quick gameplay compared to Monopoly.

Best For: families and educational groups seeking a fun, accessible introduction to investing and stock market concepts for children aged 10 and above.

Pros:

- Engaging and educational gameplay that simplifies investing concepts without heavy math

- Suitable for a variety of skill levels with three different modes of play

- Promotes family bonding, decision-making, and strategic thinking in a fun environment

Cons:

- Initial rules and instructions can be confusing or unclear for new players

- Limited complexity may not fully satisfy advanced investors or experienced players

- As a discontinued product, availability might be limited or pricing varies across retailers

Renegade Acquire 60th Anniversary Edition Board Game

The Renegade Acquire 60th Anniversary Edition stands out as an ideal choice for families and game enthusiasts who appreciate strategy and classic gameplay. This deluxe version offers high-quality components, like weighted poker-style chips and a branded drawstring bag, making the game more tactile and visually appealing. Suitable for ages 12 and up, it supports 2-6 players and lasts about 90 minutes. Players manage resources, acquire stocks, and build headquarters to outsmart opponents. The inclusion of multifunctional trays keeps gameplay organized and smooth. Celebrating 60 years, this edition is a collectible that combines nostalgia with modern refinements, making it perfect for teaching money skills in a fun way.

Best For: families and game enthusiasts who enjoy strategic, classic board games with high-quality components and a touch of nostalgia.

Pros:

- Deluxe components like weighted poker chips and a branded drawstring bag enhance tactile and visual appeal.

- Supports 2-6 players with an engaging gameplay duration of around 90 minutes, making it suitable for family game nights.

- Multifunctional trays help keep gameplay organized and efficient, improving overall user experience.

Cons:

- The game may be too lengthy for very casual players or those with limited time.

- The complexity might be challenging for younger players under age 12.

- The deluxe components and packaging may come at a higher price point compared to standard editions.

Learning ADVANTAGE-4373 Budgeting Game for Kids

Parents seeking an engaging way to teach their children essential financial skills will find the Learning ADVANTAGE-4373 Budgeting Game for Kids especially valuable. This game combines hands-on gameplay with real-world financial concepts like budgeting, saving, investing, and taxes, helping kids develop math, reasoning, and problem-solving skills. Designed for children ages 9 and up, it encourages thoughtful decision-making as players plan budgets, earn income, and manage risks. With components like a game board, currency, and record-keeping tools, it makes learning about money practical and fun. Plus, it promotes family bonding while instilling responsible financial habits early on.

Best For: parents and educators seeking an interactive, hands-on tool to teach children ages 9 and up essential financial literacy, budgeting, and math skills while promoting family bonding.

Pros:

- Engages children with practical, real-world financial scenarios for effective learning.

- Supports development of reasoning, problem-solving, and math skills aligned with educational standards.

- Encourages family involvement and makes learning about money fun and memorable.

Cons:

- May require additional funds for larger transactions, such as $50 bills, for smoother gameplay.

- Lacks a spinner, which could streamline game turns and add variety.

- Some players might find the game components or instructions less intuitive without prior guidance.

Rich Dad Cashflow 101 Board Game

If you’re looking for an engaging way to teach teenagers and young adults about personal finance, Cashflow 101 by Robert Kiyosaki stands out as an excellent choice. This educational board game simulates real-life financial scenarios, helping players develop investment strategies, recognize spending habits, and understand how money is created. Designed for ages 14 and up, it encourages learning through hands-on experience. The game includes a variety of components like deal cards, profession cards, and worksheets, making complex concepts accessible. Playing Cashflow 101 can shift mindsets, promote wealth-building habits, and motivate players toward financial independence and early retirement.

Best For: teenagers and young adults aged 14 and above who want to learn personal finance, investment strategies, and wealth-building in an interactive, hands-on way.

Pros:

- Provides a practical, engaging approach to understanding complex financial concepts

- Includes comprehensive components like deal cards, worksheets, and profession cards for an immersive experience

- Helps develop positive financial habits, mindset shifts, and motivation for early financial independence

Cons:

- May require adult supervision or guidance for younger players to fully grasp strategies

- The game’s complexity could be overwhelming for some beginners or those with limited interest in finance

- Heavier and larger in size, making it less portable and requiring dedicated space for setup

Factors to Consider When Choosing a Family Finance Board Game

When selecting a family finance board game, I look at several key factors to guarantee it’s the right fit. Things like age appropriateness, educational value, and how engaging the gameplay is really matter. I also consider durability and whether the cost matches the overall quality and learning benefits.

Age Appropriateness

Choosing a family finance board game that’s suitable for everyone starts with considering the recommended age range. I always check if the game’s age guidelines match the players’ developmental and cognitive abilities to guarantee it’s engaging and understandable. It’s important to select content and complexity that align with the players’ financial knowledge, avoiding frustration or boredom. I also consider how many players fit within the age group to promote inclusive family participation. Some games offer adjustable difficulty settings or variations, which are helpful for accommodating different age levels and keeping the game challenging yet accessible. Finally, I verify that the themes and language are appropriate and engaging for the intended age group, making sure everyone stays interested and comfortable throughout the game.

Educational Content Depth

Evaluating the educational content depth is essential to selecting a family finance game that truly benefits everyone. I look at how well the game covers financial concepts appropriate for the players’ age and knowledge level, ensuring it’s neither too simple nor too complex. It’s important that the game balances theoretical knowledge with practical skills like budgeting, investing, and decision-making, offering real-world relevance. I also consider whether the content includes layered learning opportunities—basic principles for beginners and more advanced topics for experienced players. Additionally, thorough explanations, prompts, or supplementary materials can deepen understanding and reinforce key concepts. A well-designed game should grow with players, fostering financial literacy at every stage while keeping the learning engaging and relevant.

Gameplay Engagement Level

Engagement plays a pivotal role in ensuring that a family finance board game remains enjoyable and educational for everyone involved. A game that captures attention through dynamic gameplay, such as real-life scenarios and decision-making, keeps players invested. The level of engagement can be measured by how well the game sustains interest over multiple rounds without becoming monotonous. Features like chance cards, realistic market fluctuations, and strategic choices help maintain excitement and variety. A highly engaging game balances luck, skill, and interaction, appealing to different ages and skill levels. Additionally, the game’s duration should match players’ attention spans—some games are quick, while others offer a longer, more immersive experience. Ultimately, engagement keeps the learning fun and meaningful.

Material Durability

Have you ever wondered how long a family finance board game will last with regular use? Material durability plays a vital role in guaranteeing the game withstands frequent family play, especially with kids involved. High-quality components like sturdy plastics, thick cardboard, or laminated cards resist wear and tear better than flimsy alternatives. Choosing durable materials helps prevent issues like bent cards, torn pieces, or peeling boards, keeping the game looking and functioning well over time. This durability not only maintains the game’s visual appeal but also reduces the need for repairs or replacements, adding to its overall value. When selecting a game, considering material quality guarantees that it remains engaging and functional for many enjoyable family sessions.

Cost and Value

When choosing a family finance board game, considering cost and value helps guarantee you’re making a smart investment. I evaluate whether the price reflects its educational content, durability, and replayability, ensuring it’s worth the money. High-quality components and materials justify a higher cost and contribute to the game’s longevity. I also compare the number of practical skills and learning features offered against the price to determine if it provides all-encompassing financial education. Sometimes, extra bonuses like books or digital resources add value beyond the physical game. Finally, I balance the cost with the game’s ability to engage multiple age groups and foster ongoing family learning and interaction, making sure it offers long-term benefits for everyone involved.

Replay and Variety

How can you guarantee that a family finance board game remains fun and educational over time? The key is replay and variety. Games with high replay value offer varied scenarios, multiple strategies, and randomized elements that keep each session fresh. Expansion packs or question sets add new challenges and themes, preventing boredom. Incorporating different game modes or difficulty levels also introduces new learning opportunities and keeps players engaged. A diverse range of financial themes—like investing, budgeting, or entrepreneurship—broadens educational exposure and maintains interest. Additionally, games that feature multiple roles, scenarios, or outcomes make each playthrough unique, encouraging repeated play. Choosing a game with these elements ensures that your family continues to enjoy learning about money while having fun together.

Frequently Asked Questions

Are These Games Suitable for Children With No Prior Financial Knowledge?

You’re wondering if these games are suitable for kids with no prior financial knowledge. I believe they are! These games are designed to be educational and fun, making learning about money approachable for beginners. I’ve seen children pick up basic concepts quickly while enjoying the play. So, even if your kids have no experience with finances, these games can help them learn in a relaxed, engaging way.

Which Games Promote Strategic Thinking Alongside Financial Education?

When I think about games that blend strategic thinking with financial lessons, I realize they do more than just teach money skills—they encourage thoughtful planning. For example, Monopoly challenges players to manage resources and make strategic investments, while The Game of Life prompts foresight about future goals. These games subtly nurture decision-making skills, helping kids build confidence in handling real-world financial situations while having a lot of fun.

How Do These Games Accommodate Different Age Groups Within a Family?

When I consider how games cater to different ages, I realize many are designed with adjustable rules or varied difficulty levels. Younger kids might enjoy simpler concepts, while older players can tackle more complex financial strategies. I find that selecting games with scalable challenges guarantees everyone stays engaged and learns at their own pace. This way, family fun and educational value go hand in hand, regardless of age differences.

Can These Games Be Used in Classroom Settings or Only at Home?

Imagine a lively classroom where students gather around tables, enthusiastic to learn through play. These games aren’t just for home; I’ve seen them work wonderfully in classrooms too. They bring hands-on fun to teaching money skills, making complex concepts easier to grasp. Whether at home or in school, these games spark engagement, encourage teamwork, and help kids understand real-world financial lessons in a playful, memorable way.

Do Any of These Games Include Digital or Online Versions?

Many of these finance games now offer digital or online versions, making them more accessible and flexible. Some have dedicated apps or online platforms, so you can play on your devices anytime. I find that digital versions often include interactive features that enhance learning and engagement. If you’re interested, check each game’s website or app store listing to see which options are available for digital play.

Conclusion

Choosing the right family finance board game is like planting seeds for a future of smart money habits. These games are more than just fun—they’re the keys to revealing financial literacy in a playful, engaging way. So, explore these options with enthusiasm and watch as your family’s understanding of money blossoms. After all, the best lessons are those learned while having fun—turning game night into a voyage toward financial empowerment.